*Mr. Cuban may receive financial compensation for his support.

Last Updated: June 12, 2024

Are you ready to formalize your business by starting a limited liability company (LLC)? Due to the low cost of living and its open market, Mississippi may be the right state for your LLC.

You’ll need to take specific steps to start an LLC in Mississippi. To enjoy the liability limitation and other benefits of a Mississippi LLC, you can follow these steps to form your LLC.

Understanding the detailed laws for starting an LLC in Mississippi can feel like overwhelming. That’s why we’re here to help guide you through the process of starting an LLC in Mississippi.

How to Start an LLC in Mississippi

To start an LLC in Mississippi, you’ll have to file a Certificate of Formation with the Mississippi Secretary of State and pay a filing fee. You’ll also have to choose a registered agent. This agent accepts legal notices on behalf of the business. We’ll get more into registered agents later.

There are additional steps for starting an LLC in Mississippi after you file your Certificate of Formation. You may draft an operating agreement that will help govern your LLC. You’ll also likely need to obtain an Employer Identification Number (EIN) from the Internal Revenue Service (IRS).

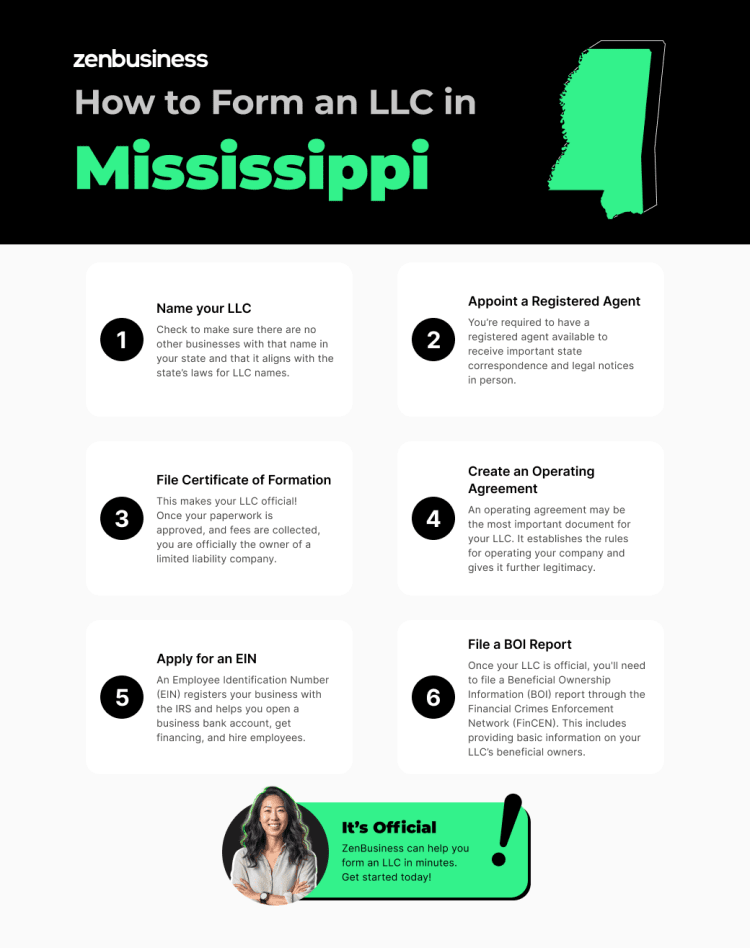

LLC in MS in 6 Steps

LLC requirements vary state by state so it’s important that you are well-versed in Mississippi laws before proceeding. Generally, it comes down to these steps:

- Name your Mississippi LLC

- Appoint a registered agent in Mississippi

- File a Mississippi Certificate of Formation

- Draft a Mississippi operating agreement

- Apply for an EIN

- File your LLC’s BOI report

Be sure to follow each essential step below.

Step 1: Name your Mississippi LLC

The first step is to choose your Mississippi LLC’s name. You can pick any name as long as it complies with the state’s LLC naming requirements. There’s a chance that the name you want most for your business is already taken, so be sure to conduct a business name search. Try coming up with a list of several names, too. If you’ve already tried and are drawing a blank, then check out our article on coming up with a great business name.

Official Naming Requirements

If you’ve conducted a Mississippi business search to see if the name you want is available and found that it is, then great! However, you need to make sure your name complies with Mississippi’s LLC naming requirements. The biggest rule is that your name has to be distinguishable from other names in the state by running a Mississippi business search.

Aside from that, your name should meet these criteria:

- Include “LLC” or “limited liability company”

- Avoid words that imply government affiliation or include the name of a manager or member

Unfortunately, if you don’t comply with these name requirements for your LLC, Mississippi’s Secretary of State will reject your LLC application. Check out Section 79-29-109 of the Mississippi Limited Liability Company Act for more information.

Reserving a Business Name

You can reserve your Mississippi LLC’s name with the Mississippi Secretary of State. This way, no one else can take your name while you’re getting your business set up.

If you go the reservation route, then Mississippi will protect your chosen name for 120 days. The filing fee is $25.

Getting a Domain Name

In today’s business environment, an online presence is absolutely essential. To connect with customers, it’s almost essential to have a website that’s easy for your customers to find. After all, if they can’t locate you online, how will they learn more about your business, your location, and your services?

This is where a domain name (a URL for your business website) comes in. Ideally, your chosen business name should match (or very closely resemble) your domain name. This will make it easier for your customers to find you, and it’ll help you build a consistent brand identity. Our domain name registration service can help you set up your domain name quickly and easily.

Consider a “fictitious business name” in Mississippi

Some businesses use “doing business as” (DBA) names if their legal name isn’t cutting it or to branch out into other types of business. Mississippi calls these “fictitious business names.” If you’d like to use a name other than your LLC’s legal name to do business in the state, then consider registering a fictitious business name with us. You can also register this name with the Mississippi Secretary of State online.

Federal and State Trademarks

When you check your business name, you should also check that your name doesn’t infringe on any protected trademarks. Trademarks can be protected at both the state and federal levels. To start, we recommend running a trademark search on the United States Patent and Trademark Office’s website. Then run a similar search on the Mississippi Secretary of State’s website.

If your name is trademarked, you’ll need to pick a different one. If it isn’t, you have the option to trademark the name yourself. This process can be lengthy and expensive, but it’s the ultimate way to protect your business name.

Ready to Start Your Mississippi LLC?

Enter your desired business name to get started

Step 2: Appoint a registered agent in Mississippi

Next, you’ll choose a registered agent for your LLC in Mississippi. As we mentioned earlier, registered agents accept legal documents on behalf of LLCs in addition to certain notices from the Secretary of State. Mississippi law requires all LLCs to have a registered agent in the state. You’ll name your agent in the LLC Certificate of Formation.

What is a registered agent?

A registered agent accepts legal and government notices on behalf of a business. This can include things like notices of service of process (lawsuits). This must be done in person, so your registered agent must have a physical address in Mississippi and be available to accept these documents during regular business hours. This agent informs the LLC’s owner(s) that these forms require their attention.

Who can be a registered agent for your LLC in Mississippi?

Mississippi actually allows two types of agents: a commercial registered agent or a noncommercial registered agent. Both types accomplish the same goal (and meet state requirements). Commercial agents simply register with the state to publicly serve businesses as an agent as their own business endeavor. Noncommercial registered agents are privately appointed by the businesses they serve.

Any registered agent, whether they’re commercial or noncommercial, must:

- Be an individual resident of the state OR a business entity with authority to conduct business in Mississippi

- Have a physical address in Mississippi where they’re present during all regular business hours (no P.O. boxes)

Can I be my LLC’s registered agent or should I hire a registered agent service?

Many small business owners wonder if they can act as their own registered agents. If you have a physical address in Mississippi and are available to accept legal documents during regular business hours, then you can legally serve as your LLC’s own agent.

However, there are some disadvantages. You must be at your physical address during regular business hours, making it difficult to run errands, take sick days, visit clients/customers, go on vacation, etc. Plus, it can be embarrassing to receive legal notices (like a lawsuit) while potential customers or employees are present.

Also, the last thing you want is for the state to declare your LLC as being out of compliance because your agent was unavailable. A lawsuit can also move forward without you knowing if there was an attempt to serve you while you were unavailable. In this case, registered agent services might be a good fit for your LLC.

If you need peace of mind, our registered agent service can fill this role for you seamlessly and simply with complete compliance with Mississippi state laws.

Step 3: File a Mississippi Certificate of Formation

Your third step is to file a Certificate of Formation for your Mississippi LLC via online filing. Filing your Certificate (known in most other states as Articles of Organization) with the Mississippi Secretary of State and getting it approved officially recognizes your LLC as a business entity. You’ll have to pay a filing fee when submitting this document. We can also help you with our business formation plans to ensure everything is correct on your formation documents.

Create an online account with the Mississippi Secretary of State

The Mississippi Secretary of State’s online portal is the only way to file your LLC registration documents. You can’t submit paper applications. You’ll need to create a Registered Filer account with a username and password and provide a business email address. You’ll need this information for filing your LLC’s formation documents and other filings down the road.

Information Needed for Your Certificate of Formation

You’ll need the following information for your LLC’s certificate:

- Your Mississippi LLC’s official name

- A business email address

- Your LLC’s effective date (either immediate or within 90 days of the filing)

- Your LLC’s North American Industry Classification System (NAICS) Code (which is the federal government’s business classification system)

- Your registered agent’s name and address

- The name of one incorporator (also known as the LLC’s organizer)

How to File Your Certificate of Formation

When the time comes to officially file your Certificate of Formation, you’ll do so by logging into your Registered Filer account on the Secretary of State’s website. From there, follow the directions for submission. When it’s filed and approved, you’ll receive your new LLC’s business ID number.

Member-Managed or Manager-Managed?

Mississippi LLCs can be either member-managed or manager-managed. A member-managed LLC sees the owners/members as the managers. This is the default setup under Mississippi law.

If you wish, you can instead elect to have a manager-managed LLC. With this, you can hire outside managers or appoint one or more members to take care of day-to-day operations. This is helpful if some members do not want to be responsible for LLC management.

Whichever management structure you choose for your LLC in Mississippi, you’ll make this designation in your Certificate of Formation.

What if I need to make changes to my Certificate of Formation?

You’ll only have to file your Certificate of Formation once. However, if you need to make any changes, you’ll need to file an amendment online for a fee. We offer an amendment filing service to make the amendment process more streamlined. Plus, our Worry-Free Compliance service includes two amendment filings each year.

Why would I delay my Mississippi filing date?

Normally, your LLC’s effective date will be when you file your Certificate of Formation. There are some instances where future business owners would like to delay the filing date. For example, if you don’t want to worry about filing taxes for your LLC for only part of the year, you may want to delay your LLC filing date until January 1. Mississippi allows you to delay your filing date 90 days after you file your Certificate of Formation.

When you use our service to file your LLC Certificate of Formation, you can pay an additional fee to delay your LLC filing date by 90 days. (This service is only offered from October to January.)

Step 4: Draft a Mississippi operating agreement

Creating a Mississippi LLC operating agreement is your fourth step. Although not a legal requirement in Mississippi, many LLCs benefit from having an operating agreement. An operating agreement sets the LLC’s internal rules and policies, which helps members make important decisions. There’s no formal operating agreement guide to follow, so you’ll have to decide what to add it to. Let’s go over some details.

Benefits of MS LLC Operating Agreements

If you want to stray from the state’s default provisions for LLCs or clarify things, then consider an operating agreement. Keep in mind that you can stipulate how your LLC will run in this agreement so long as the business’s operations don’t fall outside the law.

Writing your own operating agreement lets you customize your rules and management structure and even how you distribute profits. Plus, a good operating agreement helps prove that you’re treating your LLC like a separate legal entity, which helps maintain your limited liability protection. Even for single-member LLCs, that’s immensely helpful.

What should I include in my LLC’s operating agreement?

Since the operating agreement stipulates how the LLC will run, you’ll want to include as much detailed information as possible. Items typically addressed in an LLC operating agreement include:

- Ownership proportions: how much (i.e., the percentage) of the business each member owns

- Decision-making processing: who can buy property, hire employees, etc.

- Voting powers

- How to add and remove members

- How to dissolve the LLC, if needed

- Any other provisions your unique business needs

If you’d like to create an operating agreement but are unsure where to start, we’ve got you covered with our customizable operating agreement template.

Do I need an operating agreement if I’m the only owner?

Even if you own a single-member LLC where business disputes likely won’t arise, you may want to create an operating agreement, anyway. Investors and lenders sometimes like to see an operating agreement before agreeing to fund a business. In addition to setting policies and internal governance procedures for your LLC, an operating agreement can also detail what will happen to the business if you die or become incapacitated. An operating agreement can further demonstrate that you and the LLC are separate entities, reinforcing the limited personal liability.

Step 5: Apply for an EIN

Your final step is to apply for an IRS Employer Identification Number (EIN). An EIN is also referred to as a Federal Employer Identification Number (FEIN) and a Federal Tax Identification Number.

You’ll use this number to file taxes. Plus, many banks require an EIN to open a business bank account for your LLC. Mississippi has plenty of financial institutions that are eager to help small businesses, so be sure to get an EIN. You can get an EIN online through the IRS website, by mail, or by fax. We also offer an EIN service.

Mississippi State Tax Registration

All businesses in Mississippi should register with the Mississippi Department of Revenue for corporate income and franchise taxes, sales and use taxes, withholding taxes, and other applicable taxes. You’ll need to create an account with the Department’s Taxpayer Access Point (TAP) tool. Here, you can make payments, view your refund status, upload documents, and more.

Mississippi Tax Info for Employers

If you’re an employer, you’ll register for withholdings with the Department of Revenue. Mississippi also requires that you register and pay unemployment insurance and report all new hires to the Mississippi Department of Employment Security (MDES).

Can filing as an S corp lower my taxes?

The LLC model is popular due to its flexibility, and that extends to taxes. LLCs are taxed as sole proprietorships by default if there’s only one member. If there are multiple members, then the business is taxed as a partnership. This is exceptionally appealing since it avoids double taxation. Sometimes, though, LLC owners choose to tax their LLCs as either C corporations or S corporations due to their benefits.

C corp taxation carries with it double taxation. This could be a problem, but certain LLCs may consider it anyway due to the benefits a C corp offers. C corps can have a wide range of tax deductions, for example.

An S corp, on the other hand, carries the pass-through taxation benefit that LLCs enjoy along with another advantage: the potential of saving money on self-employment taxes. This is possible by allowing you to be an “employee-owner.” You can split your income into your share of the LLC’s profits and your salary. Through this method, you’ll pay self-employment taxes on your salary and not the profits. Keep in mind that you’ll still have to pay other appropriate taxes on your profits.

S corp designations do have their cons, though. They tend to get more attention from the IRS, meaning that the risk of an audit is higher. S corp status is also harder to qualify for. If you’re still on the fence about your LLC’s tax designation, then we encourage you to speak with a tax professional. We can help you apply for S corp status in Mississippi, but only during the business formation process.

Step 6: Submit your LLC’s beneficial ownership information report

After the state approves your Certificate of Formation, you have another step to complete: filing the beneficial ownership information report, or BOI report. This requirement was introduced by the Corporate Transparency Act, which strives to help prevent financial crimes by making it more difficult for organizations to hide illicit activities behind shell corporations.

To accomplish this, the act requires LLCs and other small businesses to report information about their beneficial owners to the Financial Crimes Enforcement Network (FinCEN). According to the act, a beneficial owner is anyone who exercises substantial control over a business, gets significant economic benefit from it, or holds 25% or more of its ownership interest. So when you file your BOI report, you’ll be asked to provide the name, address, and identifying documents of each person who meets those criteria for your LLC.

Failing to provide this information can have serious consequences, so make sure you submit your online filing or PDF upload to FinCEN on time. The due date for LLCs that are organized during 2024 is 90 days after the state approves your Certificate of Formation. LLCs that organize in 2025 and beyond will have just 30 days. Any LLCs formed prior to 2024 have until January 1, 2025.

The FinCEN website can provide you with additional information about the form, its requirements, and the Transparency Act itself. If you’d like help filing your BOI report, our BOI report filing service can streamline this step for you.

Steps to Take After You’ve Formed a Mississippi LLC

After you’ve created your LLC, your work isn’t quite finished. There are a few steps yet to finish to help ensure that your business complies with state law both now and into the future.

Get business licenses and permits

Post-formation, it’s crucial to obtain the necessary business licenses and permits. These vary based on your business activity and location in Mississippi. For example, Mississippi doesn’t have a general business license at the state level, but there are many cities or counties that require one instead. There’s also a good chance that you’ll need industry-specific permits.

It’s your responsibility to check that your LLC has all the licenses it needs. Our business license report can help streamline this step.

Build your online presence

Earlier in this guide, we mentioned that you should consider acquiring a domain name for your business. A domain name will be essential for building a business website, which you can use to help new customers find you, to interact with your existing clients, and more. If you’re looking to make online sales for your product or service, then adding in an eCommerce platform might be helpful.

But your efforts shouldn’t stop with a business website. Social media handles are also vital. Whether you opt to use Instagram, TikTok, Facebook, or anything in between, try to find handles or usernames that closely resemble your business name to make it easy for customers to find you.

If the idea of running a bunch of social media accounts sounds overwhelming, do a little customer research. Learn what platforms your customers use the most, and prioritize those accounts to get the most impact from your social media efforts.

Set up an accounting system

Establishing an effective accounting system is essential for financial management. It aids in tracking expenses, managing budgets, and preparing for taxes, ensuring financial health and compliance.

There are lots of tools you can use to manage your books, from a simple spreadsheet to robust accounting software or even hiring a professional. ZenBusiness Money can also help. The most important thing is that you pick a system and stick to it.

Open a business bank account

Opening a business bank account can help keep your finances in order and avoid commingling personal and business funds. Commingling funds can be troublesome come tax season. It can also result in some legal troubles if you’re ever taken to court and someone challenges whether you and your business are truly separate entities.

We offer a discounted business bank account for your small business. With it, you’ll get online banking features, unlimited transactions, a debit card, and much more. We also offer a banking resolution template that allows you to authorize others in your LLC to use your bank account.

Your business’s finances will need a professional to manage them. You can hire an accountant to take care of this, or you can do it yourself with our help via ZenBusiness Money. You can manage clients, create invoices, keep track of business expenses, transfer payments, and more, all from one place. This can greatly streamline your business finance handling needs.

Stay informed about legal requirements

Staying updated with ongoing legal and tax requirements is crucial for maintaining good standing. For one thing, you’ll need to file your annual report each year (more on this later). There’s also a good chance you’ll need to fulfill other requirements at the local level, such as getting city licenses, paying local taxes, and so on.

These requirements are subject to change at any time. Regularly review state and local guidelines to keep abreast of changes in laws affecting LLCs. Many entrepreneurs also find it helpful to consult with a business attorney or tax professional on a regular business just to stay informed. These professionals are well-informed on Mississippi’s specific requirements, so they can be a big help.

How to Get a Certificate of Good Standing

If you stay compliant with state regulations, then you are eligible to get a Certificate of Good Standing from the Secretary of State. You can even request one online with the Order Documents platform. The fee for one is $25.

A Certificate of Good Standing is especially helpful for certain business activities, such as partnering with another business owner, entering contracts, or sometimes even getting a business bank account. It’s essentially a stamp of approval from the state that your business is compliant.

A Certificate of Good Standing can expire, so if you have an old one, check that it’s still valid. If not, you’ll need to get an updated version.

Get business insurance

Your company, like all other important things in your life, needs coverage. The LLC structure comes with personal asset protection, but it doesn’t hurt to get extra coverage. Accidents in the workplace, professional mishaps, and more can result in heavy costs. Certain types of coverage can be helpful depending on your industry. There are plenty of business insurance companies out there, so if you don’t know where to start, then check out our guide on getting business insurance.

File your Mississippi LLC annual report

By law, your LLC in Mississippi needs to file an annual report with the Secretary of State. It’s due by April 15th of each calendar year. Online filing is the only method. As we went over in Step 3, you’ll need to create an account with the Secretary of State’s website to submit this report. Failing to file your report on time may result in your LLC’s dissolution.

More Information on Mississippi LLCs

There may be some additional questions running through your head now that you’re one step closer to finalizing your new LLC.

How to Hire Employees in Mississippi

Finding the perfect employee is no easy feat, but by doing some research, you can pinpoint exactly what you need to do. You’ll first need to take care of all your business’s paperwork and other responsibilities we went over above. That way, your business is legitimate and you’ll be ready to get started.

From there, you can start looking into who best fits your company. How you go about searching for candidates is up to you. If you aren’t sure how to get started, check out the Mississippi Department of Employment Security’s “Recruit Employees” page. The MDES can help you find resources for hiring your employees.

Types of LLCs in Mississippi

In Mississippi, various types of LLCs cater to different business needs and structures, each with unique characteristics.

Single-Member LLC

A single-member LLC is tailored for individual business owners. It combines the simplicity of a sole proprietorship with the liability protection of an LLC, making it ideal for solo entrepreneurs in Mississippi.

Multi-Member LLC

A multi-member LLC is very similar to a single-member LLC in its structure, but instead of one owner, there are two or more. A multi-member LLC offers a flexible structure, allowing for shared decision-making and responsibility while maintaining the benefits of an LLC.

Foreign LLC

A foreign LLC is an LLC that was originally formed in another state but operates in Mississippi. To compliantly operate in the state, registering for authority to transact business is required.

Professional LLC

Specifically for professionals who require state licensing (like doctors or lawyers), a professional LLC adheres to both the standard regulations of an LLC and the additional requirements of professional services.

We can help you file a Mississippi LLC

Business filings can be tough, but now that you’ve looked over our guide, we hope you have a much better understanding of what you’ll need to do and what to expect. Even if you still feel a little lost, we’re here to help with our LLC formation service.

We can take care of many aspects of starting and running your Mississippi LLC with our professional services so that you can focus on what’s important to you: growing your business. It doesn’t matter if you’re setting up shop in busy Jackson or settling in a quieter neck of the woods like Natchez. We’re here to help wherever you are.

Related Topics

MS LLC FORMATION THAT’S FAST AND SIMPLE

Take it from real customers

Mississippi LLC FAQs

-

Mississippi doesn’t have a statewide business license. However, depending on the type of business you’ll be conducting, you may need specific Mississippi LLC business permits and licenses.

You may also have to contact your local county or city to see if you need a particular license or permit to do business in that jurisdiction.

Instead of calling all over the state, we can take care of the footwork for you with our business license report service to handle your licensing requirements.

-

The cost of forming an MS LLC starts at $53. However, there are additional fees if you want to reserve your name, obtain a Certificate of Good Standing, or register your DBA.

Plus, filing fees change over time, so check with the Mississippi Secretary of State to confirm all fees.

-

Mississippi does not tax LLCs if they’ve elected to be taxed as partnerships. Instead, members pay tax only on their share of the profits. However, you may have to pay certain other taxes to the state if you employ workers, such as unemployment and withholding taxes.

LLCs sometimes elect a C corporation or S corporation tax election at the federal level. An S corporation can potentially save a lot in self-employment taxes while avoiding double taxation.

A C corporation can offer tax deductions, which can be beneficial in some situations. For example, certain employee benefits can be written off as business expenses. Consult with a tax professional for more information.

-

This is up to you as your LLC’s operating agreement should state how to transfer ownership of a Mississippi LLC. The law specifies when and how you may transfer ownership if you don’t have an operating agreement.

-

You don’t need a business plan to form or operate your LLC in Mississippi. However, investors and lenders often want to see a business plan before they decide to help your business. It shows that you’re serious and want the business to succeed. Learn more about planning your business.

-

The primary benefits of a Mississippi LLC are:

-

Protection for your personal assets from the business’s debts and legal liability.

-

Management flexibility that allows you to run the business how you want so long as you don’t commit anything illegal.

-

Paying personal taxes on profits instead of paying taxes on individual earnings and corporate profits (known as “double taxation”).

-

Avoiding corporate maintenance duties and certain reporting requirements.

You can also choose your LLC’s tax designation. Depending on what you believe would benefit your business the most, you can choose an S corporation or C corporation tax election.

-

-

Some online filings are approved immediately. However, sometimes the Mississippi Secretary of State needs to review your filing or will request additional information. This should be done within 24 hours of submission, according to the Mississippi Secretary of State website.

-

No, you don’t need to file your LLC operating agreement with the state. However, drafting one can be very beneficial, as we discussed in Step 4. You should keep it with a copy of your LLC’s Certificate of Formation.

-

Most LLCs choose to be pass-through entities so they don’t experience double taxation. However, some LLCs choose C corporation or S corporation tax designations.

Read why in the “How are LLCs taxed in Mississippi?” FAQ. You should discuss your concerns with an accountant to determine what’s right for you.

-

No, Mississippi does not allow Series LLCs. A Series LLC involves creating a primary, or parent, LLC with several other entities falling under it. Each of these entities will have their own names, operating agreements, members, managers, bank accounts, and more.

-

First, you must consult your LLC operating agreement and Mississippi law for all the steps required before officially dissolving your LLC. Often, you’ll need the consent of all of the LLC’s members to move forward with dissolution.

After following the law’s and operating agreement’s procedures for winding up and shutting down your LLC, you’ll file a dissolution form with the Mississippi Secretary of State through the online portal. Check out our Mississippi LLC dissolution guide.

-

Yes, you can register a fictitious business name for your Mississippi LLC with the Mississippi Secretary of State online. Check out the “Consider a “fictitious business name” in Mississippi” section in Step 1 for more information.

-

Your operating agreement should state how to remove an LLC member and the reason for doing so. If you don’t have an operating agreement, you can remove a member only with the written consent of all of the LLC’s members. You’ll then update the state of Mississippi with your annual filing.

-

Yes, LLCs must file annual reports with the Mississippi Secretary of State online. We offer an annual report filing service to save you the burden of making costly mistakes.

Disclaimer: The content on this page is for information purposes only and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

ZenBusiness is a financial technology company and is not a bank. Banking services provided by Thread Bank, Member FDIC. The ZenBusiness Visa Debit Card is issued by Thread Bank pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa debit cards are accepted. FDIC insurance is available for funds on deposit through Thread Bank, Member FDIC.

*Your deposits qualify for up to a maximum of $3,000,000 in FDIC insurance coverage when placed at program banks in the Thread Bank deposit sweep program. Your deposits at each program bank become eligible for FDIC insurance up to $250,000, inclusive of any other deposits you may already hold at the bank in the same ownership capacity. You can access the terms and conditions of the sweep program at https://go.thread.bank/sweepdisclosure and a list of program banks at https://go.thread.bank/programbanks. Please contact customerservice@thread.bank with questions regarding the sweep program.

LLC Formation States Near Mississippi

Ready to Start Your LLC?