*Mr. Cuban may receive financial compensation for his support.

Last Updated: June 12, 2024

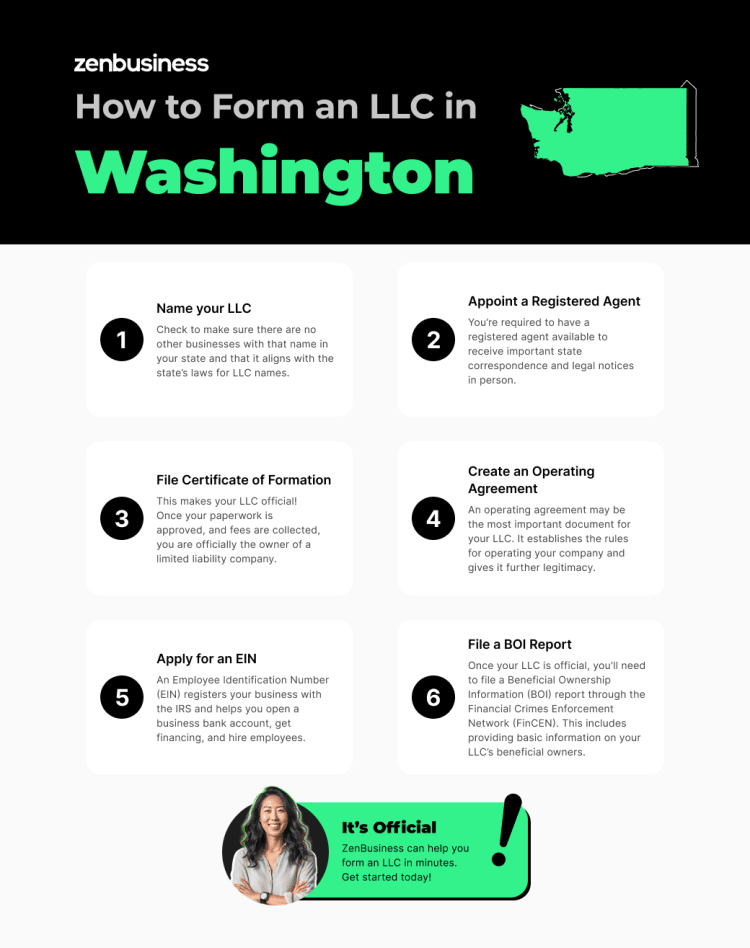

How to Start an LLC in Washington

Starting a business in Washington is an exciting journey, and ZenBusiness is here to support every step. From initial ideas to launching your business, we provide the tools and guidance needed for success. This is your guide to limited liability companies (LLCs) in Washington. You’ll learn how our suite of products and services can assist you in forming, operating, and expanding your business from scratch.

Embarking on the journey of forming an LLC in Washington State involves several key steps to ensure your business is set up correctly and compliant with state regulations. From naming your LLC to obtaining vital tax identification, each step plays a crucial role in establishing the foundation of your business. Below, we outline the essential stages of this process, providing a clear roadmap for aspiring entrepreneurs to successfully launch their LLC in Washington.

This introduction provides a concise overview of the process, setting the context for the subsequent detailed steps.

- Name your Washington LLC. Ensure the chosen name reflects your business vision and complies with Washington state naming regulations.

- Appoint a registered agent in Washington. A reliable registered agent helps ensure seamless service of legal documents and helps maintain your LLC’s good standing with the Washington Secretary of State.

- File a Washington LLC Certificate of Formation. This certificate is a crucial legal document that officially registers your business with the Washington Secretary of State.

- Create an operating agreement. The operating agreement details the liability, management structure, and profit distribution among LLC members, establishing a clear operational framework for your business.

- Apply for an EIN. An EIN is essential for tax purposes and crucial for opening a business bank account, distinguishing your business as a separate entity.

- File a beneficial ownership information report for your WA LLC

Starting an LLC in Washington

Starting a limited liability company in Washington State isn’t as complicated as it may seem. It does, however, require meticulous attention to detail. Before you can officially submit your Certificate of Formation, there are initial factors you must consider. These include selecting a unique name that meets Washington’s requirements, appointing a registered agent to receive legal correspondence for your business, and developing an operating agreement as comprehensive as a business plan.

That might sound as daunting as crossing the Cascades in winter, but our abundant resources and support services can make the journey of forming an LLC in Washington more like a leisurely stroll along the Puget Sound. This will allow you to focus on what truly motivates you: constructing and growing your business, watching it rise and thrive.

Note: These directions apply to starting a domestic LLC in Washington. The formation steps and filing requirements for other entities, such as a foreign LLC or professional LLC (PLLC) may differ.

1. Name your Washington LLC

Choosing the right name for your LLC is crucial. The name should be distinctive, memorable, and compliant with Washington’s naming regulations. The state has a business name search, or use our Washington business name search page, and we’ll walk you through the process step by step.

Washington LLC Naming Requirements

Washington state law requires you to include some variation of “Limited Liability Company” as the name’s suffix. You can end your company’s name with the full “Limited Liability Company,” shorten it to “Limited Liability Co.,” or use the abbreviations “LLC” or “L.L.C.”

The state additionally prohibits certain words and combinations of words from appearing in LLC business names. You can’t use words that would suggest your limited liability company is a financial institution, like “banker,” “banking,” “trust,” or “cooperative.” You also can’t combine the words “trust” and “loan.” Finally, you may not use any combination of two or more of the following words: “savings,” “association,” “society,” “home,” “loan,” or “building.”

Seek a compatible domain name

As you search for available business names, check if relevant domain names are available for those business names. A website is an affordable marketing tool that can drive customers to your business. You want a domain that aligns with your LLC name, making the website easy for search engines to find. Check out our domain name registration and domain name search services for more information.

Federal and State Trademarks

The state-level search doesn’t take into account trademarks. The state could approve your LLC’s name and you can spend money on signage, business cards, advertising, etc. only to have someone serve you notice that you’re infringing on their trademark.

To see if your desired LLC name is trademarked on a national level, do a search on the U.S. Patent and Trademark Office website. You can also try applying for a trademark of your own, but this can be a long and costly process.

To see if your name is trademarked at the state level, the Washington Secretary of State site has a trademark search engine. You can also apply for a state trademark of your own for a fee.

We should mention here that neither of the methods above is a guarantee that no one will file a trademark infringement lawsuit against you. The more research you can do on your desired business name (conducting Internet searches or even consulting a trademark attorney, etc.) beforehand, the better.

Reserving a Business Name for your Washington LLC

You might not be ready to take the next step and file your Certificate of Formation right away. Washington gives you the option to reserve your intended name for 180 days by completing a name reservation form and paying a small fee.

Filing a DBA in Washington

If you plan to use an alternate name for your limited liability company, you’ll need to apply for a trade name, commonly known as a “Doing Business As” (DBA) name. You’ll first need to check that your trade name is available and compliant with Washington’s requirements. Unlike your LLC’s official name, your trade name should not have any business entity suffix, including “Limited Liability Company,” “LLC,” or “L.L.C.” The trade name should also not include any words relating to financial institutions, such as “bank,” “trust company,” “credit union,” or other similar words or phrases.

Once you’ve found an acceptable DBA name, you’ll need to register it. Our guide to Washington DBAs can give you the specifics.

Ready to Start Your Washington LLC?

Enter your desired business name to get started

2. Appoint a registered agent in Washington

Select a registered agent for your LLC. Every registered Washington business entity needs to have a registered agent. This is a person or entity acting as the point of contact for service of process (notification of a lawsuit) and other legal documents on behalf of the business. A registered agent’s service is invaluable in maintaining your LLC’s compliance. This service helps ensure that all legal documents are received and handled promptly.

The registered agent must have a Washington residency in the form of a physical street address in the state. If the agent is a business entity, it must have authorization to do business in the state. The agent must also be available in person during normal business hours to receive service of process.

Can you be your own registered agent?

As an LLC member, you can list yourself as a Washington registered agent for your company; however, this option isn’t always in your best interest. If you’re served with a lawsuit, for example, you don’t want to receive this paperwork at your place of business, with customers and clients around. Plus, you probably don’t want to be bound to your office all day in case a process server shows up.

Instead, consider our professional registered agent service. We can help you fill this legal requirement and make sure all important documents get to you in a discreet and time-efficient manner.

ZenBusiness can provide your registered agent

When you use our registered agent service, we’ll provide you with an agent who’s available to receive important legal and Secretary of State notices in person. This gives you the peace of mind of knowing you’re in compliance with the registered agent requirements.

As a bonus, our service also helps keep you organized. When you get important documents, we’ll quickly inform you and keep them together in your online digital dashboard so that you can view, download, and/or print them whenever you want. It’s better than rummaging through piles of papers to try to find important legal documents when you need them.

3. File a Washington LLC Certificate of Formation

Submit your LLC paperwork to the state. Once you’ve decided on a business name and appointed a registered agent, the next step is making your Washington LLC official. To do so, you’ll need to complete a Certificate of Formation and file it with the Washington Secretary of State. Once approved, this is the official document that formally establishes your LLC as a recognized legal entity in Washington.

Information Required in the Washington LLC Certificate of Formation

To officially form your LLC, filing with the Secretary of State is a key step. The Washington Secretary of State oversees the legalities and ensures your business complies with state laws.

To complete your certificate, you’ll need:

- Registered agent name and address. As noted above, this is the person or business that will receive legal documents on behalf of your business, be available during regular business hours, etc.

- Principal office address and contact information. You’ll need to provide a phone and email contact for your business. Your business street address and mailing address (if they are different) are also required. Please note: Unless you’re acting as your own registered agent, this address is not the same as your registered agent’s address.

- Duration. You will choose if your company has a perpetual duration, if it expires after a certain number of years, or if it expires on a specific date.

- Effective date. This is the date your business begins to exist. You can select the date of filing or a different date, but the date isn’t allowed to be more than 90 days from your filing date. It also can’t be prior to the filing date.

- Executor. Washington requires each business to have at least one executor. An executor is a person forming the LLC and signing the Certificate of Formation. An entity is not allowed to be its own executor.

- Governor. Washington also requires each business to have at least one governor. A governor is a person or entity listed on the business’s annual report, and in an LLC is usually a member or a manager.

- Nature of the business. You can be specific, but a more general statement will suffice.

- A return address for filing. This is the email and address where you want follow-up correspondence on your application to go.

File online with the Washington Secretary of State

Obtaining a Certificate of Formation from the Washington Secretary of State is essential to legitimize your LLC. This certificate serves as the legal foundation of your business in Washington.

The Washington Secretary of State prefers online filing but does accept paper forms for an extra fee. Once accepted, your LLC will receive a Washington State Unified Business Identifier (UBI). Be sure to keep a record of that number, as you will use it when dealing with other state agencies.

Within 120 days of forming an LLC in Washington, you’re required to file an Initial Report, which is really the first annual report your LLC will file every year.

Get professional filing help

If this sounds overwhelming, don’t worry. Take a look at our business formation packages and let our team do the work for you. Once the Washington Secretary of State approves your LLC, your state paperwork will be available on your ZenBusiness dashboard, where you can keep it and other important business paperwork digitally organized.

In addition, we offer customized business kits to help you keep these important documents organized and looking professional. Whether it’s an operating agreement, member certificate, business contracts, compliance checklists, transfer ledgers, or anything else, you can be sure it’s all in one safe place.

4. Create an operating agreement

Adopt an LLC operating agreement. An operating agreement is a legal document where you put in writing how the business will run, the breakdown of responsibilities, how profits will be shared, and more. All members (owners) of the LLC will need to approve and sign it, making it a binding contractual relationship between the members. Washington doesn’t require a business to have an operating agreement, but most experts strongly encourage all LLCs to have one.

Why should you get an operating agreement in Washington?

In the operating agreement, every member plays a vital role. It outlines each member’s responsibilities and the operational framework of the LLC, helping ensure a clear path for decision-making and conflict resolution. And, if a conflict arises and you have no operating agreement in place, the default state LLC laws will control the outcome.

What does a Washington operating agreement look like? What’s contained inside will depend on the specifics of your business, but there are a few things you’ll likely want to include:

- Percentage of ownership and distribution of profits

- Voting rights and responsibilities

- Division of roles and responsibilities with members and any managers

- Required meetings

- Buyout and buy-sell rules

Once it’s completed and signed, it should be kept in a secure location with other important business formation information. You don’t need to file it with the state.

If you’re unsure as to how to start creating an operating agreement for your LLC in Washington, then check out this guide. Make note that, if you decide to form your LLC with ZenBusiness, we offer a customizable operating agreement template to save you time researching and crafting the agreement yourself.

5. Apply for an EIN

Get a federal Employer Identification Number (EIN). This is a nine-digit code the Internal Revenue Service (IRS) uses to identify businesses for tax purposes. Most Washington LLCs need this tax ID number, sometimes even those that are single-member LLCs with no employees.

Getting an EIN should be a priority, anyway, as it can help with practical things like opening a business bank account. You can use our EIN registration service to make it easy.

Step 6: Submit your LLC’s beneficial ownership information report

The Corporate Transparency Act went into effect in the beginning of 2024, meaning LLCs and other small businesses have a new requirement: filing a beneficial ownership information report, or BOI report. Under the terms of the act, reporting companies are required to disclose information about their beneficial owners. This, according to the act, will help deter financial crimes by making it more difficult to hide money laundering and other illicit activities behind shell corporations.

When you file your BOI report, you’ll be asked to provide the name, address, and identifying documents for each of your LLC’s beneficial owners. A beneficial owner is anyone who holds 25% or more of your LLC’s ownership interest, gets significant economic benefit from its assets, or exercises substantial control over it. You will submit this information to the Financial Crimes Enforcement Network (FinCEN), and you can do so online or by PDF upload.

Failing to provide this ownership information can have severe criminal and civil penalties, so be sure to file — and on time. For LLCs that organize in 2024, the due date is 90 days after Washington approves your Certificate of Formation. LLCs that organize in 2025 and beyond will see that due date cut to just 30 days post-approval. Any LLCs that organized prior to 2024 will have until January 1, 2025.

If you’d like to learn more about this filing, check out FinCEN’s website. And if you’d like help filing this new form, our BOI report filing service has you covered.

After You Form Your Washington State LLC

Once your Washington State LLC is established, your job isn’t quite finished. There are still a few post-formation steps to tackle to help ensure that your LLC operates compliantly, paving the way to success.

Getting Business Licenses and Permits

There’s a very good chance that your LLC will need business licenses or permits to operate compliantly. For starters, Washington has a general business license that most business entities need to get. Cities and counties sometimes require a general license of their own, too.

It’s also not uncommon for businesses to need an industry-specific permit. You’ll have to do some research to learn if any industry permits apply to your company. If this sounds overwhelming, our business license report can help streamline this process for you.

Setting Up an Accounting System

It’s vital to implement an accounting system to manage finances, track expenses, and prepare for taxes. Good accounting can also help you have a comprehensive view of your business’s progress.

There are lots of options available to you for an accounting system: a simple but thorough spreadsheet, accounting software, hiring a professional bookkeeper, or even just using our ZenBusiness Money app. The priority is that you get an accounting system in place and use it faithfully.

Opening a Business Bank Account

Once you’ve secured your EIN, you’ll be able to open a business bank account. It’s important to keep separate accounts for your business and your personal banking, as failing to do so might land you in legal trouble and open your personal assets up to creditors or those looking to file a lawsuit against your business.

To help you avoid this, we offer a discounted bank account for new businesses. This allows for unlimited transactions, online banking, a debit card, and more. When you want to authorize others in your business to use the account, we offer a banking resolution template to simplify the process.

If you don’t feel confident in your financial skills quite yet, try ZenBusiness Money. It can help you create invoices, receive payments, transfer money, and manage clients all in one place.

Staying Informed About Legal Requirements

Keep abreast of legal changes and requirements, including tax obligations and employment laws, to maintain compliance. Laws and tax rates are subject to change at any time, and it’s your responsibility to stay informed and, of course, adhere to the changes that affect your business.

It can be helpful to occasionally consult with a Washington attorney or CPA to stay informed about relevant changes in a timely manner.

Correcting Filing Mistakes

If you’ve made a mistake in one of your business formation documents, don’t worry; you can correct the issue. To amend an item like your registered agent address, your contact information, or something similar, you’ll need to file an “Amended Certificate of Formation” form with the Washington Secretary of State.

To do this, you must complete the amendment form, detailing the changes being made and the reasons for these changes. Once completed, submit the form along with the required fee to the Secretary of State. It’s important to ensure all information is accurate to avoid further issues or spending extra money on non-refundable filing fees.

Dissolving Your Washington State LLC

Sometimes, an LLC has to close down; maybe it’s time to retire or move on to the next venture. If that’s the case, you’ll need to formally dissolve your LLC to avoid ongoing annual fees and tax liabilities.

Dissolving an LLC in Washington State requires careful steps. To start, a formal decision to dissolve must be made, usually through a vote in accordance with the LLC’s operating agreement. Following this, a “Certificate of Dissolution” must be filed with the state.

After filing, the LLC must settle any debts, liquidate its assets, and distribute any remaining assets to members. It’s crucial to also notify creditors and settle all tax obligations to ensure a smooth dissolution process. For more information, check out our Washington dissolution guide.

We can help

Once you’ve finished the steps above, you’re (literally) in business! You’ve taken the first steps toward building your dream company. But there’s a lot more to know than just how to start an LLC in Washington state.

You need to know about things like hiring employees, getting business licenses and permits, getting additional financing if you need it, how to make changes in your business, and how to stay in compliance with the government.

Our many services can not only help you form your LLC (our LLC formation service starts at $0), but our business experts can also give you long-term business support to help start, run, and grow your business.

WA LLC FORMATION THAT’S FAST AND SIMPLE

Take it from real customers

Washington LLC FAQs

-

The cost of starting an LLC in Washington State depends on your situation. Filing a Certificate of Formation requires a fee, and you must also provide your Initial Report within 120 days, which will cost an extra fee. The cost varies based on filing method, and you’ll pay more if you need expedited service. The total cost could range from $200 to around $300 based on these factors.

In addition to this cost, you may have state and local business licenses, permits, and insurance to pay for when starting your Washington LLC. This will depend largely on the type of business you run. For example, if you work in the food service industry, you need a state business license, health permit, and possibly a liquor permit — to name just a few. LLCs with employees will need workers’ compensation insurance, as well.

-

LLCs in Washington offer flexibility and protection for business owners. By choosing the LLC structure, entrepreneurs combine the advantages of both corporation and partnership business models. Limited liability is a cornerstone of the LLC structure. It usually provides protection for your personal assets against the liabilities of your business operations.

LLCs aren’t the only type of business you can form in Washington. However, about 90% of our customers choose to form an LLC over all other types. Compared to corporations and other forms of entities, LLCs come with enticing benefits. The reporting requirements for LLCs are less extensive than those of a corporation, for instance, and they allow for flexible management structures.

Forming your LLC in Washington state means you’ll reap the following added benefits:

- Skilled labor. Washington highlights its expert workforce as a major boon for business owners. One-third of workers have a postsecondary degree. The state’s many colleges and universities frequently work with businesses in public-private partnerships, feeding the workforce.

- Excellent supply chain. Geographically, Washington is ideally situated for doing business. It’s on the coast, well-connected via ports and on-land transport. It’s also equidistant between Europe and Asia, allowing for promising international business opportunities.

- Favorable tax situation. Washington is one of the few states to have neither personal nor corporate income tax. The state also offers incentives to spur growth: for example, tax deferrals and credits.

-

Your Washington LLC will likely need to pay taxes on the federal, state, and local levels.

At the federal level:

- If you choose pass-through taxation, your income taxes are paid on members’ personal tax returns without first being taxed on the business level.

- Owners typically make quarterly estimated tax payments during the year.

- You can elect to have your LLC treated as a C corporation or S corporation for tax purposes using the IRS Form 8832 for a C corporation and Form 1120-S for an S corporation. In doing this, you’ll need to file a business tax return and report your earnings on your personal taxes.

At the state level:

- While Washington doesn’t have a personal or business income tax, there is a Business and Occupation (B&O) tax, sales and use tax, property tax, and some industry taxes. You can find out more details by visiting the Washington Department of Revenue’s website.

- Small businesses often will file an excise tax return. How often you need to file is assigned to you after you submit your business license application and is based on the estimated amount of tax you owe.

At the local level:

- Most of Washington’s cities and towns have a local sales tax rate, which will be collected by the Washington Department of Revenue.

- Most also have a Business and Occupation tax that the cities collect on their own — for more information on these taxes, you’ll want to contact the city or town where you do business.

Sales tax:

- Sales tax depends on location, and businesses collect sales tax based on the rate of the location where the product or service was delivered.

- To determine the correct rate, the state has provided an online lookup tool.

State employment tax:

- Unemployment tax (also called unemployment insurance tax) is paid quarterly to the Employment Security Department (ESD).

- Tax calculations are based on a rate supplied to your business by ESD and multiplied by each employee’s wages.

Workers’ compensation premiums:

- Workers’ compensation premiums are also paid quarterly to the Department of Labor and Industries.

- Rates are calculated on the risk classification your business will receive from the department and multiplied by hours worked by employees in that classification.

- Employers can deduct a portion of the rate from an employee’s pay — the amount of which will be included in your rate notice.

-

It depends. Your Certificate of Formation will be processed with the Washington Secretary of State in the order in which it is received. Online filing is the quickest way; your LLC paperwork is usually processed within two business days. Washington has options for expediting your filing for an additional fee.

-

No. The operating agreement is kept internally by the members.

-

As an LLC, you have different tax classification options to choose from. The majority of LLC owners opt for the default status. Under this setup, profits are passed through the LLC to the members. You pay taxes only on your individual income tax return. This is unlike most corporations, in which profits are taxed twice, first at the business level and again at the individual shareholder level.

If you meet the IRS criteria, you could also have your LLC taxed as an S corporation. For some LLCs, this can decrease the amount of taxes the members would pay for Social Security and Medicare.

Alternatively, you can have your LLC taxed as a C corporation federally. A C corporation can take advantage of the widest range of deductions, but this is usually advisable only for much larger and more profitable LLCs.

A tax professional can advise you as to which tax status makes the most sense for your business.

Note that the LLC will likely be subject to other state taxes, however. Washington requires LLCs to pay business and occupation taxes, for instance. These are calculated based on your business’s gross receipts. The tax rate varies depending on the type of business.

-

A series LLC is a special business structure that allows multiple limited liability companies to operate under one “parent” organization. Washington does not allow Series LLCs (only a minority of states do).

-

All LLCs in the state of Washington need to file an Initial Report within 120 days of being formed. It should be submitted to the Washington Secretary of State. The Initial Report is the first version of the annual report required each year.

-

You’ll first need to review your operating agreement, as this document should outline how your business handles the addition of new LLC members. Once the addition of the member has been agreed upon by the members, you’ll need to amend your operating agreement or draft a new agreement entirely to document the changes. You may also need to amend your Certificate of Formation with the state.

-

Yes, any LLC doing business in the state is required to file an annual report. This rule applies regardless of whether it’s a domestic LLC or a foreign LLC authorized by the Washington Secretary of State to conduct business in Washington. The Washington LLC annual report can be filed online or mailed in. In both cases, the filing fee is the same — $60.

Staying compliant with the Washington Secretary of State guidelines is vital for your LLC’s longevity. Regular filings and adherence to state regulations, as outlined by the Washington Secretary of State, keep your business in good standing.

-

Formally, you can. However, there are some pitfalls you need to be aware of. These pitfalls can be avoided with ZenBusiness’s professional registered agent service.

-

Before starting the dissolution process, the members of an LLC should vote to dissolve it. For the subsequent steps, please refer to our Washington business dissolution guide.

-

An LLC registered in a different state, also referred to as a foreign LLC, should undergo registration with the Washington Secretary of State before it can conduct business in the state.

Disclaimer: The content on this page is for information purposes only and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

ZenBusiness is a financial technology company and is not a bank. Banking services provided by Thread Bank, Member FDIC. The ZenBusiness Visa Debit Card is issued by Thread Bank pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa debit cards are accepted. FDIC insurance is available for funds on deposit through Thread Bank, Member FDIC.

*Your deposits qualify for up to a maximum of $3,000,000 in FDIC insurance coverage when placed at program banks in the Thread Bank deposit sweep program. Your deposits at each program bank become eligible for FDIC insurance up to $250,000, inclusive of any other deposits you may already hold at the bank in the same ownership capacity. You can access the terms and conditions of the sweep program at https://go.thread.bank/sweepdisclosure and a list of program banks at https://go.thread.bank/programbanks. Please contact customerservice@thread.bank with questions regarding the sweep program.

LLC Formation States Near Washington

Ready to Start Your LLC?