*Mr. Cuban may receive financial compensation for his support.

Last updated: June 12, 2024

Starting a Minnesota LLC can be as thrilling as navigating your boat through a maze of docks on a bustling Saturday at Lake Minnetonka. Sure, the entrepreneurial fire is roaring inside you, reminiscent of those Minnesotan cozy fireplace nights. However, piecing together all the details for your Minnesota LLC might feel like assembling an IKEA dresser after a couple of Grain Belt brews.

But don’t fret. We’re here to make your journey of initiating, operating, and prospering with your Minnesota limited liability company (LLC) as pleasant as a walk in one of the state’s picturesque state parks. Tapping into that good ol’ “Minnesota Nice,” we’ve compiled all the tidbits to clear the path for your Minnesota LLC dreams. So, grab your warmest mittens and a steaming cup of Joe and let this guide be your North Star.

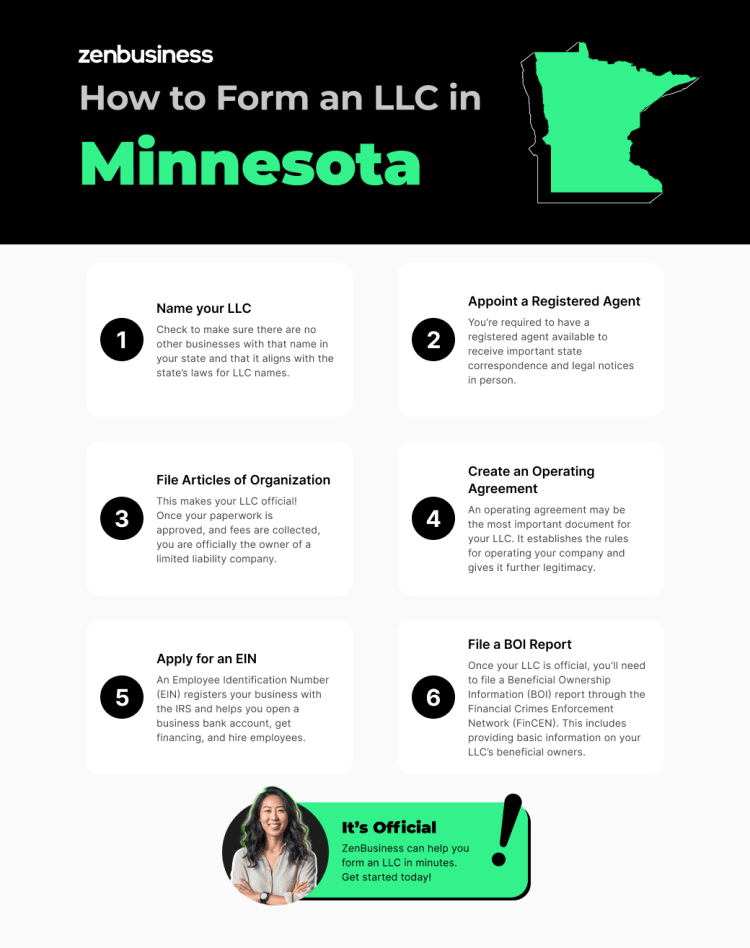

How to Start an LLC in Minnesota

We’ll start with finding a unique name for your LLC before we move on to appointing a registered agent. Next, we’ll file the official paperwork to form your LLC with the Articles of Organization, draft an operating agreement, and get a federal tax ID number. And, we’ll give you more info you may need after you finish those five important steps.

Just a heads-up before we set out: This guide is all about the ins and outs of launching a domestic LLC in Minnesota. If you’re leaning toward a foreign LLC or a PLLC, that’s a different ballgame (or should we say, ice fishing hole?).

- Name your Minnesota LLC

- Appoint a registered agent in Minnesota

- File Minnesota Articles of Organization

- Create an operating agreement

- Apply for an EIN

- File your BOI report

Why create an LLC?

As you get started, you might be wondering why you should create an LLC instead of another structure like a sole proprietorship or partnership. And while those are perfectly viable options, the biggest advantage of an LLC is in its name: limited liability, or personal asset protection.

From a legal standpoint, a limited liability company is a separate legal entity from its owners. The LLC can enter contracts, buy property, and even be sued. But the LLC also has a corporate veil that, in most cases, protects its owners. That means the LLC members usually can’t have their personal assets seized if the business defaults on a loan or can’t pay a legal settlement.

This protection really sets an LLC apart; now let’s explore how to start one.

1. Name your Minnesota LLC

Find a unique name for your LLC. Choosing a name for your business is the first step to forming an LLC in Minnesota. It’s a chance to be creative and really pin down what you and your business have to offer.

When thinking about how to name your LLC, keep in mind that your name should be unique and descriptive. The best name for your Minnesota LLC should:

- Set your business apart from the competition

- Allow consumers to identify your LLC’s purpose quickly

- Transfer easily to usage on the internet

Minnesota state law governs how LLCs are named. When thinking about and conducting your Minnesota business name lookup, follow these five guidelines:

- The name must be in English or any other language expressed in English letters or characters.

- The name must end with “LLC” or “Limited Liability Company.”

- The name must be different from the name of each domestic LLC, limited liability partnership, corporation, and limited partnership, and each foreign limited liability company, limited liability partnership, corporation, and limited partnership on file, authorized or registered to do business in Minnesota.

- The name can’t contain the words “corporation,” “incorporated,” or any abbreviations related to those words.

- The name can’t contain a phrase or a word that implies the business is organized for something other than its allowed purpose.

Minnesota LLC Name Search

You’ll need to conduct an online search to see if the name you want to reserve or register is in use. Checking name availability for your new limited liability company is done online through the Secretary of State.

You’ll need to create an online account and sign in to the website to search. Any name conflicts will be listed after you submit the search form.

Federal and State Trademarks

Even if the Minnesota Secretary of State approves your business name, that’s no guarantee that someone else hasn’t already claimed it with a federal or state trademark. It’s not always easy to see if your desired name is already trademarked because there’s no one central place to check. Some businesses even employ an attorney specializing in trademarks to see if they’re in the clear.

You can take some measures yourself, like searching the trademark database on the U.S. Patent and Trademark Office website. This can help you determine if someone’s already claimed a federal trademark on the name you want.

State trademarks are applicable only within the borders of a state. To see if anyone has a state trademark on the business name you want, contact the Secretary of State office. You can also apply for your own state trademark there. However, you can only do this by mail or in person.

In addition to checking these databases, it’s wise to do an internet search for your business name, including checking domain names, social media sites, and online phone directories.

Check for a matching domain name

After looking up names on the Secretary of State’s website, you can check whether your desired domain name is available. We have a tool to help you do a preliminary domain name search, and our domain name registration service can help you secure the online name that will best serve your business.

Reserving a Business Name with the Minnesota Secretary of State

If you’ve chosen the perfect name but aren’t ready to register your LLC, you have the option to reserve it. This way, no one else can use it while you’re busy figuring out the rest of your business plan. To reserve your business name, you pay a fee and complete a Request for Reservation of Name form.

Your Minnesota LLC name reservation is valid for 12 months after the filing date. When the reservation expires, you can renew it for up to another 12 months. Reserving a name doesn’t count as registering the business; it reserves your right to register an LLC in that name at a later date.

Filing a DBA in Minnesota

If you’ve already registered your Minnesota LLC under one name but want to do business under another, you’ll need to file for an assumed name, also known as a “doing business as” (DBA) name. You’ll complete a Certificate of Assumed Name form and pay a fee for this service.

Your assumed name certificate needs to be renewed every year. It’s free to do so if the assumed name is active and in good standing. However, if the certificate has expired, then you’ll need to pay to reinstate it.

Minnesota law requires that you publish your original Certificate of Assumed Name and any following amendments in a qualified legal newspaper for two consecutive issues. This information must be published in the county where the principal place of business is located. The newspaper will send you an affidavit, or proof of publication, afterward. Be sure to hold onto it so that you can prove you followed the law.

Ready to Start Your Minnesota LLC?

Enter your desired business name to get started

2. Appoint a registered agent in Minnesota

Select a registered agent for your LLC. A registered agent is an individual or business that receives legal notices and certain correspondence from the Secretary of State on behalf of your LLC.

Minnesota law differs from most states in that a business entity formed under the laws of Minnesota may designate a registered agent in its formation document, but does not have to. Only business entities that formed under the laws of another jurisdiction must designate a registered agent when registering to do business in Minnesota.

However, an LLC must still have a registered office where legal notices and state correspondence can be received. A registered office:

- Does not have to be the same as the principal place of business in this state or the principal executive office of the entity;

- Must be a physical street address and may not be a P.O. box or mailbox service.

If you appoint a registered agent, the agent can be:

- A natural person residing in the state;

- A domestic business entity; or

- A foreign (out-of-state) business entity authorized to transact business in the state.

The address of the registered agent and the address of the registered office must be the same.

You can be your own Minnesota registered agent, but you may not want to be. For example, if you’re the LLC’s registered agent and your place of business is the registered office, you could be served notice of a lawsuit in front of clients and employees.

Minnesota LLC Registered Agent Services

That’s where we come in to help ease the burden. A registered agent service like we offer many benefits, including:

- Meeting the legal obligations of the registered agent and office

- Offering privacy, security, and prompt service

- Always being available during business hours to receive notices when you otherwise may not be

To appoint a registered agent in Minnesota, you must include their name when you fill out the Articles of Organization form and file it with the Secretary of State.

3. File Minnesota Articles of Organization

File your paperwork with the state. The Articles of Organization officially registers an LLC with the government. To form your LLC in Minnesota, you must file the Articles of Organization form with the Secretary of State. You can file as an individual or with a business partner or partners. You’ll need the following information to complete the form:

- The name of the LLC

- The registered office address

- The registered agent’s name (if applicable)

- The organizer’s name, address, and signature

- An email address for official notices

- A contact name and daytime phone number

The fee for filing your Minnesota Articles of Organization is $155 for online filings and expedited services in person.

If you choose to mail your Articles of Organization, send it to:

Minnesota Secretary of State – Business Services

First National Bank Building

332 Minnesota Street, Suite N201

Saint Paul, MN 55101

(Note that this is a recent address change from the Minnesota Secretary of State – Business Services Retirement Systems of Minnesota Building address.)

Annual LLC Renewal in Minnesota

In addition, all Minnesota LLCs must be renewed every year by the end of December to avoid being shut down by the state. Most states have an “annual report” that must be filed every year along with a fee, but instead, Minnesota has this Annual Renewal form.

Fortunately, there is no charge for the Annual Renewal. If you need to change the company’s name, registered agent, or office address, you must submit an amendment form and LLC renewal form with an accompanying fee.

4. Create an operating agreement

Draft an LLC operating agreement. An operating agreement sets forth the rules for how your LLC and its members are going to work. According to state law, your MN operating agreement governs:

- Relations among the LLC members

- Relations between the members and the LLC

- Rights and duties of the managers

- Company activities and conduct

- Conditions for amending the agreement

Minnesota LLC Operating Agreement

It’s not required to file your operating agreement with the state, but it’s highly recommended to create and adopt an agreement. Otherwise, under Minnesota law, your LLC will be subject to default provisions that were created to apply to all LLCs without an operating agreement. An operating agreement also helps prevent conflict among members by putting all the terms in writing.

Once an operating agreement is signed by all the members, it becomes legally binding. You don’t need to file it with any government agency, but keep it with your other important legal business documents so you can refer to it easily.

If you’re not sure how to go about creating an operating agreement for your LLC, we have a customizable template to help get you started.

Do I need an operating agreement if I’m the only owner?

It seems like most of the things in your operating agreement are intended to avoid disputes among the LLC members, so we understand why you might think you don’t need one if your LLC doesn’t have more than one member. But potential investors, future business partners, and others may want to see your operating agreement regardless.

Your operating agreement can also spell out what you want to happen to the business and its assets if you die or become incapacitated.

One more thing to keep in mind: Occasionally, someone will take an LLC owner to court to try to prove that the owner and the LLC are the same entity so that they can go after the owner’s personal assets (this is called “piercing the corporate veil”). If that happens, having an operating agreement in place is one more thing to further demonstrate to the court that the business owner and the LLC truly are separate.

5. Apply for an EIN

Get an Employer Identification Number (EIN). Unless you’re a single-member LLC without employees (and sometimes even then), you’re required to get an Employer Identification Number (EIN) from the Internal Revenue Service (IRS).

Even if you don’t legally need an EIN, most banks require one to open a business bank account. You might also need one to obtain credit to grow your business.

You can get your LLC’s EIN through the IRS website, by mail, or by fax. If you don’t want to deal with that particular government agency, we can handle it for you. Our EIN service eliminates the hassle.

After you apply, you’ll receive a seven-digit number to use when it’s time to report and pay business taxes.

Get a Minnesota Tax ID Number

Just as you need a federal tax ID number, you’ll likely need a state tax ID number. You can apply for one through the Minnesota Department of Revenue website. To do so, you’ll need:

- An EIN

- Your LLC’s name and address

- Your North American Industry Classification System (NAICS) code

- Business officers’ names and Social Security numbers

- Contact name and email address

Step 6: Submit your LLC’s beneficial ownership information report

Once your LLC is official, it’s time to file a beneficial ownership information report, or BOI report. This report was introduced by the Corporate Transparency Act, and it’s a new requirement in 2024. The Corporate Transparency Act aims to promote financial transparency and make it more difficult for organizations to hide illegal money laundering behind shell companies.

To do that, the BOI report collects information about your LLC’s beneficial owners: anyone who holds 25% or more of your ownership interest, exercises significant control over the company, or gets substantial economic benefit from the LLC’s assets. For each beneficial owner, you’ll be asked to provide their name, address, and identifying documents. You can file this information with the Financial Crimes Enforcement Network (FinCEN) by uploading a PDF or filling in their online BOI report form.

The BOI report is a federal report (Minnesota doesn’t have a state version), and filing is crucial. Failing to file has severe potential consequences, so be sure to file on time. LLCs created in 2024 will have 90 days after Minnesota approves their Articles of Organization, while LLCs organized in 2025 and beyond will have just 30 days. LLCs that organized before 2024 have until January 1, 2025, to file a BOI report.

For more information about the BOI report, check out FinCEN’s website. If you need help, our BOI report filing service can streamline this step for you.

What to Do After Establishing an LLC in Minnesota

Once your LLC Minnesota is established, it’s essential to take the right steps to ensure your business operates effectively and remains compliant with state regulations. This will help keep your business in good standing well into the future.

Get Business Licenses and Permits

There’s a very good chance that your business will need at least one license or permit to operate legally. Minnesota doesn’t have a general business license at the state level, but your city or county might require one. Likewise, there are plenty of industry-specific permits that might apply to your unique business.

If researching this step sounds overwhelming, our business license report can help.

Open a business bank account for your MN LLC

Once you’ve secured an EIN, you can open a business bank account. Having separate accounts for business and personal banking is critical for sorting out your finances at tax time. It also helps you avoid commingling funds.

Commingling funds makes your taxes more difficult to sort out, and it could also be used against you if someone takes you to court to challenge whether you and your LLC are truly separate entities (that is, they want to sue you for not just your business assets, but also your own assets). You may also want to get a business credit card to make small purchases and start establishing your company’s credit score.

We offer a discounted bank account for your new business. This allows for unlimited transactions, online banking, a debit card, and more. When you want to authorize others in your business to use the account, we offer a banking resolution template to simplify the process.

For more help managing your new company’s finances, try ZenBusiness Money. It helps you create invoices, receive payments, keep track of deductible expenses, transfer money, and manage clients all in one place.

Set Up an Accounting System

Implement an accounting system to manage your finances, track income and expenses, and prepare for tax season. This step is vital for financial organization and decision-making.

You can use a variety of tools for your accounting and bookkeeping, including a spreadsheet, accounting software, or even our Money App. What’s most important is that you set up a system and stick with it.

Evaluating Your Processes Regularly

As time passes, your LLC will evolve, hopefully growing and attracting new customers steadily. The processes and strategies you use when you’re a solo operator might work while you’re small. But as you grow, you might need new processes to operate effectively. For example, you might find that your client scheduling is getting difficult to manage, and you’ll decide to buy booking software.

To stay successful and adapt to changes in the business landscape, be sure to regularly evaluate what’s working, what isn’t, and pivot accordingly.

Managing Your LLC Tax Obligations

A big perk of operating an LLC is that this business structure allows for you to pick the most favorable tax format. By default, LLCs are taxed like pass-through entities at the federal level, meaning the LLC itself doesn’t pay tax on its income; instead, it passes its profits through to its members (owners), who pay their share on their personal income tax returns. For many businesses, this creates a lower tax burden since the business income is only taxed once (as opposed to twice, as in corporations).

But pass-through status doesn’t always give the lowest tax burden. Sometimes, LLCs can benefit from electing S corporation status or even C corporation status. These alternative statuses can offer tax breaks on self-employment taxes, deductions, and so on. It’s important to consult with a tax attorney to discuss which approach is best for you.

What about Minnesota state taxes?

In Minnesota, your tax structure mirrors how you are taxed at the federal level. So if your LLC is taxed like a pass-through entity, you’ll pay taxes on your Minnesota personal tax return. However, if you’re taxed like a corporation, you’ll be subject to the state’s corporation franchise tax.

Beyond that, there’s also a good chance you’ll need to register for, collect, and pay sales taxes. Then there are industry-specific taxes to consider. For example, certain businesses may need to administer the new cannabis tax (introduced in 2023).

Because taxes can be pretty complicated and unique from one business to another, we highly recommend consulting with a Minnesota tax professional to get personalized tax advice.

Legal Requirements for Your LLC in Minnesota

Ensuring compliance with legal requirements is critical for the smooth operation of your LLC in Minnesota. Minnesota’s requirements are subject to change at any time; laws can change. So, it’s a good idea to consult with a business attorney or tax professional regularly to stay informed about these legal requirements and any new ones that come up.

Maintaining Proper Records

Keep accurate and detailed records of all business transactions. This includes financial statements, tax records, contracts, business decisions, and any other documentation that’s important for the lifespan of your LLC. You should also keep an updated copy of your business plan and your operating agreement.

Filing Necessary Reports and Taxes on Time

Submit all required reports and tax filings on time to maintain good standing with the state and avoid penalties. This includes filing your annual renewal, sales tax reports, income taxes, and more.

Adhering to Employment Laws

If your LLC has employees, ensure compliance with Minnesota’s employment laws. This can include wage laws, health and safety standards, employee benefits, and more. You should also register for and pay your unemployment insurance taxes. Minnesota requires you to get workers’ compensation insurance (or self-insure) to protect your employees.

What happens if I don’t follow Minnesota’s legal requirements?

Failing to uphold Minnesota’s business laws can have serious consequences, from penalties and fees to the loss of good standing. Severe cases can even lead to administrative dissolution (when the state shuts down your LLC by force). For example, if you fail to file your Minnesota annual renewal, you might not be able to get a Certificate of Good Standing, which is necessary for certain business transactions.

Thankfully, if your LLC is dissolved, you can get reinstated in most cases. Minnesota will reinstate your LLC if you correct what caused this issue, such as appointing filing your outstanding renewals. There is a $25 reinstatement fee.

A Note About Personal Liability

Another potential consequence of not adhering to Minnesota laws can come in the form of liability protections. While the exact circumstances vary, if an LLC’s members fail to treat their business like a separate legal entity, they might find themselves in legal trouble. A court might rule that the limited liability protections of their company no longer apply, allowing creditors to seize personal assets of the members in compensation for outstanding debts.

In short, not following the rules can defeat the purpose of your LLC’s existence: personal asset protection.

Types of LLCs in Minnesota

There are a few different types of LLCs in Minnesota, each with their own nuances. Explore the different types of LLCs in Minnesota — from single-member LLCs to series LLCs — and find out which type suits your business model.

Single-Member LLC

A single-member LLC is a limited liability company with just one owner or member. That member maintains exclusive management rights.

Multi-Member LLC

As its name implies, a multi-member LLC is an LLC with multiple members or owners. There can be just two members or twenty; the distinction is that there are more than one.

Domestic LLC

A domestic LLC is any LLC that originates in Minnesota.

Foreign LLC

“Foreign limited liability company” doesn’t imply an LLC that originated in another country. Instead, it’s an LLC that was formed in any other state but has applied for authority to conduct business in Minnesota.

Series LLC

Minnesota technically allows series LLCs. In a series LLC, a master LLC owns different “sub-LLCs,” or series, acting much like a parent company. In many states, businesses use a series to protect certain aspects of their business from the liabilities of other areas; each series usually has its own liability protection, so “Series A” won’t suffer if “Series B” gets sued.

However, in Minnesota, series laws dictate that each series shares liability, so the series LLC isn’t as advantageous in this state.

Professional Firm LLCs

Minnesota doesn’t technically offer a separate LLC structure for professionals like doctors, dentists, or lawyers. In other states, they’re called a professional limited liability company. But Minnesota doesn’t technically have a professional LLC. Instead, professional firms that want to organize as an LLC will need to include additional language in their Articles of Organization.

Need help filing your LLC in Minnesota?

If you follow all the steps above, you should be the proud owner of a new LLC! But there’s still more to know than just how to start an LLC in Minnesota. You need to know about things like hiring employees, getting business licenses and permits, getting additional financing if you need it, how to make changes in your business, and how to stay in compliance with the government.

We offer many services beyond just helping you form your LLC. Our business experts can also give you long-term business support to help run and grow your company.

So, if the paperwork of starting a business feels frustrating, we can help. Let us take care of LLC formation, compliance, and more. That way, you can get back to running your dream business, whether it’s a nail salon in Duluth or a Christmas tree farm in Eagan.

Related Topics

MN LLC FORMATION THAT’S FAST AND SIMPLE

Take it from real customers

Minnesota LLC FAQs

-

The cost to start an LLC in Minnesota varies based on several factors. Minnesota LLC Articles of Organization cost $155 when filed online or in person for expedited service. Minnesota’s Secretary of State can process LLC filings online in as few as approximately three to five business days.

Note that the above doesn’t consider ongoing costs like renewing licenses and permits.

-

The benefits of forming a Minnesota LLC include:

- Protection of personal assets

- Exemption from double taxation

- Flexible management structure

- Fewer requirements and formalities than corporations

-

LLCs are typically considered “pass-through entities,” meaning that the business itself typically doesn’t pay federal income tax on its profits. Instead, the responsibility to pay income taxes falls only on the individual. This differs from a typical corporation, where profits are taxed at both the business level and the individual owners’ level.

Single-member LLCs don’t have to file a separate federal return for their LLC. They report the LLC income on their personal income tax return (Form 1040). But LLCs with multiple members must file a separate information federal return for the LLC, Form 1065. Then each LLC member reports their share of the profits on Schedule K-1 and attaches it to their own personal federal tax return.

-

Expedited online processing is immediate. Expedited in-person filing is done while you wait in the office. Processing time by mail varies, as it is done on a non-expedited, first-in-first-out basis. Your Articles of Organization, for instance, if filed by mail, can take approximately four to seven business days for approval (not counting the time in transit).

-

No, you don’t need to file your operating agreement with any government agency in Minnesota. However, the state recommends that you form an operating agreement before registering your LLC with the Secretary of State’s office.

-

Most LLC owners pay state and federal taxes on income earned from their business as part of their individual taxes. Sometimes, larger LLCs choose to file taxes as a corporation.

The structure you choose for your Minnesota LLC depends on different factors. It’s best to consult with a tax professional to be sure that you’re following all applicable tax laws and doing what’s best for your LLC.

-

Minnesota technically allows series LLCs. In a series LLC, a master LLC owns different “sub-LLCs,” or series, acting much like a parent company. In many states, businesses use a series to protect certain aspects of their business from the liabilities of other areas; each series usually has its own liability protection, so “Series A” won’t suffer if “Series B” gets sued. However, in Minnesota, series laws dictate that each series shares liability, so the series LLC isn’t as advantageous in this state.

-

Minnesota doesn’t require a statewide general business license, However, some Minnesota counties and municipalities may require one. You should check your city and county website before opening up your doors to do business to ensure you’ve got the required permits and licenses from your city or town.

In addition, your LLC is likely to need licenses and permits of some kind to operate legally. The Minnesota Employment and Economic Development website has some information about state licensing, but it isn’t comprehensive.

Licensing also happens at the federal and local levels, and different industries require different licenses and permits. So, there’s no one central place to check to see if you have every license and permit you need. You’ll have to do some research.

If you don’t have the time or inclination to do all this research, or if you just want the security of knowing that your business has all the licenses and permits it’s legally obligated to have, our business license report service can do the work for you.

-

You must renew your LLC in Minnesota every year by filling out the appropriate online renewal form. There is no charge for renewals as long as the company is in good standing with the state.

-

To dissolve your LLC in Minnesota, you’ll need to file dissolution paperwork with the state. The first is a Statement of Termination form, and the second is a Statement of Dissolution form.

For more information, visit our Minnesota business dissolution guide.

Disclaimer: The content on this page is for information purposes only and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

ZenBusiness is a financial technology company and is not a bank. Banking services provided by Thread Bank, Member FDIC. The ZenBusiness Visa Debit Card is issued by Thread Bank pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa debit cards are accepted. FDIC insurance is available for funds on deposit through Thread Bank, Member FDIC.

*Your deposits qualify for up to a maximum of $3,000,000 in FDIC insurance coverage when placed at program banks in the Thread Bank deposit sweep program. Your deposits at each program bank become eligible for FDIC insurance up to $250,000, inclusive of any other deposits you may already hold at the bank in the same ownership capacity. You can access the terms and conditions of the sweep program at https://go.thread.bank/sweepdisclosure and a list of program banks at https://go.thread.bank/programbanks. Please contact customerservice@thread.bank with questions regarding the sweep program.

LLC Formation States Near Minnesota

Ready to Start Your LLC?