*Mr. Cuban may receive financial compensation for his support.

Last Updated: June 12, 2024

How to Start an LLC in Nebraska

Thinking about cultivating a Nebraska LLC amidst the sprawling prairies and vibrant cities? The enthusiasm is contagious, but before you plant the seeds of your business venture, there are some hurdles to clear — and it isn’t all cornfields and Husker games.

Embarking on the Nebraska business journey requires careful navigation. This guide is your trusty companion, providing the essential information and sage advice to ensure your path is both purposeful and compliant.

Every state has its quirks, and Nebraska’s limited liability company (LLC) landscape is no exception. Gaining a deep understanding of the state’s regulations and requirements will keep you one step ahead. Beyond just the inception, an adept LLC business service will stay by your side, assisting you throughout your entrepreneurial adventure. So, after your Nebraska LLC takes root, you can shift gears to let it thrive.

Here’s a snapshot: To establish an LLC in Nebraska, you’ll need more than a unique name. A registered agent is required, followed by the accurate filing of a Certificate of Organization with the Nebraska Secretary of State. And while it might seem straightforward, it’s the kind of detail that demands attention.

Follow this with the creation of an operating agreement, secure any licenses and permits, and prep for federal, state, and local tax obligations. And, don’t forget Nebraska’s publication requirement.

In this guide, we aim to untangle the intricacies of setting up an LLC in Nebraska. Just to be clear, our focus here is on the ins and outs of domestic LLCs in Nebraska, not foreign LLCs or professional LLCs (PLLCs). So, saddle up, and let’s ride through the details.

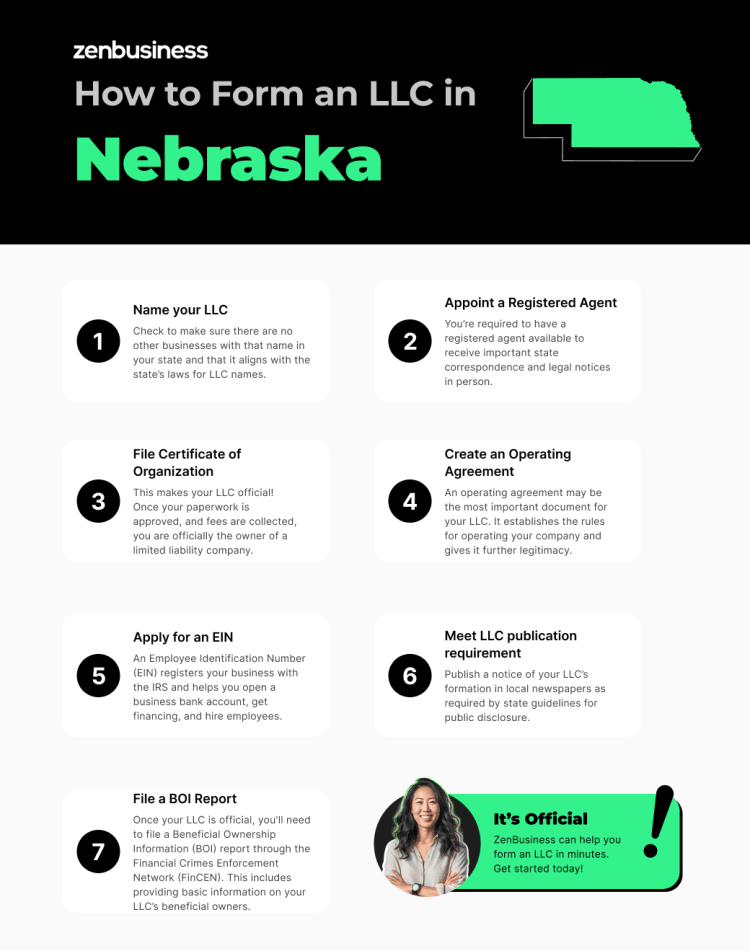

Nebraska LLC Steps

- Name your Nebraska LLC

- Appoint a registered agent in Nebraska

- File Nebraska Certificate of Organization

- Create an operating agreement

- Apply for an EIN

- Meet the Nebraska LLC publication requirement

- Submit your beneficial ownership information report

Step 1. Name your Nebraska company

Choose a unique name for your company. There’s more than meets the eye when it comes to naming your LLC in Nebraska. You can’t just pick whatever name you’d like and be done. First, you need to make sure the name you want is not already taken or too similar to another business’s name in Nebraska. We can show you how to do that with our Nebraska business name search page.

To comply with Nebraska LLC naming guidelines, your company name is required to end with the words “limited liability company,” “limited company,” or the abbreviation L.L.C., LLC, LC, or L.C.; “Limited” may be abbreviated as “Ltd.,” and “company” may be abbreviated as “Co.” Additional information about name requirements can be found in the Nebraska Revised Statute 21-108.

Get creative

Naming your Nebraska LLC offers a creative opportunity to craft a unique and memorable brand identity. The creative process allows you to infuse personality and purpose into your business’s name. Consider what message you want your LLC’s name to convey to potential customers. Think about the emotions, values, and associations you want it to evoke. Brainstorm words, phrases, or imagery that captures the essence of your business and resonates with your target audience. Experiment with different combinations, wordplay, or even subtle references that reflect your industry or niche.

Reserving a Business Name

If you have your desired name chosen before you’re ready to file your Certificate of Organization, you may also want to reserve the name so that it doesn’t get snagged in the meantime. Reserving your business name requires filling out an Application for Reservation of LLC Name and paying a filing fee. The registration lasts for 120 days and can be renewed at the same price as needed. If you plan on filing right away, however, you can skip this step.

Check for federal and state trademarks

To make sure you’re entirely in the clear with your business name, visit the United States Patent and Trademark Office website to see whether your business name or logo is federally trademarked. Trademarks can also happen at the state level. To find out if your desired business name is already trademarked and/or apply for a trademark of your own, go to the Nebraska Secretary of State website page for trademarks.

Getting a Matching Domain Name

When you’re coming up with a business name, it’s wise to consider whether you can secure a matching domain name so that your future website can be easily found online. We have a tool to help you do a preliminary domain name search, and our domain name registration service can help you secure the online name that will best serve your company.

DBAs in Nebraska

Another thing to consider when it comes to your LLC name is whether you’ll want a Nebraska DBA. A DBA or “doing business as” name (sometimes called a “trade name”) is another name you can use for your business other than its legal name. Check the Nebraska Secretary of State Corporate and Business search site to see whether your desired DBA name is available. You’ll want to file it with the Nebraska Secretary of State Corporate Document eDelivery site.

Ready to Start Your Nebraska LLC?

Enter your desired business name to get started

Step 2. Appoint a registered agent in Nebraska

Designate a registered agent. In Nebraska, appointing a registered agent is a crucial step when starting an LLC. A registered agent is an individual or entity responsible for receiving legal documents, official correspondence, and notices on behalf of your business. This role helps ensure that your LLC stays compliant with state regulations and maintains good standing.

While you can serve as your own Nebraska registered agent, many business owners opt for a registered agent service. These services provide an extra layer of convenience and privacy. By hiring a registered agent service, you help ensure that important documents are handled promptly and confidentially, allowing you to focus on running your business without the worry of missing critical notifications.

Step 3. File Nebraska Certificate of Organization

Submit the paperwork to form your LLC. Now it’s time to file! The Certificate of Organization (also known as the Articles of Organization in many other states) is an official document that, once approved, establishes your business entity and registers it with the state.

Get professional help with your LLC filing

Filing official government documents like this can be intimidating and/or complicated for many people, which is why we’re here. With our business formation plans, our professionals handle the filing for you to make sure it’s done quickly and correctly the first time. But, although we can handle this for you, we’ll show you how the process works below.

How to File

Your LLC’s Certificate of Organization can be filed online, by postal mail, or in person. You must also pay a filing fee of $103 if filing online, $110 for filing by mail. If filing online, you would complete the Certificate of Organization form and upload it to the Nebraska Secretary of State website. If filing by mail, you would send the form and filing fee to:

Nebraska Secretary of State

P.O. Box 94608

Lincoln, NE 68509

The Certificate of Organization form requires the following information:

- The name of your company, including the LLC designator

- Your business’s designated physical address and mailing address (if different)

- The name and address of your registered agent or registered agent service (this should be a street address)

- The effective date for the start of the business, if you want it to be at a later date than when you’re filing (this can’t be more than 90 days from the time of filing)

- Name and signature of the LLC organizer

Times are approximate, but filing online usually has a turnaround time of two to three business days. Filing by mail generally takes longer due to the time in transit.

Keep your paperwork organized

If you have us handle filing your Articles of Organization, once the state approves your LLC, your paperwork will be available from your ZenBusiness dashboard, where you can keep it and other important paperwork digitally organized.

Once you get your physical paperwork back from the Nebraska Secretary of State approving your new LLC in Nebraska, you’ll want to keep it in a safe location along with your other important documents, such as your operating agreement, member certificates, contracts, compliance checklists, transfer ledger, etc. We offer a customized business kit to help you keep these important documents organized and looking professional.

Step 4. Create an operating agreement

Draft an LLC operating agreement. The next step when starting your LLC in Nebraska is creating an operating agreement. This document puts into writing how your LLC will be run. While not legally required in Nebraska, an operating agreement can save you some headaches if disagreements occur in the future.

An operating agreement clearly defines rules for all members to follow, which helps resolve disputes down the road. It also creates a clear succession plan should a member leave the business and allows you to avoid some of the default rules of the state and set your own terms for how the LLC will be operated.

If you’re unsure as to how to start creating an operating agreement for your Nebraska LLC, we offer a customizable operating agreement template to help get you started.

Step 5. Apply for an EIN

Get an Employer Identification Number. Obtaining an Employer Identification Number (EIN) is essential for your Nebraska LLC. This unique identifier, also known as a Tax ID Number, is required for LLCs with multiple members or employees. While single-member LLCs without employees may sometimes use their owner’s Social Security number, getting an EIN is a safer option, reducing the risk of identity theft. You can obtain your LLC’s EIN through the IRS website, mail, or fax, but for a hassle-free experience, consider using our quick EIN service, which simplifies the process.

Step 6. Meet the Nebraska publication requirement

Publish notice of your LLC’s formation. One final step specific to the state of Nebraska is that all newly formed LLCs are required to publish notice of organization. Publication is achieved by taking out an advertisement in a legal newspaper with a general circulation near your business location. Costs vary depending on the newspaper, the number of words, and the length of time that the ad runs.

The ad must run for a minimum of three consecutive weeks, and Proof of Publication needs to be filed with the Secretary of State. You can learn more about the specifics on our Nebraska publication requirement page.

Step 7: Submit your LLC’s beneficial ownership information report

After Nebraska approves your Certificate of Organization, you have another new requirement to fulfill: submitting a beneficial ownership information report. This is a new requirement for 2024, introduced by the Corporate Transparency Act. To comply with the act, you’ll be asked to provide the name, address, and identifying documents for each beneficial owner of your LLC.

According to the act, a beneficial owner is anyone who exercises significant control over the LLC, gets substantial economic benefits from it, or owns 25% or more of its ownership interest. You’ll report this information directly to the Financial Crimes Enforcement Network (FinCEN). Thanks to this information, FinCEN strives to counteract financial crimes like money laundering by making it more difficult to hide illegal transactions behind shell companies.

You can file your BOI online with FinCEN or by uploading a PDF version of the form. It’s free to file, and it only happens at the state level (Nebraska doesn’t have its own version). Just be sure to file on time to avoid civil and criminal penalties. If you form during the 2024 calendar year, you’ll need to file the BOI report within 90 days of getting Nebraska’s approval for your Certificate. LLCs that form in 2025 or later will have just 30 days instead. For LLCs that organized prior to 2024, the due date is January 1, 2025.

For more information about the BOI report and the Corporate Transparency Act, check out FinCEN’s website. And if you’d like help submitting the report, look no further than our BOI report filing service.

Steps to Take After Forming Your Nebraska LLC

Once your LLC is officially formed in Nebraska, taking the right steps to establish and maintain your business is essential for its success and compliance.

Getting Business Licenses and Permits

Your new LLC may need specific licenses and permits to operate legally. These depend on your business type and location. For example, Nebraska doesn’t require a general business license on the state level, but your city or county might. There’s also a good chance that your business might need an industry-specific license.

It’s your responsibility to ensure that your business has all the required licenses and permits. Our business license report can streamline this step for you.

Setting Up an Accounting System

Establishing an effective accounting system is crucial for tracking your business finances. This system will help you handle invoicing, monitor expenses, manage payroll (if applicable), and prepare for annual taxes. Accurate accounting is key to the financial health and compliance of your LLC.

There are several tools available for you, including accounting software, hiring a professional, or even just using our Money tool. What’s important is that you get a system in place and use it faithfully.

Opening a Business Bank Account

Opening a distinct business bank account is crucial for Nebraska LLCs, maintaining a clear divide between personal and business finances, simplifying bookkeeping, and enhancing legal protection. This separation streamlines financial management and helps safeguard personal assets, a fundamental step for any LLC owner.

We offer a discounted bank account for your new business. This allows for unlimited transactions, online banking, a debit card, and more.

Establishing Your Online Presence

Establishing a strong online presence is a critical aspect of launching your Nebraska LLC, and securing a domain name is key to achieving this goal. Your domain name serves as your digital identity and often serves as the first interaction customers have with your business. It should closely align with your LLC’s name to enhance brand recognition and credibility.

When selecting a domain name, focus on reflecting your business, keeping it simple, and ensuring it’s easy to remember and spell. Additionally, consider incorporating relevant keywords for SEO benefits, check for trademark conflicts, and plan for future growth. Protecting your brand by purchasing similar domain extensions is also wise. Choosing a strategic domain name is a valuable investment that reinforces your brand and facilitates online marketing efforts, making it easier for potential customers to find and remember your business in the digital landscape.

Staying Informed About Legal Requirements

Keep updated with the legal requirements for your LLC in Nebraska. This includes understanding state and federal tax obligations, employment laws if you have employees, and any industry-specific regulations. It can also be helpful to consult with an attorney regularly to get customized guidance for your business’s unique needs.

Correcting Filing Mistakes

If you discover errors in your LLC’s filing documents, such as the Articles of Organization, Nebraska allows you to correct these mistakes. You’ll need to file the “Amended Certificate of Organization” with the Nebraska Secretary of State.

In this form, you’ll clearly indicate which section (or sections) requires amendment and provide the corrected information. There is a $25 fee to file this online or a $30 fee to file by mail. You can also use this form to update changing information for your business.

Other Business Entity Types in Nebraska

In Nebraska, entrepreneurs have several options when choosing a business entity, each with its own advantages and disadvantages compared to LLCs:

- Sole Proprietorship: This is the simplest form, where the business is not a separate legal entity from the owner. It offers complete control but provides no liability protection. Personal assets are at risk if the business incurs debts or legal issues.

- Partnership: Partnerships are similar to sole proprietorships but involve two or more owners. They offer shared control and can be either general (equal management and liability) or limited (one partner manages and others have limited liability).

- Corporation: Corporations are separate legal entities that provide strong liability protection. Owners (shareholders) are not personally responsible for business debts or legal issues. However, they require more formalities, such as regular meetings and extensive record-keeping.

- S Corporation: S corporations are a tax designation rather than a separate business structure. An LLC or a corporation can elect to be an S corporation, provided it meets the criteria. They have pass-through taxation, similar to an LLC, but have the potential to save the owners on self-employment taxes. However, they have restrictions on the number and type of shareholders.

- Professional Corporation (PC): PCs are designed for licensed professionals like doctors, lawyers, and accountants. They provide liability protection to individual professionals within the organization.

- Nonprofit Corporation: Nonprofits are formed for charitable, religious, educational, or other nonprofit purposes. They have specific tax benefits and must reinvest their earnings into the organization’s mission.

- Limited Partnership (LP): LPs have both general partners (with management control and personal liability) and limited partners (with no management control and limited liability).

The choice of business entity depends on factors like liability protection, management structure, tax considerations, and the nature of the business. Entrepreneurs should carefully evaluate their goals and consult with legal and financial professionals to determine the most suitable option.

Popular Nebraska Cities for Businesses

Here are some of the largest population areas in Nebraska and their potential business categories:

- Omaha, NE:

- Population: Omaha is the largest city in Nebraska with a population of over 400,000.

- Prominent Business Categories: Omaha has a diverse economy with strengths in finance, healthcare, information technology, and agriculture. It is also known for its robust startup community and has a growing tech scene.

- Lincoln, NE:

- Population: Lincoln is the state capital and the second-largest city in Nebraska, with a population of over 280,000.

- Prominent Business Categories: Lincoln has a strong presence in education, government, healthcare, and agriculture. It also has a budding tech and startup ecosystem.

- Bellevue, NE:

- Population: Bellevue is a suburb of Omaha and has a population of around 53,000.

- Prominent Business Categories: Given its proximity to Omaha, Bellevue shares in the economic activities of the larger city. It is also home to Offutt Air Force Base, which contributes to the local economy.

- Grand Island, NE:

- Population: Grand Island has a population of approximately 50,000.

- Prominent Business Categories: Agriculture, manufacturing, and healthcare are significant sectors in Grand Island. The city’s location in the heart of Nebraska’s agricultural region makes it a hub for related businesses.

- Kearney, NE:

- Population: Kearney has a population of around 33,000.

- Prominent Business Categories: Kearney is known for its strong presence in healthcare, education, and retail. It’s also an important transportation and distribution center.

- Fremont, NE:

- Population: Fremont has a population of approximately 26,000.

- Prominent Business Categories: Manufacturing, agriculture, and healthcare are key sectors in Fremont. The city has a history of manufacturing and is home to several industrial companies.

Dissolving Your Nebraska LLC

Dissolving an LLC in Nebraska involves a few crucial steps. First, the decision to dissolve must typically be agreed upon by the LLC members, as outlined in the operating agreement (the operating agreement has a huge impact on this process). After this decision, the LLC must settle any outstanding debts and obligations.

Once these financial obligations are resolved, you need to file a Statement of Dissolution form with the Nebraska Secretary of State. This filing officially winds up the LLC and notifies the state of its closure. It’s important to also handle any final tax obligations, including filing a final tax return and paying any owed taxes, to ensure a clean dissolution. After the outstanding liabilities are all paid, the LLC can distribute any remaining assets among its members (again, as dictated by the operating agreement).

For more information on this process, check out our guide to dissolving a Nebraska LLC.

We can help

At ZenBusiness, we believe every aspiring entrepreneur should have the tools and support necessary to create a business, which is why we’ve made it easy with our free LLC service. We handle the complexities of starting an LLC in Nebraska, while you focus on your business. Along with LLC formation, we provide worry-free compliance services and more to keep your business in good standing. With expert support on hand every step of the way, we have everything you need to run and grow your business effortlessly.

So, whether you’re forming a coffee shop in Lincoln or a pet sitting business in Omaha, join the hundreds of thousands of businesses we’ve helped launch.

NE LLC FORMATION THAT’S FAST AND SIMPLE

Take it from real customers

Nebraska LLC FAQs

-

The state fees for forming a Nebraska LLC range from approximately $103 to $175, depending on factors such as your method of filing, whether you choose to reserve your business name, etc. Note that fees change over time, so you should check the Secretary of State website for the most recent fee schedule.

-

An LLC is a common business structure that many small businesses choose when forming their companies. LLCs offer great flexibility in managing your company with minimal regulations and red tape to cut through.

LLCs also make it easy to separate member (business owner) personal assets from company finances, offering more secure legal protections.

Here are some of the primary reasons many Nebraska business owners opt to form an LLC:

- The LLC business structure separates your personal assets and debts from your business finances and liabilities.

- LLCs offer flexible management structures, allowing you to organize and run your LLC in a way that makes sense for your industry and company.

- By default, an LLC protects you from double taxation. Unlike a corporation, an LLC’s profits aren’t taxed at the business level, just the personal level.

- LLCs have very few reporting requirements, making them easier to manage administratively than corporations.

These are just a few of the main benefits of forming an LLC. The benefits of forming a business in Nebraska include:

- The state is known for its friendly people, safe neighborhoods, and high quality of life.

- The Nebraska government offers an incentive package for new businesses that can save you money.

- Nebraska has some of the lowest power rates in the nation.

- Multiple industrial sites and buildings are ready for immediate occupancy.

-

Since filing happens electronically, it usually takes only a few business days to complete. If you’re in a hurry, you can contact the Secretary of State Business Services Division at (402) 471-4079 to request expedited processing of a filing submitted electronically.

-

No, operating agreements don’t need to be filed with the state. However, since they’re legally binding documents, your operating agreement should be kept in a safe place in case it’s needed in the future.

-

Federal Taxes

LLCs are typically considered “pass-through entities,” meaning that the business itself typically doesn’t pay federal income tax on its profits. Instead, the responsibility to pay income taxes falls only on the individual. This differs from a typical corporation, where profits are taxed at both the business level and the individual owners’ level.

Single-member LLCs don’t have to file a separate federal return for their LLC. They report the LLC income on their personal income tax return (Form 1040). But LLCs with multiple members must file a separate information federal return for the LLC, Form 1065. Then each LLC member reports their share of the profits on Schedule K-1 and attaches it to their own personal federal tax return.

Although LLCs are taxed as sole proprietorships or general partnerships by default, LLCs also have the option to be taxed as corporations. Some LLC members choose to classify their businesses as an S corporation or a C corporation, which can be advantageous for certain LLCs.

In particular, many LLCs elect to be taxed as S corporations because it can save the members money on self-employment taxes. You can learn more on our “What Is an S Corp?” page.

You also have a few other forms of federal taxation to keep in mind. For example, you will likely need to pay self-employment taxes on your portion of the LLC’s profits. These are the taxes that go toward Social Security and Medicare. Fortunately, an LLC member can deduct half of the self-employment taxes paid as a business expense.

State Taxes

For state income taxes, Nebraska treats LLCs the same way they choose to be taxed by the federal government.

If your LLC sells goods, and you collect sales tax, or if you have employees, you must register your LLC with the Nebraska Department of Revenue so that you’re set up to pay the appropriate taxes on time and remain in compliance.

-

LLC owners typically only pay state and federal taxes on their personal income from the LLC. An LLC is not separately taxed.

Some LLCs (particularly those with high earnings) may choose to file taxes as either an S corporation or a C corporation. This option has some distinct advantages for certain LLCs. You can learn more about how these methods of taxation compare on our LLC vs. S corporation and LLC vs. C corporation pages.

In evaluating these options, it’s helpful to get advice from qualified accounting professionals.

-

No, Nebraska does not currently allow Series LLCs. A Series LLC is set up with one primary LLC that acts as an umbrella over several other LLCs in order to shield the LLCs from each other’s liabilities. Still, most states in the U.S. don’t allow for this type of company.

-

Your Nebraska biennial report is due on odd-numbered years by April 1.

We can help you with your biennial report in a couple of ways. Our biennial report service will help you file your biennial report, and our Worry-Free Compliance service not only helps with filing your biennial report but also sends you other important compliance reminders and helps you with two amendment filings each year.

-

Dissolving a Nebraska limited liability company requires that you file a Statement of Dissolution and pay a filing fee. You will also need to give a public notice and follow the terms in your LLC’s operating agreement.

For more information, visit our Nebraska business dissolution guide.

-

Nebraska businesses are required to give public notice when they first form or amend their Nebraska LLC Certificate of Organization, merge, or dissolve. This requirement is met by posting an advertisement in a local legal newspaper for three consecutive weeks.

-

When a foreign LLC conducts business in Nebraska, it’s required to undergo a procedure of authorization. Once it’s authorized by the state, it will obtain a Certificate of Authority that enables it as an entity eligible to conduct business in Nebraska.

Disclaimer: The content on this page is for information purposes only and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

ZenBusiness is a financial technology company and is not a bank. Banking services provided by Thread Bank, Member FDIC. The ZenBusiness Visa Debit Card is issued by Thread Bank pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa debit cards are accepted. FDIC insurance is available for funds on deposit through Thread Bank, Member FDIC.

*Your deposits qualify for up to a maximum of $3,000,000 in FDIC insurance coverage when placed at program banks in the Thread Bank deposit sweep program. Your deposits at each program bank become eligible for FDIC insurance up to $250,000, inclusive of any other deposits you may already hold at the bank in the same ownership capacity. You can access the terms and conditions of the sweep program at https://go.thread.bank/sweepdisclosure and a list of program banks at https://go.thread.bank/programbanks. Please contact customerservice@thread.bank with questions regarding the sweep program.

LLC Formation States Near Nebraska

Ready to Start Your LLC?