*Mr. Cuban may receive financial compensation for his support.

Last updated: June 12, 2024

Don’t let the process of starting a company in Maine overwhelm you. We have your back. Our guide shows you how to get your Maine limited liability company (LLC) up and running quickly and affordably.

In this guide, we outline five steps to help you start a Maine LLC. We also explain how the right LLC service can make the process easier and quicker, allowing you to focus on opening and growing your business. We’re here to help whether you file yourself or use a service like ours.

Following this guide will help you save time by avoiding missteps along the way.

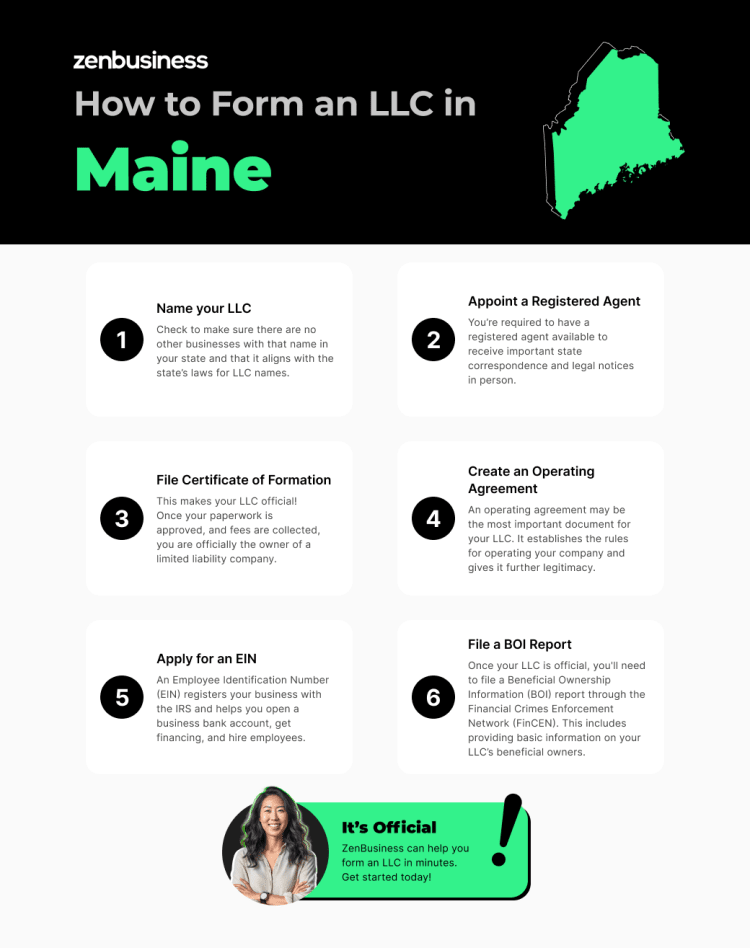

How to Start an LLC in Maine

LLC requirements vary state by state so it’s important that you are well-versed in Maine laws before proceeding. Generally, it comes down to these steps:

- Name your Maine LLC

- Appoint a registered agent in Maine

- File the Maine Certificate of Formation

- Create an operating agreement

- Apply for an EIN

- File your LLC’s BOI report

Step 1: Name your Maine LLC

Pick a unique name for your LLC. The first step is selecting an LLC name. That may sound simple, but it’s important to consider a few factors. You need a name that’s clear and identifiable for your Maine business.

LLC Naming Requirements

Maine state law requires that your business name include one of the following designators in its name indicating that the company is an LLC:

- Limited Liability Company

- Limited Company

- L.L.C.

- LLC

- L.C.

- LC

Be careful about names that can sound questionable in nature. Maine forbids using obscene language, as well as anything that promotes illegal activity. You also can’t use a name that makes a false connection to a public entity.

Name Search and Reservation

Before finalizing anything, though, you need to research whether the name you want is available. You can’t have the same name as any other business in Maine. We have a Maine business name search page that can guide you through this process.

If you find a name you like but aren’t yet ready to file your Articles of Organization, Maine allows you to reserve a business name for 120 days for a $20 filing fee. This reservation can’t be renewed.

Securing a Matching Web Domain

When you’re coming up with a business name, it’s wise to consider whether you can secure a matching domain name so that your future website can be easily found online. We have a tool to help you do a preliminary domain name search, and our domain name registration service can help you secure the online name that will best serve your company.

Registering an Assumed Name

If you plan on naming your LLC one thing but want to do business with another name, you will need a DBA (“doing business as”) name, known in Maine as an “assumed name.” For this, you’ll need to file a Statement of Intention to Do Business Under an Assumed or Fictitious Name. There is a filing fee involved for an assumed name filing. Each assumed name filing costs $125 for LLCs.

Note that the Pine Tree State (unlike most other states) differentiates between an assumed name and a “fictitious name.” Here a fictitious name is a name adopted by a foreign (out-of-state) corporation authorized to transact business in Maine because its real name is unavailable. There’s a fee involved for a fictitious name filing.

If you want to simplify and speed up the process of securing an assumed name, we have a Maine DBA service you can use.

Check for federal and state trademarks

To make sure you’re entirely in the clear with your business name, visit the United States Patent and Trademark Office website. There you can find out whether your business name or logo is federally trademarked.

Trademarks can also happen at the state level. To find out if your desired business name is already trademarked in Maine and/or apply for a trademark of your own, go to the Maine Secretary of State website and run a Corporate Name Search.

Ready to Start Your Maine LLC?

Enter your desired business name to get started

Step 2: Appoint a registered agent in Maine

Choose a registered agent. A registered agent is a person or business entity designated to receive legal documents and certain correspondence from the Secretary of State on behalf of your business. Basically, an agent will be the designated recipient of legal summons if someone ever takes your business to court.

Because legal proceedings are quite important, Maine requires a registered agent to be listed and kept current.

Who can serve as your registered agent?

To serve as a registered agent in Maine, the following criteria must be met. A Maine registered agent must:

- Be an individual resident 18 or older of the state OR a company authorized to do business in the state

- Have a physical address in Maine (no P.O. boxes)

- Be present at that address during normal business hours

Under those criteria, you can technically serve as your own agent, appoint a friend or family member, or hire a registered agent service. It’s generally recommended to appoint a registered agent service. We can provide you with a Maine registered agent service through our third-party partner.

Why should I use a registered agent service?

There are several reasons you should appoint a registered agent service.

- Practicality: Hiring a service frees you up to complete other crucial business tasks. It also prevents you from being tied down to a single address, too.

- Staying organized: A good registered agent service can help you organize the legal mail you receive and help ensure you don’t miss any notices.

- Maintaining professional image: Serving as your own agent could mean receiving notice about a lawsuit against you while you’re in front of a client or your employees. Using a registered agent service ensures you never face that embarrassment.

Step 3: File Maine Certificate of Formation

File the paperwork to officially form your LLC. Now that you have your name and registered agent, it’s time to file your Certificate of Formation. To complete the application, you will need the following information:

- The name of the company

- The filing date (You can choose between the date you file the paperwork or a later date.)

- Your designation as a low-profit LLC (You only complete this section if you meet specific qualifications.)

- Your designation as a professional LLC (Here, too, you only complete if you meet certain qualifications.)

- A registered agent (You can select from a noncommercial or commercial registered agent.)

- Any attachments the LLC owners or members decide to include

- Signature (At least one authorized person needs to sign the application.)

The application also requires a cover letter that includes:

- The name of your organization

- A list of the filings you’re enclosing (Certificate of Formation)

- Any special handling requests (This is where you can check a box if, for example, you want expedited filing. You can pick 24-hour or immediate service.)

- Contact information (List the person the Secretary of State’s office should contact if they have any questions.)

- The address where the Secretary of State’s office will return documents

To file your application, you must pay a filing fee of $175. Expedited filing is an additional cost for 24-hour processing and immediate processing. All applications must be delivered by mail or in person. Maine is unusual in that it has no online filing option.

To mail in your Certificate of Formation, send it to:

Department of the Secretary of State

Division of Corporations, UCC and Commissions

101 State House Station

Augusta, ME 04333-0101

That all being said, filing official government documents like this can be intimidating and/or complicated for many people, which is why we’re here. With our business formation plans, our professionals handle the filing for you to make sure it’s done quickly and correctly the first time.

Step 4: Create an operating agreement

Write an operating agreement. Unlike most states, Maine requires LLCs to have an operating agreement, which it calls an LLC Agreement. According to the statute, you can create the agreement before or after filing your Certificate of Formation, but you must create one.

Even if Maine didn’t require an LLC operating agreement, we’d still recommend writing one. That’s because a Maine operating agreement presents a lot of benefits:

- Protecting personal assets: A good operating agreement provides further proof that you’re treating your LLC as a separate legal entity, which makes it much harder for your corporate veil to be pierced, meaning your personal assets are safer.

- Solving (and even preventing) disputes: Your operating agreement will clearly delineate member responsibilities, profit distributions, and more. Since these terms are set out from the get-go, you help avoid problems. On a similar note, you’ll have a set method for resolving any problems that do arise anyway.

- Setting up your business’s future: Your agreement will describe how to add or remove members from your LLC, what would happen if you were incapacitated, how you could dissolve your business, and more. Even if you plan to be in business for the long haul, these provisions are essential for your long-term success.

Your operating agreement, once complete, should be kept with your business filings.

Let us help take the guesswork out of creating your operating agreement. We have plans that include a customizable operating agreement template.

Step 5: Apply for an EIN

Get an EIN. The fifth step is to apply for an Employer Identification Number (EIN), also called a Tax ID Number. You can apply for an EIN through the IRS website or by mailing Form SS-4. But if you’re unfond of dealing with that particular government agency, we can get it for you. Our EIN service is quick and eliminates the hassle.

Your business EIN works like a Social Security number for your business and is also referred to as a Federal Tax Identification Number. Among other things, you need an EIN if you have multiple LLC members or if you plan to hire employees. Still, even if neither of those applies to your business, you should consider obtaining an EIN, anyway. Most banks require an EIN to open a business bank account.

Maine State Taxes

Your Maine LLC may also need to pay a variety of state and local taxes. These include taxes that are payable to the Maine government, like sales tax. If you plan to sell products or services taxable in Maine, you will need to file an Application for Tax Registration with the Maine Revenue Services.

For state income taxes, your LLC will be taxed the same way as you elected to have it taxed by the federal government. If you have your LLC taxed as a corporation at the federal level, you’ll also need to pay Maine’s corporate income tax.

To learn more about your tax responsibilities, contact the Maine Revenue Services and your local tax authorities. We also advise consulting a tax professional.

Step 6: Submit your LLC’s beneficial ownership information report

At the beginning of 2024, the Corporate Transparency Act went into effect, bringing with it a new requirement for LLCs and small businesses: a beneficial ownership information report, or BOI report. The report requires you to disclose information about your LLC’s beneficial owners — anyone who exercises substantial control over it, gets significant economic benefit from its assets, or holds 25% or more of its ownership interest.

When you file a BOI report with the Financial Crimes Enforcement Network (FinCEN), you’ll be asked to provide the name, address, and identifying documents for each beneficial owner. By requiring this information, FinCEN aims to deter financial crimes like money laundering by making it more difficult to hide illicit activities behind shell companies.

Filing is free (and limited to the federal level), and you can file online or by uploading a PDF to FinCEN’s website. Just be sure to file on time: the report is due within 90 days of getting Maine’s approval for your Articles of Organization if you form during 2024. If you form in 2025 onward, that timeline drops to just 30 days. Any LLCs that organized before 2024 have until January 1, 2025, to file.

To learn more about the Corporate Transparency Act and the BOI report, check out FinCEN’s website. If you’re looking for help filing the form, our BOI report filing service has you covered.

Steps to Take After Forming Your Maine LLC

Once your Maine LLC is established, it’s crucial to undertake a few more steps to ensure smooth operation and compliance.

Getting Business Licenses and Permits

Your LLC may need specific licenses or permits, depending on its type and location. For example, even though Maine doesn’t have a statewide general business license, sometimes cities or counties do. There’s also a good chance that you’ll need an industry-specific permit.

Ultimately, it’s your responsibility to ensure you acquire all necessary permissions to operate legally in Maine. If this feels like a tall order, our business license report streamlines this step for you.

Setting Up an Accounting System

Implement an effective accounting system to manage your finances, track expenses, and prepare for taxes. It’s essential for maintaining financial health and compliance.

There are lots of good tools available: spreadsheets, accounting software, professionals for hire, or even our ZenBusiness Money tool. What matters most is that you pick a system, implement it, and stick with it.

Opening a Business Bank Account

Once you’ve secured an EIN, you’ll be able to open a business bank account. Having separate accounts for your business and your personal banking is critical for sorting out your finances at tax time and helps you avoid commingling funds. Commingling funds can not only make your taxes more difficult, but it could also be used against you if someone takes you to court to challenge whether you and your LLC are truly separate entities.

We offer a discounted bank account for your new business. This allows for unlimited transactions, online banking, a debit card, and more. When you want to authorize others in your business to use the account, we offer a banking resolution template to simplify the process.

Staying Informed About Legal Requirements

Stay updated on ongoing legal requirements, including tax obligations and any changes in business laws, to ensure your LLC’s compliance in Maine. These obligations are subject to change at any time. That’s why a lot of entrepreneurs have a regular consultation with an attorney or tax professional to make it easier to stay informed.

Correcting Filing Mistakes

If you accidentally made a mistake on your Certificate of Formation, don’t worry; you can correct them. The process involves filing the Certificate of Amendment form (available on the Maine Secretary of State website). Fill out the form with the correct information, clearly indicating the errors being corrected. After completing the form, submit it along with the required $50 filing fee. It’s important to double-check the form before submission to ensure all corrections are accurate.

Timely correction of these details is crucial for maintaining accurate public records and ensuring your LLC’s compliance with state regulations.

Dissolving Your Maine LLC

Dissolving an LLC in Maine is a multi-step process that requires careful attention. First, refer to your LLC’s operating agreement for any specified dissolution procedures. You should follow those guidelines when getting consent for the dissolution from your members. After that, you’ll need to file a Certificate of Cancellation with the Secretary of State. This document officially notifies the state of your LLC’s termination.

As part of this process, you’ll also have to ensure that all debts and liabilities of the LLC are settled, and any remaining assets are distributed among the members according to the LLC’s operating agreement or state law. Additionally, it’s vital to address any final tax obligations. This includes filing a final tax return and paying any outstanding taxes. Properly concluding all business and tax affairs is essential to avoid legal complications or financial liabilities after dissolution.

For more information about this process, check out our guide to dissolving a Maine LLC.

Need help filing an LLC in Maine?

At ZenBusiness, we believe every aspiring entrepreneur should have the tools and support necessary to create a business, which is why we’ve made it easy with our free LLC service. We handle the complexities of starting an LLC in Maine, while you focus on your business.

Along with LLC formation, we provide worry-free compliance services and more to keep your business in good standing. With expert support on hand every step of the way, we have everything you need to run and grow your business effortlessly.

So, whether you’re starting a rental property business in Augusta or a food truck in South Portland, join the hundreds of thousands of businesses we’ve helped launch.

Related Topics

ME LLC FORMATION THAT’S FAST AND SIMPLE

Take it from real customers

-

The state fees for forming a Maine LLC range from approximately $175 to $195, depending on factors such as whether you choose to reserve your business name. Note that filing fees change over time, so you should check the Secretary of State website for the most recent fee schedule. There are also expedited filing options, which would incur additional costs depending on the speed you opted for.

-

There are several benefits to selecting an LLC structure for your business. A few include:

- Limited liability for individual owners or members. If your business is sued or goes out of business owing debt, the personal assets of individual members are usually protected.

- Taxes. The income that your business earns will be distributed to the members, and those members will be taxed on their personal income. This is different from a corporate structure where the business would be taxed and then the income distributions would also appear on personal taxes.

- Less red tape. There’s more flexibility over the structure and record-keeping of an LLC than with a corporation.

Learn more about the benefits of the LLC business structure.

-

LLCs are typically considered “pass-through entities,” meaning they’re not subject to federal corporate income taxes. Instead, the profits are passed through to the owner’s personal income, and the responsibility to pay taxes falls only on the individual. This is unlike most corporations, in which profits are taxed twice, first at the business level and again at the individual shareholder level.

Single-member LLCs don’t have to file a separate federal return for their LLC. They report the LLC income on their personal income tax return (Form 1040). But LLCs with multiple members must file a separate informational federal return for the LLC, Form 1065. Then each LLC member reports their share of the profits on Schedule K-1 and attaches it to their own personal federal tax return.

Although LLCs are taxed as sole proprietorships or general partnerships by default, LLCs also have the option to be taxed as corporations. Some LLC members choose to classify their businesses as an S corporation or a C corporation, which can be advantageous in some cases. In particular, many LLCs elect to be taxed as S corporations because it could potentially save the members money on self-employment taxes. You can learn more on our “What Is an S Corp?” page.

You also have a few other forms of federal taxation to keep in mind. For example, you will likely need to pay self-employment taxes on your portion of the LLC’s profits. These are the taxes that go toward Social Security and Medicare.

-

According to the Secretary of State website, after filing your Maine LLC Certificate of Formation, it takes approximately 25 to 30 business days to be processed. Maine has options for expediting your filing for an additional fee.

-

While Maine is one of several states requiring an LLC to have an operating agreement, you’re not required to file it with the Secretary of State’s office.

-

LLC owners typically only pay state and federal taxes on their personal income from the LLC. An LLC is not separately taxed.

Some LLCs (particularly those with high earnings) may choose to file taxes as either an S corporation or a C corporation. This option has some distinct advantages for certain LLCs. You can learn more about how these methods of taxation compare on our LLC vs. S corporation and LLC vs. C corporation pages.

In evaluating these options, it can be extremely helpful to get advice from qualified accounting professionals.

-

No. As of this writing, Maine doesn’t allow Series LLCs. A Series LLC is set up with one primary LLC that acts as an umbrella over several other LLCs in order to shield the LLCs from each other’s liabilities.

-

Your Maine LLC must file an annual report and pay an accompanying fee to the Secretary of State by June 1 of each year.

We can help you with your Maine annual report in a couple of ways. Our annual report service will help you file your annual report, and our Worry-Free Compliance service helps you file your annual report, sends you important compliance reminders, and helps you with two amendment filings each year.

-

You can officially dissolve your LLC by following the terms set forth in your operating agreement and filing the Articles of Dissolution with the Maine Secretary of State. There’s a filing fee involved for submitting the application.

For more information, visit our Maine business dissolution guide.

-

Yes, an LLC registered in a different state may conduct business in Maine after it files a Statement of Foreign Qualification to Conduct Activities and pays the requisite fee.

Disclaimer: The content on this page is for information purposes only and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

ZenBusiness is a financial technology company and is not a bank. Banking services provided by Thread Bank, Member FDIC. The ZenBusiness Visa Debit Card is issued by Thread Bank pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa debit cards are accepted. FDIC insurance is available for funds on deposit through Thread Bank, Member FDIC.

*Your deposits qualify for up to a maximum of $3,000,000 in FDIC insurance coverage when placed at program banks in the Thread Bank deposit sweep program. Your deposits at each program bank become eligible for FDIC insurance up to $250,000, inclusive of any other deposits you may already hold at the bank in the same ownership capacity. You can access the terms and conditions of the sweep program at https://go.thread.bank/sweepdisclosure and a list of program banks at https://go.thread.bank/programbanks. Please contact customerservice@thread.bank with questions regarding the sweep program.

LLC Formation States Near Maine

Ready to Start Your LLC?