*Mr. Cuban may receive financial compensation for his support.

Updated: June 12, 2024

How to Start an LLC in Massachusetts

Launching a Massachusetts LLC is akin to setting sail on an entrepreneurial adventure reminiscent of a fall drive along the Mohawk Trail. The Bay State serves as more than just a backdrop for tea parties and clam chowder tales. It’s a burgeoning epicenter for innovation and opportunity. So, if the revolutionary zeal of Paul Revere inspires you to blaze a new trail in Massachusetts, then the LLC structure might just be your beacon, illuminating the path ahead.

An LLC in Massachusetts isn’t just a pick from the bunch; it’s like choosing the Red Sox jersey in a store full of baseball teams. Why? Because it provides a blend of tax advantages, a shield for personal assets, adaptability in management, and so much more.

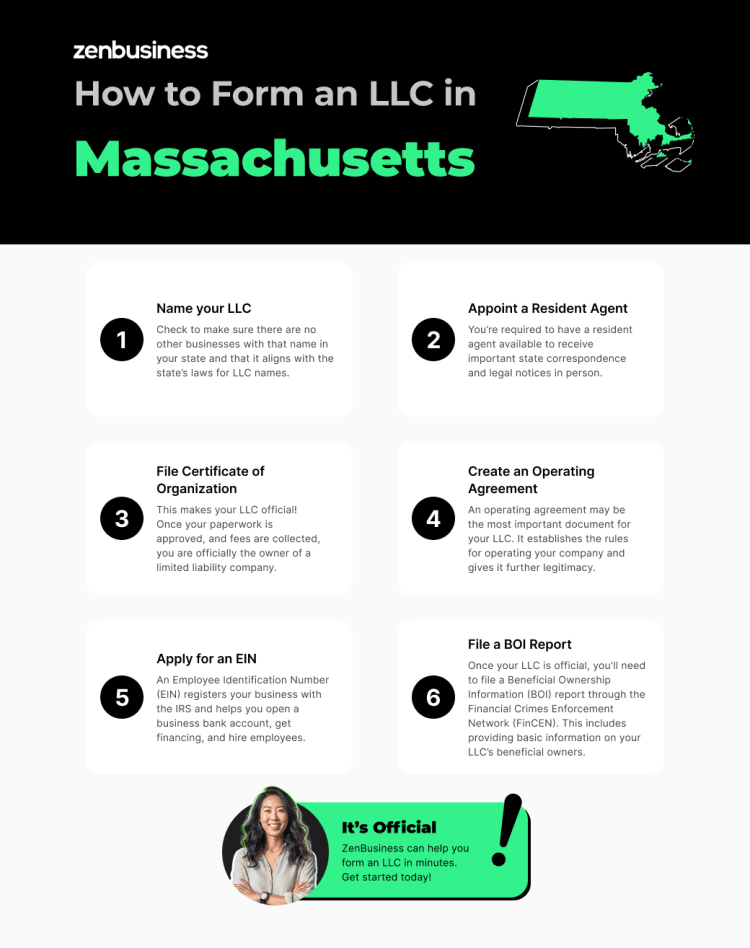

Six steps to starting your new business

Now, here are the six basic steps to creating an LLC in MA:

- Branding your LLC with the perfect name. Choosing a unique and compliant name is one of the fundamental steps in the formation process.

- Appointing a resident agent (or as some say, “registered agent”) to be your business’s recipient of legal notices. It’s essential to have a resident agent with a physical address in the state for legal correspondence.

- Registering your Certificate of Organization with the Secretary of the Commonwealth Corporations Division. This crucial step formally registers your business with the state and involves a filing fee.

- Crafting an operating agreement to lay down your LLC’s ground rules. Although not mandatory, it’s a wise way to outline the LLC’s management and financial structure.

- Securing an EIN to keep Uncle Sam in the loop. Necessary for tax purposes, this service is often provided by companies assisting with LLC formation.

- File a BOI report for your LLC

To make things as smooth as a Boston cream pie, we’ve baked you a five-step guide detailing the Massachusetts LLC inception process, seasoned with our top-tier services, plus a few pro tips to help ensure your business journey is more marathon than sprint.

Just a heads up: our focus here is on the formation of a for-profit, domestic LLC in Massachusetts. If your compass points toward a foreign LLC or a professional limited liability company (PLLC), note that the route and landmarks differ. While we don’t directly help with those formations, we do have a roadmap for establishing a Massachusetts PLLC. Safe travels!

Step 1: Name your Massachusetts LLC

Choose a name for your LLC. Massachusetts has some rules for naming an LLC, so it’s important that you do some research to ensure that the name you want follows them. You’ll also want a name that’s catchy, will perfectly translate what your business is about, and be memorable. We have an article that can help you come up with a great business name.

Naming Requirements for Massachusetts LLCs

Although Massachusetts doesn’t have a long list of naming rules for LLCs, consider each carefully anyway. According to Part I – Title XXII – Chapter 156C – Section 3 (Name of a Limited Liability Company) of Massachusetts’ General Laws, an LLC’s name:

- Cannot be identical or “deceptively similar” to the name of any other LLC, corporation, or limited partnership that’s already organized or reserved with the state. This also includes names licensed or registered under a foreign LLC, foreign corporation, or foreign partnership.

- Can contain the name of a manager or member of the LLC.

- Must contain one of the following “designators” indicating that it’s an LLC:

- Limited Liability Company

- Limited Company

- L.L.C.

- LLC

- L.C.

- LC

During this process, you can check if the business name you want is available by using the entity search tool found on the Massachusetts Secretary of the Commonwealth’s website. You can also consult our Massachusetts business search page for more information.

Reserving a Massachusetts Business Name

If the name you want is available and meets the state’s rules, then you may want to consider reserving it until you get your LLC paperwork together. The Massachusetts Corporations Division has a form titled “Application of Reservation of Name” that you can fill out and file for a fee.

The reservation is good for 60 days. You have the option to renew it for another 60 days for an additional filing fee.

Getting a Domain Name

Unless you plan on running a strictly online business, getting a domain name may seem like something you’d rather skip. But in the digital age where everyone has access to the Internet, people looking for goods and services like yours will most definitely take to Google or another search engine to find what they need.

A domain name will provide a space for your business website, and that means an additional source of marketability. People will also find it easier to locate your business’s information (address, phone number, hours of operation, etc.). It can also allow people to do business with you online. It’s best to get a domain name that’s identical or very close to your LLC’s name. That way, people will find you more easily.

If the domain name for the business name you want isn’t available, then you can try your second option for a business name. If a matching domain name for that one is available, you can move forward.

Is your Massachusetts LLC name available as a domain name?

As you explore potential names for your LLC, you can also check to see if it has a matching domain name. This makes it easier for people to search for you. If the business name you want doesn’t have a matching domain name, then maybe you should consider another business name.

You can’t have a website without a domain name. A website can help people find your business online and help you make sales and market the LLC online. You may also want to check to see if social media handles matching your business’s name are available.

If you’re ready to register a domain name, we can do that for you. You can also add domain name privacy, create a business website, and get a business email address.

Federal and State Trademarks

It’s wise to perform a trademark search on your LLC’s name to make sure it doesn’t have one. You’ll want to do this because the state won’t when you submit your formation documents. It’d be unfortunate to get a trademark infringement notice because the name you chose for your LLC had a trademark.

You can check in a couple of ways. First, you can do so on a national level by going to the U.S. Patent and Trademark Office (USPTO) website. If you’d like, you can apply for a trademark there.

To check at the state level, go to the Massachusetts Corporations Division website. There, you’ll find a trademark database that allows you to search by the trademark/service mark, the registrant, the mark’s description, and more. You can also apply for a state trademark by filling out a Trademark/Service Mark Application form on the Corporations Division website for a fee. The trademark is good for five years.

In addition to checking these databases, it’s wise to do an internet search for your business name, including checking domain names, social media sites, and online phone directories. You can also hire an attorney specializing in trademarks to perform a search for you, although this method may be a bit pricey.

Getting a DBA Name in Massachusetts

If your business plans to operate under any name other than its legal one, then you’ll need to file a “doing business as” (DBA) name at the local level. This is also known as a trade name, fictitious name, or assumed name. Reach out to your city clerk for more information on the prices and requirements of registering a DBA name for your LLC. Check out some additional information about Massachusetts DBA names.

Ready to Start Your Massachusetts LLC?

Enter your desired business name to get started

Step 2: Appoint a resident agent in Massachusetts

Name a resident agent. Massachusetts requires all LLCs to have a resident agent. You’ll name this agent in your Certificate of Organization. This person or entity must be available at their physical address during normal business hours. This person or entity must also give consent to being the LLC’s resident agent in the Certificate of Organization.

What is a resident agent?

This person or entity is responsible for receiving legal notices (such as subpoenas) and certain official government correspondence on behalf of your business. This title is also known as a registered agent, statutory agent, and agent for service of process in other states.

Who can be a resident agent for your Massachusetts LLC?

The state has rules for who can serve as a resident agent. The agent must be:

- An individual who is at least 18 years old and a resident of Massachusetts, or:

- A domestic business entity or foreign business entity that’s authorized to operate in Massachusetts can serve as the resident agent.

- This person or entity must have a physical street address in the state, known as a “resident address.” P.O. boxes are not allowed.

What if a process server can’t find my Massachusetts resident agent?

First, you must name a resident agent for your LLC in your Certificate of Organization; otherwise, the state will reject the form. If you have a resident agent in place and then lose them later on (due to them moving, for example), then you’ll need to appoint a new one by filing a “Statement of Change of Resident Agent/Office” by mail or online with the Massachusetts Corporations Division.

If you don’t appoint one or if a process server attempts to serve a lawsuit and can’t find your resident agent, then your business runs the risk of falling out of compliance and risking your limited liability protection. You can also face the possibility of a lawsuit moving forward without your knowledge.

Can I be my LLC’s resident agent?

There are no laws forbidding an LLC owner from being their company’s resident agent. As long as you meet the requirements set by the state, you can list yourself as this agent. Whether you should is something entirely different, however.

Remember that a resident agent needs to be at their resident address during normal business hours. This can make it very difficult to leave the office to run errands, meet clients, or go on vacation. Also, if your business is ever sued, having papers served to you in person can make you (and your business) look bad in front of potential customers.

Using Resident Agent Services

If you’ve Googled “registered agent service” and didn’t find anything helpful, then know that using a trusted resident agent service like ours offers many benefits, a few being:

- Consistent availability during normal business hours

- Offering discretion by receiving important legal documents on your behalf

- Alerting you when you’ve received any documents

With our professional service, you also won’t have to worry about your resident agent retiring or leaving their position.

ZenBusiness can provide your Massachusetts resident agent

As mentioned above, our Massachusetts resident agent service offers many benefits. As soon as you sign up and have an agent assigned to your LLC, you won’t have to worry about losing them and risk falling out of compliance with the state.

On top of the perks we went over earlier, when you receive any important documents, our service helps ensure that you’ll be swiftly informed while keeping them organized in your online dashboard. Here, you can view, download, and print these forms whenever you want. You can avoid having to dig through piles of papers desperately trying to find important documents. You also don’t have to worry about losing these documents, either.

Step 3: File Massachusetts Certificate of Organization

Complete and file your Massachusetts Certificate of Organization with the Corporations Division. This formation document is also referred to as the Certificate of Registration and Articles of Organization by the Secretary of the Commonwealth. It needs to be carefully filled out and reviewed. Once the state approves it, your LLC is officially recognized as a legal business entity.

If you’d rather have us file for you, then look into our business formation plans so that you can avoid any mistakes in your formation documents. But let’s go over a few things that you should know/do before submitting your Certificate of Organization if you’d rather do it yourself.

Information Needed for Your Certificate of Organization

If you’re wondering what exactly you’ll need to include in your Certificate of Organization to ensure the state approves it, then read on. The information you’ll need to include is as follows:

- The LLC’s exact name

- The LLC’s street address

- A general description of the business the LLC will conduct

- The name, street address, and signature of the resident agent

- The names and street addresses of each manager, if any

- The LLC’s effective date

Additional information may vary depending on your situation, so be sure to fill the Certificate out as best as you can.

Member-Managed or Manager-Managed?

You’ll need to choose a management structure for your LLC. Massachusetts allows for LLCs to be member-managed or manager-managed. According to Massachusetts General Laws, Part I, Title XXII, Chapter 156C, Section 24, “Unless otherwise provided in the operating agreement, the management of a limited liability company shall be vested in its members.” As we went over earlier, you’ll first list the managers’ names in the Certificate of Organization.

Most LLCs with a single member or a few members prefer to manage the company themselves. In this manner, the members will run the business and make decisions for it. Other LLCs prefer a manager-managed structure. In this manner, one or more of the members of the LLC will make management decisions. The members can also hire someone outside of the company to be the manager.

Filing Your Certificate of Organization

You can file your Massachusetts Certificate of Organization electronically or print it if you plan to fax, mail, or hand-deliver the form. If you’re going to file online, then you’ll need to go to the Secretary of the Commonwealth’s Corporations Online Filing System. On the system’s homepage, click the option to form a new entity, choose the Certificate of Organization, and go from there.

To file by fax, mail, or in person, go to the Secretary’s “Filing Methods” page, choose your option, print it, and fill out the Certificate of Organization. As of this writing, the filing fee is $520.

Expedited Services

Massachusetts allows for expediting services when filing your Certificate of Organization for a small fee. If you decide to go with our business formation services, then you’ll have the chance to use our faster filing service. Although it won’t speed up the state’s processing time, it will prioritize your filing.

What if I need to make changes to my Certificate of Organization?

After your Certificate of Organization gets approved and your LLC becomes official, your business will probably undergo some changes as time goes on. Whenever major changes occur, such as member changes, a change in resident agent, relocating to another address, etc., you’ll need to file a Massachusetts Certificate of Amendment.

You can do this online by going to the Secretary of the Commonwealth’s “Amendments” page. You’ll find additional information about amendments that you’ll need to look over before filing. There’s also a filing fee. We offer an amendment filing service that can help you. Our Worry-Free Compliance service also includes two amendment filings per year.

Keep your Massachusetts LLC documents in one digital dashboard

If you decide to have us file your Certificate of Organization, then once the Secretary of the Commonwealth’s office approves the paperwork and your LLC becomes official, your documents will be available to view through your ZenBusiness dashboard. You can also keep other important documents and paperwork digitally organized. As for your physical documents from the state, be sure to keep them in a safe location.

Why would I delay my Massachusetts filing date?

In Massachusetts, your LLC’s effective date will be the day you filed the Certificate of Organization. For example, if you filed the Certificate on October 10 but the document wasn’t approved until October 15, then your LLC’s effective date is October 10. The state also allows one to delay the filing date. You can request this through the Certificate of Organization. Why would you want to do this?

Future business owners can have different reasons for delaying their LLC’s filing date. One includes not having to file taxes for only a portion of the year. Delaying the effective date to January 1 means paying taxes for the new calendar year and not the previous one. In Massachusetts, you can set your delayed effective date up to 90 days. You can choose to delay your LLC’s filing with us if we file for you.

Step 4: Create an operating agreement

Draft a Massachusetts LLC operating agreement. These agreements establish the business’s organizational structure, rules, and other details. You should know that in Massachusetts, operating agreements aren’t legal obligations, but putting one together can help your business run smoother and establish its rules.

An operating agreement is not like a business plan. Rather, it allows you to spell out ownership and management details for the LLC, among other things. This is great since it allows you to run the LLC how you want so long as you stay within the law. Without an agreement, the company will be subject to the state’s default rules for LLCs.

Do I need an operating agreement if I’m the only owner?

If you’re the only owner of your LLC, then you might be thinking that you don’t need an operating agreement since it’ll just be you running the company, right? Reconsider, because an agreement can still come in handy.

For example, potential investors, financial institutions, and others may request to see your agreement. The agreement can make the company look better organized and planned out, showing anyone who requests to see it that you’re serious about running the business.

Additionally, as the only owner, an agreement allows you to decide what will happen to the LLC if you pass away or become incapacitated due to an injury or illness. You can choose to have someone else take over or have the business dissolved on your behalf. It’s entirely up to you.

Benefits of MA LLC Operating Agreements

Having an agreement comes with plenty of benefits. A few include:

- Setting the rules for how your LLC will run, as we mentioned above.

- Defining your LLC’s management structure. We briefly spoke about member-managed and manager-managed LLCs in Step 3.

- Preventing and resolving potential conflicts between the company’s members by listing the powers, privileges, and responsibilities of each.

- Helping you further separate the LLC from your personal assets. Having an agreement in place further demonstrates to the courts that you and the business are separate entities in case anyone tries to challenge that in order to go after your personal assets.

- Detailing the reasons for and procedures for removing a member and the requirements for member additions.

- Detailing what will happen to the ownership portion of a member who’s left, retired, or died.

- Detailing what will become of the company if there’s only a single member who happens to pass away or become incapacitated. Will it pass on to someone else or will dissolution take place?

What should I include in my LLC’s operating agreement?

You can include anything you want in your agreement that you feel will help the business’s daily operations and more. Here are a few basics:

- Ownership allocation. For example, if there are four members, you can go 25% ownership for each, 40% for one member, and 20% each for the others, etc.

- Addition and removal of members. Which specific requirements and processes do you want to use for adding a new member? The same goes for member removals and the reasons for doing so. What will happen to their ownership portion?

- Member responsibilities. Who specifically is in charge of negotiating business deals, the company’s financials, and more? You can also detail each member’s voting powers for business-related decisions.

- Reasons for and process of dissolution. You can also detail what will become of the business’s assets, the distribution of remaining profits among the members, and more. Be aware that if you plan to dissolve the LLC, you’ll need to inform Massachusetts by submitting a Certificate of Cancellation to the Secretary of the Commonwealth.

If you aren’t sure how to start your operating agreement, rest easy because we offer a customizable template that can get you started.

Step 5: Apply for an EIN

Get an Employer Identification Number (EIN) for your LLC. An EIN is also known as a Federal Employer Identification Number (FEIN) and a Federal Tax Identification Number. You can get an EIN from the Internal Revenue Service (IRS).

This nine-digit number is like a Social Security number for a business. Having one allows you to do several things, like getting a business bank account, paying taxes, and hiring employees. You can get an EIN by visiting the IRS website, by fax, or by mail. You can also get one with us with our EIN service.

Massachusetts Tax Registration

Register your LLC with the Massachusetts Department of Revenue’s MassTaxConnect website to pay taxes online. You’ll need your EIN, your business’s name, your business address, and your business’s start date in order to register.

As an LLC owner, you’ll need to register for the following depending on your industry, location, and more:

- Massachusetts sales tax, also known as sales and use tax. You’ll need a Sales and Use Tax Registration Certificate if you plan to sell or lease goods that are subject to sales or use tax.

- Employee withholding tax if your LLC has employees.

- Unemployment insurance tax if you have employees. You’ll do this through the Department of Unemployment Assistance.

Visit the MassTaxConnect website to find out what other taxes you’ll need to register for.

Can filing as an S corp lower my taxes?

LLCs offer more flexibility than a corporation. One of those flexibilities is how you can choose to have your LLC taxed.

By default, an LLC has pass-through taxation. This appeals to most LLC members because it avoids “double taxation,” in which a corporation pays taxes at both the business level and again when the income is paid to the individual owners. But some LLCs opt to be taxed as a C corporation or an S corporation because, in their case, it works to their advantage.

Being taxed as a C corporation does mean you get double taxation, but, for some LLCs, the pros may outweigh the cons. One benefit is that C corporations have the widest range of tax deductions, which could be an advantage in some scenarios, especially for more profitable LLCs. For example, insurance premiums can be written off as a business expense.

S corp is short for “Subchapter S Corporation” and is a tax status geared toward small businesses. Like a standard LLC, an S corp has pass-through taxation. But there’s another potential advantage for some LLCs: It could reduce your self-employment taxes.

Self-employment taxes are the part of your taxes that pay for Social Security and Medicare. In a typical LLC, you would pay these on all of your profits.

But filing as an S corp allows you to be an “employee-owner” and split your income into your salary and your share of the company’s profits. In this way, you pay employment taxes on your salary, but not self-employment taxes on your profits. (You’ll still pay the other applicable taxes on your LLC profits, of course.)

The drawback is that the Internal Revenue Service scrutinizes S corps more closely, meaning you’re more likely to get audited. S corps also have more restrictions for qualifying.

While it’s possible that being taxed as a corporation could benefit your LLC, remember that business taxes are very complicated. They’re also very specific to your situation. That’s why you need to consult a tax professional to see which tax method would work best for your Massachusetts business and help with tax filings.

If you decide to form your LLC with an S corp status, our Massachusetts S corp service can help you do that.

Step 6: File a beneficial ownership information report for your LLC

2024 introduced a new requirement for LLCs (and other small businesses): filing a beneficial ownership information report, or BOI report. The Corporate Transparency Act introduced this requirement, asking businesses like your new LLC to provide information about their beneficial owners. According to the act, a beneficial owner is anyone who holds 25% or more of the LLC’s ownership interest, exerts significant control over the business, or gets substantial economic benefit from the business assets.

When you file your BOI report, you’ll be asked to provide the name, address, and identifying documents for each beneficial owner. By providing this information, you help the Financial Crimes Enforcement Network (FinCEN) accomplish their goal: reducing financial crimes by making it more difficult for businesses to hide illicit activities behind shell corporations. As a result, failing to file can have serious civil and criminal consequences.

You can learn more about this filing or submit your BOI report online or by PDF upload on FinCEN’s website. LLCs that form during the 2024 calendar year must file within 90 days of getting Massachusetts approval for their Certificate or Organization. LLCs created before 2024 will have until January 1, 2025, to file. LLCs organized in 2025 and beyond will need to file within 30 days of approval.

If you’d like help completing your BOI report, our BOI report filing service can simplify this process for you.

Important Steps to Take After Forming Your LLC

The steps listed above are the main ones to follow/consider when starting an LLC. In this next section, we’ll talk briefly about filing your annual report, which is a requirement. The others, though, are considerations.

Open a business bank account with your EIN

You’ve probably considered getting a business credit card for your LLC, but what about a bank account to keep track of your business finances? It’s always best to have business accounts separate from your personal accounts as this makes it easier to organize your business income and other financials.

We’re proud to offer a discounted small business bank account. You’ll enjoy a debit card, unlimited transactions, online banking, and more. You can also authorize others in your LLC to use the account. Check out our banking resolution template to learn more.

ZenBusiness Money

You can also take advantage of ZenBusiness Money. Your business will need a careful eye to watch over its finances, and this tool can help you do that. You can manage your business finances, manage your clients, create invoices, and more.

Getting Business Insurance

You may also want to consider looking into getting business insurance for your LLC. By default, your LLC will already come with personal liability protection. However, getting extra coverage with various types of business insurance can further secure your company’s well-being.

With so many insurance companies out there offering competitive rates and policies with countless features and benefits, it can be tough to decide where to start. To help you, check out our article on the basics of business insurance.

File your Massachusetts LLC annual report

Your LLC is required to file a Massachusetts annual report with the Corporations Division. This report will be due on the anniversary date of the Certificate of Organization’s filing. So, if you filed your Certificate on June 1, then your report will be due on June 1 every year after. You can file online or by mail for a fee.

Check out our annual reports page to learn more.

More Information on Massachusetts LLCs

After your LLC is formally established, you may have some additional questions, like how to hire employees and file any additional paperwork. Let’s take a look at these topics below.

How to Hire Employees in Massachusetts

When the time comes to add employees to your growing business, you’ll have to consider a few things. First, head over to the official Massachusetts state website (Mass.gov). Search for the state’s laws about hiring employees. Familiarize yourself with any laws that may apply to you and how to hire.

As for actually searching for qualified candidates, that’s something you and the other members of the LLC will need to discuss. What skills and level of experience will they need to help the business run smoothly and grow? Of course, we can’t tell you who to hire. This is something you’ll have to do as a new business owner. You may want to start by looking into the state’s HireNow Program.

Getting a Certificate of Good Standing

In Massachusetts, you can get a Certificate of Good Standing for your LLC from the Department of Revenue. This document isn’t a requirement to form an LLC or conduct business, but having one can be beneficial. Having a Certificate of Good Standing can help with the following and more:

- Obtain financing

- Enter into contracts with other businesses and investors

- Renew licenses

- Participate in the state’s HireNow Program

You can get your Certificate of Good Standing through the Department of Revenue’s MassTaxConnect tool. If you’d like more information about Certificates of Good Standing, check out our Massachusetts Certificate of Good Standing page. We can also help you obtain one.

We can help!

After completing all of the steps above and getting your formation documents approved, your LLC will be up and running! By going through our guide to see what to expect during your Massachusetts LLC formation, you’re already one step closer to making your business idea into a reality.

We offer many services that will help you make your LLC official. We also have other services that can help you run and grow your business. You’ll have us by your side every step of the way, no matter if you plan to open a Red Sox souvenir shop in Boston or a lawn care business in Amherst.

MA LLC FORMATION THAT’S FAST AND SIMPLE

Take it from real customers

MA Limited Liability Company FAQs

-

The Massachusetts licenses and permits you’ll need will depend on such factors as which industry your LLC is in and its location. In Massachusetts, you don’t need a general, state-level business license, but you should check in with your city or county to find out what you’ll need to legally operate within its jurisdiction.

If you plan to sell physical products, then you’ll need a Sales and Use Tax Registration Certificate, also known as a seller’s permit. After registering with the Department of Revenue’s MaxTaxConnect website, you’ll get one.

Massachusett’s Professional Licenses and Permits webpage can help you find many of the licenses you may need to operate in the Commonwealth. Your business could need other licenses and/or permits, too. Unfortunately, because licensing varies by industry and location and can occur on the federal, state, and local levels, there’s no central place to check to see if you have all the business licenses and permits you need. You’ll have to do some research.

If all of this sounds too overwhelming to do on your own, then we recommend our business license report service. It provides a comprehensive report of everything you’ll need to legally operate.

-

In Massachusetts, the formation fee for your Certificate of Organization is $520 if done by mail, in-person, fax, or online. This total can be higher depending on other services you get, like reserving a business name and getting a DBA name.

-

You’ll need to decide how your Massachusetts LLC will be taxed. LLCs are “pass-through” entities by default. This means that the business itself doesn’t pay federal income tax. The LLC’s income instead passes down to the owners. From there, they pay taxes on the earnings as regular income.

Keep in mind that you can choose to have your LLC taxed as a C corporation or an S corporation. Both have their benefits and drawbacks. A C corp designation lacks the pass-through tax benefit, meaning it’s taxed at both the business and individual levels. However, this can be beneficial to certain LLCs. For example, you can write off certain business expenses like insurance premiums.

On the other hand, an S corp designation retains the pass-through tax benefit that comes with an LLC with the addition of possibly saving members a lot in self-employment taxes. The caveat is that applying for S corp status has more restrictions and, if the business gets the status, the LLC can get more attention from the IRS.

We suggest speaking with a licensed tax professional for more information on LLCs and business taxes.

-

In order to transfer the ownership of your Massachusetts LLC, you’ll need to check your operating agreement. Here, you should’ve detailed how to do this. If you didn’t, you’ll have to follow the state’s methods for transferring ownership.

-

You aren’t required to draft a business plan to start or run an LLC. Putting one together, though, can have its advantages. For example, lenders and investors may require this plan as proof that you’re serious about the business. If you need help planning your business, then read our article about the topic.

-

As we mentioned above, the LLC business structure is very popular, and for good reason. It offers plenty of benefits that, together, can make it more appealing than other entity types like a corporation or sole proprietorship. A few include:

- “Pass-through taxation,” meaning the LLC isn’t subject to double taxation. As an LLC is a pass-through entity, it doesn’t pay federal income taxes on its profits. Instead, the company’s profits are taxed only at the individual level.

- Providing liability protection for its owners. As its name says, an LLC is a separate entity from its owners. This includes personal asset protection: your personal assets are separate from the company’s legal liabilities and debts and thus usually protected if the LLC is sued or goes into debt.

- Being more flexible in its management structure. For example, corporations must follow certain rules to remain in good standing with the state. LLCs, on the other hand, aren’t required to follow many of these rules, like having a board of directors.

-

Processing times vary by a variety of factors and the time of year, but online filings usually are processed within two business days. Filing by postal mail will take substantially longer.

-

No, the state doesn’t require LLCs to file their operating agreement. This doesn’t mean you should avoid putting one together. This document has many benefits and can help your business run without issues. Refer to Step 4 of our guide for more information.

-

You’re free to choose your LLC’s tax structure. Many LLC owners stick with the pass-through taxation that the model comes with by default. You can also consider adopting a C corporation or S corporation designation. You can learn more about how these methods of taxation compare on our LLC vs. S corporation and LLC vs. C corporation pages. We went over taxes in detail in the “How are LLCs taxed in Massachusetts?” FAQ. If you’re still on the fence about which tax structure to choose, speak with an accountant.

-

As of this writing, Massachusetts has no legislation concerning series LLCs. This structure involves a “parent” LLC with other LLCs, known as “child” LLCs, operating under it. This model shields the businesses from the liabilities of each other.

-

Yes, you can register a DBA name for your Massachusetts LLC. You’ll do this at the local level, meaning that you’ll need to reach out to the appropriate office in your city. You can start by contacting your city clerk. We went over this topic in detail in Step 1.

-

You’ll need to review your operating agreement to review the reasons for and steps to remove a member from your LLC. After doing so, you’ll need to decide what will happen to that member’s ownership portion. Will the business sell it to a third party or will the current members absorb it? You’ll also need to inform the state of the LLC’s change in ownership. You can do this by filing a Certificate of Amendment.

-

Yes, Massachusetts requires the submission of the report for LLCs. According to the Massachusetts Corporations Division website, “Every limited liability company must file an annual report with the Corporations Division on or before the anniversary date of the filing of its original Certificate of Organization. The report shall contain all of the information included in its Certificate of Organization and any other matters the authorized person determines to include.”

File online through the Massachusetts Corporations Division website or by mail. Both methods have a filing fee. You can also use our Massachusetts annual report filing service to avoid any mistakes.

-

No, only a few states allow this type of LLC in which the Secretary of State office conceals the names of the LLC members.

-

Yes. To register as a foreign (out-of-state) LLC in Massachusetts, you must file a Foreign Limited Liability Company Application for Registration and pay a fee. You’ll also need to include a Certificate of Good Standing or your state’s equivalent.

Disclaimer: The content on this page is for information purposes only and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

ZenBusiness is a financial technology company and is not a bank. Banking services provided by Thread Bank, Member FDIC. The ZenBusiness Visa Debit Card is issued by Thread Bank pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa debit cards are accepted. FDIC insurance is available for funds on deposit through Thread Bank, Member FDIC.

*Your deposits qualify for up to a maximum of $3,000,000 in FDIC insurance coverage when placed at program banks in the Thread Bank deposit sweep program. Your deposits at each program bank become eligible for FDIC insurance up to $250,000, inclusive of any other deposits you may already hold at the bank in the same ownership capacity. You can access the terms and conditions of the sweep program at https://go.thread.bank/sweepdisclosure and a list of program banks at https://go.thread.bank/programbanks. Please contact customerservice@thread.bank with questions regarding the sweep program.

LLC Formation States Near Massachusetts

Ready to Start Your LLC?