*Mr. Cuban may receive financial compensation for his support.

Last updated: July 2, 2024

How to Start Your Georgia LLC

With a booming economy and vibrant population, it’s no surprise the Peach State is open for business.

Ready to get in on the action? Starting an LLC in Georgia can open up a world of opportunities. To create an LLC in Georgia, you’ll need to follow certain steps. And, if you want to take advantage of the liability protection and tax benefits of an LLC while avoiding delays and costly fines, you’ll need to follow those steps carefully.

We can help you get started with our fast, reliable formation services. It’s a simple way to get your LLC off the ground.

If you prefer to form an LLC on your own, we can help you there, too. Follow our step-by-step guide to learn how to start an LLC below.

Forming a Georgia Limited Liability Company

Whether you’re walking around Piedmont Park or driving through the suburbs, new construction and growth are everywhere in Atlanta. And it’s similar across the great state of Georgia. From film production to technology companies, opportunities abound.

All Georgia limited liability companies are formed by filing GA LLC applications with the Georgia Corporations Division of the Office of the Secretary of State.

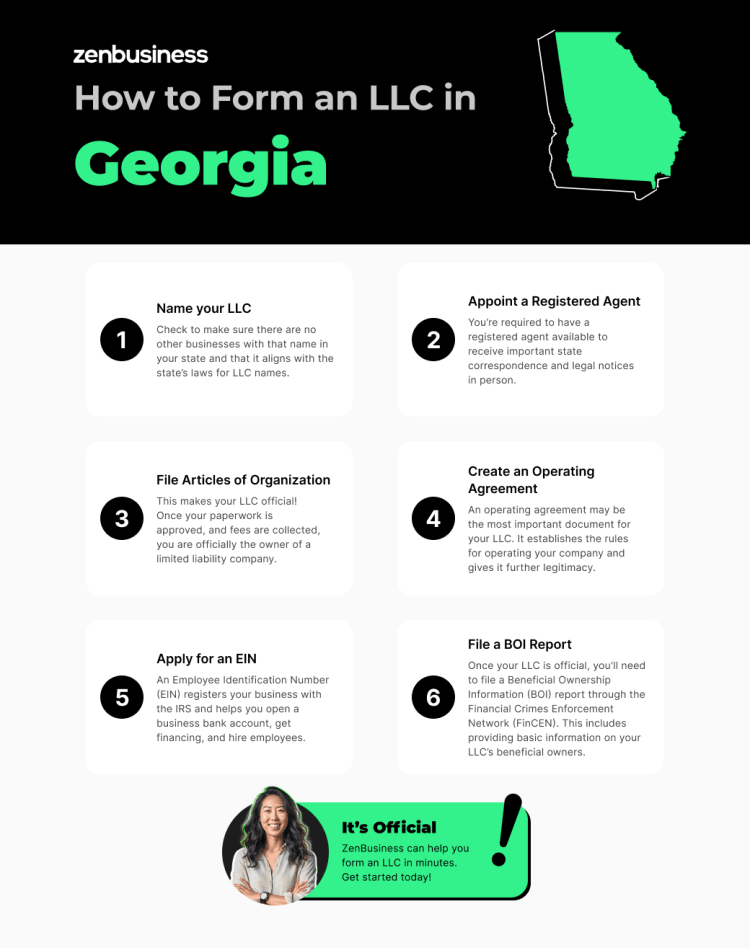

Follow the 6 steps below to create your own limited liability company in Georgia. From naming your LLC to properly filing the paperwork, it’s important to submit your information correctly online. This will make it a lot easier when getting an LLC in GA.

- Choose a unique name for your Georgia limited liability company

- Appoint a registered agent to receive notices for your business

- File your Georgia LLC Articles of Organization

- Create an operating agreement to establish the rules for your LLC

- Register for your EIN Number with the IRS and review your tax requirements

- File a Georgia BOI report

To form your LLC, you must register your business in Georgia. This process enters your new company into the public record. It provides the information necessary for the state to communicate with and regulate your new limited liability company.

Before that, though, you’ll need to choose a registered agent. Your Georgia registered agent receives legal notices and official correspondence from the state. After you file the required paperwork, you’ll still have some other boxes to check. For example, you’ll likely want to draft an operating agreement and get an EIN.

Note: This is a step-by-step guide on how to get an LLC in Georgia when you’re starting a domestic LLC. A domestic LLC is one started within the state you’re residing in. A foreign LLC is one that originated in a different state. To register a foreign LLC, you follow a different process.

Step 1: How to choose an LLC name

The first step is to name your LLC. Congrats! Creating your business name is one of the most exciting steps to starting a business. Sure, there are a lot of considerations, but picking a name is where it all beings.

When it comes to naming your LLC, start by getting creative. Your name is the first impression you’ll give to potential customers. You want it to represent you and your business now and in the future. Draft a list of your favorite names. After that, you can get into the specifics and naming rules in the state of Georgia.

Name Requirements for LLC Entities

There are Georgia business naming laws you need to consider before you submit your name. The first and most important rule is that your limited liability company (LLC) name has to be distinguishable from the other LLCs, corporations, or limited partnerships (LPs) filed with the Secretary of State.

What makes a name distinguishable? The Secretary of State of Georgia will make that determination, but here’s a list of items that are NOT considered distinguishable:

Adding “a,” “an,” or “the” to a name: If an existing name is “Flower Store LLC,” you can’t name yours “The Flower Store LLC.”

Abbreviations: You can’t name your LLC “Georgia Consulting Firm” if “Ga. Consulting Firm” exists.

Phonetic Spellings: “Grillz LLC” is not distinguishable from “Grills LLC.”

Punctuation: “A.B.C., LLC” is not distinguishable from “ABC, LLC.”

Plural: Plural forms of the same word are not distinguishable when it comes to naming your LLC.

Suffix: A suffix added to the same word in another LLC’s name doesn’t count as distinguishable, either.

Keep these name considerations in mind when writing yours.

Restricted LLC Names

Some words can’t be used to describe your LLC without submitting a letter of approval from the appropriate agency. These include:

Insurance words: You need approval from the Office of the Commissioner of Insurance to use the words insurance, assurance, surety, fidelity, reinsurance, reassurance, or indemnity.

Banking words: Written approval of the Department of Banking and Finance is required to use the words bank, banc, banque, banker, banking company, banking house, trust, credit union, bankruptcy, or trust company.

Education words: Using the words “college” or “university” requires written approval of the Georgia Nonpublic Postsecondary Education Commission.

Keep an eye out for these words when you’re coming up with a business name.

Can my LLC filing be rejected because of the name I choose?

Yes. In fact, not following the Georgia naming standards is one of the most common reasons an LLC submission gets denied.

Our formation service can handle submitting your business name for you. We’ll help make sure your LLC gets filed with a name that works for the state of Georgia.

What if I have my business name but am not quite ready to file?

Have the perfect name? If you’re not ready to form your LLC but want to reserve your name, you can reserve your business name today.

Georgia’s Secretary of State office allows you to reserve a business name. You can submit up to three name preferences (in case the first one isn’t available) for up to 30 days.

Name Registration: More Information on Naming Your Business

Have questions about Georgia’s naming rules? Contact them at (404) 656-2817. They can make sure your name is compliant with the state.

Additional Naming Considerations

Getting a Domain Name: We assume you’ll want to have a website for your business. An online presence is essential for most companies. Keep your website’s domain name (URL) in mind when you come up with a name. For example, if your first name choice is already an existing website, you may lean toward your second choice. It’s up to you! Use our Domain Name Registration Service to get the website domain for your business.

Trademarking Your LLC’s Name: You also need to check trademarks at the federal and state levels. For federal trademarks, check the U.S. Patent and Trademark Office’s website to see if someone’s already trademarked your business name. For Georgia trademarks, you can search the Georgia Secretary of State website page for trademarks.

Filing for a DBA Name: DBA, or “doing business as” names, are other names your business may use instead of your legal business name. In Georgia, DBAs are referred to as “trade names.” You can learn more about getting a trade name on our Georgia DBA page.

Ready to Start Your Georgia LLC?

Enter your desired business name to get started

Step 2: Appoint a registered agent in Georgia

Appoint a registered agent in Georgia. LLCs are required by Georgia law to have a registered agent. So what is a registered agent? Your registered agent is the person or business designated by your LLC to receive any official documents, communication, or service of process.

The registered agent is viewed by the state as the official mailbox for your LLC. They need to be available at their given address during business hours without exception so they can accept legal notices in person.

Who can be a registered agent in Georgia?

Your registered agent needs to be a person or company that acts as the point of contact for your LLC.

Georgia registered agents can also be:

- An individual: Keep in mind this person has to be over the age of 18 and have a street address in Georgia. The person must also be located at that address.

- Another company: There are registered agent service companies that can serve as your registered agent. They can serve as yours as long as the company is a domestic corporation, another domestic LLC, or a foreign corporation or LLC that has a certificate of authority to transact business in the state of Georgia.

In Georgia, a post office box or mail drop can’t be used as your registered agent’s address.

Due to the nature of a registered agent’s role, many LLC owners rely on a registered agent service. For example, your registered agent is the person who will receive serving papers if your company is sued. An owner, shareholder, employee, or member in the LLC can serve as a registered agent.

What if the state can’t find my Georgia registered agent?

You run the risk of consequences from the state if it can’t reach your registered agent. For example, if you serve as your own registered agent and are on vacation or not at the specified address during business hours, you may miss an important piece of information.

This can also happen if your registered agent moves or quits and you forget to update your paperwork with the state.

Failing to maintain a registered agent could mean you miss notice of litigation and a court case moves forward without you knowing. You may also not respond to direct mail from the state, resulting in fines. You can avoid the risk of issues by having a reliable registered agent service.

Use the ZenBusiness registered agent service

One of the many services we offer is our registered agent service. When you sign up, we’ll provide you with a registered agent, meaning that there will always be someone available to receive important legal, tax, and other notices from the state.

Not only will this keep you in compliance, but it avoids scenarios where you could be served papers for a lawsuit in front of clients.

Our service also keeps you organized. When you get important documents, we’ll quickly inform you and keep them together in your online “dashboard” so that you can view, download and/or print them whenever you want. No more digging through piles of papers to try to find misplaced critical documents. Learn more about our Georgia registered agent service.

If you’ve already submitted a registered agent and want to change it, you simply need to file an amendment to your annual registration.

Step 3: File Your Articles of Organization

File your Articles of Organization with the state of Georgia. You’ve made it to the most pivotal step! It’s time to file your Articles of Organization with the state. Once your Articles are submitted and approved, you officially have a legal LLC in Georgia.

How do you file them? You submit your LLC’s information online on the Secretary of State’s online services page. You’ll also need to create a user account, and then select “create or register a business.”

Want help filing your Articles of Organization? We can do it for you with our guaranteed formation filing service. We’ll handle filing and keep all your documents in your personalized dashboard.

Register LLC in Georgia: What to File with Your Articles of Organization

Before you file your Articles of Organization, be sure to gather the following information:

- Name of your LLC (or valid name reservation number if you’ve already reserved it).

- Principal office address for your LLC

- Your name and address

- A valid email address

- Mailing address of the principal office location

- Name and address of your registered agent

- Name and address of each organizer.

- Choose an effective date. In Georgia, you can choose when you want your LLC to formalize. The LLC can go into effect either at the time of filing or on a later date. Keep in mind the delayed effective date must be within 90 days of filing the Articles of Organization.

- Authorized signature: An authorized person or entity must sign your state of Georgia Articles of Organization. The signer can be an organizer, a manager, a member, or an attorney-in-fact.

- Any provisions you may need to add to your Articles of Organization (optional)

- Credit card you’ll pay to register your Georgia LLC with

The initial filing fee is $100 and can be paid online with a Visa, MasterCard, American Express, or Discover card.

We offer step-by-step directions on how to file your Articles of Organization in Georgia. Review them for more detailed information on this step. Filling out your Georgia LLC application is a crucial step in the process.

Changes to Your LLC

What if things change over time? Don’t worry. You don’t need to file your Articles of Organization again. To make most other changes to your Articles of Organization, you need to file Georgia Articles of Amendment along with a fee. If you need to file an amendment, we have an Amendment Filing service that can handle it for you as well.

Keeping up with your business compliance can be as stressful as running on the Beltline in August. That’s why many customers rely on us to help them stay compliant. Use our Worry-Free Compliance service and reduce your stress to a calm stroll down the Beltline on a nice fall day.

How long will it take for my Articles of Organization to be processed?

All online filings are processed in the order in which they are received, although expedited filings are available. Standard processing times are seven business days. For an additional fee, you can request two business days or same-day processing for expedited filings.

Once your Articles of Organization are filed and approved, it’s time to celebrate! Congratulations — you have officially formed an LLC in Georgia. Georgia recognizes your LLC as a business entity. Yes, there are a few other steps ahead, but this is a big moment. Perhaps you can celebrate with a nice dinner at the Sun Dial — or at least enjoy a greasy meal at the Varsity.

Do I need to submit annual reports?

Once your Articles of Organization are approved, and you’ve enjoyed a celebratory dinner, don’t forget to mark your calendar to submit your annual registration. This is also known as an annual report in other states.

Annual registrations need to be filed with the Secretary of State

Between January 1 and April 1 of each calendar year once your LLC is formed. Changes like the principal office address or registered agent change can be addressed in these reports (or amended annual registrations). Note if you don’t submit one each year, your LLC is subject to being dissolved.

Secretary of State – Contact

By Mail:

2 MLK Jr. Dr. S.E. – Floyd W. Tower

Suite 814

Atlanta, GA 30344

Primary: (404) 656-2817

Fax: (404) 656-0513

Visit the Georgia SOS Contact page

Step 4: Create an operating agreement

Create an operating agreement for your Georgia LLC. Operating agreements for limited liability companies are not required in Georgia, but having one is a good idea.

An operating agreement will cover important things like the rules that your company will follow, how finances will be handled, the business structure, and how decisions will be made.

What should you include in your Georgia operating agreement?

Here are some items you may want to include in your operating agreement:

LLC details: This includes your business name, members, registered agent, and other important information.

Profit distribution: Clearly explain what happens to profits, especially if you have multiple members in your LLC. For example, how are they allocated? Are they evenly distributed, based on ownership percentages, or something else entirely?

Dissolution: This one is often overlooked, but it’s an important detail to consider. If the business dissolves, how will assets and debts be split up? What will the process be?

Member responsibilities: You should spell out who is responsible for the day-to-day business operations.

These are the main components, but you can add any details you find important.

Do all members need to sign the agreement?

If you’re creating an LLC with other members (owners), all parties involved should sign it. This formalizes their agreement to the terms. Some LLCs in Georgia even have their operating agreements notarized.

Operating Agreement Template: LLC Georgia

Since Georgia doesn’t require an LLC operating agreement, there’s no form to fill out and file with the Georgia Secretary of State. If you’re unsure as to where to start, you may want to consider using one of our Georgia customizable operating agreement templates.

What are the benefits of having an operating agreement?

Still not convinced you need one for your LLC? Here are a few benefits of having an operating agreement:

It houses the rules of your LLC. Not only is this important for LLC members, but it can also help avoid state-imposed default rules.

You will have written agreements on how disputes will be handled. Hopefully, you won’t need to refer to them, but it’s better to have them laid out clearly.

It outlines the structure of your company. If you ever need to provide information to investors or others, this is a helpful document to have available. Some banks and lenders also like to see the agreement before granting credit or loans

Provide additional asset protection. By clarifying which assets are part of the business and personal, you add another layer of protection between legal issues associated with your business and yourself.

Do I need an operating agreement if I’m the only owner?

You might think you don’t need an operating agreement for a single-member LLC. But potential investors, future business partners, and others may want to see your operating agreement.

Some banks won’t let you open a business bank account without one. It can also spell out what you want to happen to the business if you become incapacitated.

Further, occasionally someone will take an LLC owner to court to try to prove that the owner and the LLC are the same entity so that they can go after the owner’s personal assets. If that happens, having an operating agreement in place is one more thing to further demonstrate to the court that the owner and the LLC truly are separate.

Step 5: Apply for an EIN

Register your Georgia LLC with the federal government by getting an Employer Identification Number (EIN). EINs are important for a variety of reasons, but in Georgia, they’re required to register your business with the Georgia Department of Revenue.

EINs are also known as Federal Tax Identification Numbers. They’re nine-digit numbers assigned to LLCs from the Internal Revenue Service (IRS). It essentially acts as a Social Security Number for your business. You can obtain your EIN through the IRS website, but we can handle it for you with our EIN service.

EINs are also typically required for opening business bank accounts and hiring employees. But in Georgia, they’re most important for tax purposes.

Step 6: File the beneficial ownership information report

At the beginning of 2024, the terms of the Corporate Transparency Act went into effect. Congress introduced this act with the primary goal of helping counteract certain financial crimes by making it difficult for organizations to use shell corporations to hide funds. That’s because the act requires LLCs and many other small businesses to disclose information about their beneficial owners.

A beneficial owner is anyone who owns 25% or more of the LLC’s ownership interest, exerts substantial control over the LLC, or gets substantial benefit from the LLC’s assets. When you file your BOI, you’ll need to provide the name, address, and identifying documents of each beneficial owner.

You will file the BOI report with the Financial Crimes Enforcement Network, or FinCEN. You can file online on their website or upload a PDF version of the form (it’s free). If you create your LLC during 2024, you’ll need to file the BOI within 90 days of Georgia approving your Articles of Organization. LLCs that organized prior to 2024 have until January 1, 2025. And any LLCs that organize in 2025 or later will have just 30 days post-approval to file. Georgia doesn’t have a state version of the form, so you’ll just have the federal form.

Learn more on FinCEN’s website.

Our BOI report filing service can make this step simple.

LLC Georgia: Registering for State Taxes

Newly formed LLCs need to register with the Department of Revenue if they haven’t filed a tax return or haven’t created a tax account with the state. To register, create a profile on Georgia.gov’s Georgia Tax Center website.

Completing the registration will register your LLC for various state-specific taxes, including:

- Corporate income tax

- Sales and use tax

- Transportation services tax

- And many more

Note that unemployment insurance taxes are not paid through the Department of Revenue in Georgia. If you’ll need to register for this tax, do so with the Department of Labor.

What You’ll Need to Register with the Department of Revenue

Your EIN will be required to register your LLC with the state. Other items you’ll need to have prepared:

- Legal name for your business

- Date of first Georgia sale

- Name and information for your LLC’s officers/members

- Business mailing address

Once you’re all set online, you’ll need to file your taxes monthly or quarterly depending on your specific situation.

Next Steps…

So you’ve established your LLC in the heart of the Peach State. Congratulations! But forming your LLC is just the beginning. There are several steps to consider post-formation to ensure the smooth sailing of your business venture in Georgia.

Open a business bank account

Once you’ve secured an EIN, you’ll be able to open a company bank account. Separating your company bank account and your personal banking is crucial for separating your business and personal finances at tax time.

Banking Payments and Invoicing

We have a partnership with LendingClub that offers a discounted bank account for your new business. This allows for online banking, unlimited transactions, a debit card, and more. And, when and if you want to authorize others in your business to use the account, we also offer a banking resolution template to simplify the process.

Managing Your Money

Looking for additional help with your business finances? We offer an on-the-go business finance software called ZenBusiness Money. It gives you a central place for creating invoices, receiving payments, transferring money, and managing clients. Keep your LLC’s finances in one location and easily manage your money in one convenient location.

Secure relevant licensing and permits

Depending on your business’s nature, you might require specific state or local licenses to operate legally. For instance, if you’re opening a restaurant in Atlanta, you’ll need health permits and a liquor license if you plan to serve alcohol. Be sure to check Georgia’s official state website or consult with a local business advisor to ensure you have all the necessary permits in hand.

Georgia state sales tax registration

If your Georgia-based LLC is selling tangible goods, you’ll likely need to register for a State Sales and Use Tax Certificate. Remember, tax regulations can be intricate, and they vary depending on what you sell and where you operate. Always stay updated on state-specific sales tax obligations, especially if you’re doing business in multiple states.

Invest in business insurance

Protection is crucial, especially in the unpredictable world of business. Depending on your industry, you might consider general liability insurance, professional liability insurance, or workers’ compensation if you have employees. Suppose you’re launching a tour boat company on the Savannah River. In that case, having adequate insurance ensures you’re covered against potential damages or accidents.

Trademark your brand assets

Your brand identity is integral. Once you’ve designed a logo or a slogan that represents your LLC, consider trademarking it to protect it from unauthorized use. This step secures your brand’s identity in Georgia and can be especially pivotal if you plan to expand beyond state lines.

Remember, while forming an LLC in Georgia is a significant step, it’s essential to be proactive about these subsequent stages. Each ensures that your business not only thrives but also remains compliant and ahead of the curve in Georgia’s dynamic business landscape.

We can help

We offer fast, accurate LLC entity formation online. Our services provide long-term business support to help you start, run, and expand your business. While it’s not as simple as pressing a “Create LLC: Georgia” button, we guarantee we’ll help get your Georgia limited liability company up and running.

If starting an LLC in Georgia seems as stressful as sitting in Atlanta’s rush hour traffic, we can reduce your stress. Let us take care of formation, compliance, and more. That way, you can get back to building your dream business, whether it’s a small business in Sandy Springs or a consulting business based out of Midtown.

Benefits of LLCs in Georgia

Personal Asset Protection

One of the standout benefits of an LLC is the protection of your personal assets (in most cases). This means that if your business faces any legal claims or debts, your personal belongings are usually safeguarded.

Let’s say you own a quaint cottage overlooking Lake Lanier. With an LLC, even if your business faces financial challenges, that lakeside retreat likely remains untouched and separate from any business liabilities.

Tax Flexibility

Unlike most corporations, which face double taxation, LLCs offer a pass-through taxation advantage. Essentially, the business itself isn’t taxed. Instead, business income or losses are reported on the owners’ individual tax returns.

Imagine your LLC runs a popular peach orchard in Fort Valley. The profit from your peach sales will flow through to your personal tax return, without the business itself being subject to a separate tax.

Credibility

Adding the “LLC” title to your business name not only portrays professionalism but also instills a sense of trust among clients, suppliers, and partners.

If you’re starting a boutique in Atlanta’s Ponce City Market, having an LLC can give you a leg up against the competition. Customers might feel more secure purchasing from “Southern Styles, LLC” as opposed to just “Southern Styles.”

Simplified Management

LLCs, compared to corporations, have fewer formalities and administrative requirements. There’s no need for board meetings, annual reports, or rigid management structures.

Picture this: you’re running a craft brewery in Athens. With an LLC, there’s no need for formal board meetings every time you want to introduce a new brew or host a local band. Decisions can be more fluid, allowing you to adapt quickly to the vibrant Georgian market.

Cost-Effective Establishment

Starting an LLC in many states is generally more affordable than setting up a corporation, and Georgia is no exception. With minimal startup fees and paperwork, it’s a cost-effective route for budding entrepreneurs.

The funds you save from the cost-effective LLC setup in Georgia can be invested in other aspects of your business, like securing a prime spot at the Atlanta Food & Wine Festival or expanding your offerings in Savannah’s bustling market.

In a nutshell, forming an LLC in Georgia offers an array of advantages that not only protect and benefit the business owner but also enhance the overall business operations, reputation, and growth in the Peach State.

Understanding LLC Taxation in Georgia

As with any business, running a Georgia LLC means paying taxes. Here’s a breakdown of how to register for state taxes and the primary taxes you and your LLC may be responsible for.

Registering for State Taxes

Newly formed LLCs need to register with the Department of Revenue if they haven’t filed a tax return or haven’t created a tax account with the state. To register, create a profile on Georgia.gov’s Georgia Tax Center website.

Completing the registration will register your LLC for various state-specific taxes, including:

Corporate income tax

Sales and use tax

Transportation services tax

And many more

Note that unemployment insurance taxes are not paid through the Department of Revenue in Georgia. If you’ll need to register for this tax, do so with the Department of Labor.

Information You’ll Need to Register with the Department of Revenue

Your EIN will be required to register your LLC with the state. Other items you’ll need to have prepared:

Legal name for your business

Date of first Georgia sale

Name and information for your LLC’s officers/members

Business mailing address

Once you’re all set online, you’ll need to file your taxes monthly or quarterly depending on your specific situation.

Federal Tax Considerations

LLCs provide the benefit of avoiding “double taxation.” The business pays no federal income tax, instead passing the income straight through to the LLC’s owners.

Then, each business owner pays taxes on the earnings as regular income. This is unlike most corporations, in which profits are taxed twice, first at the business level and again at the individual shareholder level.

IRS Tax Administration for LLC Members

The IRS administers federal taxes based on each member’s share in the LLC. So, if you own 50% of an LLC and are entitled to 50% of the profits, the IRS will tax you on 50% of your LLC’s earnings.

Self-Employment Tax Requirements for LLC Members

Importantly, members might be required to pay self-employment tax to the IRS to make up for the fact that they don’t pay have an employer withholding taxes like those related to Medicare or Social Security from their paychecks.

Comparing LLC and C Corporation Tax Structures

The LLC tax structure can save business owners a significant amount of money compared to a traditional C corporation.

However, LLCs can elect to be taxed as a C corporation if they wish, subjecting owners to double taxation, though this can still be beneficial to certain LLCs because of the wide range of deductions available to C corporations.

Electing S Corporation Taxation for LLCs

Some LLCs elect to be taxed as an S corporation (S corp). The S corp classification has more restrictions and greater scrutiny from the IRS, but it has the potential to save some members a lot in self-employment taxes. It also avoids the double taxation you would have from being taxed as a C corporation.

We have an S corp service to help you set up an LLC with S corporation status. But before you decide how to have your LLC taxed, we highly recommend consulting a tax professional.

Consulting a Tax Professional for LLC Tax Decisions

Ultimately the IRS handles federal business taxes. They collect corporate taxes like self-employment tax and federal corporate income tax.

Contacting the IRS for Federal Tax Inquiries

For specific federal tax questions, you can reach out to the IRS.

State and Local Taxes

When forming an LLC in Georgia, it’s essential to understand the taxation aspects at both the state and local levels. Here’s a breakdown of how a Georgia LLC is taxed and the common types of taxes it might encounter:

State-Level Taxes:

- Georgia State Income Tax: Although the LLC itself doesn’t pay state income tax, Georgia LLC members are subject to state income tax on profits from the LLC, and the tax rate varies based on taxable income.

- Sales and Use Tax: Georgia has a statewide sales tax rate, but local jurisdictions may also impose additional sales taxes. LLCs involved in retail or selling taxable goods or services must collect and remit these taxes to the appropriate authorities.

- Corporate Income and Net Worth Tax: If you choose to have your LLC taxed as a corporation, you’ll be subject to Georgia’s corporate income tax. If you’re over a certain income threshold, you’ll also pay the Net Worth Tax based on your company’s net worth.

- Annual Registration Fee: Georgia LLCs are required to file an annual registration with the Georgia Secretary of State. While this is not an income tax, it’s an essential annual obligation.

Local-Level Taxes:

Local Income Taxes: Some Georgia cities impose local income taxes. The rates and rules can vary by municipality. It’s crucial to check if your LLC operates in an area with local income taxes and comply accordingly.

Property Tax: If your LLC owns real property, you may be subject to property taxes levied by the county where the property is located. The rates and assessment methods can vary by county.

Business License Fees: Some Georgia cities and counties require LLCs to obtain a business license and pay associated fees. The requirements and fees can differ by location.

Occupational Tax: In certain municipalities, an occupational tax, also known as a privilege tax, may be imposed on LLCs and other businesses operating within city limits.

Employment Taxes: If your LLC has employees, you’ll need to comply with federal and state employment taxes, including payroll taxes and unemployment insurance.

It’s important to note that tax laws and rates can change over time, so it’s advisable to consult with a tax professional or the Georgia Department of Revenue for the most current and specific tax information relevant to your LLC. Staying informed about your tax obligations helps ensure that your LLC remains compliant with state and local tax laws.

Types of LLCs in Georgia

Looking to set up shop in Georgia? The Peach State offers various LLC types tailored for different business needs. Here’s a quick dive into understanding which might be the best fit for your new venture.

Single-Member LLCs

Ideal for the solo entrepreneur, the single-member LLC in Georgia is the go-to for individuals seeking the benefits of limited liability paired with straightforward taxation. It’s a balance of autonomy and protection, ensuring that while you steer your business, your personal assets remain safe.

Multi-Member LLCs

If you’re envisioning a joint venture with colleagues or friends, the multi-member LLC might be your best bet. It brings multiple stakeholders under one roof, allowing shared responsibilities and a clear division of the company’s profits or losses. It’s a collaboration made seamless.

Related Topics

GA LLC FORMATION THAT’S FAST AND SIMPLE

Take it from real customers

FAQs about LLC's in Georgia

-

The state fees for forming a Georgia LLC range from $100 to $145, depending on factors such as your method of filing and whether you choose to reserve your business name. Note that fees change over time, so you should check the Georgia Secretary of State website for the most recent fee schedule.

-

Many people start LLCs for a good reason. The legal structure it provides gives individual members protection from liability and taxes and is relatively inexpensive and straightforward.

Create LLC Georgia Benefits:

- Like a corporation, the business operations can continue even in the event of a member’s death. Ownership interests can be transferred from one member to another.

- An LLC member (LLC owner) risks only what they invested in the business and their remaining personal assets are not usually at risk.

- Earnings will be distributed among the members and taxed at their personal tax rates without first being taxed at the business level.

-

You are not required to file an operating agreement. However, as discussed above, an operating agreement is still an important document to have, as it provides additional protection for you and your business.

-

The state of Georgia does not, at this time, allow the formation of a Series LLC. Series LLCs are a relatively new concept where an umbrella LLC is formed with separate LLC “cells” under it. The law may change, so check back with Georgia from time to time if this is a concept that interests you.

-

While Georgia does not require a blanket business license, it does require licensing for many individual professions and businesses. You can visit the Georgia Secretary of State’s licensing page to search for Georgia licensing requirements, fill out a license application if needed, track your status, and more.

Additionally, some local municipalities may require licensing. Make sure you familiarize yourself with the requirements in the location your business calls home. Other business licenses can be federal or industry-specific. You’ll have to research which business licenses and permits your business needs or hire a service to do this for you, such as our business license report.

-

If the time comes to dissolve your business, you must file a Certificate of Termination with the Georgia Secretary of State. The first step is to check and make sure your business is currently up to date in its registration. Once it is, the certificate can be submitted with no filing fee. Once the application is submitted, it typically takes two to eight business days to be processed. The termination date will be the date the application is received.

Your Certificate of Termination must:

- Include the name of the LLC.

- State that known debts, liabilities, and obligations have been taken care of or provisions have been made.

- State that no legal actions are pending against the LLC or that provisions have been made if there are.

For more information, visit our Georgia business dissolution guide.

-

While an LLC in Georgia does need to keep a current list of its officers with the state, which it does by filing an annual registration, it does not maintain a list of business owners. The business itself maintains that list.

-

An LLC is a business entity, while S Corp is a tax filing. Learn more about the differences and compare LLCs vs. S Corps.

Disclaimer: The content on this page is for information purposes only and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

ZenBusiness is a financial technology company and is not a bank. Banking services provided by Thread Bank, Member FDIC. The ZenBusiness Visa Debit Card is issued by Thread Bank pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa debit cards are accepted. FDIC insurance is available for funds on deposit through Thread Bank, Member FDIC.

*Your deposits qualify for up to a maximum of $3,000,000 in FDIC insurance coverage when placed at program banks in the Thread Bank deposit sweep program. Your deposits at each program bank become eligible for FDIC insurance up to $250,000, inclusive of any other deposits you may already hold at the bank in the same ownership capacity. You can access the terms and conditions of the sweep program at https://go.thread.bank/sweepdisclosure and a list of program banks at https://go.thread.bank/programbanks. Please contact customerservice@thread.bank with questions regarding the sweep program.

LLC Formation States Near Georgia

Ready to Start Your LLC?