*Mr. Cuban may receive financial compensation for his support.

Last updated: July 2, 2024

Want to kick off your business adventure with an LLC? South Carolina is known for its charm, and like a comforting bowl of shrimp and grits, the South Carolina LLC structure is a welcoming option for entrepreneurs. It gives you the advantage of liability protection without the stuffy, rigid structure of a corporation. It’s kind of like enjoying the beautiful South Carolina coastline without the crowds.

Starting an LLC in South Carolina does mean you’ll need to follow specific guidelines and meet certain requirements. If the idea makes you feel like you’re lost in the maze of historic Charleston streets, don’t fret. We’re here to guide you step by step through the entire process.

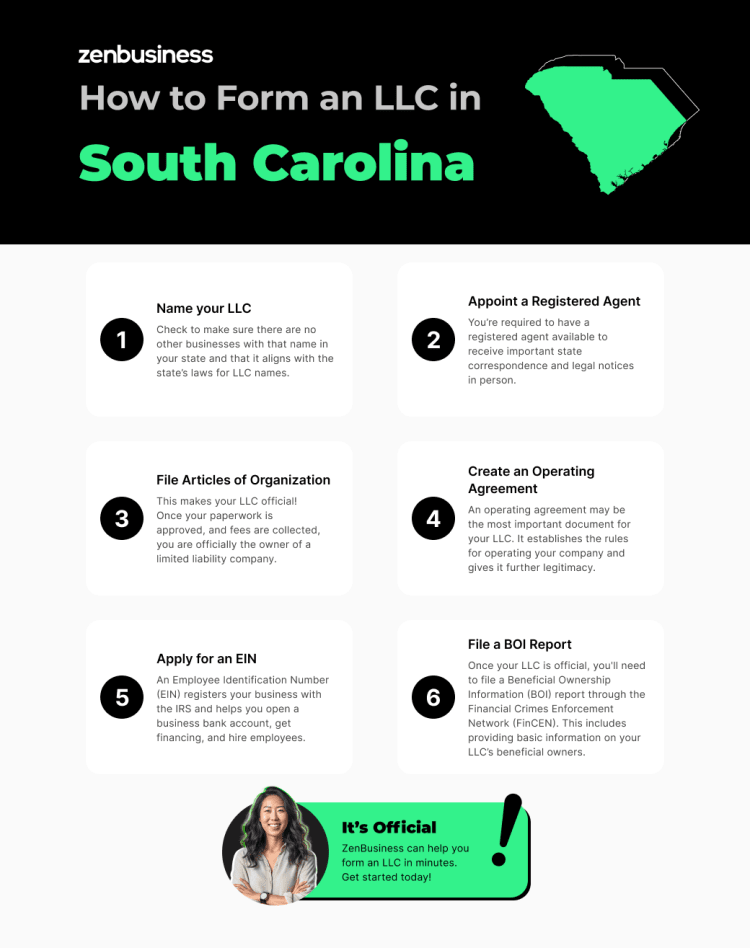

How to Start an LLC in South Carolina

To ease your journey into the world of business in the Palmetto State, here are five fundamental steps:

- Pick a unique name for your LLC.

- Designate a registered agent to handle essential communications for your business.

- File Articles of Organization with the South Carolina Secretary of State.

- Draft an operating agreement to lay down the rules for your LLC.

- Register your business with the IRS and explore your tax obligations.

- File your BOI report for your LLC

We’ll explore how to start a South Carolina LLC throughout this article. Note that the above guidelines are for creating a domestic LLC, meaning one that’s started within South Carolina itself.

Step 1: Name your South Carolina LLC

Give your LLC a name. Naming your LLC in SC is an integral part of establishing your business. You want to make sure the name represents the purpose and character of your business, but there are some rules that must be followed.

LLC South Carolina Naming Requirements

Under state law, the name of your LLC in South Carolina must contain one of the following designators to indicate that it’s an LLC: “limited liability company” or “limited company” or the abbreviation “L.L.C.,” “LLC,” “L.C.,” “LC,” or “Ltd. Co.”

The name you choose also needs to be distinguishable from other South Carolina businesses. We have additional resources if you’d like more details on how to name your LLC.

Checking and Reserving Your Business Name

Once you’ve chosen a name, you can consider reserving it so no one else can swoop in and take it before you officially register the name. An LLC name in South Carolina can be reserved for 120 days.

Register a domain name

In this day and age, having an online presence is crucial. Regardless of whether you have a brick-and-mortar business, provide a service, or focus on e-commerce, people are going to search for you online. Register a domain name that you can use to establish your website, email address, and web hosting. If you don’t register your domain name, someone else can take it and charge you a higher fee to have it.

Is your LLC name available as a web domain?

A website helps build credibility in your industry and legitimize your business, no matter the size. One reason why your LLC needs a website is to reach your target consumers.

The URL you choose for your website can make a big difference in whether or not potential customers can find you online. Use our domain name search tool to see if your desired business name is available as a URL. If you find a domain name you like, you might want to acquire it before someone else does.

Your business name and the domain name can be the same, or they can be different as long as the domain name makes sense. It may also be worth checking if related social media handles are available. Social media platforms are a way for businesses to stay engaged with current customers and acquire new ones.

We can help you find and purchase your domain name through our Domain Name Service.

Federal and State Trademarks

Even if the Secretary of State approves your business name, that’s no guarantee that someone else hasn’t already claimed it with a federal or state trademark. To truly check to see if your business name isn’t trademarked isn’t easy because there’s not one single place to check. Some businesses even employ an attorney specializing in trademarks to see if they’re in the clear.

You can take some measures yourself, like searching the trademark database on the United States Patent and Trademark Office website. This can help you determine if someone’s already claimed a federal trademark on the name you want.

State trademarks are applicable within the borders of a state. The South Carolina Secretary of State maintains a list of state trademarks on its website, so you can check your desired name against that. If you want, you can also apply for your own state trademark on the site.

In addition to checking these databases, it’s wise to do an internet search for your business name, including checking domain names, social media sites, and even online phone directories.

Applying for a DBA

DBA stands for “doing business as.” If you’d like your LLC to go by a name other than your official registered name, you’ll need to register a DBA in the county where your business operates. This process doesn’t involve the Secretary of State. Each county has its own process, which generally starts at the County Clerk’s office.

Ready to Start Your South Carolina LLC?

Enter your desired business name to get started

Step 2: Appoint a registered agent in South Carolina

Name a registered agent for your business. Every formal business entity in South Carolina is required to appoint a registered agent. In South Carolina, this is also sometimes referred to as an Agent for Service of Process.

What is a registered agent?

This individual or business is tasked with receiving important legal notices (such as subpoenas) and state correspondence for your company. You need to have a registered agent chosen when you register your South Carolina LLC. Their information and signature are required on the formation documents. Your registered agent must be available during all normal business hours.

Who can be a registered agent?

A registered agent must reside in the State of South Carolina. If using a registered agent service like ours, the service must be authorized to transact business in South Carolina. You may choose an individual within the company or another qualifying individual to serve as the registered agent, or you can do it yourself. However, difficulties could arise if you take a vacation or even take a long lunch break and miss the service of important papers. Plus, many business owners don’t like the thought of being served with notice of a lawsuit in front of customers. Therefore, many companies use a separate agent.

Step 3: File South Carolina Articles of Organization

File your Articles of Organization with the state. The official formation of your South Carolina LLC occurs when you file your Articles of Organization with the Secretary of State. Without this document, your company doesn’t exist. Jumping through the hoops of gathering information for your Articles of Organization and ensuring proper filing can be time-consuming and intimidating. We can help with our LLC South Carolina Formation Services.

E-Filing Articles of Organization with the Secretary of State

Although you can submit Articles of Organization by mail, electronic filing is much more convenient and efficient. Filing can be done on the Secretary of State’s website once you create an account. The cost to file this document is $125 but there may be other additional costs.

South Carolina doesn’t offer expedited filings. Filing online takes one to two business days for processing, while filing by mail takes four weeks.

Information needed for your Articles of Organization

A little planning can go a long way. Make sure that you have all the necessary information prepared before filling out your South Carolina Articles of Organization. You’ll need to have the following information to start an LLC in SC:

- The official name of your South Carolina LLC

- The designated address of the business

- The name, physical street address, and signature of the LLC’s registered agent

- The name and address of at least one organizer

- The term date, if the LLC is only going to exist for a certain period of time

- The names and addresses of initial managers (if applicable)

- Whether the effective date will have a delay

- Any additional provisions deemed necessary

- The signature of each organizer

Consider whether you want your LLC to be managed by members or managers. This will change the information you provide in your Articles of Organization.

Amending Articles of Organization

Though your Articles of Organization must be correct at the time it’s filed, that doesn’t mean the information can’t change. If you decide to switch your registered agent, contact information, or management type, you can do so using Articles of Amendment.

We can make this process easy with our amendment filing services. It’s important to make sure you update your information with the Secretary of State. We can also help keep you compliant with our Worry-Free Compliance Service, which includes two amendments annually.

Step 4: Create a South Carolina operating agreement

Write an operating agreement for your LLC. An operating agreement isn’t a legal requirement to function as a valid LLC in South Carolina, but it’s a very good idea to have one.

What is an operating agreement?

An operating agreement is an important document used to govern how a limited liability company operates. It details the management structure of the LLC, including how it’s organized, membership rights, roles and responsibilities of management, conflict resolution, profit and loss distributions, and dissolution of the business.

Operating agreements help ensure that all members have the same expectations for how the business will run. Having an official document that everyone can reference reduces the risk of conflict among members.

How to form an operating agreement

An operating agreement should take into consideration all aspects of the business. If you’re unsure as to how to create an operating agreement for your South Carolina limited liability company, we offer a customizable template to help get you started. You could also use an attorney or attempt to write it yourself.

Do I need an operating agreement even if I am the only owner?

The purpose of your operating agreement is to lay out how the LLC will run and detail the responsibilities of members and managers. Although some people think that a single-member LLC doesn’t need an operating agreement, this isn’t necessarily true. Despite the fact that, as a sole owner, you don’t have to worry about conflict between members, the operating agreement still has a lot of value.

Here are some reasons that it’s a good idea to have an operating agreement even if you’re the sole owner of the limited liability company:

- If you’re trying to acquire funding, you can show the operating agreement to potential lenders to give them an overview of the company structure.

- If you can’t manage your business because of illness or some other reason, whoever steps in will have guidelines to follow.

- In some cases, potential investors, business partners, and financial institutions may require an operating agreement.

If you don’t have an operating agreement, your business will be subject to default state rules that may or may not be beneficial for your LLC.

Step 5: Apply for an EIN

Get a federal Employer Identification Number (EIN). This nine-digit number is assigned by the Internal Revenue Service (IRS) and identifies your LLC for tax purposes. You must apply to the IRS to receive one, and it’s required for many LLCs, including those with employees or more than one owner.

Why does an LLC need an EIN?

An EIN is like a Social Security number for a business. It’s often necessary to open business bank accounts, hire employees, and file and manage both federal and state taxes.

How to obtain an EIN

An EIN is free from the IRS, but you do have to go through the application process either online or by mail. You’re going to have a lot to do when starting a business. We can obtain your EIN for you with our EIN Service.

Step 6: File your LLC’s beneficial ownership information report

LLCs (and other small businesses) have a new requirement beginning in 2024: filing a beneficial ownership information report, or BOI report. This reporting requirement was introduced by the Corporate Transparency Act with the goal of reducing financial crimes by making it more difficult for companies to use shell corporations to hide illicit activities. That’s because the report requires businesses to disclose information about their beneficial owners.

When you file your BOI report, you’ll be asked to provide the name, address, and identifying documents for each beneficial owner. According to the act, a beneficial owner is anyone who holds 25% or more of the ownership interest of the LLC, exerts significant control over it, or receives substantial economic benefit from the business assets.

You’ll submit the BOI report online or by PDF upload to the Financial Crimes Enforcement Network (FinCEN). It’s free to file. Just be sure to meet the due date: LLCs formed in 2024 will have up to 90 days after South Carolina approves your Articles of Organization. LLCs formed before 2024 have until January 1, 2025. Any LLCs formed in 2025 or after will have 30 days after approval to file.

For more information about the BOI, check out the FinCEN website. And for help filing the BOI, check out our BOI report filing service.

What to Do After Starting Your LLC

After successfully forming your LLC in South Carolina, your work isn’t quite finished. There are several important steps to complete that will help ensure your business’s ongoing success and compliance.

1. Obtain necessary business licenses and permits

In South Carolina, it’s very common for a new LLC to need at least one license or permit (but many businesses need more than one). While the state doesn’t have a general business license at the state level, your city or county might require a license. There are also industry-specific permits that you might need to get.

While getting your licenses is ultimately your responsibility, our business license report can help streamline the process for you.

2. Set up a business bank account

For a business owner, keeping personal and business finances separate is absolutely essential. And to do that, you’ll need a business bank account. Before you apply for your business bank account, make sure you have an EIN, as most banks ask to see this number before issuing an account.

After you have an account set up, be sure to vigilantly use your business account exclusively for business and your personal accounts for personal use. Don’t let them overlap.

3. Accounting and Bookkeeping

Establish a system for managing your finances, including bookkeeping and accounting. This will help you track expenses and income and prepare for tax season. You can use something as simple as a thorough spreadsheet, or you can invest in more expensive software. What’s important is that you have a system in place to guide your finances.

Our Money app can also help simplify this process for you.

4. Understand and fulfill tax obligations

Taxes are an unavoidable part of any business, and every business will have slightly different tax requirements. Every business owner will pay income tax at the state and federal levels; whether it’s corporate income tax or personal income tax will depend on your taxation structure.

A lot of businesses will also be responsible for sales tax, employment taxes, and much more. Familiarize yourself with tax requirements and adhere to them. If you need to, consult with a CPA or licensed tax attorney to get customized guidance for your unique tax situation.

5. Create a marketing plan

Develop a strategy to promote your business, attract customers, and build your brand. This could involve online marketing, staying active on social media, paid advertising, and networking. There are many marketing options available to you; the important thing is that you develop a plan and stick to it.

6. Review and update your business plan regularly

As your business grows and evolves, so should your business plan. Regularly updating it will help you stay focused on your goals and adapt to changes. Plus, if you ever bring on new investors or new members, there’s a good chance they’ll ask to see your business plan; showing them an updated, current plan will send the right impression.

7. Continuously monitor legal compliance

In this guide, we’ve covered the current essential steps you need to complete to start your South Carolina LLC. But these steps and procedures are subject to change at any time (especially tax codes, which tend to change yearly).

To help protect your LLC, do your best to stay updated on all legal changes in South Carolina. If needed, have a regular consultation with a business attorney to stay informed.

By following these steps, your SC LLC can be well-equipped for operational success and growth.

Other Business Entity Types in South Carolina

In South Carolina, entrepreneurs have various business entity options to choose from, each tailored to specific needs. Here’s a quick overview of recognized Secretary of State business entities:

- Sole Proprietorship: A simple and cost-effective choice where a single individual owns and operates the business. The owner is personally responsible for all business liabilities.

- General Partnership: Similar to a sole proprietorship but involving two or more individuals who share the management and profits. Like sole proprietors, partners have personal liability for business debts.

- Limited Partnership (LP): LPs consist of both general partners, responsible for managing the business, and limited partners who invest capital but have limited involvement. General partners bear personal liability, while limited partners enjoy liability protection.

- Limited Liability Partnership (LLP): Often favored by licensed professionals, LLPs offer personal liability protection to all partners while allowing them to participate in management.

- Corporation (C Corporation): C corporations provide strong liability protection but face double taxation. They’re ideal for larger businesses with complex structures and shareholders.

- S Corporation: An S corporation isn’t a business entity, but a tax status that qualifying LLCs and C corporations can apply for. It offers pass-through taxation and the potential to save owners on self-employment taxes. However, they have specific eligibility criteria and restrictions.

- Nonprofit Corporation: Designed for organizations pursuing charitable, religious, or educational missions, nonprofit corporations benefit from tax-exempt status and must adhere to specific regulations.

These various business entities offer a range of advantages and considerations. Choosing the right structure for your South Carolina venture depends on your specific goals, liability preferences, and tax implications. Consulting with a legal or financial advisor can help you make an informed decision tailored to your business needs.

LLC Formation Checklist

Here’s a quick summary and checklist of the steps to take when forming your LLC:

- Name your business.

- Appoint a registered agent.

- File Articles of Organization with the Secretary of State.

- Create an operating agreement.

- Get an EIN.

- Obtain necessary licenses and permits.

- Set up a business bank account.

- Implement accounting and bookkeeping.

- Understand and fulfill tax obligations.

- Create a marketing plan.

- Regularly review and update your business plan.

- Continuously monitor legal compliance.

Completing these steps will help ensure your South Carolina LLC’s ongoing success and compliance with essential requirements.

Need help filing your South Carolina LLC?

Whether you’re entering the tourism industry at Myrtle Beach, opening a college pub in Clemson, a restaurant in Charleston, or anything in between — we can help you through the process and provide support. There’s a lot to do when you start a business. We can take care of formation, compliance, and more so you can focus on making your enterprise a success.

SC LLC FORMATION THAT’S FAST AND SIMPLE

Take it from real customers

South Carolina LLC FAQs

-

There’s no statewide general business license required in South Carolina. However, many cities and counties require businesses to obtain a local business license at a local level. The business permits and licenses your LLC needs to operate depend on your location, industry, and activities. These can be found at the local, state, or federal levels. It can take a lot of time and research to ensure you’ve met all requirements for your business. We can help with our business license report.

-

The cost to start an LLC in South Carolina is $125 when filing online. This fee is paid to the South Carolina Secretary of State when you submit your LLC’s Articles of Organization. There may be additional fees associated with starting your LLC, such as retaining a registered agent, reserving a business name, and securing licenses and permits.

-

One of the biggest benefits of having a limited liability company is personal liability protection that usually protects your personal assets without the double taxation or rigid requirements of a corporation. Also, the start-up process isn’t as difficult for an LLC as it may be for a corporation. Tax flexibility is also a plus.

-

Unlike corporations, LLC taxes are, by default, paid only on the owners’ personal income taxes. Being taxed directly at the personal income level is called “pass-through taxation.” This structure avoids “double taxation,” where you’re taxed at both the business and personal level. However, LLC members can also elect to have their company taxed as an S corporation or a C corporation. This can provide tax benefits to certain LLCs by allowing them to lower their self-employment taxes and/or claim more deductions.

-

Filing your Articles of Organization online takes approximately one to two business days for processing, while filing by mail takes four weeks. South Carolina doesn’t offer expedited filings.

-

An operating agreement isn’t necessary to function as an LLC in South Carolina, but it’s a good idea to have one. You don’t need to file your operating agreement with the state, but you should keep it somewhere secure.

-

LLC owners have the ability to choose the tax structure that’s best for them. Most opt for pass-through taxation as a default or by electing to file as an S corporation. Filing as a C corporation can sometimes benefit larger LLCs. You may want to consider consulting with a tax professional to determine what’s best for your specific business.

-

South Carolina doesn’t allow a series LLC business structure.

-

There are several steps to dissolving your LLC in SC. The first is to refer to your operating agreement. This document should have provisions for dissolution. Closing your business tax accounts is the next step, followed by filing Articles of Dissolution. Learn more in our South Carolina dissolution guide.

-

Your LLC operating agreement should contain provisions for ownership transfer that are specific to your business. Ownership changes usually need to be agreed upon by all members and may impact the voting rights of the purchasing party. See our guide to transferring ownership of a South Carolina LLC.

-

If you want your business to go by a different name than your registered name, you’ll need to file for a DBA in the county where your business operates. Each county has its own process, which generally starts at the County Clerk’s office.

-

Similar to a transfer of ownership, your LLC operating agreement should detail the provisions for removing a member. You’re required to file Articles of Amendment with the state to update the membership.

-

South Carolina LLCs aren’t required to file an annual report unless they file taxes as a C corporation. South Carolina’s annual reports are part of the state corporate income tax.

-

You aren’t required to create a business plan for your SC LLC, but it’s always advisable. This plan can outline your business structure, plan, and goals.

Disclaimer: The content on this page is for information purposes only and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

ZenBusiness is a financial technology company and is not a bank. Banking services provided by Thread Bank, Member FDIC. The ZenBusiness Visa Debit Card is issued by Thread Bank pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa debit cards are accepted. FDIC insurance is available for funds on deposit through Thread Bank, Member FDIC.

*Your deposits qualify for up to a maximum of $3,000,000 in FDIC insurance coverage when placed at program banks in the Thread Bank deposit sweep program. Your deposits at each program bank become eligible for FDIC insurance up to $250,000, inclusive of any other deposits you may already hold at the bank in the same ownership capacity. You can access the terms and conditions of the sweep program at https://go.thread.bank/sweepdisclosure and a list of program banks at https://go.thread.bank/programbanks. Please contact customerservice@thread.bank with questions regarding the sweep program.

LLC Formation States Near South Carolina

Ready to Start Your LLC?