*Mr. Cuban may receive financial compensation for his support.

Last Updated: June 12, 2024

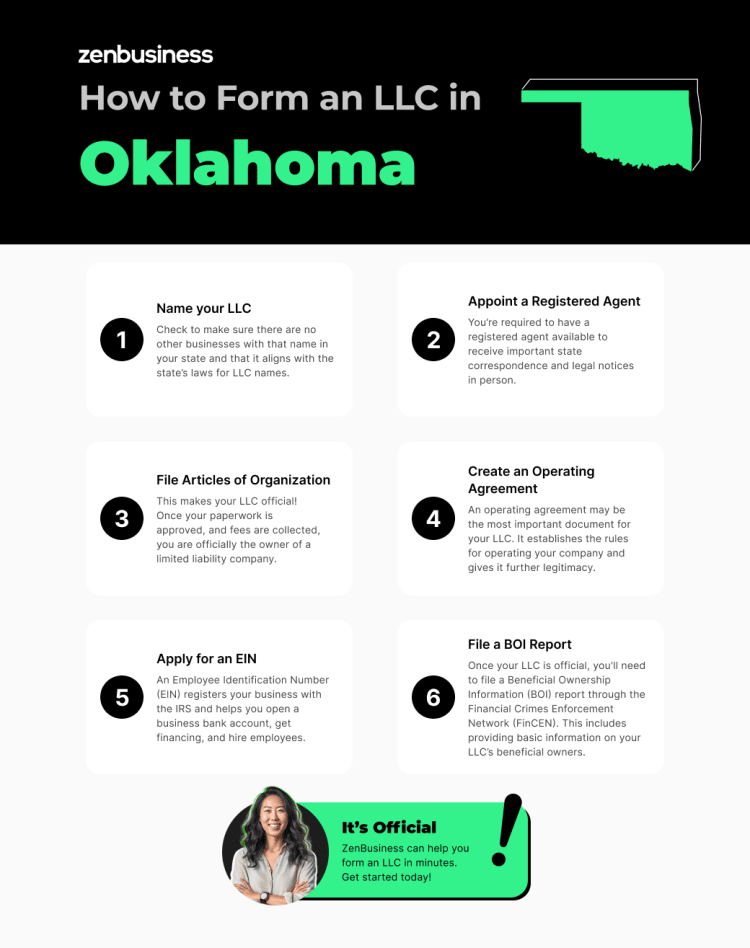

How to Start an LLC in Oklahoma

Thinking of starting an LLC? Oklahoma offers many opportunities for ambitious entrepreneurs with its business incentive programs and low cost of doing business. But do you know how to start an LLC in Oklahoma?

First, let’s define what an LLC is. A limited liability company (LLC) is a business entity type that allows its owners (called “members”) to have the personal limited liability protection of a corporation with the tax benefits and organizational flexibility of a partnership or sole proprietorship. You can read more on what does LLC mean & what does it stand for here.

An LLC avoids the “double taxation” of a typical corporation, in which profits are taxed first at the business level and again on the personal level. An LLC is a relatively informal business structure that bypasses many of the strict structural and reporting requirements of a corporation while protecting the owners’ personal assets from the debts and liabilities of the business.

Still, Oklahoma LLC registration does require you to complete and file the right paperwork with the state. If you’re new to starting a business, navigating this red tape may leave you feeling ignorant. But, as Oklahoma’s favorite son, Will Rogers, once said, “Everybody is ignorant, only on different subjects.”

How to Start an Oklahoma Limited Liability Company

Don’t worry; we’re here to educate you about starting an LLC in Oklahoma. This article will take you through the steps for how to get an LLC in Oklahoma. Along the way, we’ll show you how our business services can make the process even less stressful.

Your first step is to find a name for your LLC. From there, you’ll need to appoint a registered agent and file Articles of Organization with the Oklahoma Secretary of State. Afterward, you’ll probably want to make an LLC operating agreement and get a federal tax identification number. Finally, file your BOI report.

Note: These are the steps for creating a domestic LLC, meaning one that originates within the state. To create a foreign LLC — one that originated in another state but wants to do business in Oklahoma — or an Oklahoma professional limited liability company, you would need to follow a different process.

Okay, let’s show you how to set up an LLC in Oklahoma with the following steps.

- Name your Oklahoma LLC. Choosing a unique and compliant name is one of the fundamental steps in the formation process.

- Appoint a registered agent in Oklahoma. It’s essential to have a registered agent with a physical address in the state for legal correspondence.

- File Oklahoma Articles of Organization. This important step formally registers your business with the state and involves a filing fee.

- Create an operating agreement. Not mandatory, however it’s a wise way to outline the LLC’s management and financial structure.

- Apply for an EIN. Necessary for tax purposes, this service is often provided by companies assisting with LLC formation.

- File your LLC’s BOI report

Step 1: Name your Oklahoma LLC

Choose a name for your Oklahoma LLC. Brainstorming a name for your new business can be fun, but just remember that you must conform to Oklahoma LLC naming guidelines. If the Secretary of State rejects your business name, your entire Oklahoma LLC filing will be rejected. You’ll have to start the whole process over, which is both a pain and a delay.

Find a name that’s unique, tells people who you are and what you offer, and resonates with your target market. For both marketing and legal reasons, your new business’s name must be distinguishable from other business names in the records of the Oklahoma Secretary of State. Slight variations in spelling, punctuation, and suffix won’t cut it.

Conduct an Oklahoma business name search

Make a list of possible names and then follow the instructions for searching for business names on our Oklahoma Business Entity Search page. To garner more results (and to make sure the name isn’t too close to another business), just enter the key portions of the name. The more detailed your query, the fewer results you’ll receive.

You can also check on the availability of your desired company name by telephoning the Secretary of State at (405) 522-2520.

Oklahoma LLC Name Requirements

You’ll also need to choose the proper “designator” for your company’s name indicating that the business is an LLC. You need to have some variation of “limited liability company” as the name’s suffix. You can end your company’s name with the full “Limited Liability Company,” shorten it to “Limited Company,” or use the abbreviations LLC, LC, L.L.C., or L.C. The word “limited” may be abbreviated as “Ltd.,” and the word “company” may be abbreviated as “Co.”

In addition to having a designator and being distinguishable from other Oklahoma business names, your LLC’s name must avoid words that could make it sound as if it’s a government agency. Certain words relating to banking and certain licensed professions may need approval from the appropriate agency.

Federal and State Trademarks

The Oklahoma Secretary of State checks to see if your company name is already claimed by another company in the state, but they don’t check to see if your name has been trademarked. If you choose a name that’s already trademarked by someone else, it’s likely to cause you problems later.

Trademarks exist at both the federal and state level. Checking to see whether a name has been trademarked isn’t easy because there’s no one central place to check. Some businesses even employ an attorney specializing in trademarks to see if they’re in the clear.

You can take some measures yourself, like searching the trademark database on the U.S. Patent and Trademark Office website. This can help you determine if someone’s already claimed a federal trademark on the name you want.

State trademarks are applicable only within the borders of a state. To see if your proposed company name has an Oklahoma state trademark, call the Trademark Division of the Oklahoma Secretary of State. If you want, you can also apply for your own state trademark on the site by completing a form on the site and paying a filing fee.

In addition to checking these databases, it’s wise to do an internet search for your company name, including checking domain names, social media sites, and online phone directories.

Finding a Matching Domain Name

When coming up with a company name, it’s wise to consider securing a matching domain name for your future website. We have a tool to help you do a preliminary domain name search. Our domain name registration service can help you secure the best available online name for your company.

Reserving an LLC Name

If you aren’t ready to officially register your LLC but don’t want someone else to get your company name in the meantime, Oklahoma allows you to reserve your business name for 60 days. You would need to pay a small fee and complete an Application for Reservation of Name either online or by mail.

Filing a DBA in Oklahoma

A DBA (“doing business as”) name, known as a “trade name” in Oklahoma, is a name your business uses that’s different from its legally registered name. Sometimes businesses want to represent themselves under a different name when they’re opening a new venue or launching a new product line. But to do so legally, they need to complete a Trade Name Report and submit it to the Secretary of State along with a filing fee.

We have a DBA service that can handle this for you.

Ready to Start Your Oklahoma LLC?

Enter your desired business name to get started

Step 2: Appoint a registered agent in Oklahoma

Next, appoint a registered agent for your LLC. An Oklahoma registered agent is a person or entity responsible for receiving legal and certain official notices on behalf of the business, such as a notice of a lawsuit against the company.

Your registered agent is expected to be available during regular business hours at a registered office that you determine. The registered office doesn’t have to be your place of business, but it does have to be a physical street address in Oklahoma. The registered office can’t be a P.O. box because some legal notices must be delivered in person.

Who can be a registered agent in Oklahoma?

In Oklahoma, a registered agent must be one of the following (Title 18, Section 2010):

- An individual resident of Oklahoma

- A domestic or qualified foreign corporation, LLC, or limited partnership

The registered agent is required to maintain a business office identical to the registered office.

As the owner, you can act as your company’s registered agent (provided you meet the above criteria). While that may seem like the easiest and most logical option when you file an LLC in Oklahoma, it’s not always in your best interest. After all, being served with a lawsuit in front of customers can tank your company’s reputation.

Benefits of Hiring Registered Agent Services

Using a registered agent service like ours has several advantages:

- Being served with a lawsuit in front of clients and employees can be embarrassing and detrimental to your business. Using a professional registered agent service allows such notices to be received discreetly away from your business site.

- You’re required to be available during standard business hours if you serve as your own registered agent. If you work outside the office, take business trips, go on vacations, etc., this requirement could be problematic.

- If you provide your personal or business address as your registered agent address, you’ll need to update your registered agent paperwork with the state each time you move. At rapidly growing companies, it’s easy to see how this essential step could get overlooked.

Step 3: File Oklahoma Articles of Organization

Complete and file your Articles of Organization with the Oklahoma Secretary of State. Once approved, the Oklahoma Articles of Organization makes your LLC official.

Filing official government documents like this can be intimidating and/or complicated for many people, which is why we’re here. With our business formation plans, we handle the filing for you to make sure it’s done correctly the first time. But, although we can do this for you, we’ll show you how the process works below.

LLC Articles of Organization Requirements

To accurately fill out the Articles form, you’ll need the following:

- The name of your LLC

- The address of the principal place of business (a P.O. box isn’t acceptable)

- Email address of the primary contact for the business

- The name of your registered agent and the registered office address

- The ability to sign the document with one or more LLC organizer signatures

- Information on how to reach the designated contact person

- How long the company will be in existence (perpetual or a specific number of years)

- Payment for the nonrefundable fee

View our step-by-step instructions on how to file your Oklahoma LLC Articles of Organization.

You can also fill out the document and mail it in or use the Secretary of State portal to submit your Oklahoma LLC application online. Either way, you’ll be responsible for paying a nonrefundable $104 fee (as of this writing).

Digitally Storing Your Oklahoma LLC Paperwork

If you have us handle filing your Articles, once the state approves your LLC, your paperwork will be available from your ZenBusiness dashboard. Here you can keep it and other important paperwork digitally organized.

Once you get your physical paperwork back from the state, you’ll want to keep it in a safe location along with your other important documents. These may include your LLC operating agreement, member certificates, contracts, compliance checklists, transfer ledger, etc. We offer a customized business kit to help you keep these important documents organized and looking professional.

How to Amend Your Articles of Organization

If any of the original information in your Articles needs to be changed or updated, your business is required to inform the state about the changes.

You would report these changes by filing Amended Articles of Organization with the Oklahoma Secretary of State and paying a fee. For some guidance, see our page on amending your Oklahoma Articles of Organization and how to change your business name in Oklahoma.

If your Articles of Organization isn’t current, it could impact your ability to get an Oklahoma Certificate of Good Standing. A Certificate of Good Standing isn’t required to conduct business, but it’s important for things like expanding your LLC to other states, renewing certain licenses and permits, and attracting potential investors. We can help you get one with our Certificate of Good Standing service.

Do you need help amending your Articles of Organization? We have an amendment filing service that can handle it for you, as well as our Worry-Free Compliance service, which includes two amendment filings every year.

Step 4: Create an operating agreement

Write an operating agreement for your LLC. An Oklahoma operating agreement is an internal document that documents how the LLC will be run and many other important issues. It answers questions like:

- Who manages the company?

- Who has an ownership interest in the LLC, and what percentage of ownership does each LLC member have?

- How are new members added to the LLC?

- How often does the LLC hold meetings?

- Who gets to vote on important decisions?

- What financial contributions have people made to the company?

- What is the process for dissolving the LLC?

- How are the profits divided up among the members?

- What is the process for removing a member from the LLC?

It’s not uncommon for LLC owners to be tempted to forgo writing up an operating agreement, especially in states like Oklahoma where it’s not legally required. After all, they may think, “It’s going so well. Why do I need to talk to everyone about all this legal stuff? Won’t that jinx it?”

Unfortunately, many business disputes, especially those involving new or small businesses, stem from the same thing: misunderstandings. In many cases, everyone could have avoided the misunderstanding by simply putting an agreement in writing.

Feeling unsure as to how to create an operating agreement for your LLC? We offer a customizable template to help get you started.

Step 5: Apply for an EIN

Get an IRS Employer Identification Number (EIN). The next step in creating an LLC in Oklahoma is obtaining an EIN. Every Oklahoma LLC will need this nine-digit number unless you are a single-member LLC with no employees (and sometimes even then).

The Internal Revenue Service (IRS) uses EINs to identify businesses. You may also see an EIN referred to as a FEIN (Federal Employer Identification Number) or FTIN (Federal Tax Identification Number). An EIN is used for tax and financial paperwork, including filing taxes and hiring new employees. Most banks require one for opening a business bank account.

You can get your LLC’s EIN through the Internal Revenue Service website, by mail, or by fax. If you’d prefer not to deal with the IRS more than necessary, we can get it for you. Our FEIN service is quick and eliminates the hassle.

Register for Oklahoma state business taxes

Your business will likely have to pay a variety of state taxes, so you’ll need to register with the Oklahoma Tax Commission. You can do this through the Oklahoma Taxpayer Access Point (OKTAP).

Step 6: Submit your LLC’s beneficial ownership information report

Now that your LLC is official, you have another step to complete: filing a beneficial ownership information report. This report is a new requirement for 2024, introduced by the Corporate Transparency Act. The Act strives to promote financial transparency and make it harder for organizations to hide illicit activities behind shell corporations. To accomplish this goal, new businesses — including your new LLC — have to disclose information about their beneficial owners.

A beneficial owner is anyone who exerts substantial control over the business, holds 25% or more of the business’s ownership interest, or gets significant economic benefit from it. For each owner, you’ll be asked to provide a name, address, and identifying documents. You’ll submit this information online or by PDF to the Financial Crimes Enforcement Network (FinCEN).

Failing to file has severe consequences, including civil and criminal penalties, so be sure to file on time. If you create your LLC in 2024, you’ll have 90 days after Oklahoma approves your Articles of Organization to file the BOI report. LLCs created before 2024 have until January 1, 2025. But in 2025 and beyond, new LLCs will have just 30 days to file.

For more information about this filing requirement, check out FinCEN’s website. Our BOI report filing service can also help make this step hassle-free.

Additional Steps

Once you’ve completed the basic five steps for forming an LLC in Oklahoma, you may need to take some additional steps depending on your circumstances.

Apply for business licenses

Once you’ve obtained your Employer Identification Number, check if your new Oklahoma LLC will need any licenses or permits. To determine if your LLC is required to obtain a license or permit, start by visiting the Oklahoma Department of Commerce’s Business Licensing and Operating Requirements page.

Your LLC could need licenses or permits on the federal, state, and/or local levels. Many licenses are also industry-specific. Unfortunately, there’s no central place to check to see if your business has every license and permit it needs, so you’ll need to do some research to make sure you’ve covered all the bases.

If you just want peace of mind knowing that your business has all the licenses and permits it’s legally required to have, our business license report service can do the work for you.

Open a business bank account for an Oklahoma LLC

Another thing you can do after securing an EIN is to open a business bank account. Having separate accounts for your business and your personal banking is critical for sorting out your finances at tax time. Commingling business and personal funds can make your taxes more difficult. It could also be used against you if someone takes you to court to challenge whether you and your LLC are truly separate entities.

We offer a discounted bank account for your new business. This allows for unlimited transactions, online banking, a debit card, and more. When you want to authorize others in your business to use the account, we offer a banking resolution template to simplify the process.

For further help managing your new business’s finances, try ZenBusiness Money. It can help you create invoices, receive payments, transfer money, and manage clients all in one place.

For Employers

If your LLC is going to have employees, you’ll need to meet some additional requirements, including:

- Set up a withholding account for income taxes through the Oklahoma Tax Commission.

- Create an account for employees’ unemployment taxes through the Oklahoma Employment Security Commission.

- Provide workers’ compensation insurance for your employees.

Oklahoma LLC Taxes

LLCs are typically considered “pass-through entities,” meaning they’re not subject to federal corporate income taxes. Instead, the profits are passed through to the owner’s personal income, and the responsibility to pay taxes falls only on the individual. This is unlike most corporations, in which profits are taxed twice, first at the business level and again at the individual shareholder level.

Single-member LLCs don’t have to file a separate federal return for their LLC. They report the LLC income on their personal income tax return (Form 1040). But LLCs with multiple members must file a separate informational federal return for the LLC, Form 1065. Then each LLC member reports their share of the profits on Schedule K-1 and attaches it to their own personal federal tax return.

Although LLCs are taxed as sole proprietorships or general partnerships by default, LLCs also have the option to be taxed as corporations. Some LLC members choose to classify their businesses as an S corporation or a C corporation, which can be advantageous in some cases. In particular, many Oklahoma LLCs elect to be taxed as S corporations because it could potentially save the members money on self-employment taxes. You can learn more on our “What Is an S Corp?” page.

You also have a few other forms of federal taxation to keep in mind. For example, you will likely need to pay self-employment taxes on your portion of the LLC’s profits. These are the taxes that go toward Social Security and Medicare.

You can read more about how LLCs are taxed at the federal level on the IRS website.

Oklahoma Tax Filing Requirements

If you have your LLC taxed as a pass-through entity for federal income tax, Oklahoma will tax you in the same manner for state income tax. If you choose to file as a corporation, though, you’ll be required to pay Oklahoma’s corporate income tax.

Income taxes aside, your LLC might be subject to other taxes, including:

- State employer taxes, if you have employees

- State unemployment insurance taxes, if you have employees

- Sales tax and use tax, if you sell goods

- Excise tax, if you sell beverages, fuel, cigarettes, or tobacco

This isn’t a complete list of Oklahoma taxes your LLC may be responsible for. To learn more, visit the Oklahoma Tax Commission website and see our page on Oklahoma small business taxes.

Local Taxes

You may owe taxes to your county, municipality, and other tax districts. You’ll need to check with your local tax authorities to make sure you’re paying all the taxes you owe.

Types of LLCs in Oklahoma

When forming an LLC in Oklahoma, understanding the different types of LLCs available is crucial to help ensure that you choose the right structure for your business needs. Here’s a section that outlines the main types of LLCs you can establish in Oklahoma:

- Single-Member LLCs: A single-member LLC is owned by one individual or entity and is a popular choice for solo entrepreneurs. This type of LLC combines the simplicity of a sole proprietorship with the liability protection of a corporation. In Oklahoma, single-member LLCs are treated as disregarded entities for tax purposes unless they elect to be taxed as a corporation.

- Multi-Member LLCs: Multi-member LLCs are owned by two or more members and can be ideal for businesses with multiple partners. These LLCs offer the same limited liability protection but are generally treated as partnerships for tax purposes, providing the flexibility of a partnership structure with the benefits of limited liability.

- Domestic LLCs: A domestic LLC is an LLC that is formed and operates within Oklahoma. To establish this type of LLC, you need to file Articles of Organization with the Oklahoma Secretary of State and adhere to Oklahoma’s LLC regulations.

- Foreign LLCs: If your LLC is formed in another state but you want to conduct business in Oklahoma, you must register it as a foreign LLC. This involves filing an Application for Registration with the Oklahoma Secretary of State and complying with state-specific regulations, including appointing a registered agent within Oklahoma.

- Series LLCs: Oklahoma recognizes the series LLC, a unique structure where a single “parent” LLC contains multiple independent “series” or cells. Each series can have separate members, managers, assets, and liabilities, and can conduct business independently. This structure is advantageous for businesses that want to segregate their assets and liabilities into different series within the same overall entity.

- Professional LLCs (PLLCs): PLLCs in Oklahoma are designed for licensed professionals, such as doctors, lawyers, and accountants. Members of a PLLC must typically hold a professional license, and the PLLC is often subject to additional regulations specific to the profession.

- Member-Managed vs. Manager-Managed LLCs: This distinction refers to the management structure of the LLC. In a member-managed LLC, all members participate in the business’s day-to-day management. In contrast, a manager-managed LLC designates one or more managers (who may or may not be members) to handle business operations, which can be beneficial for members who prefer a more passive role.

We can help

Following all the steps above should help you form a new LLC. But there’s still more to know than how to file an LLC in Oklahoma. You may need to know about things like hiring employees, getting business licenses and permits, getting additional financing if you need it, how to make changes to your business, and how to stay in compliance with the government.

We offer many services beyond just helping you form your LLC. Our business experts can also give you long-term business support to help run and grow your company.

The Sooner State has many business opportunities, but, if the paperwork of starting a business in Oklahoma feels overwhelming, we can help. Let us take care of the Oklahoma LLC registration process, compliance, and more. That way, you can get back to running your dream business, whether it’s a rye farm in Lawton or a recording studio in Tulsa.

OK LLC FORMATION THAT’S FAST AND SIMPLE

Take it from real customers

Related Topics

Oklahoma LLC FAQs

-

The state fees for forming an LLC in Oklahoma can range from $100 to $135, depending on factors such as whether you choose to get a trade name or reserve your business name. Note that filing fees change over time, so be sure to check the Secretary of State website for the most recent fee schedule.

-

LLCs aren’t the only type of business you can form in Oklahoma. However, most of our customers choose to form an LLC over other business entities. Many entrepreneurs view LLCs as the “best of both worlds” when it comes to business entity types. Forming an Oklahoma LLC means you’ll have the following benefits:

- Personal asset protection: Your personal liability will usually be separate from your business liability and debts.

- Avoiding double taxation: You’ll only pay personal taxes rather than both personal and corporate taxes on the company’s profits.

- Flexible management: You’re not required to have a board of directors or annual meetings.

- Less reporting: Compared to corporations, LLCs have fewer required meetings and reports.

For a more in-depth look at why an LLC might be a better option for you, see our breakdown of what an LLC is and how it compares to a corporation.

-

In just two business days, your Articles of Organization will typically be processed with the Oklahoma Secretary of State if you file online. Filing by mail takes a bit longer — usually seven to 10 business days, not counting the time in transit.

-

No. The operating agreement is kept internally by the members (owners) of the Oklahoma LLC. While some states legally require LLCs to have an operating agreement in place, Oklahoma does not.

-

When you get an EIN, you will be informed of the available tax classification options. Many Oklahoma LLCs elect the default tax status, which is to be taxed as a sole proprietorship (for a single-member LLC) or a partnership (for a multi-member LLC). For either of these options, the LLC itself isn’t taxed on income, but the LLC members pay taxes on their portion of its profits on their individual tax returns.

Some LLCs (particularly those with high earnings) may choose to file taxes as either an S corporation or a C corporation. This option has some distinct advantages for certain LLCs. You can learn more about how these methods of taxation compare on our LLC vs. S corporation and LLC vs. C corporation pages.

In evaluating these options, it can be extremely helpful to get advice from qualified accounting professionals.

-

Yes. A series LLC is a group of limited liability companies operating under one “parent” entity. While each entity under the parent is considered independent, entrepreneurs are often attracted to the structure if they wish to create numerous companies to explore different avenues but not risk one’s success due to the liabilities of another. However, only a few states have adopted laws allowing series LLCs — one of which is Oklahoma.

-

The business licenses and permits required to run your Oklahoma LLC vary depending on your industry and location. You can learn more on our Oklahoma business licensing page. As mentioned above, our business license report can help you with determining what licensing you need.

-

Every limited liability company in Oklahoma is required to file an Oklahoma annual certificate (also known as an annual report) with the Oklahoma Secretary of State. You can file online, in person, or by mail. Whichever way you choose to file, you are required to pay a filing fee.

We can help you with your Oklahoma annual certificate in a couple of ways. Our annual report service will help you file your annual certificate, and our Worry-Free Compliance service not only helps with filing your annual certificate, but also sends you other important compliance reminders and helps you with two amendment filings each year.

-

Before starting the dissolution process, the members of an LLC should consult the operating agreement and follow all established rules for dissolving the LLC. For subsequent steps, please refer to our Oklahoma business dissolution guide.

Disclaimer: The content on this page is for information purposes only and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

ZenBusiness is a financial technology company and is not a bank. Banking services provided by Thread Bank, Member FDIC. The ZenBusiness Visa Debit Card is issued by Thread Bank pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa debit cards are accepted. FDIC insurance is available for funds on deposit through Thread Bank, Member FDIC.

*Your deposits qualify for up to a maximum of $3,000,000 in FDIC insurance coverage when placed at program banks in the Thread Bank deposit sweep program. Your deposits at each program bank become eligible for FDIC insurance up to $250,000, inclusive of any other deposits you may already hold at the bank in the same ownership capacity. You can access the terms and conditions of the sweep program at https://go.thread.bank/sweepdisclosure and a list of program banks at https://go.thread.bank/programbanks. Please contact customerservice@thread.bank with questions regarding the sweep program.

LLC Formation States Near Oklahoma

Ready to Start Your LLC?