*Mr. Cuban may receive financial compensation for his support.

Last updated:July 2, 2024

How to Start an LLC in Colorado

Is it time to transform your entrepreneurial vision into a tangible business? Exploring various corporate structures is a key step in this journey. One widely chosen format is the limited liability company (LLC). This option is favored for its advantages in liability protection and tax efficiency, among other benefits.

For entrepreneurs aiming to establish an LLC, Colorado presents a prime opportunity. Renowned for its business-friendly environment and a demographic ready to become potential clients, Colorado stands out. The journey to establish a Colorado limited liability company, akin to navigating the state’s rigorous winters, can be complex. To assist in this endeavor, we have compiled a guide detailing each step required to successfully set up your LLC in Colorado and commence your business operations.

Note: Colorado had temporarily lowered the filing fees for LLCs to $1 in 2022, but that fee has returned to $50.

Starting a Limited Liability Company in Colorado

In order to form an LLC, Colorado requires you to do so with the Colorado Secretary of State (SOS). The SOS’s website walks you through the process, but if it’s your first time putting an LLC together, you may have a ton of questions and wonder if you’re doing things the right way.

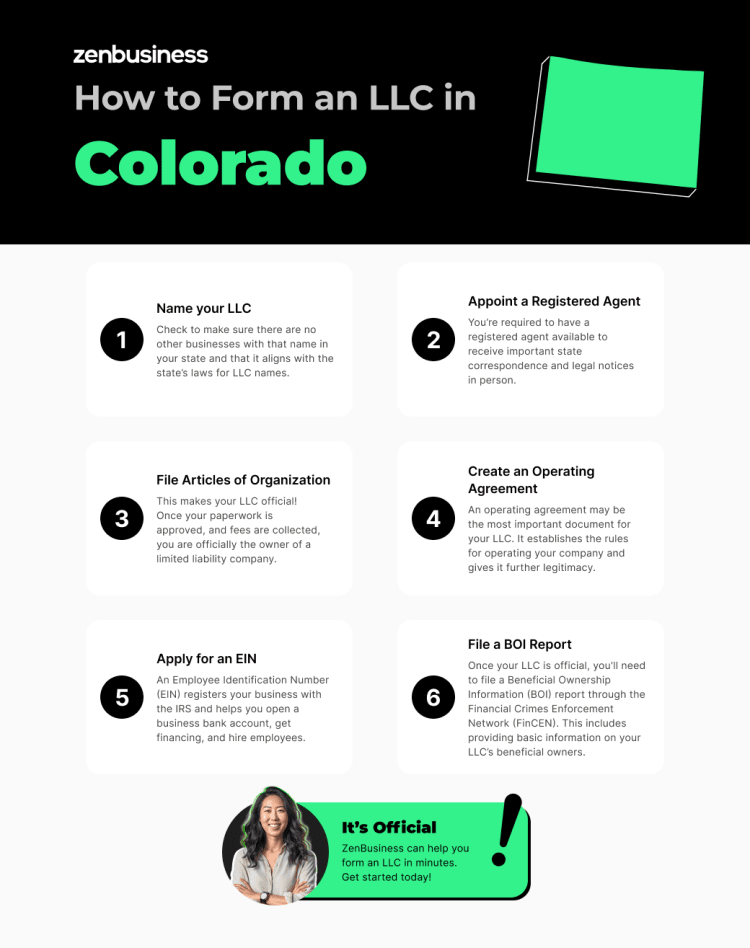

Our guide includes six steps to forming your LLC in Colorado:

- Picking the right name for your business (that follows the state’s rules)

- Appointing a registered agent who will receive important notices on your business’s behalf

- Filing the Articles of Organization, which, when approved, formally recognizes the LLC as a business

- Drafting an operating agreement where you can list your LLC’s rules

- Registering your business with the Internal Revenue Service (IRS) and reviewing your tax responsibilities

- File your LLC’s BOI report in Colorado

If this sounds like a lot of hard work, don’t worry. Each step will go into detail on how to accomplish them. We’ll additionally highlight some of our services that can make your business formation less complicated along with running and growing your company.

Something to Keep in Mind

If you’re looking to start an LLC in Colorado, then you should know that this guide is for forming a domestic, for-profit LLC. If you’re looking to start a foreign (out-of-state) LLC, then you’ll need to check in with the Colorado SOS. The website has a guide that walks you through that process, as well.

Step 1: Name your Colorado LLC

Your first step is to decide on a name for your Colorado LLC. This can be a fun process because it can get your creative juices flowing. One thing that you need to remember, though, is that whatever name you choose can have implications from both legal and marketing standpoints.

Your name should be one that you’ll be proud of and reflects what you offer. And, of course, your name needs to follow Colorado’s rules, which we’ll cover next.

Colorado Limited Liability Company Naming Rules

In order to properly name your LLC, Colorado has a few rules that you’ll need to follow in order to get your business approved. The Secretary of State website has detailed rules, but we’ll highlight some below:

- The name must be distinguishable from other business names that the state already has on record.

- The name must include one of the following phrases or abbreviations. The Secretary of State website points out that capitalization doesn’t matter, but punctuation does:

- Limited Liability Company

- Ltd. Liability Company

- Limited Liability Co.

- Ltd. Liability Co.

- Limited

- L.L.C.

- Ltd.

- If you want to include a character in your name like a number or symbol, then you’ll need to refer to the Secretary of State’s page of acceptable characters.

Once you’ve decided on a name that follows the state’s rules, you can make sure that it isn’t already taken. The Secretary of State website has a tool to do this, and we show you how to use it here. You can also contact the Secretary of State directly to ask if your name is available.

Reserving Your Colorado LLC’s Name

If all looks good and the name you want for your LLC is available, then you may want to consider reserving it in the meantime while getting your business set up. To do so with the state, you’ll need to file a Statement of Reservation of Name form. This form can only be filed electronically and will reserve your name for 120 days. You can renew the reservation by filing a Statement of Renewal of Reservation of Name.

Federal and State Trademarks

If you’re looking to trademark your business name, then you should consider Colorado’s rules. As the Secretary of State website states, “A business name is not generally eligible for registration as a trademark, except when the name is used for advertising or placed on goods, i.e., when the name of the entity is used to describe the source of goods or services. You may wish to contact an attorney to discuss ways of protecting your business name and whether you should trademark your business name.”

If you decide to move forward, then you’ll need to file a Statement of Registration of Trademark form with the Secretary of State. The trademark is good for five years and can be renewed. If you want to file a trademark at the federal level, then visit the U.S. Patent and Trademark Office website for more information.

Get a domain name for your LLC in Colorado

Having an online presence is a great way to build your customer base. A business website with a domain name that matches your LLC’s name can help you reach a larger audience that your physical location can’t. While choosing the best name for your LLC, check if it’s available as a domain name. If it isn’t, then you might want to adjust your LLC name so that a matching and available domain name goes with it.

Filing for a “trade name” in Colorado

In Colorado, you can file for a “trade name” if you’d rather operate under a name different from the business’s true name. This name is sometimes referred to as a “doing business as” (DBA) name.

The state requires for-profit LLCs to file a trade name if the entity plans to do business under a different name. You’ll need to file a Statement of Trade Name of a Reporting Entity form with the Secretary of State.

Ready to Start Your Colorado LLC?

Enter your desired business name to get started

Step 2: Appoint a registered agent in Colorado

Next, you’ll need to choose a registered agent for your Colorado business. A registered agent is a person or entity that’s tasked with receiving important documents, like service of process, on behalf of your business. In Colorado, this agent must have a physical address.

As the owner of an LLC, Colorado requires you to have a registered agent, and failing to appoint one can have some penalties for the business and its owners. Let’s go over a few things about registered agents.

Who can be a registered agent in Colorado?

As we mentioned above, in Colorado, this agent can be either a person or an entity, like a business. There are some requirements to consider:

- If appointing an individual, this person must be over 18 years old and have a primary residence in Colorado.

- If appointing an entity, it must have a place of business in Colorado.

You should also know that:

- A business entity can be its own registered agent in Colorado.

- The person or entity must agree to be the LLC’s agent.

- Only one person or entity can be the registered agent for the LLC.

What happens if I don’t maintain a registered agent?

During the life of your business, changes will happen. One of them may be a change in registered agents. As we pointed out above, an LLC must maintain a registered agent in Colorado. If it doesn’t, it can risk the following:

- Missing critical information for a lawsuit. If your LLC is sued and no registered agent is available to receive this notice on your behalf, then this can result in legal troubles down the road.

- Losing a “good standing” designation with the state. An LLC that follows all rules is known to be in good standing. Without a registered agent in place, you can lose this designation, which can negatively impact your business’s image.

- Having your business labeled as “delinquent.”

- Heavy fines and penalties for both the business and maybe even you, the owner.

Can I be my own registered agent?

You can be your own registered agent if you’d like, and you may want to since it can make things easier, right? The truth is, the duties of this agent can make it difficult to run your business. Here are some things to consider:

- You must be at your registered address during normal business hours. This makes it harder to run errands, meet with customers, go on vacation, etc.

- If the LLC is sued, then having papers served in front of your customers and clients can be a very bad look.

Having someone else serve as your registered agent may be the best option. There are many registered agent services out there, but we offer a service to make things easier for you.

Step 3: File Colorado Articles of Organization

File your Articles of Organization with the Colorado Secretary of State. Now that you’ve chosen a great name and know who will be your registered agent, the time has come to submit your Articles of Organization. If all looks good and the Secretary of State approves your Articles, then your LLC will become official. The filing cost is $50 and can only be done online through the Secretary of State website.

Processing Times

According to the Secretary of State website, documents that are submitted online are filed in real-time. This means that documents are processed immediately after you’ve received your payment confirmation. You can find more information in the Filing Documents – Business FAQs section of the Secretary of State website.

Information to Include in Your Colorado Articles of Organization

If you’ve never filled out a form like an LLC’s Articles of Organization before, then you might be wondering what exactly you’ll need to include. Here’s a general list of what you’ll need to provide:

- The LLC’s name

- The LLC’s principal office address

- The LLC’s mailing address (can be the same as the physical address)

- The registered agent’s name along with the agent’s:

- Physical address

- Mailing address

- Consent to being your registered agent

- Confirmation if the LLC will be member-managed or manager-managed

- The name and address of the individual(s) forming the LLC

- Member statement: Check the appropriate box confirming that there is at least one member of the limited liability company.

- A delayed effective date (if needed)

- The name and address of the individual(s) submitting the Articles

- Payment for filing

After filing the Articles, the office of the Secretary of State will provide you with an ID number. This is NOT an Employer Identification Number (EIN).

Member-Managed or Manager-Managed?

One thing you’ll have to decide when creating your LLC is whether it’ll be member-managed or manager-managed. You’ll make this decision in the Articles of Organization. If you aren’t sure how you want your LLC managed, then here is a brief rundown of what member-managed and manager-managed mean:

- A member-managed LLC involves the members participating in making decisions for the business. If a dispute arises, then a vote is typically taken. Other business-related matters may require unanimous consent.

- A manager-managed LLC involves one or more managers taking on the responsibility of decision-making instead of the members. A manager can be one of the members or an outsider. Single-member LLCs can be manager-managed as well.

How to Amend Your Articles of Organization

When creating an LLC in Colorado, you’ll only need to file your Articles of Organization once. However, if your business grows and other changes occur, you may need to alter the Articles in the future. If you do this, you’ll need to inform the Secretary of State.

You’ll need to submit an Articles of Amendment form that can only be filed online. The form itself is used to change the LLC’s name, but there is an option to include additional documentation that needs to be amended. Be sure that all information is correct before submitting. Contact the Secretary of State if you need help.

What should I know if I want to delay my filing?

When filling out your Articles of Organization for your LLC in Colorado, you’ll have the option to delay its filing. What does this mean, exactly? As the term suggests, a delayed filing allows you to delay your Articles from being filed.

Why would you want to delay your filing? This varies depending on a person’s situation, so if you feel that you aren’t ready to file the Articles of Organization yet, then you can delay it. The state allows you to delay the start of business filing up to 90 days from the current date. Check out the Colorado Secretary of State website for more information.

Step 4: Create an operating agreement

Draft an operating agreement for your Colorado LLC. An operating agreement (OA) allows you to establish the rules for how your LLC will operate and other important factors. An operating agreement might not be legally required in Colorado, but it’s a cornerstone for any LLC. It outlines member roles, ownership percentages, owner contributions, profit distribution, the management structure of the LLC, and more. It also provides guidance in case the unexpected happens, such as a member leaving, a new member wanting to join, or the sale of the company.

The Benefits of Having an Operating Agreement

If drafting more business documents while creating an LLC in Colorado sounds like a bore, then you might reconsider after finding out the benefits of having an operating agreement.

A few common ones include:

- Setting rules for how the LLC will run (as long as they don’t involve anything illegal)

- Enhancing your LLC’s limited liability status

- Spelling out the roles of the individuals involved in the LLC

- Deciding ownership percentages

- Highlighting how voting will be conducted for business-related decisions

- Further legitimizing the business by making it look more professional and planned out

- Helping you get loans since some financial institutions may require an operating agreement

What to Include in Your Colorado LLC’s Operating Agreement

If creating an operating agreement is something you want to do but aren’t sure what exactly to include, then consider the following:

- The names of the owners and their ownership percentages

- If the LLC will be member-managed or manager-managed (detailed in Step 3)

- The duties of each member/manager

- How voting on business matters will be conducted

- How profits will be distributed

- Directives on how new members will join the LLC

- Reasons and rules for removing a member/manager

- How ownership interests will be handled if a member leaves the LLC or retires, dies, etc.

- How the LLC will be taxed (more on this later)

- Reasons for and how to handle dissolving the business

✓ If you want to create an operating agreement but aren’t sure how to get started, then check out our customizable template.

Do I need an operating agreement if I’m the only owner?

If you’ll be the only owner of the LLC, then you may figure that an operating agreement isn’t necessary. Besides, since it’s only you, then you don’t have to document the LLC’s rules and other factors, right? Well, having an operating agreement even if you’re the sole LLC owner can still be beneficial.

In Step 4, we discussed the merits of having an operating agreement. Having one can make your LLC look more professional and help make it easier to get a loan since some financial institutions may require seeing one before granting said loan.

Perhaps the biggest perk of having an operating agreement as the sole owner of your LLC is delegating what should happen to the business if something happens to you, like becoming incapacitated or dying. An operating agreement can also further demonstrate that you and the business are truly separate entities, helping prevent your personal assets from being seized if legal troubles come up.

Step 5: Apply for an EIN

Your last step is to apply for an Employer Identification Number (EIN) with the IRS. If you’ve never heard of an EIN before, then you should know some things. It’s also referred to as a Federal Employer Identification Number (FEIN) and a Federal Tax Identification Number. You’re going to need an EIN for tax purposes, hiring employees, and getting a business bank account. You can get an EIN through the IRS or with us.

Register with the Colorado Department of Revenue

You’ll need to register with the Department of Revenue for a state tax number. The website allows you to access important forms, apply for a sales tax license, file sales and retailer use tax, and more. When signing up, you’ll need to include some information, like your EIN (referred to as a Federal Employer ID Number on the website) and some personal information.

Can filing as an S corp lower my taxes?

Forming an LLC allows you to apply for an S corporation status. If you aren’t familiar with S corps, then let’s review them. Hearing the term “corporation” in S corporation might lead you to believe that it’s a type of business entity. Actually, an S corp is nothing more than a tax designation. This means certain business entities like LLCs and traditional corporations (C corporations) can apply for S corp status.

One thing that might be on your mind about forming an LLC is how it’ll be taxed. LLCs are taxed as sole proprietorships if there’s only one member or as a partnership if there are multiple members. LLCs are a very attractive business structure since they avoid the “double taxation” that corporations face. This means being taxed at the personal and business levels.

With an LLC that has S corp status, you’ll still avoid double taxation while potentially saving some money on self-employment taxes. You’ll be an “employee-owner,” allowing you to divide your income from the LLC into your salary and your share of profits. This way, you’ll only pay self-employment taxes (Social Security and Medicare) on your salary and not on the profits.

However, you should know that an S corp designation does have some drawbacks. The IRS tends to keep a watchful eye on S corps, meaning that you may be at higher risk of an audit. The S corp status is also more difficult to qualify for.

If you’d like to apply for S corp status, then we can help. You should know, though, that we can only do this during the formation period. If you already own an LLC and want to apply for S corp status, then you’ll need to do that on your own. Speak with a tax specialist for more information.

Step 6: File your LLC’s beneficial ownership information report

In the beginning of 2024, the terms of the Corporate Transparency Act came into effect, meaning LLCs and many other small businesses will be expected to file a beneficial ownership information report, or BOI report. The act aims to counteract financial crimes (like using a shell corporation to hide money laundering) by requiring businesses to disclose information about their beneficial owners.

According to the act, a beneficial owner is anyone who holds 25% or more of the LLC’s ownership interest, receives significant economic benefit from it, or exerts substantial control over the business. And for each of your beneficial owners, you’ll need to provide their name, address, and identifying documents.

You can submit your BOI report online or by uploading a PDF version of the form to the Financial Crimes Enforcement Network’s website (FinCEN). There is no fee to file. If you create your LLC during the 2024 calendar year, you have up to 90 days after Colorado approves your Articles of Organization to file your BOI report. LLCs created prior to 2024 have until January 1, 2025. LLCs organized in 2025 and beyond will have just 30 days to file. For more information about the report and due dates, check out FinCEN’s website.

If this sounds overwhelming, our BOI report filing service can help you tackle this step.

Next Steps After Forming an LLC

Once you’ve successfully formed your LLC in Colorado, there are several critical steps to solidify your business’s foundation and help ensure smooth operations.

Open a business bank account

Separate your personal and business finances by opening a dedicated bank account for your LLC. An EIN is typically required for this step; your bank might also ask to see your Articles of Organization or your operating agreement.

Opening a dedicated business bank account for your business is a crucial step in establishing financial separation between your personal and business affairs. This separation is essential for several reasons. First and foremost, it helps protect your personal assets from business liabilities, helping ensure that your home, savings, and other personal belongings remain shielded in case of legal or financial issues within the company.

Additionally, maintaining a separate business account simplifies financial record-keeping, making it easier to track income, expenses, and tax-related transactions. It also enhances your professional image by allowing you to accept payments in your LLC’s name, promoting credibility and trust with clients and partners.

Obtain necessary licenses and permits

You may need to do some research to figure out which licenses and permits you’ll need to legally operate in Colorado. The state does not issue or require a general business license. Instead, licenses are issued by different agencies and governments depending on your industry and possibly other factors.

You can start by checking out the Colorado Department of Regulatory Agencies (DORA). The DORA’s website has a page dedicated to looking up which licenses you’ll need depending on your industry. You should also check out the Colorado Department of Revenue’s website for tax-related information for your business.

Set up accounting and bookkeeping systems

Implement robust accounting systems to track expenses, income, and financial statements. For small-scale businesses, this might be as simple as a good spreadsheet. Other businesses will need more robust tools. Either way, accurate bookkeeping and accounting can make tax time easier, and it’s helpful to evaluate the health of your business at a glance.

Develop a business plan

If you haven’t already, create a detailed business plan. This document should outline your business goals, strategies, market analysis, and financial projections. It’s different from an operating agreement, which helps govern your business’s day-to-day operations. A good business plan helps guide your start-up efforts, and it’s common for investors to ask to see your plan.

Establish an online presence

In today’s digital age, having a website and social media presence is crucial. If you can, register a domain name that matches or coordinates with your business name. From there, create a professional website. Use social media platforms to engage with your target audience on a regular basis.

Review insurance needs

Assess your business’s risks and get appropriate insurance, such as a general liability insurance policy. If you have a business vehicle, you’ll likely need auto insurance. On a different note, if you have employees, you’ll need to get workers’ compensation insurance.

Even if you don’t “need” some types of insurance by law, it can be helpful to have, protecting the time and money you’ve invested in your business.

Create a marketing strategy

Develop a marketing plan to attract and retain customers. This could include online marketing, advertising, and networking events. Your strategy can be robust and detailed, or it can be simple with just a few tenets. The important thing is to have one.

Continuous Learning and Adaptation

The business scene changes all the time. From new Colorado business laws and tax codes to industry trends and fads, there are lots of shifts that could greatly affect your business. Pay attention to these trends, and do your best to adapt and evolve your strategies accordingly.

By carefully managing these aspects, your LLC Colorado will be well-positioned for success and growth. Remember, continuous learning and adaptation are key to thriving in the dynamic business environment.

File periodic reports

Colorado requires LLCs to file periodic reports, sometimes referred to as annual reports by other states. Failing to do so may jeopardize the company’s “good standing” designation. This report is the state’s way of keeping the LLC’s information up to date. Even if nothing has changed, a periodic report is still required.

You can find out when your periodic report is due by looking at your business’s Summary Page on the Colorado Secretary of State website. You’ll need to look up your LLC using the Business Database Search tool.

We can also help you file your periodic report.

Colorado LLC Taxes

When forming an LLC in Colorado, it’s essential to understand the various tax obligations that may apply to your business. Here’s a breakdown of some of the different tax obligations for a Colorado LLC:

State Income Tax: While the LLC itself doesn’t pay state income tax, the members pay state income taxes on their personal returns. Colorado has a flat state income tax rate, which means that all income is taxed at the same rate, regardless of the amount.

Federal Income Tax: LLCs are pass-through entities for federal income tax purposes. This means that the LLC itself does not pay federal income tax. Instead, the income, losses, deductions, and credits “pass through” to the individual members, who report these items on their personal federal income tax returns. This pass-through taxation is a significant advantage of LLCs, as it avoids the double taxation that C corporations face.

Sales and Use Tax: If your company engages in the sale of goods or taxable services, you’re typically required to collect, report, and remit state and local sales and use taxes. The specific tax rates and rules can vary depending on the location and type of business activities. Ensure that you understand the sales tax requirements relevant to your business.

Employment Taxes: If your company has employees, you must comply with federal and state employment tax obligations. This includes withholding and remitting federal income tax, Social Security tax, and Medicare tax from employees’ wages. Additionally, your LLC is responsible for paying state unemployment insurance taxes and workers’ compensation insurance premiums.

Property Taxes: Colorado LLCs that own tangible personal property or real estate may be subject to property taxes. The exact property tax requirements vary by location and are assessed at the county level. Be sure to check with your county assessor’s office for specific property tax obligations.

Excise Taxes: Some industries or activities may be subject to excise taxes at the state or federal level. These taxes can apply to specific goods, services, or activities, and their rates and regulations vary. Research whether your business falls within any excise tax categories.

Special District Taxes: In some areas of Colorado, special district taxes may be imposed to fund local projects or services. These taxes can vary widely by location, so it’s important to check with local authorities for any special district tax obligations.

Federal Self-Employment Tax: If you’re a member of a Colorado LLC and actively participate in the business, you may be subject to self-employment tax at the federal level. This tax covers Social Security and Medicare contributions for self-employed individuals.

It’s crucial to keep accurate financial records, file taxes on time, and comply with all federal and state tax regulations to ensure your Colorado business remains in good standing. Consulting with a tax professional or accountant can provide valuable guidance in managing your LLC’s tax obligations and optimizing your financial strategy.

Taxation Options for a Colorado LLC

Colorado LLCs have flexibility in choosing their federal taxation status. They can elect to be taxed as a partnership, C corporation, or S corporation, depending on their business goals and structure:

Partnership Taxation (Default): By default, a multi-member LLC in Colorado is taxed as a partnership for federal income tax purposes. Income and losses flow through to the members’ individual tax returns. This is the most common taxation option for LLCs.

C Corporation Taxation: An LLC can elect to be taxed as a C corporation by filing Form 8832 with the IRS. C corporations are subject to corporate income tax at the entity level. This option may be chosen if the LLC intends to reinvest profits into the business or if it wants to take advantage of the tax deductions for C corporations.

S Corporation Taxation: To be taxed as an S corporation, an LLC must meet certain eligibility criteria and file Form 2553 with the IRS. S corporations also have pass-through taxation, like partnerships, but with additional restrictions on the number and type of shareholders. This option can sometimes provide savings on self-employment taxes for eligible LLCs.

Maintaining Your LLC’s Liability Protection

To maintain the liability protection of your LLC in Colorado and prevent the “piercing of the corporate veil,” follow these key steps:

- Operate legitimately: Conduct your LLC’s activities lawfully and professionally, including obtaining required licenses and fulfilling tax obligations.

- Separate finances: Keep personal and business finances distinct by using a dedicated business bank account.

- Record-Keeping: Maintain thorough records of financial transactions and comply with LLC formalities.

- Adequate Capitalization: Ensure your LLC has sufficient capital to meet financial obligations.

- LLC Formalities: Hold regular meetings, follow operating agreements, and sign contracts on behalf of the LLC.

- Avoid personal guarantees: Refrain from providing personal guarantees for LLC debts.

- Insurance Coverage: Obtain appropriate liability insurance for added protection.

- Avoid fraud: Never engage in fraudulent or illegal activities through your LLC.

- Legal Counsel: Consult with a business attorney to ensure compliance with legal requirements.

These practices help protect your personal assets from potential LLC liabilities and maintain the corporate veil’s integrity.

Different LLC Types in Colorado

When forming an LLC in Colorado, it’s important to understand the different types of LLCs available to choose the one that best suits your business needs. Here’s a list and brief description of the various types of LLCs in Colorado:

Domestic LLC: A domestic LLC is the most common type. It’s simply an LLC that was formed within Colorado’s borders.

Foreign LLC: If your LLC was initially formed in another state but intends to conduct business in Colorado, you must register as a foreign LLC. This allows out-of-state businesses to operate legally within Colorado.

Manager-Managed LLC: In a manager-managed LLC, one or more appointed managers are responsible for the daily operations and decision-making. This structure is useful when some members want limited involvement in management.

Member-Managed LLC: In a member-managed LLC, all members actively participate in the day-to-day management of the business. This structure is suitable for small businesses where all members want to be directly involved in decision-making.

Professional Service LLC (PLLC): Professionals in licensed fields, such as doctors, lawyers, accountants, and architects, can form a professional limited liability company (PLLC). This structure provides limited liability protection while allowing licensed professionals to offer their specialized services.

Single-Member LLC (SMLLC): A single-member LLC is owned by a single individual or entity and offers limited liability protection while maintaining simplicity in management and taxation.

Multi-Member LLC: A multi-member LLC is one that is owned by two or more members.

Selecting the right type of LLC in Colorado depends on factors like your business goals, management structure, and specific industry regulations. Consulting with legal and financial professionals can help you make an informed choice and help ensure that your Colorado LLC aligns with your business objectives.

Other Business Structures in Colorado

In Colorado, several business structures are available, each with its characteristics and implications. Here’s an overview of these structures and how they compare to an LLC:

Sole Proprietorship:

- A sole proprietorship is owned and operated by a single individual.

- Unlike an LLC, it offers no personal liability protection, putting the owner’s personal assets at risk. It’s straightforward to set up but lacks the legal separation of an LLC.

General Partnership:

- A general partnership involves two or more individuals or entities sharing ownership and management responsibilities.

- Like an LLC, it offers pass-through taxation, but lacks the limited liability protection. Partners in a general partnership are personally liable for business debts.

Corporation (C Corporation):

- A C corporation is a separate legal entity from its owners (shareholders) and provides liability protection for owners.

- Unlike an LLC, C corporations face double taxation — profits are taxed at the corporate level, and dividends distributed to shareholders are taxed again on their individual returns. They are suitable for businesses seeking to raise capital through stock sales.

S Corporation:

- An S corporation isn’t a business structure, but a tax status that an LLC or a corporation may choose if it meets the necessary criteria. It has pass-through taxation.

- S corporations have pass-through taxation like an LLC, but they may be able to also save the owners on self-employment tax in some situations.

Limited Partnership (LP):

- Consists of general partners with unlimited liability and limited partners with limited liability.

- Limited partners in an LP have liability protection similar to LLC members, while general partners bear unlimited liability. LPs are often used for investment purposes.

Limited Liability Partnership (LLP):

- Typically formed by licensed professionals like lawyers or accountants, providing liability protection for partners.

- LLPs offer limited liability for all partners, similar to an LLC. They are often restricted to licensed professionals and may involve additional regulatory requirements. An LLP doesn’t protect a partner from professional malpractice claims.

Choosing the right business structure in Colorado depends on factors like liability protection, taxation, management structure, and business goals. An LLC offers a balanced approach with limited liability and management flexibility, making it a popular choice for many small businesses. Consulting with legal and financial advisors can help determine the most suitable structure for specific needs.

We can help

At ZenBusiness, we believe every aspiring entrepreneur should have the tools and support necessary to create a business, which is why we’ve made it easy with our free LLC service. We handle the complexities of starting an LLC in Colorado, while you focus on your business. Along with LLC formation, we provide worry-free compliance services and more to keep your business in good standing. With expert support on hand every step of the way, we have everything you need to run and grow your business effortlessly.

Join the hundreds of thousands of businesses we’ve helped launch and experience the ZenBusiness difference today!

CO LLC FORMATION THAT’S FAST AND SIMPLE

Take it from real customers

Colorado LLC FAQs

-

The LLC business model is incredibly popular for many good reasons. A few of the benefits of starting one in Colorado include:

- Avoiding “double taxation”

- Liability protection

- Separating the business from the owners by identifying the LLC as its own entity

- Avoiding certain requirements like reporting and maintenance seen in other entities like corporations

- A flexible management and ownership structure.

-

Since the IRS classifies LLCs as “pass-through” entities, Colorado does as well. The company’s owners are required to pay a flat state income tax rate of 4.63% of its profits. Additionally, the IRS taxes the LLC’s owners based on their ownership percentage of the company. So, if an owner owns 45% of the LLC, then they will be taxed 45% of the business’s earnings.

LLCs can also be taxed as either an S corporation or a C corporation. C corp status carries double taxation, but S corp status doesn’t. This is something you should consider since it can affect you in certain ways come tax season. As we discussed in Step 5, S corp status can also help you save on self-employment taxes. Remember, though, that applying for S corp status is tough and the IRS tends to pay closer attention to businesses with this designation.

You should also check out the Colorado Department of Revenue’s website for more information about business taxes.

-

No, Colorado doesn’t require business owners to file an operating agreement with the state. However, as we discussed in Step 4, having one is still beneficial, so consider putting one together to help your LLC run smoothly.

-

This is something that you should consider on your own or with a licensed professional. Different tax structures come with different benefits, but they can each also have drawbacks. Many entrepreneurs go for a business structure that has pass-through taxation, and, luckily, the LLC model has this by default.

Keep in mind that adopting a different tax structure, like C corp status, can remove this feature. An S corp status, on the other hand, retains pass-through taxation, but is more difficult to get. Overall, weigh the pros and cons of different tax structures carefully before making a choice.

-

If your LLC needs to be dissolved, no matter the reason that you included in your operating agreement, then you’ll need to do so through the Colorado Secretary of State. Filing a Statement of Dissolution can be done electronically through the Secretary of State website. You’ll need to include some information that can be found on the Secretary of State’s Instructions: Statement of Dissolution page. You can also visit our Colorado business dissolution guide for more information.

-

If you plan to transfer ownership of your Colorado LLC to someone else, then how you’ll do that depends on how you’ve stipulated it in your operating agreement. In most cases, there are two options to transfer ownership of the LLC:

- With the “buyout” provision, the members who will remain with the LLC will buyout the interests of the member(s) planning to leave.

- A full transfer clause involves the members who are leaving to sell their interests or the company entirely.

Whichever option is chosen will require you to inform the state of the change in the LLC’s ownership. You can do this by filing Articles of Amendment.

-

If you need to remove a member from your LLC, then you’ll have to ensure that the reason for doing so is laid out in the operating agreement. Additionally, the operating agreement should detail how that member’s ownership interests will be handled after they’re removed.

It’s best to get in touch with an attorney if you’re looking to remove a member to make sure that it’s done so in a legal manner. Also, after the process is done, you’ll have to inform the state of the LLC’s ownership status by filing Articles of Amendment.

-

Colorado does not require businesses to have a business plan. However, drafting one can prove to be beneficial since it allows you to do the following and more:

- Focus on what your business will achieve

- Lay out how you will conduct business

- Create a blueprint of your financial projections

- List the types of financing you’ll get

- Detail your market

Disclaimer: The content on this page is for information purposes only and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

ZenBusiness is a financial technology company and is not a bank. Banking services provided by Thread Bank, Member FDIC. The ZenBusiness Visa Debit Card is issued by Thread Bank pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa debit cards are accepted. FDIC insurance is available for funds on deposit through Thread Bank, Member FDIC.

*Your deposits qualify for up to a maximum of $3,000,000 in FDIC insurance coverage when placed at program banks in the Thread Bank deposit sweep program. Your deposits at each program bank become eligible for FDIC insurance up to $250,000, inclusive of any other deposits you may already hold at the bank in the same ownership capacity. You can access the terms and conditions of the sweep program at https://go.thread.bank/sweepdisclosure and a list of program banks at https://go.thread.bank/programbanks. Please contact customerservice@thread.bank with questions regarding the sweep program.

LLC Formation States Near Colorado

Ready to Start Your LLC?