*Mr. Cuban may receive financial compensation for his support.

Last updated: July 2, 2024

Looking to start an LLC in the Sunflower state? Let’s help you bring your vision to life. Whether you’re in the bustling streets of Wichita, the historic avenues of Topeka, or the vibrant business districts of Kansas City, setting up an LLC in Kansas is an adventure in its own right. And if you’re feeling like sifting through the state’s legal requirements is harder than predicting a tornado, don’t worry. You’re not alone.

In this guide, we’ll walk through the essential steps you’ll need to navigate, covering everything from choosing a distinctive name to understanding state-specific guidelines and everything in between.

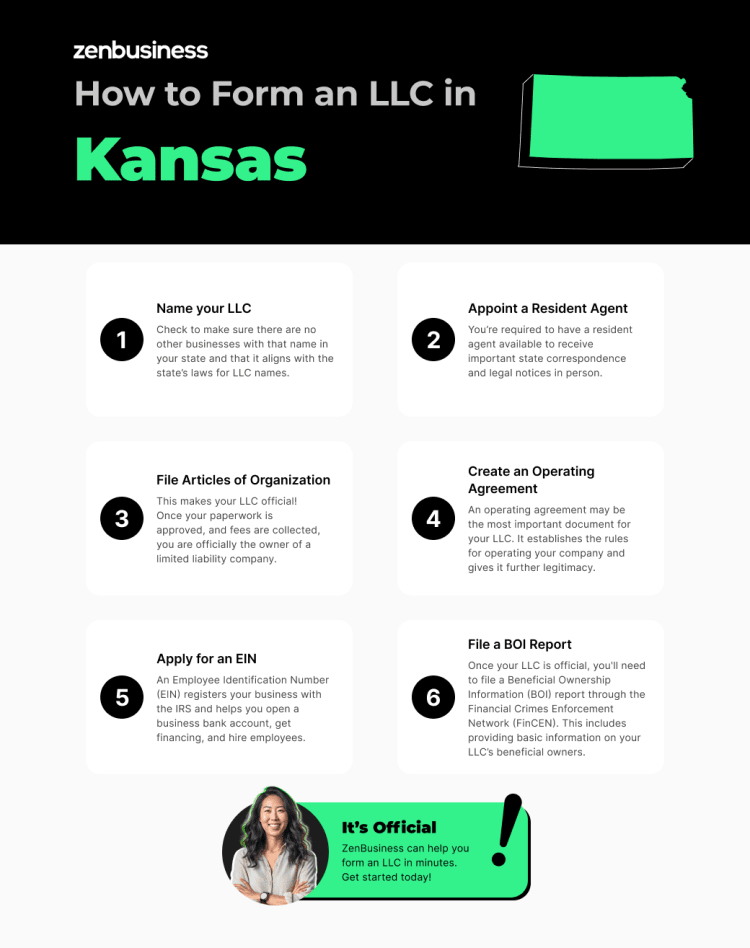

How to Start an LLC in Kansas

Grab your most trusted business hat, and let’s explore the five steps to starting an LLC in Kansas.

- Name your Kansas LLC

- Appoint a Kansas resident agent

- File Kansas Articles of Organization

- Create an operating agreement

- Apply for an EIN

- File your LLC’s BOI report

Now, a word to the wise: This guide focuses on starting a domestic LLC in Kansas. If you’re looking to start a foreign LLC, professional LLC (PLLC), or a Series LLC, you’ll need to follow slightly different steps, which aren’t covered here.

Step 1: Name your Kansas LLC

Select a unique name for your LLC. Start the LLC formation process by naming your business. It’s not just about branding: Without a distinct name, your business doesn’t exist in the eyes of the Kansas Secretary of State. Accordingly, you’ll need to decide what to call your business before you proceed with your Kansas LLC registration.

Kansas Limited Liability Company Name Requirements

To some, this step may seem simple: Perhaps you have an LLC name in mind already or want to use your own name in the title of your business. However, you’ll need to keep two official requirements in mind when picking a company moniker.

- Your name must be completely unique. It can’t match (or be too close to) the name of another registered business in Kansas. To check if your name is available, it’s essential to run a Kansas business name search. You should also run a trademark search on the U.S. Patent and Trademark Office’s website (and Kansas’s website) to ensure you’re not infringing on federally or state-protected trademarks.

- Your name must include a designator, such as “LLC,” “Limited Liability Company,” or an accepted abbreviation.

Reserving a Business Name

Once you have a name selected, you have the option to reserve it so that no one can grab it before you can form your business. This isn’t required, but it could be helpful if you have a good name in mind but aren’t yet ready to file your LLC paperwork.

You can reserve a name for 120 days by completing a form and paying a small fee. At the time of this writing, Kansas currently charges a $30 filing fee for this reservation.

Get a matching domain name

If you can, try to pick a business name that matches an available domain name. That way, you can set up a website that’s easy for potential customers to find. This isn’t a legal requirement, but it’s a strategic choice.

You’ll need to do a domain name search to see what’s available to use. Once you’ve decided on a name, take advantage of our services to easily register your domain name.

‘Doing Business As’ Names

If you want to use a DBA, or “doing business as” name in Kansas, you can. Kansas actually doesn’t even require you to register your DBA. That said, if you eventually expand to other states, you will likely be expected to register your DBA in that state.

Ready to Start Your Kansas LLC?

Enter your desired business name to get started

Step 2: Appoint a Kansas resident agent

Name a resident agent for your LLC. As in every state, Kansas requires new LLCs to designate a registered agent as part of the business formation process. In Kansas, the official term for a registered agent is “resident agent,” although these terms mean the same thing.

The primary purpose of a registered agent is to receive documents related to legal proceedings as well as certain state correspondence on behalf of your business. Simply put, if your business is subpoenaed or sued, the state of Kansas and process servers need to know how to get the paperwork to your LLC’s leadership.

Kansas Registered Agent Requirements

Kansas lays out the following criteria for who can serve as a registered agent. The agent:

- Can be an individual or business entity allowed to do business in Kansas

- Must have a physical office in Kansas (called the “registered office”)

- Must be present at the address during normal business hours

Hiring an Outside Registered Agent Service

Many entrepreneurs assume they should serve as the registered agent and use their business location as the registered office address. Technically, that’s legal. Unfortunately, this approach can have serious downsides.

Some benefits of hiring an outside registered agent service include:

- Privacy: If you receive notice of a lawsuit against the company, it won’t happen in front of customers.

- Flexible hours: Because a registered agent must be available during traditional business hours, you can work whenever you’re most productive in growing your company.

- Organization: If you use our resident agent service for Kansas, we’ll accept your important legal documents and store them in your electronic dashboard. This way you can view, download, or print them anytime online.

Step 3: File Kansas Articles of Organization

File the LLC paperwork. Next, you’ll need to file Kansas LLC Articles of Organization. Now that you have all the necessary information, like name and registered agent, you should have the information needed to file the paperwork with the Kansas Secretary of State. The official form name is the “Limited Liability Company Articles of Organization,” and you can file online or by mail. You must include a filing fee of $166.

To complete the form, have the following information handy. Bear in mind that this information will become public record:

- Your LLC’s name

- Your resident agent’s name and registered office address

- Mailing address for your business

- Tax closing month (most businesses select December to stay on the calendar year)

- Effective Date

- Signature of the authorized person (such as an owner of the LLC in Kansas)

Usually, the day your LLC becomes effective is the day it’s filed. However, if you want to delay your filing, you can select a future filing effective date by writing “Effective date: [the date you want the LLC to become effective]” under the signature of the authorized person’s signature. The date can’t be more than 90 days from the day you file.

Some LLCs do this if they’re filing toward the end of the year and don’t want their LLC to take effect until January 1 of the new year.

LLC Formation Services

Filing official government documents like this can be intimidating and/or complicated for many people, which is why we’re here. With our business formation plans, our professionals handle the filing for you to make sure it’s done quickly and correctly the first time.

If you do your formation with us, once the state approves your LLC in Kansas, your paperwork will be available from your ZenBusiness dashboard. There you can keep it and other important paperwork digitally organized. And, once you get your physical paperwork back from the state, you’ll want to keep it in a safe location along with your other important documents, such as your Kansas LLC operating agreement, contracts, compliance checklists, etc. We offer a customized business kit to help you keep these important documents organized and looking professional.

Step 4: Create an operating agreement

Draft an LLC operating agreement. Kansas law doesn’t require new LLCs to have operating agreements before being formed. However, it’s highly advisable to create one anyway, whether you’re operating alone or with other partners.

Operating agreements clearly define the terms of ownership and management, providing additional protection and options for everyone involved. Without an agreement, you’ll be subject to Kansas’s default rules for limited liability companies, which may not reflect your wishes.

Here are just a few of the benefits an LLC operating agreement offers to business owners:

- An operating agreement helps further separate your business from your personal assets in the eyes of the courts, thus providing more shelter for your personal assets from legal liability.

- Operating agreements can help prevent and resolve conflict between multiple members (LLC owners), clearly indicating each member’s powers and privileges.

- Potential investors and lenders typically wish to review the agreement before making any financial commitments to an LLC.

What to Include in Your Operating Agreement

No two businesses will have the exact same operating agreement; it’s a custom document. Some companies hire a lawyer to complete this step, while others use a template to draft their own. No matter how you create the agreement, here are some of the most common topics you’ll probably want to include:

- Membership responsibilities

- How profits will be distributed

- How to add or remove members

- How the LLC will be managed

- Procedure to dissolve the LLC, if applicable

- Conflict resolution process

- Other items that fit your business’s unique needs

If you’d like additional insight into how to write your operating agreement, we offer a customizable Kansas operating agreement template to help you start.

Step 5: Apply for an EIN

Get an IRS Employer Identification Number (EIN). After officially setting up an LLC in Kansas, you may want to apply for an EIN. An EIN (also known as a Federal Employer Identification Number or Federal Tax Identification Number) is registered with the Internal Revenue Service (IRS). An EIN functions much like a Social Security number for your business. It allows you to perform key tasks, such as hiring employees and paying taxes.

If you operate your LLC alone, it’s possible you may not need an EIN for your business. However, if your LLC has any employees or multiple partners involved, you need to obtain an EIN. Moreover, if an EIN isn’t a requirement for your LLC, it may help open a business bank account or obtain financing.

You can apply for an EIN through the IRS website. However, if you’d like to minimize your interactions with that particular government agency, our Federal Employer Identification Number service can obtain one for you.

Step 6: Submit your LLC’s beneficial ownership information report

The Corporate Transparency Act is now in effect, meaning small businesses like your LLC have a new filing requirement: submitting a beneficial ownership information report. This act was passed in hopes of reducing and deterring financial crimes like money laundering by making it more difficult for companies to hide illegal activities behind shell corporations. To accomplish this, the act requires businesses to report information about their beneficial owners to the Financial Crimes Enforcement Network (FinCEN).

The beneficial owners of your LLC are those who hold 25% or more of the ownership interest, exercise substantial control over it, or get significant economic benefit from its assets. For each beneficial owner you have, you’ll be asked to provide their name, address, and identifying documents. Failing to disclose this information can have hefty civil and criminal penalties.

You can file your BOI report on FinCEN’s website through the online form or uploading a PDF version to the site. It’s free to file, and you’ll only need to submit the federal form (Kansas doesn’t have a state version). If you create your LLC during 2024, your BOI report is due within 90 days of Kansas approving your Articles of Organization; that time period drops to 30 days for LLCs formed in 2025 and beyond. If you organized before 2024, you’ll have until January 1, 2025 to file.

You can learn more about the BOI report and the Corporate Transparency Act on FinCEN’s website. And if you’d like help filing this report, our BOI report filing service has you covered.

Steps to Take After Establishing Your LLC in Kansas

After forming your Kansas LLC, it’s important to take additional steps to ensure your business is set up correctly and remains compliant with state regulations.

Getting Business Licenses and Permits

Secure the necessary licenses and permits for your business, as there’s a very good chance you’ll need at least one. License requirements vary depending on your LLC’s industry and location within Kansas. For example, while Kansas doesn’t have a general business license at the state level, it’s possible your city or county might administer this license.

For example, in Topeka, there isn’t a general business license but there are license requirements for salvage, alcohol distribution, and more. Kansas City is similar, but they also require commercial zoning applications and occupation taxes. Similarly, in Overland Park, there isn’t a general business license but many occupations will need to get a license from the county clerk.

There are also industry-specific licenses and permits to account for, ranging from medicine to cosmetology and everything in between. Long story short: every business will have slightly different requirements. Our business license report can greatly simplify the task of determining what licenses and permits your business requires.

Opening a Business Bank Account

Once you have an EIN, you’ll be able to open a business bank account. Having separate accounts for your business and your personal banking is critical for sorting out your finances at tax time. It also helps you avoid commingling funds, which helps maintain your personal liability protection and makes logistics simpler at tax time.

We offer a discounted small business bank account for your new business. This allows for unlimited transactions, online banking, a debit card, and more. When you want to authorize others in your business to use the account, we offer a banking resolution template to simplify the process.

Setting Up an Accounting System

After you’ve got your business bank account set up, you should also implement a system to manage your finances. This tool will help you track expenses, prepare for tax season, and see at a glance how your business is doing.

There are lots of different options from a simple spreadsheet to downloading software. Some businesses use our ZenBusiness Money tool. What matters most is that you set up a system and stick to it.

Kansas Formation Fees

The cost of starting an LLC in Kansas varies a little bit from one business to another, but here are some of the most common fees you can expect:

- Articles of Organization: $160 for online filing, $165 for paper filing

- Registered Agent Service Fee: Varies, usually between $100 and $300 annually

- Annual Report Fee: $50 for online filing, $55 for paper filing (annually)

Many businesses will have other expenses, such as license fees. It’s also important to note that these fees are subject to change, so be sure to consult the Secretary of State for the most up-to-date fees.

Kansas Legal Requirements

Running an LLC in Kansas involves adhering to specific legal obligations to ensure compliance and maintain good standing. This includes maintaining accurate business records that reflect the LLC’s financial status and operational decisions. Every year, your LLC must file an annual report with the Kansas Secretary of State, detailing essential information about your business. It’s also crucial to stay informed about state and federal tax requirements, including any industry-specific taxes that may apply.

Additionally, if your LLC has employees, you must comply with employment laws, which cover aspects like workplace safety and payroll taxes. For example, Kansas employers are required to maintain a workers’ compensation insurance policy if their payroll exceeds $20,000 per year. There are also unemployment insurance taxes to account for. And, of course, you’d be remiss not to keep your business licenses up to date.

Ultimately, keeping up with these legalities is essential for the smooth operation of your Kansas LLC. It’s highly recommended to consult with a local attorney or tax professional on a regular basis to help ensure that you’re up to date with all Kansas requirements.

Need help filing your Kansas LLC?

At ZenBusiness, we believe every aspiring entrepreneur should have the tools and support necessary to create a business, which is why we’ve made it easy with our free LLC service. We handle the complexities of starting an LLC in Kansas, while you focus on your business.

Along with LLC formation, we provide worry-free compliance services and more to keep your business in good standing. With expert support on hand every step of the way, we have everything you need to run and grow your business effortlessly.

So, whether you’re forming a consulting company in Topeka or a cleaning service in Olathe, join the hundreds of thousands of businesses we’ve helped launch.

Related Topics

KS LLC FORMATION THAT’S FAST AND SIMPLE

Take it from real customers

Kansas LLC FAQs

-

The state fees for forming a Kansas LLC range from $166 to $200, depending on factors such as whether you choose to reserve your business name.

Note that after you form your LLC, you’ll need to file a Kansas annual report and pay a corresponding filing fee every year. For all Kansas LLCs, the date for filing annual reports depends on the tax closing month. The deadline is the 15th day of the fourth month following the entity’s tax period. So, for example, a business entity with a calendar tax year period may file anytime after January 1 but no later than April 15.

Note that filing fees change over time, so you should check the Kansas Secretary of State website for the most recent filing fee schedule.

-

Before you form an LLC, you probably want to know what benefits an LLC has over other business entities. There’s a reason that so many entrepreneurs start limited liability companies: This business structure affords protection for your personal assets without a ton of complex requirements. Compared to corporations, LLCs can operate far more flexibly and avoid certain kinds of taxation.

Kansas is no exception: An LLC is a great choice for small business owners across the state. The benefits of forming a Kansas LLC include:

- Protection of your personal assets from legal liability and business debts.

- Empowering flexible management and ownership structures tailored to the nature of your business and the individuals involved.

- Fewer reporting requirements than corporations.

- Exemption from “double taxation,” in which owners pay only personal federal income taxes, rather than paying taxes on both business profits and individual earnings.

-

Federal Taxes

By default, LLCs are “pass-through entities,” meaning that the business itself typically doesn’t pay federal income tax on its profits. Instead, the responsibility to pay income taxes falls only on the individual. This differs from a typical corporation, where profits are taxed at both the business level and the individual owners’ level.

Single-member LLCs don’t have to file a separate federal return for their LLC. Instead, they report the LLC income on their personal federal income tax return (Form 1040). However, LLCs with multiple members must file a separate information federal return for the LLC to the federal government, Form 1065. Then each LLC member reports their share of the profits on Schedule K-1 and attaches it to their own personal federal tax return.

Although LLCs are taxed as a sole proprietorship or general partnership by default, LLCs also have the option to be taxed as corporations. Some LLC members choose to classify their businesses as an S corporation or a C corporation, which can be advantageous for certain LLCs, especially more profitable ones.

In particular, many LLCs elect to be taxed as S corporations because it can save the members money on self-employment taxes (the taxes earmarked for Social Security and Medicare). You can learn more on our “What Is an S Corp?” page.

You also have a few other forms of federal taxation to keep in mind. For example, you’ll probably need to pay self-employment taxes on your portion of the LLC’s profits. These are the taxes that go toward Social Security and Medicare. Fortunately, an LLC member can deduct half of the self-employment taxes paid as a business expense.

State Taxes

At the state level, Kansas takes a similar approach to taxing LLCs. Unless it elects to file as a corporation, an LLC doesn’t pay state income tax as a business entity. However, LLC members are required to pay a number of taxes, depending on a variety of factors.

Kansas business taxes may include:

- State employer taxes (if you have employees)

- State sales tax (if you sell goods)

- State unemployment tax (if you have employees)

- Taxes pertaining to certain products (e.g., liquor or tobacco)

- Taxes for using certain minerals or other public resources

To understand your state tax burden, the first step is to create an account with the Kansas Department of Revenue Customer Service Center. You can fill out a questionnaire to help indicate which state taxes you’ll need to pay. If you have employees, you may also need to register with the Kansas Department of Labor for unemployment taxes.

-

If you file online with the Kansas Secretary of State, your Articles of Organization are typically approved within 24 hours. If you choose to file by mail, however, approval often takes three to five business days, not counting the time in transit.

-

No, you don’t need to file your LLC’s operating agreement with the state of Kansas. However, it’s still prudent to create one, even if you’re the sole member of your new LLC.

-

LLC owners typically only pay state and federal taxes on their personal income from the LLC. An LLC is not separately taxed.

Some LLCs (particularly those with high earnings) may choose to file taxes as either an S corporation or a C corporation. This option has some distinct advantages for certain LLCs. You can learn more about how these methods of taxation compare on our LLC vs. S corporation and LLC vs. C corporation pages.

In evaluating these options, it’s very helpful to get advice from qualified accounting professionals.

-

Kansas law does permit the formation of a Series LLC structure, in which several separate LLCs operate under one overarching “umbrella” LLC entity. The individual LLCs (sometimes called “cells”) may have different members, assets, and obligations. In theory, individual cells and the umbrella LLC are insulated from the debts and legal liabilities of the others, providing value protection for certain small businesses.

To learn more, see our page on forming a Series LLC in Kansas. Please note that ZenBusiness doesn’t assist with Series LLC formations at this time.

-

Before starting the dissolution process, the members of an LLC consult their operating agreement and follow the terms for dissolution. For the subsequent steps please refer to our Kansas business dissolution guide.

Disclaimer: The content on this page is for information purposes only and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

ZenBusiness is a financial technology company and is not a bank. Banking services provided by Thread Bank, Member FDIC. The ZenBusiness Visa Debit Card is issued by Thread Bank pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa debit cards are accepted. FDIC insurance is available for funds on deposit through Thread Bank, Member FDIC.

*Your deposits qualify for up to a maximum of $3,000,000 in FDIC insurance coverage when placed at program banks in the Thread Bank deposit sweep program. Your deposits at each program bank become eligible for FDIC insurance up to $250,000, inclusive of any other deposits you may already hold at the bank in the same ownership capacity. You can access the terms and conditions of the sweep program at https://go.thread.bank/sweepdisclosure and a list of program banks at https://go.thread.bank/programbanks. Please contact customerservice@thread.bank with questions regarding the sweep program.

LLC Formation States Near Kansas

Ready to Start Your LLC?