*Mr. Cuban may receive financial compensation for his support.

Last updated: June 12, 2024

Starting a limited liability company (LLC) in Virginia can be a challenge without the right resources and guidance. If you do everything by the book, though, your LLC can be up and running and ready to do business before you know it. Whether you’re looking to set up your LLC in busy Richmond or in a quieter neck of the woods like Radford, we want to help.

There are many potential benefits of starting an LLC in Virginia, including personal asset protection and business flexibility.

If creating an LLC in Virginia seems harder than hiking the Appalachian Trail, use this guide to setting up a Virginia LLC. We’ll also highlight some of our services and how they can help your business grow and run smoothly.

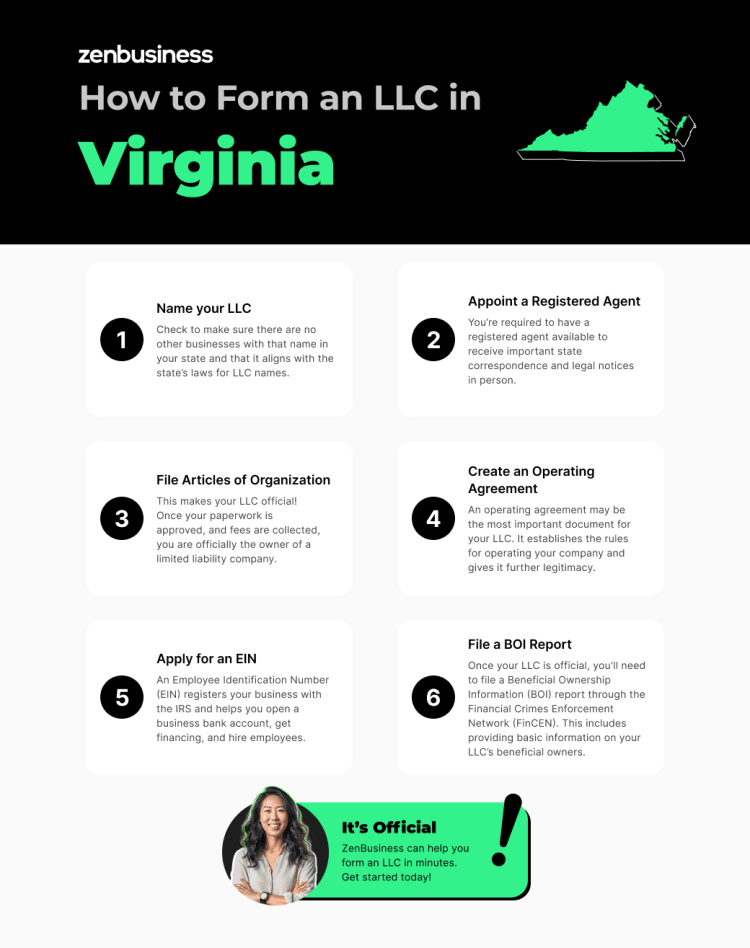

How to Start an LLC in Virginia

To get your Virginia LLC officially started, you’ll need to file an important document called the Articles of Organization with the Virginia State Corporation Commission. If approved, the state officially recognizes your LLC as a legitimate business entity. Keep in mind that submitting this document is just one of many steps you’ll need to take to make your LLC official. This guide includes the following steps:

- Choosing a business name

- Getting a registered agent

- Filing the Articles of Organization

- Creating an operating agreement

- Applying for an EIN

- File your Virginia BOI report

Don’t worry, though; we’ll go through all of that in more detail below.

Virginia LLC Formation in 6 Steps

Starting a Virginia LLC can be a pretty straightforward process with our six-step guide. It’ll cover all the important things you’ll need to do to make your company a reality. Make sure to read carefully and understand each step before checking them off.

It also doesn’t hurt to reach out to an advisor like a business attorney if you need additional help or information. Please know that this guide is for setting up a domestic, for-profit LLC in Virginia. If you’re looking to set up a foreign LLC, then you’ll need to file different paperwork.

Step 1: Name your Virginia LLC

The first step in the process is to name your Virginia LLC. This is where you can get really creative. Remember that the name you choose can have big implications for your business from a marketing standpoint. After all, this is how your customers will know you, so choose something that’ll resonate with them.

Official Naming Requirements for a LLC in Virginia

Like most states, Virginia has some naming requirements for LLCs that need to be followed, or else your paperwork might be rejected. We’ll briefly touch on them below:

- The LLC’s name cannot include words, abbreviations, or characters that imply it’s a different type of business entity. For example, an LLC cannot have the word “corporation” in its name.

- The LLC’s name cannot include certain terms like “trust,” “bank,” “engineer,” or “architecture” unless the business will engage in those services. The exception is if the remaining words in the LLC’s name make it clear that it will not engage in this type of business.

- The LLC’s name cannot include certain terms like “national,” “reserve,” “federal,” and “United States” if it will engage in certain industries like banking, insurance, savings or trusts, brokerages, loans, factorrage, and building and loan.

- The LLC’s name must include one of the following:

- Limited Liability Company

- Limited Company

- L.L.C.

- LLC

- L.C.

- LC

Use our Virginia business entity search tool to check if the name you want is available. You can find more information on business naming rules on Virginia’s State Corporation Commission website.

Reserving a Business Name for Your LLC in Virginia

Virginia allows business name reservations. You can do so by submitting an application with the State Corporation Commission. The Commission will reserve your name for 120 days so that no one else can take it. You can also renew this reservation during a 45-day period preceding the reservation’s expiration. Applications can be filed online.

Reserving a Domain Name for Your Virginia LLC

A domain name can be used for your business website’s address. It can also be used to create a business email where customers can reach you and allows you to keep in touch with your employees. It’s best to keep your domain name as similar as possible to your Virginia limited liability company’s name.

Check if your domain name is available

As you did with your business name, you can also check if the domain name you want is available. You can do this by using our domain name search tool. If the one you want is free to use, then you can register your domain name with us.

Is your Virginia LLC name available as a web domain?

While you’re coming up with a name for your LLC in Virginia, you should also take the time to check if it’s available as a domain name. A domain with the same name as your business is perfect since customers and clients will find it easier to locate you online.

An LLC’s website can offer an additional marketing advantage since you’ll be able to conduct online business and attract potential customers via social media. This depends on your industry, of course. If you offer goods and services, then having an e-commerce website can bring in additional revenue.

Use our domain name service to register yours if you find one that’s up for grabs. If you need help building a business website, then we can lend a hand with that, too. Don’t forget to secure some domain name privacy while you’re at it.

Getting a Fictitious Name for Your LLC in Virginia

After you’ve registered your Virginia LLC, you’re then free to conduct business under that name. On the other hand, if you’d prefer to do business under another name entirely, then you’re going to need to file for an “assumed name.” It’s most commonly known as a “doing business as” (DBA) name.

You can file with the State Corporation Commission for a fee by submitting a Certificate of Assumed or Fictitious Name – Business Conducted by an Entity form. Check out our page on fictitious names in Virginia for more information.

Getting a Trademark for Your Virginia LLC

Although this isn’t required, you may want to get a state or federal trademark for your business name. It adds another layer of protection that can prevent other businesses from using it. Be sure to conduct a trademark search to make sure the name you want for your LLC isn’t already taken.

The U.S. Patent and Trademark Office website has a search engine for federal trademarks. Check it to make sure if the desired business name you want for your LLC in Virginia isn’t already trademarked.

To register at the state level, you’ll need to file Form TM 1 with Virginia’s Division of Securities and Retail Franchising. The trademark is good for five years whereupon it’ll need to be renewed with Form TM 2. The renewals last five years.

Ready to Start Your Virginia LLC

Enter your desired business name to get started

Step 2: Appoint a registered agent in Virginia

Appoint a registered agent for your Virginia LLC. A registered agent is a person or business that accepts legal documents (like notices of lawsuits) on your LLC’s behalf. In Virginia, all authorized businesses are required to have a Virginia registered agent.

Who can be a registered agent in Virginia?

Virginia has several rules for registered agents. The basic requirements include:

- Being a resident of Virginia

- Being available during normal business hours

- Having a physical business address and registered office in Virginia

Unlike some other states, Virginia requires registered agents to meet at least one of the following additional qualifications:

- Being a member of the Virginia State Bar

- Being a member of the business entity’s management:

- Director or officer of a corporation

- Manager or member of an LLC

- Business trust trustee

- Partner of a registered limited liability partnership (LLP)

- General partner of a limited partnership (LP)

You can use a third-party business such as a service company or law firm to act as your registered agent. A business entity cannot be its own registered agent in Virginia.

What if my registered agent resigns?

A registered agent is a must for all businesses in Virginia, but what happens if yours resigns? If you find yourself in this situation, then Virginia grants a 31-day window to find a new registered agent.

If you don’t appoint one by then, the state will send you a notification saying that your LLC’s status has changed to “pending inactive.” If you don’t resolve this issue by the last day of the following month after receiving this notification, then the state will change your LLC’s status to one of the following:

- Terminated

- Revoked

- Canceled Automatically

You’ll then need to reactivate your LLC via the Clerk’s Information System website. You can avoid losing your registered agent by having us help you.

Can I be my LLC’s registered agent?

Yes, as an individual, you can be your LLC’s registered agent if you wish. However, you should consider the following:

- A registered agent must be available at their registered office address during all normal business hours.

- A registered agent is required to accept all forms of legal paperwork. This means that if you’re served with a lawsuit, it’ll be done at your LLC’s location, potentially making you look bad in front of customers/clients.

ZenBusiness can provide your registered agent

With our registered agent service, you’ll always have someone available to receive important legal notices and important documents on your behalf.

Our service will keep your business compliant with the registered agent requirement by ensuring that your LLC has an agent at all times. And the cherry on top is you not having to worry about handling the responsibilities of a registered agent yourself, which would require you to be at your registered address during normal business hours. That way, you’re free to meet clients, run errands, and be the business owner you always wanted to be.

Our service also keeps any documents issued to your LLC organized by making them ready for you to view, download, and/or print via your ZenBusiness customer dashboard.

Step 3: File Virginia Articles of Organization

File your LLC’s Articles of Organization with the Virginia State Corporation Commission. After choosing a business name, you’ll need to register your Virginia LLC. As we mentioned at the beginning of our guide, having your Virginia Articles of Organization (Form LLC1011) approved by the state legitimizes your LLC.

Filing formal government documents like these can be a bit intimidating, and mistakes can often be made. Don‘t fret, though, because we’re here to help. With our business filing service options, we’ll make sure that all of your documents are complete and ready to be submitted to the state.

Create an account with the Clerk’s Information System

You can file your Virginia Articles of Organization online by first making an account with the State Corporation Commission Clerk’s Information System (CIS). This system allows you to submit forms, make payments, and take care of other business activities. Creating an account is free, and the CIS has a video that walks you through the process.

To file your Articles of Organization online, go to the Virginia State Corporation Commission website. To file by mail, complete and mail the form to the following address:

Virginia State Corporation Commission

P.O. Box 1197

Richmond, VA 23218-1197

Include a $100 filing fee payable to the State Corporation Commission.

Information to Include in Your Articles of Organization

Virginia allows for your Articles of Organization to be submitted online. The form is pretty straightforward and requires you to include the following information:

- The LLC’s name, phone number (optional), and email (optional)

- The principal office address

- The registered agent’s name and email

- The registered agent’s qualifications that we went over in Step 2

- The registered agent’s office address

- The organizer’s signature

The filing fee is $100. If you should ever need to amend your business documents, we offer a service that handles that. We also encourage you to consider our Worry-Free Compliance service, which offers two amendment filings per year.

Member-Managed or Manager-Managed?

In Virginia, you have the option to establish your LLC as member-managed or manager-managed. According to Virginia Limited Liability Company Act § 13.1-1022., an LLC is member-managed by default unless otherwise specified in the Articles of Organization or operating agreement.

A member-managed LLC is operated and managed by the members. With a manager-managed LLC, the company is operated and managed by a manager. The manager may or may not be a member of the LLC.

How to Expedite Your Articles of Organization’s Filing

Virginia offers an expedited service to process your documents faster. Before submitting your documents, you’ll be given the option to expedite it, but not all forms offer expedited service.

The fees include:

- $50 or $100 for next-day filing. You’ll have to submit your forms by 2 p.m. EST for a response by 4 p.m. EST the following business day.

- $200 for same-day filing. You’ll have to submit your forms by 10 a.m. EST for a response by 4 p.m. EST that same business day.

This service is only available for form submitting through the Clerk’s Information System. Expedited service is not available for paper submissions.

Why would my Articles of Organization be rejected?

Submitting important documents to your state only to have them rejected can really be a punch in the gut, especially if you’re trying to set up a business. With an LLC, you’ll need to submit Articles of Organization, which, if approved, makes your LLC official.

But why would the state reject the Articles? Here are a few reasons as listed on the Virginia State Corporation Commission’s website:

- Discrepancies like uploading attachments that contain information that doesn’t match what you wrote in the Articles of Organization.

- Missing information in the Articles of Organization form. Fill out every required space.

- LLC name errors. This can involve using a business name that’s already taken or using a prohibited word in the name. Be sure to perform a name check beforehand.

- Submitting the wrong form. Be sure to use the general LLC form.

- Uploading additional documents. Be sure to only upload the Articles of Organization.

If the Virginia State Corporation Commission rejects your Articles of Organization, the agency will point out why and how to correct it. Avoid this problem by having us help you.

Keep track of all your business documents

If you have us file your Articles of Organization, then your paperwork will be available for you to view on your ZenBusiness dashboard once it’s approved by the state. Here, you can keep this and other important business documents digitally organized. You’ll also want to take great care of the physical forms given to you by the state. A fireproof safe is usually a safe bet.

Step 4: Create an operating agreement

Draft an operating agreement for your Virginia LLC to detail how it’ll run. Virginia does not require LLCs to adopt an operating agreement (OA). Nonetheless, you should still consider doing so when establishing your business since it helps set the rules for running your LLC.

What is an operating agreement?

According to Virginia’s Limited Liability Company Act, “An operating agreement may contain any provisions regarding the affairs of a limited liability company and the conduct of its business to the extent that such provisions are not inconsistent with the laws of the Commonwealth or the articles of organization.”

In other words, the OA establishes how the LLC will run so long as what the document says doesn’t fall outside of state law or conflict with the Articles of Organization.

The Benefits of Having an Operating Agreement for an LLC in Virginia

If dealing with more business documents while forming an LLC in Virginia sounds about as appealing as sitting in traffic on Interstate 81, then consider the benefits of drafting an OA:

- It enhances your business’s liability status. You can clarify which assets are business and which are personal.

- It clarifies verbal agreements between members/managers. Even if you trust your business partners, it’s always best to get agreements in writing, and you can keep them organized in your OA.

- It allows you to set your own rules. The OA allows you to run the business how you want so long as its activities are within the law.

- It further legitimizes the business. Your LLC will look more professionally run and planned out with an OA. Financial institutions pay extra attention to OAs and sometimes require them before granting a loan.

What to Include in Your Virginia LLC’s Operating Agreement

You should be as methodical and thorough as possible when drafting your OA. Take some time and think carefully about what you want to include, like what your day-to-day operations will look like and what you and the other members (if any) will be doing to make the business run smoothly.

Here are some things you may want to include in your OA:

- Your LLC’s name as it appears in the Articles of Organization.

- How ownership will be distributed if there is more than one owner.

- If the LLC will be member-managed or manager-managed. A member-managed LLC sees the members handling business operations whereas a manager-managed LLC sees a manager (sometimes a fellow member or someone outside the LLC) doing the same.

- The duties of the managers and members.

- How voting on business-related matters will be conducted.

- How distribution of profits will be organized.

- How and when meetings (if any) will be held.

- Directives regarding how new members will join the LLC.

- Reasons for and rules regarding the removal of members from the LLC.

- How to handle ownership interests for a member who leaves, dies, retires, etc.

- Reasons for the LLC’s dissolution and how assets will be handled.

- How and for what reason(s) the OA will be modified.

These are just a few of the things to add to your OA, but you can include whatever you want. Additionally, Virginia’s Limited Liability Company Act states that an OA must be agreed to by all members.

If you’re not sure how to go about creating an operating agreement, our operating agreement template can help you get started.

Do I need an operating agreement if I’m the only owner?

If you’re the single owner of your LLC, then you’re probably thinking that you don’t need an OA. After all, no one else will have to know how the business will operate, right? It’s true that Virginia doesn’t require OAs to be drafted, but that doesn’t mean you should avoid doing it.

As we mentioned in Step 4, an OA has many benefits that can help an owner better run their LLC. Perhaps the greatest benefit of an OA is that it makes the LLC look more professional, potentially making it easier to open a business bank account or get a loan. As the sole owner, you can also delegate in the OA what will happen to the LLC if you die or become incapacitated due to an illness or injury.

An OA can also prove to be useful if legal issues come up. For example, if someone decides to take you to court to sue you, an OA can be used to further demonstrate that you and the business are separate entities, thereby avoiding having your personal assets seized.

Step 5: Apply for an EIN

Lastly, you’ll need to apply for an Employer Identification Number (EIN) to register your limited liability company in Virginia with the federal government. You’ll need to do this with the Internal Revenue Service (IRS). An EIN is like a Social Security number for your business and is also known as a Federal Employer Identification Number (FEIN) and Federal Tax Identification Number.

You’ll need an EIN for tax purposes, getting a business bank account, and hiring employees. You can apply for one on the IRS website, but you can also get one with us.

Register with the Virginia Department of Taxation

If you plan to do business in Virginia, then you’ll have to register with the Virginia Department of Taxation’s website. Before doing so, your LLC in Virginia will need an EIN and an account with the State Corporation Commission. If you can’t register online, then you’ll need to submit a Business Registration Form (Form R-1) with the Virginia state tax department.

After registering, you’ll receive a Virginia Tax account number for each tax type, a sales tax certificate of registration (for retail sales or use tax), and additional documents letting you know what to file and when. You can use the website to file your taxes and reach out to the Department of Taxation for help or information.

Can filing as an S corp lower my taxes?

One of the biggest misconceptions about S corporations is that they’re an actual business structure like an LLC. This isn’t true. An S corp is nothing more than a designation for tax purposes. The good news is that an LLC can apply for S corp status. Why would it want to, though?

LLCs are taxed as sole proprietorships if they only have one member or a partnership if they have two or more. Many entrepreneurs find this appealing since it avoids “double taxation.” This is when the business pays taxes at both the business and individual levels.

If the LLC opts for S corp status, it’ll still avoid double taxation while also potentially saving you money on self-employment taxes. This works by allowing you to be an “employee-owner.” This way, you can divide your income from the LLC into two parts, your salary and your share of the profits. Doing this allows you to pay self-employment taxes only on your salary. You won’t pay self-employment taxes on your share of the profits, just the usual income taxes.

Like many good things, though, there’s a catch. The IRS tends to keep a closer eye on S corps, putting you at a higher risk of an audit. An S corp status is also more difficult to qualify for.

We should point out that we can help LLCs apply for S corp status only during the formation period. If you have an existing LLC, you’ll have to apply for S corp status on your own. We suggest reaching out to a tax specialist for more information about S corps.

Use your EIN to open a business bank account

Your EIN allows you to open a business bank account. This is a great way to separate your business and personal banking needs. It’s also critical for sorting out your business finances at tax time. Without a business bank account, it can be more difficult to prove that your LLC in Virginia truly is a separate entity from you.

Take control of your Virginia LLC’s finances

In order to make your finances more easily manageable, we offer a discounted business bank account. You can enjoy unlimited transactions, a debit card, and more. We also offer a banking resolution template if you want to authorize others to use this account.

Check out ZenBusiness Money

For further help managing your new business’s finances, check out ZenBusiness Money. It can help you create invoices, receive payments, transfer money, and manage clients all in one place.

Step 6: Submit your LLC’s beneficial ownership information report

At the beginning of 2024, the new Corporate Transparency Act came into effect, meaning LLCs and other small businesses are expected to file a beneficial ownership information report, or BOI report. The act aims to reduce money laundering and financial crimes by making it harder for organizations to hide behind shell corporations.

To do this, the act requires reporting companies — like your new LLC — to submit information about their beneficial owners. According to the act, a beneficial owner is anyone who exercises substantial control over the business, holds 25% or more of the LLC’s ownership interest, or gets substantial benefit from the LLC’s assets. When you file your BOI, you’ll be asked to provide the name, address, and identifying documents of each beneficial owner.

You can submit this form with the Financial Crimes Enforcement Network, or FinCEN. They accept online filings or a PDF upload; it’s free to file. If you create your LLC in 2024, the report is due within 90 days of getting Virginia’s approval for your Articles of Organization. LLCs created prior to 2024 will have until January 1, 2025, to file. LLCs created in 2025 and beyond will need to file within 30 days of their approval.

You can find the full guidelines for this process on FinCEN’s website.

If you’re feeling overwhelmed by this new filing requirement, our BOI report filing service can handle this stress for you.

Next Steps After Forming Your LLC in Virginia

After forming your Virginia LLC, there are several essential steps to take to ensure your business operates smoothly and remains compliant. Here are additional post-formation steps for your Virginia LLC:

1. Business Bank Account Opening Process

Opening a separate business bank account for your Virginia LLC is a crucial step for maintaining financial separation between your personal and business finances. To open a business bank account, follow these guidelines:

- Choose a reputable bank or credit union.

- Gather necessary documents, including your Articles of Organization, EIN (Employer Identification Number), and any relevant state or federal documents.

- Contact the bank to schedule an appointment or visit their branch.

- Complete the account application, providing accurate information about your LLC.

- Deposit the initial funds required to open the account.

2. Annual Registration Fee Payment

Virginia LLCs are required to pay an annual registration fee to the Virginia State Corporation Commission (SCC). The fee is typically due on or before the last day of your LLC’s anniversary month. The specific amount can vary, so it’s essential to check the SCC’s website or contact them directly for the current fee.

3. Business Insurance

Consider obtaining business insurance, such as general liability insurance, professional liability insurance, or workers’ compensation, depending on the nature of your business. Insurance helps protect your Virginia LLC from various risks and liabilities.

4. Compliance with State and Local Regulations

Stay informed about any additional state or local licenses, permits, or regulatory requirements that may apply to your specific industry or location. Ensure ongoing compliance to avoid potential legal issues.

5. Tax Planning and Compliance

Develop a tax strategy for your Virginia LLC that includes regular tax filings, payment of state and federal taxes, and compliance with any specific industry tax requirements. Consult with a tax professional or advisor to optimize your tax position.

6. Record-Keeping

Maintain accurate financial records, including income, expenses, receipts, and tax-related documents. Effective record-keeping ensures you have the documentation needed for tax filing and financial management.

7. Business Growth and Expansion

As your Virginia LLC grows, consider expansion strategies, marketing efforts, and additional hiring if necessary. Continuously assess your business plan and adapt to changing market conditions.

By following these post-formation steps, you can ensure the long-term success and legal compliance of your Virginia LLC. It’s also advisable to seek guidance from legal and financial professionals who can provide personalized advice tailored to your specific business needs and objectives.

Virginia LLC Taxes

When forming an LLC in Virginia, it’s crucial to understand the tax obligations specific to your business structure. Here’s an overview of the taxes that Virginia LLCs can expect to pay:

Income Tax Specifics for Virginia LLCs

Virginia treats LLCs as pass-through entities for state income tax purposes. This means that the LLC itself is not subject to income tax at the entity level, but rather, the profits and losses are passed through to the individual members. LLC members report their share of the LLC’s income or loss on their personal state income tax returns.

Virginia’s individual income tax rates range from 2% to 5.75%, depending on the taxpayer’s income level. It’s essential for members of Virginia LLCs to accurately report their income and adhere to the state’s tax filing deadlines.

Self-Employment Tax Implications

LLC owners in Virginia may be subject to self-employment tax if they are actively involved in the day-to-day operations of the business. Self-employment tax covers Social Security and Medicare contributions, similar to how it applies to sole proprietors and partnerships.

LLC members who actively participate in the management and operations of the business are considered self-employed by the IRS, and they must pay self-employment tax on their share of the LLC’s profits. This tax is calculated on Schedule SE of their federal income tax return.

Employment Tax Nuances

If your Virginia LLC has employees, you must comply with state and federal employment tax requirements. This includes withholding state and federal income taxes, Social Security, and Medicare taxes from employees’ wages, as well as paying the employer’s share of Social Security and Medicare taxes.

Additionally, Virginia LLCs are required to register with the Virginia Department of Taxation for withholding tax purposes. This involves filing periodic state payroll tax returns, making tax deposits, and reporting wages paid to employees.

It’s important to note that employment tax obligations can be complex, and compliance is critical to avoid penalties and ensure the smooth operation of your LLC. Consult with a tax professional or payroll specialist to navigate the intricacies of employment tax compliance in Virginia.

Understanding these tax implications and adhering to Virginia’s tax regulations is essential for the financial health and legal compliance of your LLC in the state. Consult with a tax advisor or accountant who is knowledgeable about Virginia’s tax laws to ensure that your Virginia LLC meets its tax obligations accurately and on time.

Other Business Entity Types in Virginia

A business entity is a legally recognized organization designed to provide goods or services, varying in types such as sole proprietorships, partnerships, corporations, and LLCs. Virginia offers various business structures to entrepreneurs, each with its own set of features and advantages. Here’s a list of other business entities available in Virginia and how they compare to an LLC:

Sole Proprietorship: A sole proprietorship is the simplest form of business entity, where the owner operates the business as an individual. Unlike an LLC, a sole proprietorship does not create a separate legal entity, meaning the owner is personally liable for business debts and legal obligations.

General Partnership: In a general partnership, two or more individuals or entities jointly manage and operate a business, sharing profits and liabilities. Similar to an LLC, a general partnership provides pass-through taxation, but partners have unlimited personal liability for the business’s debts and legal liabilities.

Corporation: A corporation is a distinct legal entity separate from its owners (shareholders). It offers strong liability protection but involves more formalities. Unlike an LLC, corporations have a complex management structure with shareholders, directors, and officers. They are subject to double taxation at the corporate and individual levels unless they elect S corporation status.

S Corporation: An S corporation isn’t a business entity, but a tax designation available to eligible corporations and LLCs. It has pass-through taxation similar to an LLC, but it can also sometimes allow LLC members to save on self-employment taxes. S corporations have strict eligibility criteria, including limitations on the number and type of shareholders, which do not apply to LLCs.

Limited Partnership (LP): A limited partnership has both general partners who manage the business and limited partners who invest capital with limited liability. LPs provide flexibility but with increased complexity compared to an LLC. Limited partners enjoy limited liability, similar to LLC members.

Limited Liability Partnership (LLP): An LLP is often formed by professionals like lawyers or accountants. It offers personal liability protection for the actions of other partners. LLPs provide liability protection for partners but involve different registration and reporting requirements compared to LLCs.

Choosing the right business entity in Virginia depends on your specific goals, liability concerns, tax preferences, and management structure preferences. Consulting with legal and financial professionals can help you determine which business type aligns best with your objectives and legal obligations in the state.

We can help you file an LLC in Virginia

Now that you’ve gone through our guide, you’ll hopefully have a much clearer understanding of forming an LLC in Virginia. Our services aim to provide long-term business support so that you can run and grow yours after you’ve formed it. Focus on running your LLC how you want and let us take care of the rest.

Related Topics

VA LLC FORMATION THAT’S FAST AND SIMPLE

Take it from real customers

Virginia LLC FAQs

-

Virginia has no requirements for a statewide general business license. However, both state and local governments may require specific licenses and permits to operate. Figuring out which licenses and permits your Virginia LLC will need will depend on a few factors, like your industry, profession, and what you’re selling.

For the most part, you’ll have to register with the Virginia Department of Taxation if you plan to sell, distribute, rent, or lease tangible personal property in the state. After registering, you’ll receive your Sales Tax Certificate of Registration along with a 15-digit sales tax account number.

We know that doing this sounds very time-consuming, and you’d rather focus on setting up your business instead. On top of that, you might have some worries that you’ll miss applying for a certain license or permit, which could put your LLC at risk. You can rely on our business license report service to help ease your worries.

-

LLCs are a very popular business model due to the many benefits they offer. Liability protection and pass-through taxation are two common reasons many entrepreneurs decide to adopt this model.

LLCs can additionally:

- Separate business and legal liabilities from the owners.

- Allow the owners to operate the business how they see fit thanks to the model’s flexible management and ownership structure as long as it operates within the law.

- Avoid certain maintenance and reporting requirements typically seen with corporations.

-

Business taxes can be really complicated, but an LLC’s structure can simplify them. LLC’s enjoy “pass-through” taxation, meaning that the business itself isn’t required to pay federal income taxes.

Instead, that responsibility is passed down to the owners, who pay taxes on the company’s earnings as regular income. The IRS also taxes each owner based on their share of the company. So if an owner owns 30% of the business, they will be taxed 30% of the company’s earnings.

LLCs have the option to be taxed as either a C corporation or an S corporation. A C corp status carries with it “double taxation,” whereas the S corp status avoids it. An S corp status can additionally help owners save more in self-employment taxes. The drawback to applying for an S corp status is that it has more restrictions and draws more attention from the IRS.

Fortunately, we can help you apply for S corp status during your LLC’s formation process. If you already own an LLC, then you’ll need to request S corp status with the IRS yourself. Before making any decision regarding how your LLC will be taxed, you should speak with a licensed tax professional.

For state income taxes, Virginia taxes LLCs as pass-through entities. They must file an annual state income tax return on Form 502. The state also requires businesses to pay certain taxes, like sales and use taxes. Other taxes unique to industry and location may also apply. To find out what applies to you, visit the state’s Department of Taxation website.

-

No, you aren’t required to file your operating agreement with Virginia. It’s still wise to draft one and keep it for your own records.

-

This is a topic best to be discussed with a licensed tax professional. What we can say is that many entrepreneurs opt for a tax structure that includes “pass-through” taxation. An LLC automatically has this feature, but you will lose it if you decide to apply for C corp tax status. This status can yield other benefits, however. Other LLCs apply for S corp status, which retains the pass-through clause and includes additional tax benefits.

-

Yes, Virginia allows for the existence of Series LLCs. This type of LLC involves an arrangement of multiple LLCs operating under the umbrella of a larger LLC. Each LLC has its own rights, obligations, and assets. At this time, we do not offer Series LLC formation services.

-

If the time comes to dissolve the LLC, for whatever reason laid out in your Articles of Organization or the operating agreement, you’ll need to file Articles of Cancellation of a Virginia Limited Liability Company.

Before doing so, you’ll need to take some steps outlined in Article IV of these Articles, which says, “The company must wind up its affairs before filing these articles. The company must pay and clear, or arrange to pay and clear, all its debts, liabilities, and obligations. Then, it must distribute the remaining property and assets to its members.”

Check out our Virginia business dissolution guide for more information.

-

How you’ll transfer the ownership of your Virginia LLC depends on what you’ve outlined in your operating agreement. Typically, two methods can be used for transferring the owner of the LLC:

- Using a buy/sell agreement. This agreement outlines how a member’s ownership interest can be purchased by the other members.

- Using a full transfer clause. This occurs when a member sells their assets or the LLC entirely.

Remember that Articles of Amendment will need to be filed with Virginia that lists the new member(s).

-

As we outlined in Step 1, a Virginia LLC can adopt a “doing business name” (DBA) name, known as a “fictitious name” or “assumed name.” You can do this by submitting a Certificate of Assumed Business Name Conducted by an Entity form. You’ll do this through the Clerk’s Information System website. At this time, we don’t offer a DBA name service for Virginia.

-

The reasons and process for removing a member from your LLC should be detailed in your operating agreement. The operating agreement should also highlight how the member’s ownership interests of the company will be handled. Will it be sold off to a third party or bought/absorbed by the other members?

You’ll also need to update Virginia on the LLC’s new member status. You’ll have to file Articles of Amendment in order to update the Articles of Organization. You should also make adjustments to your operating agreement to reflect the LLC’s new members.

-

Although you don’t need a business plan to form your LLC in Virginia, it’s still a good idea to have one. Business plans can help you in many ways. For example, this plan allows you to outline what you’re aiming to achieve with the business.

You can also detail who the LLC’s members are, what sort of financing you plan to get, and how you plan to succeed in your market. A business plan, like an operating agreement, can show financial institutions, for example, that you’re serious about running the LLC, helping you secure loans. It can even help you get investors.

Disclaimer: The content on this page is for information purposes only and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

ZenBusiness is a financial technology company and is not a bank. Banking services provided by Thread Bank, Member FDIC. The ZenBusiness Visa Debit Card is issued by Thread Bank pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa debit cards are accepted. FDIC insurance is available for funds on deposit through Thread Bank, Member FDIC.

*Your deposits qualify for up to a maximum of $3,000,000 in FDIC insurance coverage when placed at program banks in the Thread Bank deposit sweep program. Your deposits at each program bank become eligible for FDIC insurance up to $250,000, inclusive of any other deposits you may already hold at the bank in the same ownership capacity. You can access the terms and conditions of the sweep program at https://go.thread.bank/sweepdisclosure and a list of program banks at https://go.thread.bank/programbanks. Please contact customerservice@thread.bank with questions regarding the sweep program.

LLC Formation States Near Virginia

Ready to Start Your Virginia LLC?