*Mr. Cuban may receive financial compensation for his support.

Last Updated: June 12, 2024

Starting a DC LLC is a thrilling endeavor, and perhaps you’re already envisioning your business name etched into the annals of District of Columbia history — right next to Ben’s Chili Bowl and the iconic “Taxation Without Representation” license plates. If navigating the DC bureaucracy has you befuddled, you’re in good company. It’s almost as perplexing as figuring out which side of the Metro escalator to stand on so you don’t get mowed down by impatient Washingtonians.

Much like deciphering the mysterious roundabouts of Dupont Circle, forming a limited liability company (LLC) in our nation’s capital has its challenges. We’re here to steer you safely through the red tape and endless loops of paperwork. Our guide provides a Capitol tour, if you will, of each step, from inception to your official DC LLC status. With us in your corner, you can skip the anxiety and get straight to planning your ribbon-cutting — or Zoom-launching — ceremony.

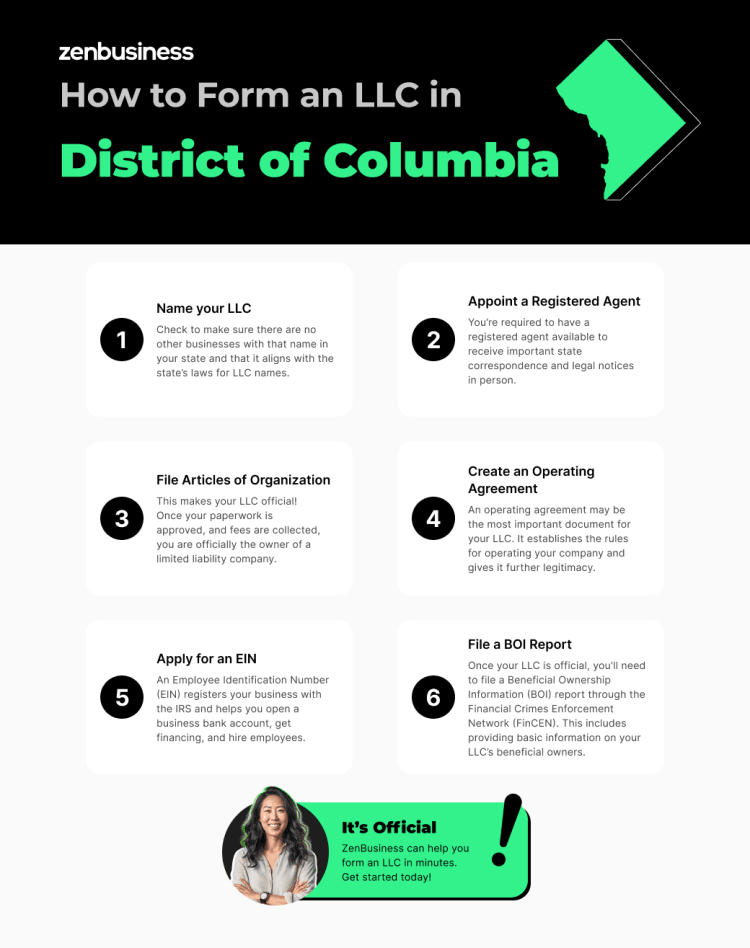

How to Start an LLC in DC

Take note that this guide orbits around the creation of domestic LLCs in the District of Columbia, not a foreign LLC or professional limited liability company (PLLC). If you’re planning on conquering states beyond the Beltway with your business, or have a specific professional license in hand, you might need a different map.

In any case, follow our six-step process to make your Washington DC LLC not just a dream but an official, local-government-recognized reality.

- Name your District of Columbia LLC

- Appoint a registered agent in the District of Columbia

- File District of Columbia Articles of Organization

- Create an operating agreement

- Apply for an EIN

- File your LLC’s BOI report

Step 1: Name your District of Columbia LLC

Find a unique name. Naming your LLC in Washington DC, is often the most enjoyable and creative part of the setup process. When selecting an official name, consider one that helps market your brand by easily communicating the goods or services you offer. It’s a good idea to come up with a few memorable names and jot them down on a list during this step.

Once your list is ready, you can go online to the DC government website to do some research so you can lock in your company’s name.

Ensure your DC LLC name meets requirements

It’s essential to ensure that your name adheres with all requirements in the District of Columbia and in the U.S. Follow this checklist, and you’ll be well on your way to creating the perfect name.

- Ensure your name is unique and available

- Run a District of Columbia Name Search for the state level

- Run a trademark search on the United States Patent and Trademark Office’s website

- Check for a matching domain name and register it if you plan to make a business website

- Include and exclude certain words:

- Include a designator (LLC, Limited Liability Company, or an acceptable abbreviation)

- Avoid using words that imply you’re affiliated with a government agency or financial institution

If you complete those above steps, you should be all set with a great business name. From there, you can consider getting a name reservation if you need more time to get set up.

Washington DC Trade Name

If you would like to use a business nickname that’s different from your legal name, you can register a trade name in Washington DC (sometimes called a “doing business as” or DBA name in other states). For instance, if your company’s registered name is “Custom Concepts Agency, LLC,” but you sell your services as “CC Agency,” you’ll need to register this secondary name as a trade name. You’ll need to pay a fee to register your trade name with the DC government.

Ready to Start Your District of Columbia (DC) LLC?

Enter your desired business name to get started

Step 2: Appoint a registered agent in the District of Columbia

Designate your LLC’s registered agent. Once your Washington DC, LLC has been officially named, you’re ready to appoint a designated registered agent. All states require LLCs to choose a registered agent, and so does DC.

What is a registered agent?

A Washington DC registered agent is the person or company that works on your behalf to receive and pass on certain government correspondence and legal notices, such as subpoenas. This means that your registered agent in DC might receive sensitive paperwork at any point throughout the business day.

As a result, your Washington DC registered agent will need to hold regular office hours at a physical street address in DC. They must be present during the workday, and their operating address cannot be a P.O. box. The agent can be either a resident of DC or a for-profit corporation with an office in DC.

Using a Registered Agent Service

Some Washington DC LLC owners decide to act as their own registered agent, and you might wonder if you should do the same. While it’s perfectly legal to be your own registered agent, there are some important things to consider before making this decision.

For a lot of business owners, it’s a hassle (or even impossible) to be tied down to your registered office address all day — which is required if you serve as your own registered agent. But the biggest reason that you don’t want to be your own registered agent is that your listed agent will be the one who receives notifications of a lawsuit. That means the process server could say “You’re being sued” to you while you’re in front of a client, employees, or a business partner.

A registered agent service like ours can help you avoid that embarrassment. We’ll accept any legal documents on your behalf discreetly and professionally, ensuring you never miss an important notice.

When you pick a registered agent service, be sure to pick a provider that fits your budget and your business needs. But more importantly, ensure that your chosen registered agent service has a reputation of reliability and professional service.

Step 3: File District of Columbia Articles of Organization

Complete and submit your Articles of Organization. Now that your name is ready and you’ve chosen a registered agent, it’s time to file your Washington DC LLC’s official paperwork. Your Articles of Organization, sometimes referred to as a Certificate of Organization in some states, will officially register your company with the District of Columbia’s government.

Filing official government documents like this can be intimidating and/or complicated for many people. With our business formation plans, our professionals handle the filing for you to make sure it’s done quickly and correctly the first time. Although we can handle this for you, we’ll show you how the process works below.

You can register your Washington DC LLC by filling out the Articles of Organization form (Form DLC-1), paying a $99 fee, and submitting it online or by mail via a check. Note that if you mail your forms, you’ll also need to include Form RA-1, which is the registered agent’s written consent form. If you file online, you don’t need to worry about this.

Washington DC LLC Articles of Organization Requirements

You’ll need to fill out the following fields when completing this form:

- Your business’s official name

- Your company’s street address

- The name and business address of your registered agent.

- Effective date of the Articles (can be the day of filing or a future date up to 90 days later)

- Miscellaneous information (such as whether you’ll be a Series LLC)

- Names and addresses of each member

- Name, address, and signature of the LLC organizer

Keep all your new Washington DC LLC paperwork in one digital dashboard

After your paperwork is approved, you’ll get physical or electronic copies back from the DC Department of Licensing and Consumer Protection (DLCP). If you file your LLC with ZenBusiness, we will help you keep this paperwork organized in your ZenBusiness dashboard. Even if you file on your own, we highly recommend setting up a system to keep your member certificates, contracts, operating agreement, and other important Washington DC documents organized.

Step 4: Create an operating agreement

Adopt an operating agreement. An operating agreement is a contract that details your Washington DC LLC’s structure and key rules and regulations about company operations. In Washington DC you’re not required to have an operating agreement, but getting one can help your company run more smoothly and prevent and resolve conflicts between members and other vested parties.

Your District of Columbia LLC’s operating agreement lays out how your company will be run, detailing your management style and member powers and limitations. It can even explain member voting structures to help handle disagreements if they arise. You’ll want to make sure all members read, agree to, and sign the operating agreement.

The benefits of an operating agreement

Although operating agreements are considered a smart move for Washington DC LLCs with multiple members, they can also be beneficial even if you’re the only member. Here’s why:

- Your agreement can detail how your business should be run if you’re incapacitated or unable to manage the company.

- Without an agreement, the way your company is managed will be handled by the DC government, which might not reflect your wishes.

- This agreement can further demonstrate the separation of your personal and business assets, giving you additional protection from legal liability that might occur if your DC LLC is sued.

Using an Operating Agreement Template

Creating an operating agreement requires some time since it details how your LLC will be run. Luckily, you don’t have to construct this all from scratch. If you’re unsure of how to create an operating agreement, we offer a customizable template to help get you started.

Step 5: Apply for an EIN

Get an Employer Identification Number. Now that you’ve officially registered your company as an LLC in Washington DC, you’re ready to get your tax information set up with the Internal Revenue Service (IRS). To do this, you’ll apply for an Employer Identification Number (EIN).

Think of an EIN like your business’s Tax ID Number (also referred to as a Federal Tax Identification Number). It helps identify your limited liability company to the government and can be used when filing taxes and hiring and paying employees.

In the District of Columbia, you’re legally required to have an EIN so that you can get a Basic Business License (more on that later). Also, most banks require an EIN to open a business bank account.

You can get your LLC’s EIN through the IRS website, by mail, or by fax, but if you’re unfond of dealing with that particular government agency, we can get it for you. Our EIN service is quick and eliminates the hassle.

Register your DC business

You must also register your new business with the DC government. We’ll cover this more in a second.

Open a business bank account for your Washington DC LLC

Once you’ve secured an EIN, you’ll be able to open a business bank account. Having separate accounts for your business and your personal banking is critical for sorting out your finances at tax time and helps you avoid commingling funds.

Commingling funds can not only make your taxes more difficult, but could also be used against you if someone takes you to court to challenge whether you and your LLC are truly separate entities. We offer a discounted bank account and ZenBusiness Money to help you manage your finances effectively.

Step 6: Submit your LLC’s beneficial ownership information report

Filing a beneficial ownership information report, or BOI report, is a brand-new requirement for LLCs in 2024. The Corporate Transparency Act introduced this requirement with the goal of making it more difficult for groups to use shell companies for illicit activities like money laundering and other financial crimes.

Under the act’s terms, LLCs and other small businesses are required to submit information about their beneficial owners to the Financial Crimes Enforcement Network (FinCEN). A beneficial owner is someone who owns 25% or more of the LLC’s ownership interest, gets substantial economic benefit from its assets, or exercises significant control over it. For each beneficial owner, you’ll provide names, addresses, and identifying documents when you file the BOI report.

You can file your BOI report online for free on FinCEN’s website, or you can upload a PDF version of the form. Either way, filing is free. Just be sure to file on time. The report’s due date varies based on when you file your Articles of Organization; for example, LLCs that existed before 2024 will have until January 1, 2025. But for LLCs that start in 2024, the BOI report is due within 90 days of getting state approval. For LLCs that organize in 2025 and beyond, that timetable drops to just 30 days.

To learn more about the BOI report, check out FinCEN’s website. Our BOI report filing service can also help streamline this process for you.

Licenses and Permits for a DC LLC

Before doing business in the District of Columbia, all LLCs must have the proper licenses and permits. There are a wide variety of different licenses, but all LLCs will need at least a basic business license and a zoning permit. Then some LLCs, depending on their industry, might need industry-specific licenses. Let’s walk through those categories.

Zoning Permits

The first license LLCs will need to get is a specific zoning permit. If you’re operating your business out of your home, you’ll need a Home Occupation permit. But if you’re using a traditional office location, you’ll need to apply for a Certificate of Occupancy.

These permits help ensure that you’re complying with all local zoning regulations.

Business License

A DC Business License actually comes in two different forms: a basic business license or a general business license. Generally speaking, they’re the same “category” of license. The District of Columbia just requires certain businesses to have the general one: retail stores, online retail stores, and a few other business types.

Other businesses will need the basic business license. Each business will only need one business license, not both.

Before you can apply, make sure that you have your registered agent set up, your Articles filed, your EIN, and your zoning permit. You should also ensure that you don’t owe more than $100 to the government of DC.

Industry-Specific Licenses

There’s a good chance that your business will also need licenses specific to your industry. These vary a lot from business to business, but it’s your responsibility to check that every person in your business has the appropriate licensure. For example, if you’re running a hair salon, you’ll need to make sure each stylist has their cosmetology license (and that it’s up to date). If you’re feeling overwhelmed at the prospect of researching your licenses and permits, don’t worry. Our business license report can help streamline this process for you.

Tax Requirements for a DC LLC

As mentioned above, forming an LLC has many tax benefits, such as exemption from double taxation. However, you’ll want to learn how your LLC will be taxed in D.C. and what decisions you’ll need to make to keep your company tax compliant. Many LLCs opt to work with a trusted accountant or tax specialist to ensure they’re following all tax laws required in DC.

We’ll walk you through a few federal and D.C.-specific tax requirements for LLCs.

Tax Requirements for All LLCs

Regardless of your tax structure and business situation, you will need to complete the following tax steps:

- Get an EIN and register with the D.C. Office of Tax and Revenue. You cannot get your basic business license without these registrations.

- Pay the District of Columbia’s franchise tax. Whether you’re taxed like a pass-through entity or a C corporation, you’ll pay at least the minimum franchise tax of $250 if you have more than $12,000 in gross income.

- Make estimated quarterly tax payments. To avoid tax penalties, you should pay estimated income taxes and self-employment taxes (Social Security and Medicare) once a quarter. You’ll pay these at the federal level and the district level.

Tax Requirements for Certain LLCs

Depending on your circumstances, you might be subject to these tax requirements:

- Collect and pay sales taxes. If your business sells items or services subject to sales tax, you’ll need to register for sales taxes with the Office of Tax and Revenue. Then you can compliantly collect those tax dollars and remit them to the District of Columbia.

- Set up withholding for employee wages. If you have employees, you’ll need to withhold federal, D.C., Social Security, and Medicare taxes from their paychecks. You can use the Electronic Federal Tax Payment System (IRS) and MyTax.DC.gov (DC) to make these payments.

Taxes can be quite complicated, so we highly recommend chatting with a tax professional in the District of Columbia to get customized guidance. That way, you can guarantee you’ll get the most favorable tax situation for your business.

Biennial Reports for a DC LLC

LLCs in Washington, D.C., are required to file a biennial report with the Department of Consumer and Regulatory Affairs every two years. Your D.C. biennial report is due every other calendar year by April 1. This form asks for the name of your LLC, the state or territory where it was formed, your principal operating address, your registered agent’s name and address, a brief statement of business conducted in the past two years, details on all members, and your signature.

You can submit this form online via the District of Columbia business portal or via mail. You’ll be required to pay a filing fee and an additional fee if your report is late.

We can help you with your biennial report in a couple of ways. Our annual report service will help you file your biennial report, and our Worry-Free Compliance service not only helps with filing your biennial report but also sends you other important compliance reminders and helps you with two amendment filings each year.

Pros and Cons of an LLC in Washington, D.C.

Just because an LLC is a popular choice for small businesses doesn’t necessarily mean it’s the right choice for your small business. It’s best to carefully consider the pros and cons of the business structure before you dive in.

Pros

Here’s a quick look at the pros to an LLC in the District of Columbia:

- Personal asset protection: The owners (members) usually can’t lose their home, car, or personal savings to pay for business debts and liabilities.

- Flexible taxation: An LLC is taxed like a pass-through entity by default, but it can elect C corporation status or S corporation status if it will create a more favorable tax burden. It’s highly recommended to chat with a tax attorney to check if switching your tax structure will benefit you.

- Easy compliance and maintenance: Compared to corporations, LLCs are easy to run and maintain. Each year you’ll file an annual report, pay taxes, and stay up-to-date on your licenses, but that’s about it.

Cons

Now let’s look at the disadvantages of an LLC:

- More complicated upkeep: Technically, an LLC is easier to run than a corporation, but they are more complicated than partnerships and sole proprietorships. While this isn’t a huge drawback, it’s worth mentioning.

- Higher costs: LLCs have start-up costs, ongoing taxes, and license fees to account for. While other business structures (especially unincorporated ones) often incur these costs, they tend to be a bit higher with an LLC.

- Difficulty raising capital: Unlike corporations, LLCs cannot sell shares of stock to raise capital. They’re limited to more traditional means like bank loans and grants.

Before you pick your business structure, you should carefully evaluate these pros and cons. An LLC is a great choice for many businesses, but not all of them.

Need help filing your DC LLC?

At ZenBusiness, we believe every aspiring entrepreneur should have the tools and support necessary to create a business, which is why we’ve made it easy with our free LLC service. We handle the complexities of starting an LLC in DC, while you focus on your business. Along with LLC formation, we provide Worry-Free Compliance services and more to keep your business in good standing.

With expert support on hand every step of the way, we have what you need to run and grow your business effortlessly. Contact us today to get started and join the hundreds of thousands of businesses we’ve helped launch.

Related Topics

DC LLC FORMATION THAT’S FAST AND SIMPLE

Take it from real customers

District of Columbia (DC) LLC FAQs

-

The government fees for forming a DC LLC can range from around $99 to $370, depending on factors such as whether you choose to reserve your business name and whether you choose expedited filing.

Note that fees change over time, so you should check the DC Department of Licensing and Consumer Protection (DLCP) website for the most recent fee schedule.

Additionally, in the District of Columbia, LLC owners must obtain a Certificate of Occupancy before acquiring space for their office. There’s a fee associated with this that is based on the square footage of the building. This application can be filled out online and must be approved by the government before an office space can be leased. You can view the full requirements on the DLCP website.

If you run your LLC out of your D.C. home (regardless of whether you own or rent), you’ll need a Home Occupation Permit (“HOP”), which carries a small fee. Follow the instructions on the DLCP site for applying. These permits are only for residentially zoned buildings.

-

When starting a business, there are different types of business entities you can choose from. Many small businesses opt to form an LLC because of the flexibility this business type offers. An LLC makes it easy to keep your business assets and liabilities separate from personal accounts. This type of company also offers tax benefits. Lastly, forming an LLC is easier than forming a corporation.

Here are the primary benefits of setting up an LLC in DC:

- Separation of your LLC’s business finances and liabilities from all members’ personal finances and debts.

- Exemption from double taxation. With an LLC (unlike most corporations), you’ll only be required to pay federal income taxes on the business’s profits on your personal taxes, rather than being taxed at both the business and personal levels.

- Flexibility to structure and manage your LLC how you choose, offering better adaptability than corporations.

- Very few reporting requirements compared to corporations.

Would you like to learn more about the LLC business structure? Get the full scoop in our guide to LLCs.

-

The processing time for your LLC will vary depending on how your Articles of Organization are filed and a variety of other factors. If you apply online, expect your request to take anywhere from five to seven business days. If you file via mail, it can take approximately three weeks, not counting the time in transit.

DC has options for expediting your filing for an additional fee. You can choose from same-day service to three-day service. If you file your Articles in person, you’ll automatically be charged the same fee as the three-day expedited service.

-

No. While there are various forms you’ll need to file with the District of Columbia, when setting up your LLC, you don’t need to file your operating agreement. This agreement will help detail how your LLC is run and managed but does not have to be provided to the government since it’s not required by law.

-

LLC owners by default only pay federal taxes on their personal income from the LLC. The LLC isn’t separately taxed.

Some LLCs (particularly those with high earnings) may choose to file taxes as either an S corporation or a C corporation. This option can have some advantages for certain LLCs. You can learn more about how these methods of taxation compare on our LLC vs. S corporation and LLC vs. C corporation pages.

In evaluating these options, we recommend getting advice from a qualified tax professional.

-

As mentioned above, forming an LLC has many tax benefits, such as exemption from double taxation. However, you’ll want to learn how your LLC will be taxed in D.C. and what decisions you’ll need to make to keep your company tax compliant. Many LLCs opt to work with a trusted accountant or tax specialist to ensure they’re following all tax laws required in DC.

We’ll walk you through a few federal and D.C.-specific tax requirements for LLCs:

- All LLCs formed in the DC must register with the D.C. Office of Tax and Revenue, which is also a prerequisite for getting the mandatory Basic Business License. This must be done online.

- LLCs that are taxed the default way (as a sole proprietorship or partnership) and have a gross income of more than $12,000 will be expected to pay a franchise tax. This tax is calculated at a flat rate, but there is a minimum $250 franchise tax. You’ll have to pay this tax to the Office of Tax and Revenue.

- You might opt to be taxed as a corporation. If you do, you’ll be required to fill out and submit an 8832 tax form as a C corporation or Form 2553 as an S corporation and file it with the IRS. Each year, you’ll be required to file your D.C. and federal business tax return by detailing all of your business investments, profits, losses, expenses, and employee wages. Your personal income will be detailed separately on your individual tax return.

- You’ll also be responsible for making estimated quarterly tax payments each year. Doing this will help you avoid tax penalties at the end of the year. You can pay your D.C. and federal taxes online. In addition, if you have employees, you’ll need to set up withholding accounts to collect federal, D.C., Social Security, and Medicare taxes from their wages. You’ll be responsible for submitting these withholdings to the IRS. You can do this by setting up accounts online with the IRS via EFTPS, the Electronic Federal Tax Payment System, and with D.C. at MyTax.DC.gov.

- Finally, if your LLC sells items or services that warrant sales tax, you’ll want to set up a sales tax account via the Office of Tax and Revenue by registering for a MyTax.DC.gov account.

-

Yes. In the District of Columbia, you’re allowed to form a Series LLC. A Series LLC refers to one or more LLCs that are nested under a parent LLC. This business structure helps insulate an LLC from the liabilities of the others in the series.

-

The insurance your business will need depends on a variety of factors, such as whether you have employees or company vehicles.

D.C. requires your business to have workers’ compensation insurance if you have at least one employee. For more on what types of insurance your company may need, visit the District of Columbia Department of Insurance, Securities and Banking.

-

A couple of terms you may have come across are “foreign” and “domestic” LLCs. A foreign LLC is a company that was created outside of the District of Columbia and carries out business and services in the D.C. territory.

A domestic LLC is one that was formed in the District of Columbia and carries out business and services in the D.C. area.

It’s important to always register your LLC in the state or territory where you intend to conduct business.

-

Over time, your operation might change. You may have new members join, decide to switch your registered agent, or adopt a new business name.

Whenever there’s a substantial change to your business, you’ll need to file an amendment with the District of Columbia government.

Follow the below steps for each change you need to report:

Change your registered agent’s information

- To update your registered agent’s address or remove and add a new registered agent, you’ll need to fill out a Certificate of Amendment.

- This will allow you to update your registered agent’s name and/or address.

- You’ll be required to pay a fee for each amendment.

Change your LLC name

- To update your LLC name, you’ll need to register a new one by filling out the Certificate of Amendment form. Be sure you follow all the directions in step one of this guide to ensure your new name is available.

- You’ll be required to pay a fee for this name change.

Add or remove an LLC member

- To update your LLC’s member list, you’ll need to fill out a Certificate of Amendment.

- This will allow you to update all member names and information.

- You’ll be required to pay a fee for each amendment.

To avoid substantial fees, try to make all updates at one time, so you’re only amending your Articles of Organization only once.

In addition to amending your documents with the District of Columbia government, you should also update your operating agreement to reflect the new changes.

-

At some point, you might find that you need to dissolve your LLC. Whether you’re forming a new business or closing your doors, to end your LLC, follow the below steps:

- Consult your operating agreement and follow the terms for dissolving the business. For example, maybe you need a unanimous decision from the members.

- You’ll need to transfer or close any LLC financial accounts. Always do this first because once your LLC is dissolved, it can be difficult to access these accounts.

- Reach out to the District of Columbia Office of Tax and Revenue to determine if there are any steps you need to take to officially dissolve your LLC. Your accountant can also help with this process.

- Lastly, you’ll need to file your Articles of Dissolution with the District of Columbia government. This form disbands the company you initially formed when filing your Articles of Organization.

You’ll need to pay a fee when dissolving your LLC. You can file and pay online or through the mail.

For more information, visit our District of Columbia business dissolution guide.

Disclaimer: The content on this page is for information purposes only and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

ZenBusiness is a financial technology company and is not a bank. Banking services provided by Thread Bank, Member FDIC. The ZenBusiness Visa Debit Card is issued by Thread Bank pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa debit cards are accepted. FDIC insurance is available for funds on deposit through Thread Bank, Member FDIC.

*Your deposits qualify for up to a maximum of $3,000,000 in FDIC insurance coverage when placed at program banks in the Thread Bank deposit sweep program. Your deposits at each program bank become eligible for FDIC insurance up to $250,000, inclusive of any other deposits you may already hold at the bank in the same ownership capacity. You can access the terms and conditions of the sweep program at https://go.thread.bank/sweepdisclosure and a list of program banks at https://go.thread.bank/programbanks. Please contact customerservice@thread.bank with questions regarding the sweep program.

LLC Formation States Near District of Columbia (DC)

Ready to Start Your LLC?