*Mr. Cuban may receive financial compensation for his support.

Last updated: June 12, 2024

If you want to know how to start an LLC in NJ (a.k.a. “Jersey”), we can understand why. LLCs are a great business structure. And, if the secret of a successful business is really “location, location, location,” then it’s nice to be in New Jersey, a state that’s close to beaches, mountains, New York City, and Philadelphia.

A limited liability company (LLC) is a business entity structure that’s popular with small business owners because it combines the tax benefits and flexibility of a sole proprietorship with the personal liability protection of a corporation.

If you do want to create an LLC, New Jersey may be the place to do it. The Garden State has one of the most highly educated workforces in the country, and real estate and office space are much more affordable than in nearby New York.

Benefits of an LLC

LLCs allow their owners (called “members” in an LLC) to have the personal limited liability protection of a corporation with the tax benefits and flexibility of a partnership or sole proprietorship.

The LLC business structure avoids the “double taxation” of a typical corporation, in which profits are taxed both at the business level and again on the personal level. LLCs also have less paperwork and fewer formalities than a corporation, yet still help protect the personal assets of the members should the business be sued or go into debt.

Even so, if you’ve never established a business before, trying to start an LLC in New Jersey can be annoying, almost as much as the tourists who call the state “Joisey.”

How to Start an LLC in New Jersey

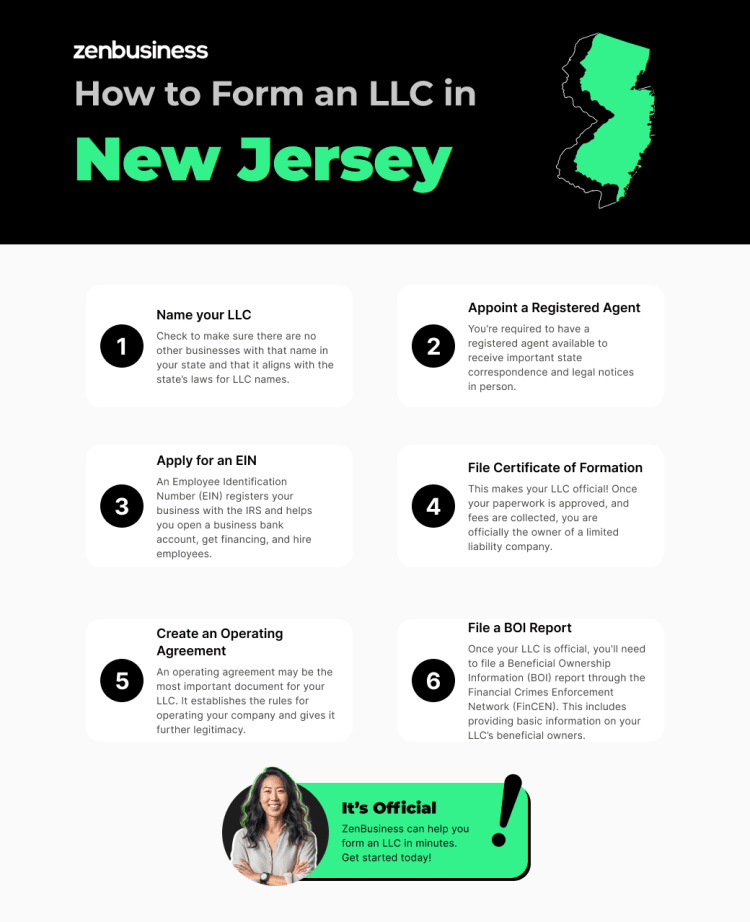

That’s where we come in. This article will explain how to create an LLC in New Jersey. Along the way, we’ll also show you how our many business services can make the process easier still. The first tasks you’ll need to complete are:

- Choose a name for your LLC

- Appoint a registered agent

- Get an EIN

- File your Certificate of Formation with the Division of Revenue and Enterprise Services

- Create an LLC operating agreement

- File a New Jersey BOI report

All right, let’s get into the details of how to start an LLC in New Jersey.

Step 1: Name your New Jersey LLC

Give a name to your LLC in NJ. Coming up with the perfect name for your business can be both challenging and fun. You want to find something memorable that reflects the products and/or services you’re offering. But you also need to follow New Jersey’s naming rules if you want your filing to be accepted:

- Choose a unique name: Your LLC’s name must be distinctive in New Jersey. Use our New Jersey business search guide to confirm no existing business has a similar name.

- Include a designator: The name should include a designator like “limited liability company,” “LLC,” “L.L.C.,” “Ltd.,” or “Co.” to indicate it’s a limited liability company in Jersey.

- Avoid certain words: Steer clear of terms that imply government affiliation (e.g., police, city) or require special licensing (e.g., medical, bank).

Outside of following New Jersey law, you have other important considerations when choosing a name for your business.

Check your business name for existing trademarks

When the state checks to see if your name is available, they don’t take trademarks into account. If you fail to check to see that your desired name isn’t trademarked by someone else, you could later (after you’ve put up signs, printed business cards, etc.) be served with a cease and desist letter, forcing you to rename your company.

Trademarks can be federal or state. You can visit the United States Patent and Trademark Office website to see whether your business name or logo is federally trademarked. You can also apply for your own trademark, but this is a long, involved process at the federal level.

State trademarks apply only within your state’s borders, but they’re less expensive and easier to get. The NJ Division of Revenue and Enterprise Services website has a search engine for checking state trademarks, along with instructions for applying for your own trademark.

Secure a domain name for your business website

Before you make the final decision on your LLC name, think about whether you can find a domain name that works well with it. Even if you don’t sell anything online, you’ll likely want customers to be able to find you on the web. If you think your website will be especially important to your business and marketing, the available domain names could have an influence on what you ultimately name your company.

The ideal domain name for your company may already be taken, but you can still find others. In fact, if you find a perfect available domain name, it might be worth naming your business after that URL rather than the other way around.

So, as you’re brainstorming business name ideas, you can do a domain name search to verify that you’ll be able to create a good website name, as well. Our domain name registration service can help you secure the online name that will best serve your company.

Reserving a Business Name

If you’ve found an available business name for your LLC but aren’t quite ready to file the rest of your LLC paperwork, you have the option of reserving it. By completing a form and paying a filing fee, you can reserve your LLC’s name for 120 days.

Filing for an Alternate Name in New Jersey

If you plan on doing business under a name other than your official business name — for example, if you want to separate different services under different titles or advertise under a name that doesn’t include the required “LLC” after the title — you can also file a New Jersey Alternate Business Name form after your business is registered with the state. This is another task we can handle for you with our DBA service.

Ready to Start Your New Jersey LLC?

Enter your desired business name to get started

Step 2: Appoint a registered agent in New Jersey

Select a registered agent for your New Jersey LLC. The state of New Jersey requires that every LLC have a registered agent for service of process. Service of process is the fancy term for the delivery of legal papers that might be headed your way, such as subpoenas.

A registered agent in New Jersey can be an individual or business entity. The key requirement is that they have a physical address in New Jersey and agree to receive and forward legal notices to you.

In New Jersey, a registered agent must:

- Be a person 18 years old or more, or a domestic or foreign (out-of-state) corporation authorized to do business in New Jersey.

- Have a “registered office” in New Jersey with a physical street address (not a P.O. box or something similar). This doesn’t need to be your business’s address, but it can be.

- Be available during normal business hours to accept legal notices in person.

Using a Registered Agent Service

You can choose to be your own registered agent, but there are definite advantages to using a registered agent service like ours:

- Discreet receipt of legal notices (as opposed to being served with a lawsuit in front of a client)

- Ability to move your office location without having to update your registered agent address with the state

- Freedom to leave the office, as the registered agent must be present at the office during all normal business hours

What if the state can’t find my New Jersey registered agent?

Serving as your own registered agent or appointing a friend or family member to be your agent might seem the simplest way to meet the New Jersey registered agent requirement. But consider what could happen if a process server is unable to find you or your appointed agent.

This could occur if you or your appointee isn’t in the office (for example, meeting a client, on vacation, sick, etc.) when someone needs to reach the agent. It can also happen if the agent moves or quits and you forget to update your registered agent name and address with the state.

In addition to legal penalties for being out of compliance, failing to maintain a registered agent could mean that a process server can’t find you to notify you of a lawsuit. In that scenario, a court case against you could actually go forward without your knowledge, meaning you wouldn’t even have a chance to defend yourself in court.

Step 3: Apply for an EIN

Request an Employer Identification Number (EIN). You’ll need to have this unique tax ID number (also called a Federal Tax Identification Number) before completing your Certificate of Formation. It’s used for paying federal taxes, and you’ll likely also need one to open a business bank account. New Jersey is different from most states in that it requires you to get an EIN from the Internal Revenue Service before you complete your Certificate of Formation. We cover how to get the Certificate of Formation in the next step.

Here’s a brief guide on how to obtain an EIN:

- Apply Online: The fastest way to get an EIN is through the IRS website. The online EIN application is available Monday through Friday, 7 a.m. to 10 p.m. EST. Once completed, the information is validated during the session, and an EIN is issued immediately.

- Apply by Mail or Fax: If you prefer not to apply online, you can complete Form SS-4 and mail or fax it to the IRS. This process takes longer; expect your EIN within four weeks if applying by mail, or within a few days if by fax.

- Information Required: Be prepared to provide details about your LLC, including the legal name of the entity, address, and the name and Social Security number (SSN) of the principal officer or LLC member.

- No Fee Required: There is no cost to apply for an EIN.

- EIN Confirmation Letter: Once your EIN application is processed, the IRS will send you a confirmation letter (CP 575). Keep this document safe as it’s your official record.

If you’re unfond of dealing with that particular government agency, we can get it for you. Our EIN service is quick and eliminates the hassle.

Can filing as an S corp lower my taxes?

One of the main advantages of the LLC business structure is the flexibility it gives you over a corporation. One of those flexibilities is how you can choose to have your LLC taxed.

An LLC has pass-through taxation by default. This appeals to most owners of LLCs because it avoids “double taxation,” in which a corporation pays taxes at both the business level and again when the income is paid to the individual owners. But some LLCs opt to be taxed as a C corporation or an S corporation because, in their case, it works to their advantage.

Being taxed as a C corporation does mean you get double taxation, but, for certain LLCs, the pros can sometimes outweigh the cons. One benefit is that C corporations have the widest range of tax deductions, which could be an advantage in some scenarios, especially for more profitable LLCs. For example, insurance premiums can be written off as a business expense.

A Subchapter S Corporation, known as an “S corp,” is a tax status geared toward small businesses. Having your LLC taxed as an S corp has pass-through taxation like a standard LLC, but there’s another potential advantage for some LLCs: It could reduce your self-employment taxes.

Self-employment taxes are the portion of your taxes that pay for Social Security and Medicare. In a typical LLC, you would pay these on all of your profits. But filing as an S corp allows you to be an “employee-owner” and split the income you get from your LLC into two sources, your salary and your share of the company’s profits. In this way, you pay employment taxes on your salary, but not self-employment taxes on your profits. (You’ll still pay the other applicable taxes on your LLC profits, of course.)

The drawback is that the Internal Revenue Service scrutinizes S corps more closely, meaning you’re more likely to get audited. S corps also have more restrictions for qualifying.

While it’s possible that one of the above options could work better for your LLC, remember that business taxes are very, very complicated. They’re also very specific to your situation. That’s why you truly need to consult a tax professional to see which taxing method works best for your Jersey business.

If you decide to form your LLC with an S corp status, our S corp service can help you do that.

For Employers

If you plan to hire employees for your business, you’ll need to take some additional steps. After verifying that an employee is able to work in the U.S., you must report the new hire to the New Jersey Child Support Employer Services Portal.

You’ll have to register for Unemployment Insurance Tax and Employee Withholding Tax on the New Jersey Department of Revenue website. You’re also responsible for providing workers’ compensation insurance for your employees and putting up any required workplace compliance posters.

The online State of New Jersey’s Employer Handbook on the Department of Labor and Workforce Development website has a lot of helpful information for employers.

Step 4: File a New Jersey Certificate of Formation

File your Certificate of Formation. To officially create your LLC in NJ, you’ll need to complete the Certificate of Formation paperwork online and have it approved by the Division of Revenue and Enterprise Services. Filing official government documents like this can be intimidating and/or complicated for many people, which is why we’re here.

With our business formation plans, our professionals handle the filing for you to make sure it’s done quickly and correctly the first time. But, although we can handle this for you, we’ll show you how the process works below.

NJ LLC Registration

On the Division of Revenue and Enterprise Services website, you’ll be asked to choose your business type and enter your business name. In addition to other required information, you’ll have the option of including a description of your business purpose.

The state charges a filing fee of $129 for your Certificate of Formation. Check the Division of Revenue and Enterprise Services website for the latest fee schedule. Additional charges apply for using a credit card or eCheck.

Information needed to file

To complete the online forms, you’ll need to provide the following information. New Jersey uses the same form for multiple types of business entities. Note that the information you submit here will become public record.

- Business name and type

- Registered agent information (including an email address to receive registered agent notifications)

- Names of all members (owners)

- If you’re a foreign (out-of-state) entity, a Standing Certificate from your home state

- Credit card or eCheck (an electronic version of a paper check used to make online payments)

After you file the Certificate of Formation, you’re required to register to pay state taxes by filing a state tax/employer registration form (Form NJ-REG). You must register the NJ-REG online within 60 days of filing your Certificate of Formation and at least 15 business days prior to opening your business.

Once you’ve successfully completed the Certificate of Formation and Form NJ-REG, the state will send you a Business Registration Certificate (BRC) for public contracting and applying for State grants and tax credits.

How to Amend Your Certificate of Formation

You need only file your Certificate of Formation once. But if any of the original Certificate of Formation information needs to be updated, altered, or expanded, your business is required to inform the state about the changes. You would report these changes by filing a New Jersey Certificate of Amendment and paying a filing fee.

Do you need help amending your Certificate of Formation? We have an amendment filing service that can handle it for you, as well as our Worry-Free Compliance service, which includes two amendment filings every year.

Step 5: Create an operating agreement

Establish the rules for your LLC with an operating agreement. An operating agreement is a critical document for an LLC. It spells out the details involved in the day-to-day operations of your business and also puts into writing things like who owns what percentage of the business, how profits are distributed, and how decisions are made.

Creating an operating agreement helps set the ground rules for you and your business partners before your business takes off. It helps you avoid disagreements and make clear decisions.

Operating Agreement Benefits

Although operating agreements are not strictly required for New Jersey LLCs, they’re definitely recommended. Among the many benefits of having an operating agreement for your LLC in NJ are:

- Further protection of personal assets: By clarifying in writing which assets and affairs are tied to the business, you add another layer of legal protection between business and personal affairs should anyone try to question it in court.

- Clearly defined rules: In the absence of an operating agreement, the state of New Jersey has its own rules for how things work in an LLC. If you want to avoid the default rules, you’ll need an agreement to clarify how your company should run.

- Assigning ownership: The agreement can spell out what percentage of the company each member owns, including what they contributed in capital and how any profits should be shared. This can help avoid future disagreements with the other members.

- Succession and dissolution: The agreement can also include explicit details about who gets your share of the business if something happens to you and how things will be divided up if the business dissolves.

- Business funding: Sometimes, to get business loans or lines of credit, a bank will want to see an operating agreement to make sure you’ve given your business some serious thought.

- Mindset: Creating an operating agreement gets you in the right mindset to start a business. It forces you to think about different scenarios and plan accordingly.

What to Include in an Operating Agreement

A good operating agreement may include the following:

- Details of the LLC: Business name, members, registered agent, and so on. This is any information that was included in the Certificate of Formation when you registered your business.

- Capital contributions: This is a record of how much money each member contributed to starting the business. These numbers are often relevant when determining how profits are to be divided.

- Distribution of profits: Perhaps the distribution of profits should be proportional to capital contributions, or maybe you and the other members want a different plan.

- Ownership percentages: Do all members own an equal percentage? Or is ownership proportional to capital contribution? You can spell this out clearly in the agreement.

- Books, records, and tax returns: Here you can clarify who maintains the books and how taxes are accounted for and prepared.

- Bank accounts: This is information about the company bank accounts and who has access.

- Management structure and voting: Who’s in charge? How are decisions made? If there’s a disagreement, does a majority rule, or do some votes count more than others? If there’s a tie, who breaks it?

- How changes in membership are handled: If someone wants to leave, are they paid a certain percentage of the business value? How will the members decide if and when to add someone new? If a member dies, does their ownership transfer to their next of kin?

- Dissolution and liquidation: If the business dissolves, how will assets and debts be split up? What will be the process?

- Arbitration: How will disagreements and disputes be handled?

Operating Agreement Template

An operating agreement is considered a legally binding document in the state of New Jersey. This means it should be drafted carefully. If you’re unsure as to how to start creating an operating agreement for your LLC, we offer a customizable template to help get you started.

Once you have finalized your operating agreement and it’s time for all members to sign, you should have the signatures notarized. This secures the legal foundation of the agreement. You do not, however, need to file the finalized agreement with the Secretary of State or any other agency. You just need to keep it in a secure location with any other business-related documents.

Do I need an operating agreement if I’m the only owner?

Most of the things in a standard operating agreement seem intended to avoid disputes among the LLC members, so we understand why you might think you don’t need one if your LLC only has one member. But potential investors, future business partners, and others may want to see your operating agreement regardless.

Your operating agreement can also spell out what you want to happen to the business and its assets if you die or become incapacitated.

Another thing to consider: Sometimes someone will take an LLC owner to court to try to prove that the owner and the LLC are the same entity so that they can go after the owner’s personal assets. If that happens, having an operating agreement in place is one more thing to further demonstrate to the court that the business owner and the LLC truly are separate.

Step 6: File a beneficial ownership information report

Beginning in 2024, LLCs (and many other small businesses) are required to file a beneficial ownership information report, or BOI. This requirement was introduced by the Corporate Transparency Act. The act strives to help promote financial transparency and make it difficult for organizations to use shell corporations to hide illegal financial activities.

As hinted by its name, the beneficial ownership information report asks you to provide information about your beneficial owners. According to the act, a beneficial owner is anyone who exercises substantial control over the LLC, gets substantial economic benefit from its assets, or holds 25% or more of the LLC’s ownership interest. You will submit the name, address, and identifying information for each beneficial owner.

The Financial Crimes Enforcement Network (FinCEN) administers these reports, and you can file for free online or by uploading a PDF version of the form to their website. For LLCs formed in 2024, the report is due within 90 days of New Jersey approving your Certificate of Formation. If you formed prior to 2024, you’ll have until January 1, 2025. Starting in 2025, new LLCs will have just 30 days to file their BOI report. You can learn more about this process on FinCEN’s website.

Need some guidance for this brand-new filing? Our BOI report filing service can help.

LLC Formation Next Steps

After successfully forming your LLC in New Jersey, there are several important steps to take to ensure that your business is operating legally and effectively. Here’s a list of key actions to consider:

- Open a business bank account: Once you’ve secured an EIN, you’ll be able to open a business bank account. Having separate accounts for your business and your personal banking is critical for sorting out your finances at tax time and helps you avoid commingling funds. Commingling funds makes doing your taxes more difficult, but it could also be used against you if someone takes you to court to challenge whether you and your LLC are truly separate entities.

- Register for state taxes: Depending on your business activities, you may need to register for state taxes in New Jersey. This may include sales tax, payroll taxes, or other industry-specific taxes. Consult with a tax professional to ensure compliance.

- Obtain necessary permits and licenses: Check if your LLC requires specific licenses or permits to operate legally in New Jersey. This varies depending on your business type and location. Research state and local requirements, and obtain the necessary approvals.

- File annual reports: All New Jersey LLCs must file an annual report with the New Jersey Division of Revenue and Enterprise Services. This annual report is intended to keep the state’s information on your business current. The report requires a filing fee and is due every year on the last day of the month in which you completed your business formation. We have an annual report service to help you keep on top of this filing.

- Comply with employment laws: If you have employees, ensure compliance with New Jersey labor laws, including minimum wage, overtime, and workplace safety regulations. Register with the New Jersey Department of Labor and Workforce Development if necessary.

- Secure business insurance: Consider the types of insurance your LLC may need, such as general liability insurance, workers’ compensation, or professional liability insurance. Insurance helps protect your business from unexpected liabilities.

- Maintain good record-keeping: Keep accurate financial records, including income, expenses, and tax-related documents. Good record-keeping simplifies tax filing, audits, and overall business management.

- Stay informed: Keep up to date with any changes in New Jersey’s business regulations, tax laws, and reporting requirements to ensure ongoing compliance.

- Consult with professionals: Consider consulting with legal, financial, and tax professionals who are knowledgeable about New Jersey’s specific business laws and regulations. They can provide valuable guidance tailored to your LLC’s needs.

By following these post-formation steps, you can help ensure that your New Jersey LLC operates smoothly, complies with all legal requirements, and maintains good standing with state authorities.

Tax Obligations

Forming an LLC in New Jersey comes with specific tax obligations that LLC owners should be aware of. Here’s a breakdown of the key tax considerations for New Jersey LLCs:

- Partnership Filing Fee: LLCs with more than one member may be subject to a $150 filing fee for each partner ($250,000 maximum for each).

- Sales Tax: If your New Jersey LLC sells taxable goods or services, you’re required to register for and collect New Jersey Sales Tax. The state’s current sales tax rate is 6.625%. It’s crucial to maintain accurate records of sales tax collected and remit it to the New Jersey Division of Taxation on the prescribed schedule.

- Corporate Business Tax: New Jersey has a Corporate Business Tax (CBT) that applies to certain LLCs, particularly those that elect to be treated as corporations for federal tax purposes. The CBT rate varies based on income, with different rates for domestic and foreign corporations.

- Property Tax: If your LLC owns real property in New Jersey, it will be subject to property tax based on the assessed value of the property. Property tax rates can vary among municipalities.

- Employment Taxes: If your New Jersey LLC has employees, you’ll be responsible for withholding and remitting payroll taxes, including federal income tax, Social Security, and Medicare taxes.

- Annual Reports: New Jersey LLCs are required to file an annual report with the New Jersey Division of Revenue and Enterprise Services. This report helps maintain the LLC’s active status and requires a filing fee of $75 (as of this writing).

- Local Taxes: Depending on your LLC’s location, you may also be subject to local taxes, such as municipal taxes or business improvement district assessments. These taxes can vary widely among municipalities, so it’s important to check with local authorities for specific obligations.

It’s important for New Jersey LLC owners to stay informed about their tax obligations, maintain accurate financial records, and meet filing deadlines to ensure compliance with state tax laws. Consulting with a tax professional or accountant who is knowledgeable about New Jersey tax regulations can help you navigate the complexities of tax obligations and optimize your LLC’s financial management.

Business Entities

In New Jersey, entrepreneurs have several business entity options to choose from, each with its own characteristics and advantages. Here are some alternate business types and how they compare to an LLC:

- Sole Proprietorship: A sole proprietorship is the simplest and most common business structure. It’s ideal for solo entrepreneurs and requires no formal registration. However, unlike an LLC, it doesn’t offer liability protection, meaning the owner’s personal assets are at risk in case of business debts or legal issues.

- General Partnership: A general partnership is a business structure where two or more individuals or entities share ownership and management responsibilities. Like an LLC, it offers pass-through taxation, but partners are personally liable for business liabilities.

- Corporation: A corporation is a separate legal entity from its owners (shareholders). It provides strong liability protection for shareholders but involves more formalities and regulatory requirements than an LLC. Corporations also have a complex management structure with shareholders, directors, and officers. Corporations have “double taxation,” in which profits are taxed at both the business and shareholder level.

- S Corporation: An S corporation isn’t a business structure, but is a tax designation available to eligible corporations and LLCs. It provides pass-through taxation similar to an LLC, but also has the potential to save on self-employment taxes. However, S corporations have strict eligibility criteria, including limitations on the number and type of shareholders.

- Limited Partnership (LP): In a limited partnership, there are general partners who manage the business and have personal liability, and limited partners who invest capital with limited liability. It offers flexibility but with increased complexity compared to an LLC.

Selecting the right business entity in New Jersey depends on your specific goals, liability concerns, tax preferences, and management preferences. Consulting with legal and financial professionals can help you determine which business type aligns best with your objectives and legal obligations in the state.

Need help filing?

Now you know how to start an LLC. New Jersey will soon have a new mover and shaker in the business world! But there’s still more to know than just how to start an LLC in New Jersey. You need to know about things like hiring employees, getting business licenses and permits, getting additional financing if you need it, how to make changes in your business, and how to stay in compliance with the government.

We offer many services beyond just helping you form your LLC. Our business experts can also give you long-term business support to help run and grow your company. Let us take care of LLC formation, compliance, and more so you can make your business a reality, whether it’s a farmers’ market in Eatontown or a Taylor Ham stand in Florham Park.

Related Resources

NJ LLC FORMATION THAT’S FAST AND SIMPLE

Take it from real customers

New Jersey LLC FAQs

-

The state fees for forming a New Jersey LLC will depend on factors such as whether you choose to reserve a business name, expedite your filing, etc. At the very least, you’ll pay a $129 filing fee (as of this writing) for your Certificate of Formation. Note that fees change over time, so you should check the New Jersey Division of Revenue and Enterprise Services website for the most recent fee schedule.

-

When considering the benefits of forming an LLC in New Jersey, it makes sense first to note the benefits of an LLC itself. Like a corporation, an LLC provides limited liability protection for its owners. But it also provides the tax benefits of a partnership or sole proprietorship. An LLC:

- Usually protects the individual owners, called “members,” from personal liability for the acts of the company. The members aren’t personally liable for debts, obligations, or liabilities created by the company in most situations.

- Has pass-through taxation like a sole proprietor or partnership.

- Is a simple business entity structure with straightforward filing, management, compliance, regulations, and administration.

- Allows for flexible management structure and ownership.

New Jersey can be a great place to launch a new business, whether it’s an LLC or another business type. Some of the state’s advantages include:

- New Jersey is one of the most diverse and densely populated states in the country.

- New Jersey has one of the largest economies in the country.

- New Jersey is located right outside of New York.

-

LLCs in New Jersey will need to pay taxes at the state and federal levels (and sometimes local). With each, there are multiple elements to consider, so we’ll address them separately below.

Federal Taxes

By default, if your LLC consists of one person, it’s taxed as a “Disregarded Entity,” meaning it’s taxed as a sole proprietorship. This means that profits aren’t taxed at the business level, but only when they “pass through” to become your income.

If your LLC has more than one member, it’s taxed as a general partnership by default, which also means the income is taxed at the individuals’ levels and not the business’s. This avoids the “double taxation” that corporations pay, in which profits are taxed at the corporate level and again when they’re paid out to the owners (“shareholders”).

Single-member LLCs don’t have to file a separate federal return for their LLC; they report the LLC income on their personal income tax return (Form 1040). But LLCs with multiple members must file a separate federal return for the LLC, Form 1065. Then each LLC member reports their share of the profits on Schedule K-1 and attaches it to their own personal federal tax return.

LLCs can also elect to be taxed as corporations. Some LLC members choose to classify their businesses as an S corporation or a C corporation for federal tax purposes, which can be advantageous in some cases. In particular, many LLCs elect to be taxed as S corporations because it can lower their self-employment taxes. You can learn more on our What Is an S Corp? page.

There are also a few other forms of federal taxation to keep in mind. For example, LLC members will usually need to pay self-employment taxes on their share of the company’s profits. Self-employment taxes are the taxes that go toward Social Security and Medicare.

State Income Taxes

If your LLC is taxed as a sole proprietor or partnership for federal income tax purposes, you’ll be taxed the same way for New Jersey state income taxes. In other words, the business wouldn’t pay state income taxes, but the individual members. If you elect to have your LLC taxed as a corporation, you’ll have to pay New Jersey’s corporate income tax.

New Jersey Partnership Taxes

LLCs with multiple members that are taxed like a partnership for federal tax purposes must file a New Jersey partnership return, Form NJ-1065, and each member must pay a $150 tax. Your multi-member LLC is required to issue Schedule NJK-1, Form NJ-1065, to each member. This does not apply to single-member LLCs.

New Jersey Sales Tax

If you’re selling taxable goods or services, New Jersey expects you to collect sales tax on them and remit those taxes to the state. If, when you registered your business, you indicated that you would be collecting this type of tax, the state of New Jersey will send you a New Jersey Certificate of Authority for Sales Tax. This is your permit to collect tax and issue and receive exemption certificates. The New Jersey Certificate of Authority must be displayed at your place of business.

New Jersey’s sales tax rate is currently 6.625%, though this could be lower if you’re doing business in an Urban Enterprise Zone.

By law, you must file a New Jersey Sales and Use Tax Quarterly Return with Form ST-50 every three months even if no tax was collected during that particular quarter.

Local Taxes

You may owe taxes to your county, municipalities, and other tax districts (fire, school, etc.). Revenues for a city or town come largely from property taxes, which a business owner may be responsible for paying based on the property they own or lease within that jurisdiction. You’ll need to check with your local tax authorities to make sure you’re paying all the taxes you owe.

Other Taxes

We wish we could say that your business’s tax liabilities are limited to what we list in this article, but we can’t. New Jersey has a wide range of taxes, including specialty taxes like admissions surcharges, tobacco and vapor product tax, occupancy tax for hotels and motels, and many more. The Department of the Treasury’s Division of Taxation can give you more information.

Even for business entities like LLCs, taxes can get very complicated. We strongly recommend consulting a tax professional. They can keep you out of trouble with tax collectors and potentially find tax savings you weren’t aware of.

-

Because the Certificate of Formation is filed online, the information is received by the state immediately. The wait time for processing varies, but New Jersey has options for expediting your filing for an additional fee.

-

Operating agreements don’t need to be filed with the state. However, they’re legally binding documents that should be kept in a safe place in case they’re needed in the future.

-

The best tax structure for your LLC will depend on your specific circumstances. By default, LLCs are treated as “pass-through entities,” meaning that the business itself doesn’t pay federal income tax on profits; only the members themselves are taxed on their share of the profits.

You have two other options, as well. You can be taxed as a C corporation (the default form of corporation) or an S corporation. A C corporation has double taxation, meaning that profits are taxed twice, once at the business level and again at the personal level.

While double taxation is a disadvantage, there are some other advantages to C corporation taxation for certain LLCs, particularly larger ones. For example, C corporations have the widest range of possible tax deductions.

Filing as an S corporation avoids double taxation and has the added benefit of saving on self-employment taxes. In a typical LLC, the members make money only through the profits the company receives. The members must then pay self-employment taxes on all of those profits.

But in an S corporation, the LLC members can also be employees of the company, meaning they’re compensated both through their salary and their share of the profits. When that happens, the LLC members only pay self-employment taxes on their salary, not the remaining profits. (The LLC members will still pay other applicable taxes on their share of the profits.)

It’s important to talk to a tax professional about which tax scenario would best benefit you and your business.

-

In a Series LLC, multiple categories of LLC interests have distinct ownership, rights, and legal obligations despite all being under one “parent” LLC. Many owners use Series LLCs to protect separate business units from cross-liability.

Series LLCs aren’t explicitly allowed in New Jersey. Check with a lawyer before attempting to register an LLC associated with a larger Series LLC in the state to make sure you won’t face legal repercussions.

-

New Jersey’s business portal provides a license and certification guide to help you determine if you need any state licenses or certifications for your business.

Many specialized professions, such as accountants, architects, attorneys, electricians, engineers, inspectors, and medical professionals, must be licensed to comply with state laws. Other types of activities may require permits, such as the sale of alcohol or controlled substances.

You’ll need to make sure your LLC has all the licenses and permits it’s required to have by law. Unfortunately, because licensing varies by industry and location and can occur on the federal, state, and local levels, there’s no central place to check to see if you have all the licenses and permits you need. You’ll have to do some research.

If you don’t have the time or inclination to do all this research, or if you just want the peace of mind to know that your business has all the licenses and permits it’s legally required to have, our business license report service can do the work for you.

-

A foreign LLC is one in which the business is not based in the state of New Jersey but wants to do business in New Jersey.

The process for registering is similar to that of a domestic LLC but requires additionally filing a Standing Certificate (known as a Certificate of Good Standing in most other states) from the home state. You can get further information from the business formation section of the New Jersey Division of Revenue and Enterprise Services website.

-

Before starting the dissolution process, the members of an LLC should consult their operating agreement and follow the established rules for dissolving the business. For the subsequent steps, please refer to our New Jersey business dissolution guide.

-

Running a new business, especially if you’ve never done it before, can be daunting.

In addition to ensuring all of the proper forms are filed, taxes are paid, and so on, you also want to establish good business practices and turn a profit. You need to know what to expect, how to form a business plan, how to keep finances in order, and much more.

Luckily, many resources are available in the state of New Jersey to help you out. Among these are:

- The Small Business Administration (SBA): This organization can provide you with information about how to plan, launch, balance, and grow your business.

- SCORE (Service Corps of Retired Executives): This is the nation’s largest network of volunteer and expert business mentors.

- Small Business Workshops: This is offered by the state, and workshop topics include “How to Register,” “New Jersey Sales Tax Seminar,” and “Online Businesses and Sales Tax.”

- Guide to Doing Business in New Jersey: This guide includes an array of topics ranging from what you need to get started to providing you with numerous informational resources.

- New Jersey Business Action Center: Here, you can find professional assistance and Business Advocates ready to take your call.

- New Jersey Business & Industry Association (NJBIA): This association has provided members with information and services and a number of other benefits to help New Jersey businesses prosper since 1910.

-

An LLC is a business entity, while an S corp is a tax filing status. Learn more about the differences and compare LLCs vs. S Corps.

Disclaimer: The content on this page is for information purposes only and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

ZenBusiness is a financial technology company and is not a bank. Banking services provided by Thread Bank, Member FDIC. The ZenBusiness Visa Debit Card is issued by Thread Bank pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa debit cards are accepted. FDIC insurance is available for funds on deposit through Thread Bank, Member FDIC.

*Your deposits qualify for up to a maximum of $3,000,000 in FDIC insurance coverage when placed at program banks in the Thread Bank deposit sweep program. Your deposits at each program bank become eligible for FDIC insurance up to $250,000, inclusive of any other deposits you may already hold at the bank in the same ownership capacity. You can access the terms and conditions of the sweep program at https://go.thread.bank/sweepdisclosure and a list of program banks at https://go.thread.bank/programbanks. Please contact customerservice@thread.bank with questions regarding the sweep program.

LLC Formation States Near New Jersey

Ready to Start Your NJ LLC?