*Mr. Cuban may receive financial compensation for his support.

Last Updated: July 2, 2024

If you want to launch your dream business and live in the First State, you may consider starting a Delaware LLC. Delaware is famous for being a business-friendly state, and LLCs are a business-friendly concept, so pairing them up appeals to many entrepreneurs.

Even so, learning how to form an LLC in Delaware can feel like fighting the beach traffic during peak tourist season. But don’t worry. Our Delaware LLC guide will walk you through the process. You can enjoy the flexibility and personal asset protection an LLC provides soon enough.

Delaware LLC Pros and Cons

If you’ve ever so much as made a purchase in Delaware, you know that the state has no sales tax. Its reputation for being pro-business comes from a variety of factors, including lower taxes, limited exposure of the business owner’s personal information, and business-friendly laws.

Delaware also has the Court of Chancery, a unique 215-year-old business court that has written most of the modern U.S. corporation case law. The Delaware Court of Chancery uses judges, not juries, which means cases involving business are usually resolved more quickly than they are in other states.

As we explain on our Delaware Benefits and Risks page, though, smaller businesses from outside the state may not reap the benefits that larger corporations would. While Delaware is the leading jurisdiction for publicly traded corporations listed on U.S. stock exchanges, according to Delaware’s own corporate law website, “For many small business entities, formation in the state where the corporation will do most of its business may be more cost-effective.”

Limited Liability Company Benefits

A limited liability company (LLC) is a legal business entity combining elements of corporations and sole proprietorships. Like a corporation, it offers limited liability protection to the business owners. If the business is sued or goes into debt, the personal assets of the LLC owners are usually protected.

Like a sole proprietorship, though, the LLC’s profits are usually not taxed at the business level before being distributed to the LLC owners (called “members”). This avoids the “double taxation” of a traditional corporation, where the profits are taxed at both the business and personal levels. LLCs also require less paperwork and have more flexibility in how they’re run.

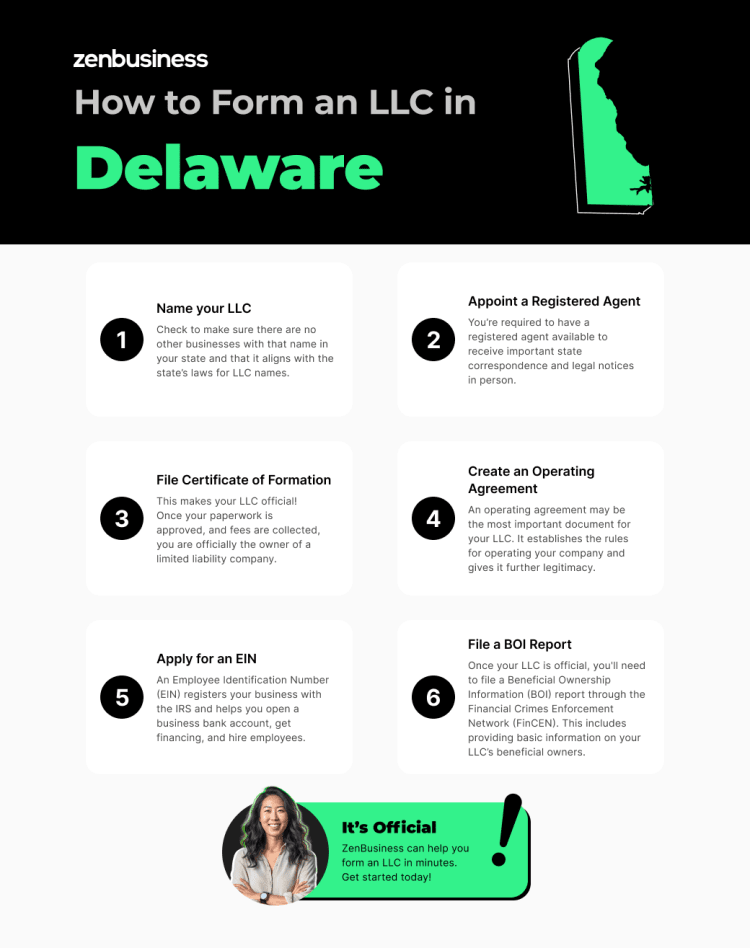

How to Form an LLC in Delaware

This article will take you through the basic steps of starting an LLC in Delaware:

- Name your Delaware LLC

- Appoint a registered agent in Delaware

- File a Delaware Certificate of Formation

- Create an operating agreement

- Apply for an EIN

- File a BOI report in Delaware

As we take you through the steps, we’ll also show you how our services can help cut through the red tape so you can get to the more enjoyable parts of running your new business.

When you’re ready, read on to learn what to do in the 302 to form an LLC.

Note: These steps are for forming a domestic LLC in Delaware. A foreign LLC, meaning one that originated in another state, will follow a different process.

Step 1: Name your LLC

Naming your Delaware LLC is a crucial step. Your LLC name must be unique, easily distinguishable from existing Delaware businesses, and compliant with Delaware naming laws.

- Uniqueness: Verify that your desired name isn’t in use by another business in Delaware.

- Designator: The name must end with “limited liability company,” “LLC,” or “L.L.C.”

- Naming Regulations: Avoid restricted words like “bank”. Words like “Company,” “Association,” “Club,” “Foundation,” “Fund,” “Institute,” “Society,” “Union,” “Syndicate,” “Limited,” “Public Benefit,” or “Trust” are permissable.

As it states on the Delaware Division of Corporations website, “We reserve the right to reject a filing for non-compliance with the Delaware Code.”

Not following the Delaware naming standards is one of the most common reasons an LLC submission gets denied. You can reapply with a different name, but being rejected obviously slows things down.

Reserving Your LLC Name

Though not required, once you select a name, consider reserving it so that nobody else takes it before you form your business. Delaware allows you to reserve a name for up to 120 days by submitting an Application for Reservation of Limited Liability Company Name and paying a fee.

Domain name and Social Media Considerations

Check if your LLC name is available as a web domain and on major social media platforms, as this is vital for your online marketing and branding. Use our domain name search tool for availability checks.

Trademark Research

Trademarks happen at both the federal and state levels. You can check the U.S. Patent and Trademark Office website to see whether your company name is trademarked at the federal level.

To check to see if your name is trademarked at the state level, contact the Delaware Division of Corporations at (302) 739-3073. You can register your state trademark by filing the State of Delaware Application for Registration of Trademark or Service Mark with a payment for the fee.

Filing a DBA in Delaware

If you plan to do business under a name other than your Delaware LLC’s legal name, you’ll need to get a DBA in Delaware. A DBA or “Doing Business As” name is sometimes used by an LLC when they want to market a new store or line of products under a new name.

If you’re interested in a DBA, you’ll need to complete the Registration of Trade, Business, and Fictitious Name Certificate, have it notarized, and submit it in each county you plan to do business in. There’s a small filing fee for this.

Ready to Start Your Delaware LLC?

Enter your desired business name to get started

Step 2: Appoint a registered agent in Delaware

Designate a registered agent for your LLC in Delaware. Like other states, Delaware requires new LLCs to appoint a registered agent as part of the business formation process. A Delaware registered agent’s primary purpose is to receive official state correspondence as well as legal documents (such as notices of lawsuits) on behalf of your business.

Delaware Registered Agent Requirements

The registered agent must be available during normal business hours to accept certain notices like subpoenas in person and relay them to the business owners. Note that the agent doesn’t dispense legal or financial advice. The registered agent must:

- Be a Delaware resident or business entity authorized to do business in the state of Delaware

- Have a physical street address (called the “registered office”) in Delaware (a P.O. box is not allowed)

- Be available in person during normal business hours

Unlike many states, Delaware allows the LLC itself to be its own registered agent.

Using a Registered Agent Service

Many owners think they should serve in this position for their company and use their business’s primary location as the registered office address. However, this approach can lead to unintended consequences, such as a process server showing up with court papers at your office and in front of clients.

Using a registered agent service like ours helps make sure you comply with Delaware’s registered agent statutes and avoid situations like the above. It also alleviates the need to constantly be present at the office to receive legal notices.

Step 3: File a Delaware Certificate of Formation

Complete and file your Certificate of Formation. This is the document (sometimes referred to as the Articles of Organization in other states) that makes your LLC in Delaware official once it’s approved.

You can file your Certificate of Formation online with the Delaware Division of Corporations (not the Delaware Secretary of State). Alternatively, you can fax or mail your paperwork. The current filing fee is $160. To mail your paperwork, send it to:

Division of Corporations

John G. Townsend Building

401 Federal Street

Suite 4

Dover, DE 19901

Certificate of Formation Requirements

The Delaware Division of Corporations provides a fillable PDF on its website for the Certificate of Formation. They ask that you include the following information:

- The full name of your LLC in Delaware, including the designator

- The name and address of your registered agent

- Certify your LLC has at least one member. Delaware law defines an LLC as a company with at least one member that’s formed under Delaware’s Limited Liability Act. The members have responsibility for operating and maintaining the LLC. While it’s not required to include a certification in your Delaware Certificate of Formation, you can add the name and address of the founding member or members in your draft.

- The signature of an authorized LLC member

The Division of Corporations also asks that you include a cover letter, which you can download from their website. You can submit the documents using their Document Upload Service or by mail. You’ll need to pay the filing fee at the same time you file.

How long does the processing take?

The Division of Corporations’ website doesn’t commit to a time frame for getting your Certificate of Formation processed. It says that the times will vary by the work volume at the time. For specific time frames and expedited service options, refer to the Delaware Division of Corporations website.

Amending the Certificate of Formation

You only need to file your Certification of Formation once. However, if you end up making any changes to your business’s name or your registered agent down the road, you’ll need to file a Certificate of Amendment for a Delaware Limited Liability Company and pay the requisite filing fee.

If you do need to file an amendment, we have an amendment filing service that can handle it for you as well as our Worry-Free Compliance service, which includes two amendment filings every year.

Step 4: Create an operating agreement

Make an operating agreement for your Delaware LLC. An operating agreement is critical for an LLC because it establishes the rules for your company, how it will be managed, how much ownership each member has, how profits will be divided, and more.

An operating agreement can allow you to:

- Prevent and resolve conflicts between members by clearly indicating the powers and privileges of each member

- Customize your business’s rules and procedures to serve your LLC’s interests, requirements, and expectations.

- Define your LLC’s management structure

- Put a plan in place for what happens if a member leaves or becomes incapacitated

- Set the rules for bringing new members into the company

- Further separate your business from your personal assets, providing an additional layer of protection for your savings from legal liability

These benefits are why we find operating agreements to be an essential part of the LLC formation process.

Do I need an operating agreement if I’m the only owner?

Because it seems like most of the things in your operating agreement are intended to avoid disputes among the LLC members, you might think you don’t need one for a single-member LLC. But potential investors, future business partners, and others may want to see your operating agreement.

Some banks won’t let you open a business bank account without one. Your operating agreement can also spell out what you want to happen to the business if you die or become incapacitated.

What’s more, occasionally someone will take an LLC owner to court to try to prove that the owner and the LLC are the same entity so that they can go after the owner’s personal assets. If that happens, having an operating agreement in place is one more thing to further demonstrate to the court that the owner and the LLC truly are separate.

LLC Operating Agreement Template

You may be uncertain as to how to draft an operating agreement for your LLC in Delaware. In that case, we offer a customizable template to help get you started.

Step 5: Apply for an EIN

Get an Employer Identification Number (EIN). After forming your new Delaware LLC with the Division of Corporations, you’ll likely need to register with the federal government and get an EIN, also known as a Federal Tax Identification Number, from the Internal Revenue Service (IRS) for tax purposes.

An EIN is like a Social Security number for your business, permitting you to hire employees, apply for a business bank account, and pay taxes.

You can get your Delaware LLC’s EIN through the IRS website, by mail, or by fax, but if you’d just as soon avoid dealing with that particular government agency, we can get it for you. Our EIN service is quick and eliminates the hassle of having to deal with the good ol’ Internal Revenue Service.

Step 6: File the beneficial ownership information report

Beginning in 2024, LLCs (and many other small businesses) are required to file a beneficial ownership information report, or BOI. This report was introduced by the Corporate Transparency Act, which strives to counteract financial crimes by making it difficult for organizations to hide illicit activities behind shell corporations. The BOI report accomplishes this by requiring you to disclose information about your beneficial owners.

According to the Act, beneficial owners are individuals who exert substantial control over the business, hold 25% or more of the LLC’s ownership interest, or receive substantial economic benefit from the LLC’s assets. For each beneficial owner, you’ll be required to provide their full legal name, address, and identifying documents. You’ll submit all of this information to the Financial Crimes Enforcement Network (FinCEN).

FinCEN offers an online version of this form, or you can upload a PDF to their website. There is no filing fee. The due date for the form varies depending on when you form your LLC. LLCs created in 2024 need to file within 90 days of getting your Certificate of Formation approved by the Division of Corporations. LLCs that started before 2024 have until January 1, 2025. LLCs that organize after January 1, 2025, will have just 30 days after approval to file. You can learn more on FinCEN’s website.

Need help? Our BOI report filing service can make this step easy for you.

Steps After Forming Your LLC

1. Register with the Delaware Division of Revenue

If you generate sales in Delaware, have employees working in Delaware, or have property or a business location in Delaware, you’ll need to register your business with the Division of Revenue by applying for a business license.

For Employers

Do you plan to hire employees? If so, you’ll need to file workers’ compensation and unemployment insurance forms, along with registering for a withholding account. You’ll need to register with the Delaware Division of Unemployment Insurance and the Delaware Office of Workers Compensation.

Delaware has a website called “Delware One Stop” that can guide you through the process of completing these requirements online.

You’re also required to report all new hires to the Delaware State Directory of New Hires within 20 days after an employee is hired, is re-hired, or returns to work.

2. Set up business banking

Once you’ve secured an EIN, you’ll be able to open a business bank account. Having separate accounts for your company and your personal banking is critical for sorting out your finances at tax time and helps you avoid commingling funds.

Commingling funds not only makes your taxes more difficult, but it could also be used against you if someone takes you to court to challenge whether you and your Delaware LLC are truly separate entities (you may get sued not just for your LLC’s assets, but also for your personal assets).

Managing Your New Delaware LLC’s Finances

For further help managing your new business’s finances, try the ZenBusiness Money. It can help you create invoices, receive payments, transfer money, and maintain clients all in one place.

3. Consider S corp status for your LLC

An LLC can choose to be taxed as an S corporation, which might offer tax advantages, especially in reducing self-employment taxes. This status allows you to be an “employee-owner,” potentially lowering the taxes on your profits. However, S corps are more closely scrutinized by the IRS and have specific qualifying restrictions. It’s crucial to consult a tax professional to see if S corp status is beneficial for your Delaware LLC. If S corp status aligns with your business needs, our S corp service can assist in this transition.

4. Get a Certificate of Good Standing

Obtaining a Certificate of Good Standing may be necessary for your LLC at some point, such as when applying for business loans, registering for insurance, securing funding, or doing business in another state. It verifies that your LLC is duly registered and up to date with all necessary filings, taxes, and fees. It serves as proof that your business is in good standing with the Delaware Division of Corporations. Additionally, when conducting business transactions or expanding your operations, you may need certified copies of important documents, such as your Certificate of Formation. These certified copies are authenticated by the state and confirm the accuracy and authenticity of the documents, often required for legal and financial purposes. To obtain these documents, you can request them directly from the Delaware Division of Corporations online or by mail.

Navigating Tax Obligations for Your Delaware LLC

Starting and maintaining an LLC in Delaware involves specific tax obligations that every business owner should understand. Here’s an overview of the key tax requirements for Delaware LLCs:

Annual Franchise Tax: Delaware imposes an annual franchise tax (also known as an Alternative Entity Tax or annual tax) of $300 on all domestic and foreign LLCs, limited partnerships, and general partnerships formed or registered in Delaware, which is essentially a fee for the privilege of conducting business within the state. The tax is due annually by June 1. There’s no requirement to file an annual report for LLCs.

Federal Income Tax: Delaware LLCs are classified as pass-through entities for federal income tax purposes, meaning the LLC itself does not pay federal income tax. Instead, the profits and losses of the LLC are reported by individual members on their personal tax returns.

State Income Tax: Delaware doesn’t impose a state-level income tax on individuals or businesses operating solely within the state. However, if your LLC conducts business outside Delaware, you may be subject to income tax in other states where you have a tax presence.

Sales Tax: Delaware is known for not having a statewide sales tax, making it an attractive location for retail businesses. However, other taxes, such as the gross receipts tax, may apply to certain types of businesses.

Other Taxes: Depending on your LLC’s specific activities and industry, you may be subject to additional taxes or fees, such as withholding tax, gross receipts tax, or property tax. Understanding your business’s complete tax obligations is crucial.

To ensure compliance with Delaware’s tax regulations and deadlines, consider consulting with a certified public accountant (CPA) or tax professional familiar with the state’s tax laws. This proactive approach will help your Delaware LLC operate smoothly while remaining fully compliant with state requirements.

Business Entity Types in Delaware

In Delaware, entrepreneurs have a range of business entity types to choose from, each catering to specific needs and objectives:

Corporation: A Delaware corporation is a separate legal entity from its owners (shareholders). It offers limited liability protection, meaning shareholders’ personal assets are generally shielded from business liabilities. Delaware is a popular choice for corporations due to its corporate-friendly laws.

Sole proprietorship: This is the simplest business structure. It’s composed of only one person and requires no registration with the state. The problem with sole proprietorships is that they offer no liability protection for your personal assets. If someone sues the business, they can go after your personal savings, home, car, etc.

General Partnership: In a general partnership, two or more individuals or entities jointly own and manage the business. Each partner shares profits, losses, and responsibilities. Unlike LPs, all partners in a general partnership have personal liability.

Limited Partnership (LP): Delaware LPs consist of general partners who manage the business and have personal liability and limited partners who invest capital but have limited liability. LPs are commonly used for investment funds, real estate ventures, and other partnerships.

Public Benefit Corporation (PBC): A public benefit corporation is a for-profit entity that also focuses on a specific public benefit or mission. It’s legally required to balance profit generation with its social and environmental goals, making it an attractive choice for socially conscious entrepreneurs.

Public Corporation: Public corporations are those that issue shares of stock to the public and are subject to federal securities regulations. Delaware is a preferred jurisdiction for many public companies due to its well-established corporate laws.

Nonprofit Corporation: Nonprofit corporations in Delaware are formed for charitable, educational, religious, or other nonprofit purposes. They enjoy tax-exempt status but must adhere to specific rules and regulations.

Choosing the right business entity in Delaware depends on factors such as liability protection, management structure, and business objectives. It’s advisable to consult with legal and financial professionals to make an informed decision tailored to your specific needs and goals.

Need help filing your Delaware LLC?

After completing the steps above, you’ll be the owner of a new Delaware limited liability company. You’ve taken the first steps toward your dream business. But there’s a lot more to know than just how to start an LLC in Delaware.

You need to know about things like hiring employees, getting business licenses and permits, getting additional financing if you need it, how to make changes in your business, and how to stay in compliance with federal, state, and local laws.

Our many services can do more than just help you form your LLC. Our business experts can also give you long-term business support to help start, run, and grow your company.

So, if you find yourself buried under a pile of red tape and uncertainty, we can help. Let us take care of your Delaware LLC formation, compliance, and more. That way, you can get back to running your dream business, whether you’re starting a tutoring service in Wilmington or a bakery in Dover.

DE LLC FORMATION THAT’S FAST AND SIMPLE

Take it from real customers

Delaware Limited Liability Company FAQs

-

As we mentioned above, if your LLC does business in Delaware, it’s required to get a Delaware Business License. This includes entities located in Delaware that conduct their business outside the state.

You must get your business license as soon as you start doing business in the state. You can complete your registration online using Delaware’s One Stop Business Licensing and Registration Service. You’ll also need to pay a fee for the license.

Once you’ve submitted your Delaware business license application, it usually takes a month to receive your license> However, you can print out a temporary license to use in the meantime.

Depending on your location, you may also need a separate general business license from your town, city, or county.

Aside from general business licenses, there are many other licenses and permits your business may need. These can be at the federal, state, and local levels and can be industry-specific, so you’ll need to do some research.

If all that research sounds daunting, we recommend using our business license report, which will provide you with a comprehensive report of all the licenses and permits required for your LLC in Delaware.

-

The Division of Corporations’ website doesn’t list a time frame for getting your Certificate of Formation processed. It says that the times will vary by the work volume at the time. You can call them at (302) 739-3073, option 2, to get an estimate. Generally speaking, online submissions will be faster than postal mail submissions.

Delaware also has options for expediting your processing for a fee. You can have your Certificate of Formation processed the next day, the same day, in two hours, or in one hour. See the latest fee schedule on the Division of Corporations website.

-

No, you don’t need to file your LLC’s operating agreement with the state of Delaware or any other government agency. Just keep it in a safe location with your other important legal documents.

-

When it comes to small business taxes in Delaware, you have a lot to consider. It’s always best to consult a qualified tax professional, but here are some basics:

Federal Taxes

By default, a limited liability company with only one member is taxed as a “Disregarded Entity” at the federal level, which is the same as being taxed as a sole proprietorship. This means that profits aren’t taxed at the business level. They’re only taxed when they become the member’s income.

Limited liability companies with multiple members are taxed as a general partnership by default. As with a single-member LLC, the income is taxed at the individuals’ level and not the business’s. This avoids the “double taxation” that corporations pay, in which profits are taxed at the corporate level and again when they’re paid out to the owners (“shareholders”).

Single-member LLCs don’t have to file a separate federal return for their LLC. They report the LLC income on their personal income tax return (Form 1040). But LLCs with multiple members must file a separate information federal return for the LLC, Form 1065. Then each LLC member reports their share of the profits on Schedule K-1 and attaches it to their own personal federal tax return.

LLCs also have the option to be taxed as corporations. Some LLC members choose to classify their businesses as an S corporation or a C corporation, which can be advantageous in some cases. In particular, many LLCs elect to be taxed as S corporations because it can save the members money on self-employment taxes. You can learn more on our What Is an S Corp? page.

There are also a few other forms of federal taxation to keep in mind. For example, you will likely need to pay certain kinds of self-employment and/or employment taxes, such as Social Security, Medicare, and unemployment.

State Income Taxes

For state income tax, Delaware always classifies an LLC the same way the LLC is classified for federal income tax. That is, if you choose to be taxed as a partnership at the federal level, Delaware will tax you as a partnership. If you choose to be taxed as a corporation at the federal level, the state will tax you as a corporation.

LLCs classified as partnerships must file Delaware Form 300 for their state taxes. LLCs electing to be taxed as corporations must file either Delaware Form 1100 or Form 1100S.

Gross Receipts Taxes

Even though Delaware has no state or local sales tax, Delaware law does impose a gross receipts tax on those selling good or services in the state.

Basically, the term “gross receipts” comprises the total receipts of a business received from goods/services sold in the state. No deductions for the cost of goods or property sold, labor costs, interest expense, discount paid, delivery costs, state or federal taxes, or any other expenses are allowed.

These gross receipts tax rates range from 0.0945% to 1.9914%, depending on the business activity. If a taxpayer gets income from more than one type of activity, separate gross receipts tax reporting is required. Whether the gross receipts tax is remitted monthly or quarterly depends on the type of business activity.

Annual Tax

Unlike most states, LLCs don’t have to file an annual report in Delaware, and, unlike Delaware corporations, they don’t pay an annual franchise tax. But don’t celebrate yet. LLCs do have to pay a flat annual tax of $300.

The annual tax for the prior year is due on or before June 1st. Failing to pay the annual taxes results in a penalty of $200.00 plus 1.5% interest per month on the tax and penalty.

-

Most LLC members have their business taxed the default way, which is as a sole proprietorship (for single-member LLCs) or a general partnership (for multi-member LLCs). This method only requires partners to pay federal taxes on their percentage of the profits on their personal tax returns. The LLC itself is not taxed.

Other options include being taxed as a C corporation (the default form of corporation) or S corporation. Each tax structure has its advantages and disadvantages.

C corporations have the most possible tax deductions and advantages for certain LLCs (especially larger, more profitable ones), which is sometimes enough to offset the disadvantage of double taxation. Double taxation refers to the fact that profits are taxed twice, at the business level and again at the individual level.

S corporations have pass-through taxation like LLCs, but they have the potential to reduce the amount the members pay in self-employment tax (Social Security and Medicare).

The right tax structure to form an LLC in Delaware depends on your specific situation and goals. It’s best to talk to a qualified accounting professional to understand all your options and choose the right tax structure for your LLC.

-

Yes. Delaware permits the Series LLC structure, in which several separate LLCs operate under one overarching “umbrella” LLC entity. Individual LLCs (sometimes called “cells”) may have different members, assets, and liabilities.

Forming a Series LLC in Delaware will require a slightly different process than forming a standard LLC. At this time, ZenBusiness doesn’t assist with Series LLC formations.

-

If you decide to dissolve your business, you’ll need to file a Certificate of Dissolution with the Delaware Division of Corporations. You’ll pay a fee for this, plus an additional fee per page if the document is more than one page.

In addition, you’ll need to pay off any business debts, sell off assets, and distribute any remaining profits to the members.

A well-drafted LLC operating agreement should describe the dissolution procedure in detail.

For more information, visit our Delaware business dissolution guide. -

An LLC is a legal business entity while an S corp is a tax filing status that can be adopted by an LLC or C corporation. For certain LLCs, filing as an S corp may have some tax advantages, such as reduced self-employment taxes. Learn more about the differences and compare LLCs vs. S Corps.

-

No. Unlike corporations, Delaware LLCs do not need to file an annual report with the Delaware Division of Corporations.

-

Each Delaware LLC must pay an annual tax of $300 to the Delaware Division of Corporations. Annual taxes for the prior year are due by June 1. Many businesses choose to pay online by credit card or bank transfer.

Disclaimer: The content on this page is for information purposes only and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

ZenBusiness is a financial technology company and is not a bank. Banking services provided by Thread Bank, Member FDIC. The ZenBusiness Visa Debit Card is issued by Thread Bank pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa debit cards are accepted. FDIC insurance is available for funds on deposit through Thread Bank, Member FDIC.

*Your deposits qualify for up to a maximum of $3,000,000 in FDIC insurance coverage when placed at program banks in the Thread Bank deposit sweep program. Your deposits at each program bank become eligible for FDIC insurance up to $250,000, inclusive of any other deposits you may already hold at the bank in the same ownership capacity. You can access the terms and conditions of the sweep program at https://go.thread.bank/sweepdisclosure and a list of program banks at https://go.thread.bank/programbanks. Please contact customerservice@thread.bank with questions regarding the sweep program.

LLC Formation States Near Delaware

Ready to Start Your Delaware LLC?