How do I form a corporation in Michigan?

If you’re ready to form your Michigan corporation, we’ve created this resource to help you get started today. Note that these steps are for forming a for-profit, domestic (in-state) C corporation (the default form of corporation) in Michigan.

How do I form a corporation in Michigan?

To start a Michigan corporation, you must file the Articles of Incorporation with the Corporations, Securities, and Licensing Bureau of the Michigan Department of Licensing and Regulatory Affairs. But there are several other steps to complete before and after this filing.

To simplify the process of forming a corporation in the state of Michigan, we’ve put together 10 easy steps to form your business.

Step 1: Name your Michigan corporation

When it comes to naming your corporation, you need to make sure you comply with Michigan business naming laws. You also have many other factors to consider during the process. This includes making sure your business name is unique, suits your business well, aligns with all regulations, and includes a corporation designator (e.g., “Inc.”).

And don’t overlook the importance of choosing a name for which you can reserve a matching website domain name that has not been taken. Additionally, you can consider any “doing business as” (DBA) names or trademarks you may want.

Guidelines for Naming Corporations in Michigan

Here are some guidelines to help you through the naming process:

- Start by brainstorming a list of potential names. Names on this list should match your business’s purpose. The more names you have, the better. The next several steps will begin to narrow down your options.

- The final version of any name you choose must contain the word “Corporation,” “Company,” “Incorporated,” or “Limited” or the abbreviation “Corp.,” “Co.,” “Inc.,” or “Ltd.”

- Search your prospective business names on the Michigan Department of Licensing and Regulatory Affairs business entity search page to eliminate any names that are too similar to existing businesses.

- Michigan corporation names can’t contain language implying they are organized for a purpose other than what’s stated in the Articles of Incorporation.

- The name can’t suggest it’s associated with any government agency or include anything indicating that it will be engaged in illegal business.

Domain Names and Trademarks

Once you’ve narrowed down your list based on the above, the next task is to search for available domain names to help ensure you can secure a website domain that matches your business name.

Before you commit to your business name, search online to make sure it isn’t already trademarked at the federal or state level. If not, you could consider getting a trademark for it. To do so at the state level, you will need to file an Application for Registration of Trademark/Service Mark with the Michigan Department of Licensing and Regulatory Affairs and pay the associated $50 filing fee. But while it’s easier and quicker to file at the state level, filing at the federal level offers broader protection, especially if you plan on doing business outside of Michigan.

Assumed Names and Name Reservations

If you’d like to do business under a name different from your official business name (often called a “doing business as,” or DBA, name), you’ll need to file a Certificate of Assumed Name and pay a $10 filing fee.

Once you’ve settled on a business name, you may choose to reserve the name if you’re not ready to register your corporation. You can do this by submitting an Application for Reservation of Name with a $10 filing fee. Name reservations are good for six months before you need to renew the name registration or register your business. You can apply online, in person, or by mail. The mailing address is Michigan Department of Licensing and Regulatory Affairs, Corporations, Securities & Commercial Licensing Bureau, Corporations Division, P.O. Box 30054, Lansing, MI 48909.

Step 2: Appoint directors

The board of directors oversees the operations of the business. The initial incorporators — those filing the Michigan Articles of Incorporation for the business — often appoint the initial board of directors. Afterward, the shareholders (those who hold stock in the company — this can include the original incorporators) annually elect the board.

Michigan only requires a single incorporator. Only one member on the board is needed, although having more is generally advisable.

Incorporators may be directors and shareholders. In fact, a single person can start a Michigan corporation and hold all associated titles. But the three titles are associated with different roles within the company. To clarify, here are some of the different roles that exist in a corporation:

- Incorporators are responsible for starting the business and filing the initial paperwork.

- The board of directors oversees the operation of the business.

- Shareholders finance the business by owning shares in the company. They also often have voting power when selecting the board of directors.

- Officers execute the duties associated with running the business.

The incorporators should appoint the initial board of directors before filing the Michigan Articles of Incorporation. Then, the appointed directors should meet to approve corporate bylaws, determine the share structure, and solidify other matters before filing. That way, your business starts on the right foot with plans clearly in place.

Step 3: Choose a Michigan resident agent

A resident agent, referred to in most states as a “registered agent,” is the point of contact for anything legal having to do with the business. The resident agent has to be available during normal business hours and to receive any tax documents, legal forms, and so on that might be sent to the business.

You are required to name a resident agent when you file the Michigan Articles of Incorporation. The requirements for a resident agent and accompanying registered office in Michigan are as follows:

- The resident agent’s address (not a P.O. box) must be in the state, which may be the same as the place of business.

- The resident agent can be a person or a business authorized to transact business in the state (such as a registered agent service).

- The business office address or resident address of the resident agent must be the same as the stated registered office address.

Step 4: File the Michigan Articles of Incorporation

Once all the previous steps have been completed, you should have everything you need to file your Articles of Incorporation. This document officially registers and establishes your business with the state. In this document, you will need to include:

- The name of your business

- The purpose of the business. As per the instructions on the form, you don’t have to get very specific unless it’s an educational corporation.

- The number of authorized shares of stock separated as common shares and preferred shares. The primary difference is that preferred shares don’t come with voting rights but do often come with better financial benefits for the shareholder. The number of shares authorized is often determined by the board of directors or the incorporators. You will also state the rights associated with each share class, as determined by the board of directors or incorporators.

- The name, physical address, and mailing address of the registered agent

- Names and addresses of all incorporators

- Any additional information you wish to include

- Signatures of incorporators

File with the Michigan Department of Licensing and Regulatory Affairs

This filing may be completed online through the Michigan Department of Licensing and Regulatory Affairs website or via paper and mailed to:

Michigan Department of Licensing and Regulatory Affairs

Corporations, Securities & Commercial Licensing Bureau

Corporations Division

P.O. Box 30054

Lansing, MI 48909

You must also pay an associated filing fee, which is $10 plus an additional amount, depending on the number of authorized shares as follows:

- $50 for 1 to 60,000 shares

- $100 for 60,001 to 1,000,000 shares

- $300 for 1,000,001 to 5,000,000 shares

- $500 for 5,000,001 to 10,000,000 shares

If you have more than 10,000,000 shares, it’s $500 for the first 10,000,000 plus $1000 for each additional 10,000,000, or portion thereof.

Step 5: Create corporate bylaws

The next step is to have the incorporators or the board of directors create the corporation’s bylaws. The bylaws establish all of the rules and day-to-day activities of your business. This is a good idea, but Michigan also requires it for all corporations.

What to Include in Michigan Corporate Bylaws

Your corporate bylaws may include:

- A clear statement of your business purpose

- A list of the board of directors and the rights, responsibilities, and qualifications of each

- Details of your management structure and the duties of each officer

- Annual meeting scheduling and goals for directors and shareholders

- How ownership and shares are distributed and how the stock is sold or transferred

- How changes are made or voted on

- Details of any committees and their responsibilities

- Process for removing a board member

- How conflicts of interest are to be handled

While you are not required to file your bylaws anywhere, you are required to keep them in a safe place with any other corporate records. It’s often a good idea when starting to set up a corporate records book where you can keep all of your corporation’s important papers, including bylaws, minutes from meetings, and stock certificates.

Step 6: Draft a shareholder agreement

The shareholder or stockholder agreement is a document that outlines the rights and responsibilities of all shareholders in the company. It should include the following:

- Shareholders and their contact information (address, phone number, etc.)

- Shareholder responsibilities, including rules about officer appointments and any actions that shareholders are allowed to take on behalf of the business

- Shareholder voting rights, including whether a simple majority or higher percentage may be required for certain decisions

- How changes to the original shareholder agreement may be made

- How stock can be sold or transferred

- The financial obligation and time commitment for each shareholder

- A clear outline of how dividends are distributed

- A plan for the distribution of assets should the business close

Again, this agreement can be drafted from a template, but you may want to utilize professional assistance. Your shareholder agreement should be kept with your other important corporate records.

Step 7: Issue shares of stock

One of the requirements for starting a corporation is issuing stock. When you filed your Articles of Incorporation, you stated the number of stock shares (common and/or preferred) that were authorized. The number of shares you issue should always be less than or equal to this number.

You’ll need to estimate how much capital you require before issuing shares of stock so that you can determine a reasonable value for each share. Shares of stock may also be issued in exchange for services or other noncash value and capital contributions.

Each share is only issued once. However, after being issued, it can be traded and sold. All issued shares must be documented in the company’s annual report. Although it is not typically required, most corporations issue certificates to shareholders, indicating their shares.

Stock may be issued publicly or privately. Privately issued stock is usually issued to the founders, managers, employees, or a private group of investors. A public corporation makes a portion of its stock shares available for public purchase.

Companies that issue public stock need to file quarterly statements with the Securities and Exchange Commission (SEC). They must also track how many shares are issued and to whom. You should also check with the Department of Licensing and Regulatory Affairs Securities and Audit Division for regulations and requirements at the state level.

Step 8: Apply for necessary business licenses or permits

To keep your new business on the right legal footing, make sure you take the time to research any required permits or licenses. What permits and licenses are needed depends on the business services you provide, the county or city where your business is located, and whether you have employees.

Be sure to search for the following:

- State and city sales tax license (if you are selling goods)

- Regulatory or professional licenses or permits (associated with the services you provide)

- Any local business licenses or permits, including alarm permits, building permits, health permits, occupational permits, signage, or zoning permits

There may still be other licenses and permits required for your business, so you’ll have to do some research if you want to stay in line with federal, state, and local government regulations.

Step 9: File for an EIN and review tax requirements

Corporations are treated as separate entities, which means they need their own tax identification number separate from the Social Security numbers of the shareholders. As such, you will need to obtain a federal employer identification number (EIN) from the IRS. Also known as a federal tax identification number, this ID number acts like the corporation’s Social Security number for tax purposes. It also allows you to open a business bank account and hire employees, among other things.

Visit the IRS website and fill out their online form. It only takes a few minutes and is free. Afterward, you will receive your employer identification number. Keep track of this number, as you will need it for future documentation and filing your business’s tax returns.

Remember that corporations must pay their own taxes separate from any taxes paid on shareholder earnings. This must be done at the federal and state levels by submitting the appropriate returns each year.

Step 10: Submit your corporation’s first annual report

In Michigan, all corporations are required to file an annual report by May 15 each year. In this report, you will need to provide the following information:

- Corporation name

- Registered agent name and office address

- Names and addresses of all officers and directors

- A statement of the type of business services provided

- Names and addresses of the shareholders (for professional corporations)

Your preprinted annual report form will be mailed to your registered office three months before the due date. It can be returned via mail or filed online and must be accompanied by a $25 filing fee.

Types of Corporations

Corporations in Michigan primarily fall into the following three categories:

- C corporations. These are owned by shareholders who elect a board of directors to oversee operations. They are taxed as a separate legal entity from anyone else involved and provide the greatest protection between businesses and personal assets.

- S corporations. Any earnings are split among shareholders and are taxed at that level only, not also separately as a business entity.

- Nonprofit corporations. These are tax-exempt (though employees still pay taxes on their wages), but this structure requires significantly more paperwork. The business must adhere to strict regulations to maintain its tax-free status.

How much does it cost to start a Michigan corporation?

The cost of starting a Michigan corporation can vary considerably, depending on the size and type of business and location. At a minimum, you will need to pay the $10 fee for filing the Articles of Incorporation and the associated fee for the number of shares authorized. Additional fees may include:

- Expedited service fees ranging from $50 to $1,000, depending on the requested turnaround time

- Registered agent service fees

- $10 name reservation fee

- $10 for an assumed name

- Fees to reserve a domain name and create a website

- Licensing and permit fees

$25 annual report fee - Fees assessed for amendments or other business filings

- Fees for an accountant or tax consultant

- Costs associated with renting space

ZenBusiness can help alleviate any stress of getting your Michigan corporation off the ground by assisting with many of the required steps for a low annual fee.

What are the benefits of a corporation in Michigan?

Many benefits come with starting a corporation in Michigan. As a business type, the benefits of a corporation include:

- Protection of personal assets

- Legal recognition as a separate entity in and outside the U.S.

- The ability to issue stock (which can help with funding and capital)

- Does not dissolve if owners leave or pass away

There are disadvantages you should be aware of, however. Among these are the tax structure (profits are taxed at both the corporation and personal income tax levels), and there is a lot more red tape and paperwork involved than other structures, such as limited liability companies (LLCs).

How is a Michigan corporation taxed?

How a corporation is taxed in Michigan depends on its designation. Corporations may be designated as a C corporation, an S corporation, or a nonprofit.

C corporations are treated as separate entities and must file their own tax returns for business income. In addition to this, all shareholders file tax returns for earnings and dividends on their individual tax returns. This results in “double taxation.” While that might seem less than ideal, there are some benefits to this tax structure, including more flexibility in what can be deducted.

S corporations are pass-through entities. Profits are passed through to the owners, who pay taxes on them on their individual income taxes. The corporation itself isn’t first taxed on the profits.

Nonprofit corporations are exempt from paying federal and state taxes, provided they stay within the rules for nonprofit activity. However, anyone drawing a salary from a nonprofit corporation will pay income tax on that salary.

Visit the Michigan Department of Treasury website for more information about additional Michigan corporate taxes your corporation may be responsible for, including sales and use tax, withholding tax, and International Fuel Tax Agreement (IFTA) tax.

We can help

When you sign up for our business formation services, our experts walk you through each step of the incorporation process as you get your business started. With our help, navigating the ins and outs of running and growing a business doesn’t have to be a headache.

Michigan Corporation FAQs

-

Corporations are known for requiring a lot more paperwork and record keeping. This is not surprising, considering they tend to have more laws to comply with and more people involved. Consider bylaws, shareholder agreements, keeping track of all stock issuances, meeting notes, corporate records, etc., and the paperwork can add up pretty quickly.

-

LLC stands for limited liability company. This type of business structure is a pass-through entity for tax purposes, and it is useful in keeping the owners’ assets separate from business assets (as with a corporation). However, LLCs do not have a board of directors and do not issue shares.

-

You can change the name of your Michigan corporation by filing a Certificate of Amendment and paying a filing fee.

-

A single person can form a corporation in Michigan. Simply file

-

Yes. By using the Department of Licensing and Regulatory Affairs Corporations Division online filing system, you can take care of all of your business filings, including initial registration.

-

To dissolve your corporation, you will need to file a Certificate of Dissolution with the Michigan Department of Licensing and Regulatory Affairs and pay a $10 filing fee.

-

Yes, you just need to register the foreign corporation in Michigan. To register your foreign corporation, whether it’s for profit or nonprofit, simply file a Certificate of Authority with the state. A filing fee must be included and you can pay for expedited filing. Forms can be submitted via mail or in person. You’ll be notified once your foreign corporation has been accepted.

Disclaimer: The content on this page is for information purposes only and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

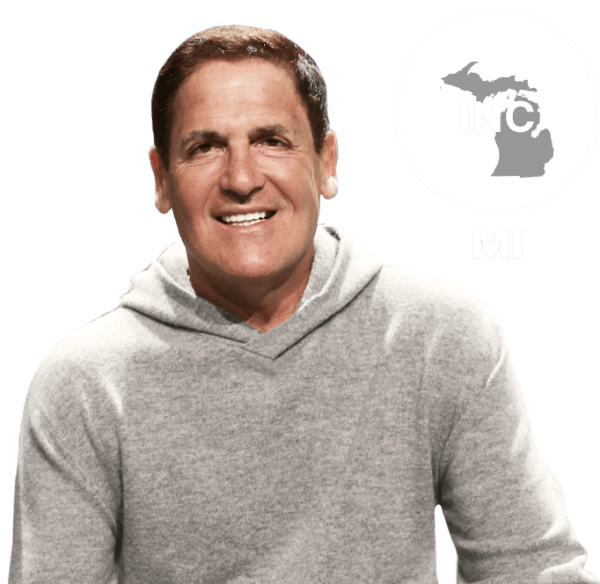

“This is your life. You want to get it right.”

– Mark Cuban on Starting a Business*

Entrepreneur and Shark Tank host lays out 3 steps to follow when starting a business

* Mr Cuban has a financial interest in ZenBusiness

Corporation Resources

Michigan Business Resources

Form a Corporation in These States

Ready to Start Your Corporation?