Start a Delaware Corporation

Delaware stands out as a top choice for many entrepreneurs setting up corporations. But what’s behind this state’s appeal? It’s more than just its East Coast location — Delaware boasts business-friendly laws, a flexible corporate framework, and a unique court system that specializes in business matters.

This combination has made it a corporate haven, drawing even Fortune 500 companies to become Delaware corporations. If you’re considering where to establish your business, understanding Delaware’s advantages can be a game-changer.

Why incorporate in Delaware?

As we’ve mentioned, Delaware is a popular home for corporations to grow their business, small and large alike. From legal benefits to investment opportunities, being incorporated in Delaware presents several benefits. Let’s explore those perks in detail.

Legal Benefits of Delaware Corporations

Delaware is renowned for its business-centric legal environment. Delaware’s General Corporation Law is designed to be favorable to corporations, promoting smooth operations and minimizing complexities that can hinder growth. Beyond this, the Delaware Court of Chancery, with judges who specialize in corporate issues, is an added benefit for businesses. This experienced court system helps ensure that any corporate disputes are addressed by experts familiar with intricate business matters, potentially leading to swift and fair resolutions.

Tax Advantages

When it comes to taxes, Delaware offers a treasure trove of benefits for corporations. One of the standout advantages is that Delaware-based corporations that operate out of state aren’t required to pay the state’s corporate income tax. Plus, there are no sales taxes, value-added taxes, or inventory taxes in Delaware. For individuals, the absence of personal property tax is a financial relief, allowing businesses and their stakeholders to maximize their profits.

Investment and Credibility

In the world of business, perception matters. Having a Delaware corporation brings with it a sense of prestige and credibility, potentially making businesses more appealing to stakeholders, partners, and consumers.

Additionally, investors often lean favorably toward Delaware corporations because the state’s consistent and clear corporate laws can provide a sense of stability and predictability. This means that investors can be more confident about the legal environment their investments operate within, which could increase the likelihood of their backing and support.

Steps to Form a Delaware Corporation

When you set up a Delaware corporation, you’re embarking on an important legal process with crucial steps to follow. Let’s discuss those steps.

Step 1: Decide on a business name

Pick the business name you’ll use in Delaware. Before starting the incorporation process, it’s crucial to pick a business name that not only represents your venture but also aligns with Delaware’s corporate naming rules. Begin by checking if your desired name is available in Delaware’s business registry to ensure no other entity has already claimed it. You can also reserve your name if you need to.

But that’s just the starting point. It’s equally vital to review potential trademarks at both the federal and state levels to avoid legal complications down the road. Once you’ve zeroed in on a name, consider securing a matching domain name. This creates a cohesive brand identity and helps your online presence align seamlessly with your corporation’s name.

Name Your Delaware Corp

Enter your desired name to get started

Step 2: Choose a Delaware registered agent

Appoint someone to serve as your registered agent. Every Delaware corporation must have a registered agent — it’s not just a formality, but a crucial role in the business structure. A registered agent accepts service of process and some state communications on your business’s behalf. To meet Delaware’s requirements, this agent must either be a resident of Delaware or a business entity authorized to operate in the state. They also need a physical address in Delaware, as P.O. boxes aren’t accepted.

While you can act as your own registered agent, many businesses opt for a registered agent service like ours. Our service helps ensure the timely receipt and handling of crucial documents, providing peace of mind and freeing up your time to focus on the core aspects of your business.

Step 3: File the Delaware Certificate of Incorporation

Officially start your Delaware corporation by filing the Certificate of Incorporation. To solidify your business’s status in Delaware, you’ll need to file the Certificate of Incorporation with the Delaware Division of Corporations. This document outlines key information about your corporation, such as its name, purpose, the number of shares it’s authorized to issue, and details about its registered agent. It’s a foundational step, serving as an official record of your corporation’s existence.

While Delaware’s process is streamlined and business-friendly, it’s crucial to ensure all information is accurate and complete to avoid any hitches. As for costs, Delaware requires a filing fee, which starts at $109 and varies based on factors like the corporation’s authorized capital. Remember, this isn’t a one-and-done task — the Certificate of Incorporation sets the tone for your business’s legal structure in the state, but you’ll need to pay close attention to ongoing compliance requirements like annual reports and franchise taxes.

Step 4: Hold the first meeting and choose directors

Appoint your initial directors at your first board meeting. Once your corporation is officially recognized, it’s time to bring its leadership into focus by holding the first organizational meeting. During this crucial gathering, initial shareholders or incorporators elect the board of directors, laying the groundwork for your corporation’s oversight and guidance.

But this meeting isn’t just about selecting directors. It’s also an opportunity to complete several foundational tasks. These include adopting bylaws (see Step 5), authorizing the issuance of shares of stock, setting the corporation’s fiscal year, and designating corporate officers. These decisions and actions provide a roadmap for the corporation’s operations and management, helping ensure clarity and direction from the get-go.

Step 5: Create Delaware corporate bylaws and a shareholder agreement

Write bylaws and a shareholder agreement to govern your Delaware corporation. Corporate bylaws are the backbone of your corporation’s operations, laying out the rules and procedures that guide its daily activities and governance. Think of them as a detailed playbook that covers everything from the frequency of director meetings to the roles and responsibilities of officers. Typical bylaws address matters such as the structure and powers of the board of directors, how and when shareholder meetings are held, and the process for amending these bylaws.

On the other hand, a shareholder agreement focuses specifically on the relationship between shareholders. This essential document outlines rights, responsibilities, and protections for shareholders, providing clarity on issues like the transfer of shares or dispute resolution. Together, these documents work hand-in-hand to help ensure smooth operations and clear communication within the corporation.

Step 6: Issue shares of stock for your Delaware corporation

Create your first stock certificates. Issuing shares of stock is more than a symbolic gesture — it’s a tangible representation of ownership in the corporation. When shares are issued, they denote a stake in the company’s assets and earnings. By distributing these shares, corporations can attract investments, compensate employees, and establish a clear ownership structure.

The process of issuing shares typically starts with the board of directors determining the number and type of shares to be issued. These decisions are then recorded in board resolutions. It’s crucial to keep an accurate and up-to-date record of all stock issuances and transfers in the corporation’s stock ledger. By properly managing and documenting the issuance of stock, corporations promote transparency, maintain shareholder trust, and comply with Delaware’s legal requirements.

Step 7: Obtain an EIN

Get an EIN for your Delaware business. An Employer Identification Number (EIN), sometimes referred to as a federal tax identification number, is a unique nine-digit number assigned by the IRS to businesses operating in the U.S. Think of it as a Social Security number for your corporation — it’s crucial for tax reporting, hiring employees, and other essential administrative tasks.

The fastest way to apply is online through the IRS website, which usually provides the number immediately upon completion. If online isn’t your preferred method, you can also apply by fax or mail, though these methods tend to take longer. Once you have your EIN, it becomes a primary identifier for your business, so keep it secure and accessible. If you’d rather avoid the hassle of getting your own number, you can use our convenient EIN service.

Step 8: Open a corporate bank account for your Delaware corporation

Get a Delaware business bank account. Keeping your personal and business finances separate is paramount, and opening a dedicated corporate bank account is the first step. A corporate bank account not only helps in managing business expenses and revenues but also provides a clear financial trail for tax purposes, making record-keeping more straightforward. Moreover, it lends credibility to your business when dealing with clients or suppliers, showing them you maintain professional financial practices.

In addition to a corporate bank account, consider obtaining a business credit card. It can aid in tracking expenses, provide purchase protections, and even offer rewards that can be reinvested into the business. Moreover, using a business credit card responsibly can help build your corporation’s credit history, potentially opening doors to better financing options in the future.

Post-Incorporation in Delaware Steps

Congratulations! Your business now officially exists. But even as you bask in the achievement, it’s essential to remember that the journey doesn’t stop here. Several post-setup steps help your corporation remain compliant and operating smoothly in Delaware.

Maintaining Good Standing

Staying in good standing with the state of Delaware is more than just a recommendation — it’s a necessity. This means consistently meeting compliance requirements. Key among these are filing the annual report and promptly paying Delaware’s franchise tax. Neglecting these responsibilities can lead to financial penalties or even the loss of your corporation’s good standing status. Always mark your calendar and ensure timely submissions.

Delaware Business Licenses and Permits

While the incorporation process lays the foundation, licenses and permits give you the clearance to operate. For starters, Delaware requires corporations to get a general business license. Then, there are industry-specific or location-specific licenses you might need. Always do your due diligence to determine which licenses apply to you. And remember, many licenses and permits come with expiration dates, so make a note of renewal timelines to avoid operational hitches.

Our business license report can help with this step. We’ll assemble a personalized list of the licenses and permits your unique business needs, freeing you up to focus on growing your new business.

Keeping Accurate Records

A well-run corporation is like a well-oiled machine, and accurate record-keeping is the lubricant. Maintaining clear, detailed records not only helps ensure compliance but also provides insights into your business’s health. This includes everything from financial statements to meeting minutes.

Regularly updating and organizing these documents can save you significant headaches in the long run and provide clarity when making strategic decisions. Adopting good record-keeping practices from the onset sets the tone for a disciplined and efficient corporate journey.

Consideration for Foreign Entities in Delaware

Operating in Delaware as a foreign corporation involves added steps. Being recognized as a foreign entity means adhering to the standards of both Delaware and your home jurisdiction.

Get a qualification to do business in Delaware from the Division of Corporations

Before they conduct business in Delaware, foreign corporations need a Certificate of Authorization. This approval requires an application detailing your corporation’s formation and purpose in Delaware, a registered agent’s information, and a Certificate of Good Standing from your home jurisdiction. Submit these with the necessary fees to Delaware’s Secretary of State.

Delaware Compliance and Regulation

With the certificate secured, there are additional compliance steps for foreign entities. While some requirements, like the annual report, align with requirements for domestic corporations, others are specific to foreign entities. Regularly consult with experts to ensure adherence to Delaware’s regulations.

Pros and Cons of Incorporating in Delaware

Incorporating in Delaware, as with any location and legal entity type, presents its unique blend of benefits and challenges. Understanding these can help businesses make informed decisions.

Advantages

Delaware law stands out for its legal protection and financial benefits. Its business-friendly laws and experienced court system offer corporations robust legal safeguards. Financially, Delaware offers tax incentives and benefits that are attractive to many businesses, making it a favored choice for incorporation.

Disadvantages

However, incorporating here isn’t without its drawbacks. The costs involved can sometimes be higher than in other states, as the state’s annual franchise tax can be quite expensive, and initial filing fees for companies with lots of shareholders can be somewhat costly as well. Additionally, businesses might encounter bureaucratic hurdles, especially if they’re foreign entities, adding layers of complexity to the incorporation process.

Summary: Starting a Delaware Corporation

Incorporating in Delaware involves key steps: selecting a business name, choosing a registered agent, filing the Certificate of Incorporation, electing directors, setting bylaws and shareholder agreements, issuing stock, securing an EIN, and opening a corporate bank account. While Delaware offers robust legal protection and financial incentives for corporations, it’s essential to weigh these advantages against potential administrative challenges. In a nutshell, Delaware can be an advantageous home base for businesses, but due diligence is essential.

We can help!

Navigating incorporation can be complex, but you’re not alone. Our incorporation service streamlines the process, helping you establish your corporation starting at just $0 plus state fees. Let us guide you every step of the way, making your business journey in Delaware smoother and more efficient.

Delaware Corporation FAQs

-

A Delaware corporation is a formal business entity formed under the laws and regulations of the state of Delaware. These corporations enjoy the state’s favorable legal environment, experienced business court system, and business-friendly laws, making Delaware a popular choice for many businesses seeking to incorporate in the U.S.

-

A Delaware corporation and an LLC (limited liability company) differ primarily in their structure, management, and taxation. While corporations have shareholders, directors, and officers with a formal structure, limited liability companies have a more flexible management system with members and possibly managers. Additionally, corporations are subject to double taxation unless they qualify for and choose S-corp status, whereas LLCs offer pass-through taxation by default.

-

A Delaware corporation and an LLC are distinct business entities. While both offer liability protection, they differ in their management structures, formalities, and tax implications.

-

Delaware is favorable for C corporations because of its well-established body of corporate law, business-friendly environment, and specialized Court of Chancery. This court deals exclusively with business disputes, promoting quicker resolutions. Additionally, Delaware’s legal framework can be particularly advantageous for larger companies with complex governance and capital structures.

-

Many startups choose to incorporate in Delaware due to its investor-friendly laws, well-established corporate legal system, and the prestige associated with being a Delaware entity. Investors may prefer Delaware corporations because they’re familiar with the state’s laws, which can provide predictability in legal disputes.

-

While Delaware remains a popular choice due to its favorable business laws and court system, the “best” state to incorporate in varies depending on a company’s specific needs. Other states might offer tax advantages or incentives that better align with a particular business’s goals. Often, it makes the most sense to simply incorporate your business in your company’s home state. However, Delaware’s reputation as a corporate haven continues to make it a top contender for many.

-

The cost to incorporate in Delaware can vary based on the type of business entity and additional services needed. The state fee for filing a Certificate of Incorporation (usually called the Articles of Incorporation in other states) for a Delaware corporation currently starts at $109. However, there could be additional costs for services like registered agents or expedited filing, and corporations with more than 1,500 shares will pay higher formation fees as well.

-

Incorporating in Delaware offers numerous benefits, including a well-established corporate legal system, a specialized business court for resolving disputes, and business-friendly laws. Additionally, the state provides strong protections for directors and officers, flexibility in business operations, and attractive tax benefits for corporations.

-

A Delaware corporation’s taxation depends on its tax status. A C corp faces double taxation, where the corporation pays taxes on its profits and shareholders pay taxes on dividends. If the corporation elects S-corp status, it can avoid double taxation, allowing income tax, deductions, and credits to pass through to shareholders. It’s worth noting that Delaware offers some tax advantages, such as no state sales tax and no value-added taxes.

Disclaimer: The content on this page is for information purposes only and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

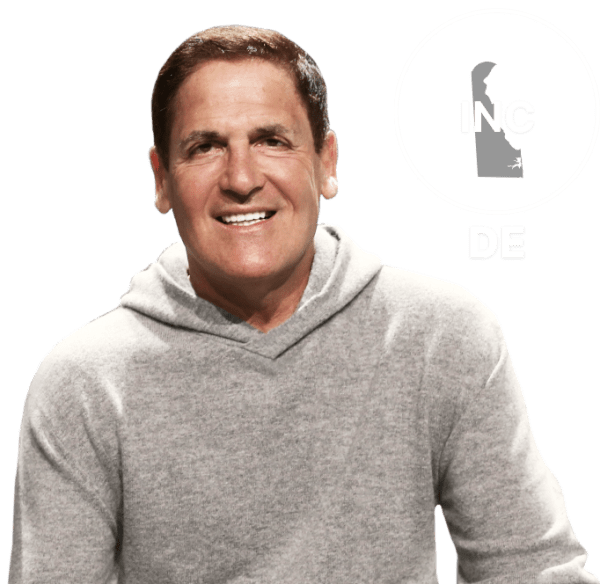

“This is your life. You want to get it right.”

– Mark Cuban on Starting a Business*

Entrepreneur and Shark Tank host lays out 3 steps to follow when starting a business

* Mr Cuban has a financial interest in ZenBusiness

Corporation Resources

Delaware Business Resources

Form a Corporation in these States

Ready to Start Your Corporation?