Start a New Jersey Corporation

Incorporating in New Jersey could be a smart move for your business. The Garden State offers a dynamic environment for startups and established businesses alike. By forming a New Jersey corporation, you provide a strong foundation for your business to grow and thrive. Incorporation in NJ grants your venture legal recognition and opens doors to numerous benefits and protections.

Starting a business isn’t as daunting as it might seem. Read our guide to understand the ins and outs of NJ incorporation.

Steps to Incorporate in New Jersey

Ready to start your New Jersey business? Follow these essential steps, and you’ll be well on your way to operating the newest corporation in New Jersey.

Step 1: Decide on a business name

Pick a name for your New Jersey corporation. Kicking off your journey to incorporation in New Jersey begins with selecting the ideal business name. This isn’t just a creative endeavor — it’s about ensuring that the name hasn’t already been claimed by another entity within the state.

Before settling, check New Jersey’s official database to see if your dream name is available, and don’t forget to follow state naming rules like including “Corporation,” “Incorporated,” “Company,” or an abbreviation of one of these words. You’ll also need to get clearance from the Corporate Filing Department if your name contains certain restricted words. Names can’t include profanity, either. New Jersey does allow name reservations if needed.

Beyond the state’s borders, it’s wise to look into federal and state trademarks. This helps ensure you won’t inadvertently infringe on someone else’s established brand, saving potential headaches down the road.

Once you’ve pinpointed a name that’s unique and resonates with your brand, consider securing a matching domain name for your business website. Not only does this step provide a seamless brand experience for your customers, but it also gives you a leg up in the digital world.

Name Your New Jersey C Corp

Enter your desired name to get started

Step 2: Choose a New Jersey registered agent

Designate your New Jersey corporate registered agent. In the realm of New Jersey incorporation, the registered agent plays an essential role in a new business. This person or business entity becomes the designated contact for some official communications, including service of process and some notices from the New Jersey Department of State.

It’s crucial to understand that a P.O. Box won’t suffice — your registered agent must have a physical address (called the registered office) in New Jersey. They have to be available during regular business hours, too.

But what if you’re out of town or busy running your business? That’s where a professional registered agent service like ours comes in handy. Using such a service means you won’t miss out on any essential notifications. Plus, using a third-party agent can offer an added layer of privacy (you won’t be served with a lawsuit in front of clients, employees, or partners), helping ensure your business matters remain discreet and allowing you to focus on what you do best: growing your enterprise.

Step 3: File the New Jersey Certificate of Incorporation

Submit the formation documents for your New Jersey corporation. To officially bring your corporation to life in the Garden State, you’ll need to file the New Jersey Certificate of Incorporation. This pivotal document outlines the essential details of your corporation, including its name, purpose, business address, and the names and addresses of its initial directors.

Additionally, it will detail your corporation’s stock structure, indicating how many shares you’ll issue and their value. While this might sound complicated, the state provides user-friendly forms, promoting a smoother filing process.

As with most things governmental, there’s a filing fee involved. The cost to file your Certificate of Incorporation is $125. It’s crucial to double-check the most current fees on the New Jersey state website or consult with a professional to avoid any surprises. Prompt payment and ensuring all details in the document are accurate can streamline the process, helping your corporation get off to a smooth start.

Step 4: Hold the first meeting and choose directors for your New Jersey corporation

Pick your initial directors at your first board meeting. With your corporation officially recognized, it’s time to assemble your team. The first organizational meeting is a monumental step in the life of a New Jersey corporation. The incorporators (those who signed the Certificate of Incorporation) or the initial board of directors (if named in the Certificate) will call this meeting. During the meeting, one of the primary tasks is electing the board of directors if they weren’t already named in the Certificate. You must have at least one director.

This organizational meeting has a hefty to-do list. Typical tasks tackled during this meeting include adopting corporate bylaws, designating corporate officers, and issuing shares of stock to the initial shareholders. Bylaws, in particular, are vital as they lay out the rules and guidelines for corporate governance, keeping everyone on the same page to run your business.

Step 5: Create corporate bylaws and a shareholder agreement

Write bylaws and a shareholder agreement to guide your New Jersey corporation. Corporate bylaws serve as the backbone of your corporation’s operational structure. Think of them as the rulebook that dictates how your corporation runs on a day-to-day basis.

They outline the responsibilities of directors, officers, and shareholders, detail the procedures for holding meetings and voting on corporate matters, and set the framework for financial and record-keeping practices. Standard bylaws often address topics like the number and powers of directors, frequency of shareholder and director meetings, and methods of amending these bylaws.

A shareholder agreement is like a prenuptial agreement for your corporation’s stakeholders. It lays out the rights, privileges, protections, and obligations of the shareholders. While bylaws provide a broad outline of corporate operations, the shareholder agreement delves deep into issues like share transfer restrictions, dividend distributions, and the protocol if a shareholder wants out or, unfortunately, passes away. Together, these documents promote clarity, help reduce potential conflicts, and provide a solid foundation for your New Jersey corporation’s growth and governance.

Step 6: Issue shares of stock for your New Jersey corporation

Create and distribute stock for your New Jersey corporation. Shares of stock are the lifeblood of your corporation. They represent ownership in the company and can be viewed as slices of the corporate pie. Issuing shares is a way to raise capital, which can fuel growth, investment, and operations. Furthermore, the way shares are distributed among stakeholders determines the decision-making power dynamics within the company.

The process of issuing shares in New Jersey involves a few vital steps. First, you’ll need to determine the number of shares you wish to issue, which should be specified in the Certificate of Incorporation. It’s essential to ensure you don’t issue more shares than authorized.

Once determined, these shares can be distributed to the initial shareholders in exchange for capital, assets, or services. Properly documenting this process, often with stock certificates, is crucial to help ensure clarity and avoid potential disputes down the line. It also aids in maintaining transparent and accurate corporate records, a hallmark of successful New Jersey corporations.

Step 7: Obtain an EIN and review New Jersey tax requirements

Get an EIN and prepare for New Jersey business taxes. An Employer Identification Number (EIN), often likened to a corporate Social Security number, is essential for all New Jersey corporations. Issued by the Internal Revenue Service (IRS), this unique nine-digit number identifies your business for tax purposes and is required for many standard business tasks like hiring employees, opening business bank accounts, or filing federal and state tax returns.

The good news? Applying for an EIN is free. Once you obtain your EIN, this number stays with your corporation for its lifetime, much like a fingerprint. If you’d rather avoid the hassle of getting your own number, you can use our convenient EIN service.

When it comes to tax in the Garden State, New Jersey corporations have specific obligations. Aside from federal taxes, New Jersey has its own corporate business tax, which is levied on corporations’ net income. Rates for New Jersey corporate taxes can vary based on gross receipts in the state, so it’s vital to stay updated with the state’s Division of Taxation.

Furthermore, depending on your business activities, you may be subject to sales tax, payroll tax, and others. Regularly reviewing New Jersey’s tax requirements and seeking guidance from a local certified public accountant (CPA) can save your corporation time, money, and potential legal hassles.

Step 8: Open a business bank account for your New Jersey corporation

Set up a business bank account. Opening a corporate bank account is an essential step for New Jersey corporations. This isn’t just about organization — it’s about integrity and clarity. By ensuring all business transactions, from revenues to expenses, flow through this account, you maintain a clear boundary between personal and corporate finances.

It provides a transparent financial narrative, which is crucial during audits, tax season, or any financial evaluations. Plus, having a dedicated business account solidifies your corporation’s credibility, offering clients and vendors confidence in your professionalism.

Next, having a business credit card provides more than just purchasing convenience. It’s a tool for managing cash flow and building a robust corporate credit history. By using a business card responsibly, you’ll pave the way for favorable financial terms in the future. Additionally, the tailored rewards many of these cards offer can be an added benefit, giving back on common business expenses.

Post-Incorporation Steps

Even after successfully incorporating in New Jersey, your journey isn’t over. To help ensure the longevity and compliance of your corporation, you need to diligently address several post-incorporation tasks. These administrative tasks lay the groundwork for a corporation’s long-term success and legal standing.

Maintain good standing

Ensuring your New Jersey corporation remains in good standing is paramount. One key way to do this is by keeping up with compliance requirements. For instance, filing the annual reportis a non-negotiable task that provides updated information about your corporation, from its operational status to changes in management. Regularly meeting these compliance milestones not only ensures you’re abiding by New Jersey’s regulations but also signals to partners, investors, and customers that your corporation is legitimate and trustworthy.

New Jersey Business Licenses and Permits

Depending on the nature and location of your business, you might need various licenses and permits. It’s crucial to identify what specific licenses your corporation needs and obtain them promptly. These could range from health permits for restaurants to specified licensing for specialized trades. If you’d like some help with this step, our business license report compiles a list of the specific permits your business requires.

Equally important is keeping track of renewal dates. Letting a license or permit lapse can result in penalties or even temporary closure, so staying ahead of these deadlines is a must for smooth operations.

Keeping Accurate Records

Record-keeping is the unsung hero of corporate operations. Maintaining accurate, timely, and organized records is not just about compliance — it’s about insight. Well-kept records provide clarity on a corporation’s financial health, aid in decision-making, and are indispensable during audits or stakeholder reviews.

It’s recommended to have a dedicated system in place, whether it’s software or manual filing, and to routinely review and update records. This practice helps ensure that, when information is needed, it’s readily available and trustworthy.

Consideration for Foreign Entities in New Jersey

For foreign entities eager to expand a business into New Jersey, there are specific regulations to navigate. It’s essential to be compliant with both New Jersey’s laws and those of your business’s home jurisdiction.

Qualification to Do Business in New Jersey

Before operating in New Jersey, foreign corporations need to complete the foreign qualification process by obtaining a Certificate of Authority. To secure this, they must submit documents like their original Articles of Incorporation and a Certificate of Good Standing to the state’s Department of State. Upon approval, they’re officially qualified to do business.

New Jersey Compliance and Regulation

Beyond qualification, foreign entities face distinct compliance demands. Apart from the annual report filed by all corporations, foreign ones might have extra reporting duties, depending on their sector. It’s crucial for these corporations to stay updated with New Jersey’s regulations, helping ensure smooth operations and avoiding potential complications.

Pros and Cons of Incorporating in New Jersey

Starting a business by incorporating in New Jersey brings with it several benefits. Foremost is the legal protection it offers. By establishing a corporation, owners typically shield their personal assets from business debts and liabilities — a key advantage in case of potential legal disputes.

Beyond this, New Jersey corporations often find it easier to raise funds. Whether it’s through selling shares or securing larger loans, the structured nature of a corporation enhances investor confidence, paving the way for greater financial flexibility and growth opportunities.

However, the path to incorporating in New Jersey isn’t without its challenges. There are associated costs, both in terms of setting up the corporation and maintaining its compliance with state regulations. One significant drawback is the issue of double taxation: Corporations pay taxes on their profits, and then shareholders pay taxes again on dividends. Moreover, navigating the bureaucratic processes can sometimes be cumbersome. If not managed efficiently, the paperwork, regular filings, and periodic renewals can become a hurdle for smooth business operations.

We can help!

Navigating the intricacies of incorporation can be daunting, but we’re here to simplify the process. Our incorporation service is designed to assist you in forming a New Jersey corporation, starting at just $0 plus state fees. Let us handle the complexities, so you can focus on your business’s success.

New Jersey Corporation FAQs

-

Currently, the cost to file the Certificate of Incorporation for a standard corporation in New Jersey is $125. However, it’s essential to make sure you regularly check with the New Jersey Division of Revenue and Enterprise Services for the most up-to-date fee structures.

-

To form your New Jersey corporation, start by selecting a unique business name that adheres to state naming rules. Next, appoint a registered agent, file the Certificate of Incorporation with the New Jersey Division of Revenue and Enterprise Services, and pay the necessary filing fee. Once approved, you can then proceed with post-incorporation tasks like obtaining an EIN and setting up a corporate bank account.

-

The time it takes to incorporate in the state of New Jersey can vary. Once you submit your Certificate of Incorporation, the state typically processes standard filings within 7-10 business days. However, expedited options are available for additional fees if you need to speed up the process.

-

If your out-of-state (foreign) business intends to conduct regular business operations or transactions in New Jersey, you’ll likely need to register it. This involves obtaining a Certificate of Authority, which allows foreign businesses to legally operate within the state.

-

A New Jersey corporation can convert to an LLC. The state allows such business structure conversions, which involve filing specific documents and adhering to particular procedures. This move might be prompted by the desire for a different management structure or tax considerations.

-

New Jersey’s corporate tax rate can vary based on the corporation’s taxable net income. As of this writing, corporations with a taxable net income of less than $50,000 pay a 6.5% rate, while those with incomes between $50,000 and $100,000 pay 7.5%, and those with incomes over $100,000 pay a 9% rate. It’s crucial to refer to the New Jersey Division of Taxation for current rates and additional details, as these rates can change.

-

Incorporating in New Jersey offers numerous advantages. Business owners gain legal protection, typically safeguarding personal assets from business liabilities. Moreover, corporations have enhanced opportunities for raising funds, better credibility in the marketplace, and potential tax benefits.

-

A limited liability company (LLC) offers more flexibility in management and avoids double taxation as profits pass directly to members, bypassing corporate tax rates. Meanwhile, a corporation follows a more structured format with shareholders, directors, and officers, and faces potential double taxation — paying taxes once on corporate profits and again on shareholder dividends.

-

In New Jersey law, only one person is needed to form a corporation. This individual can serve as the sole director, officer, and shareholder, streamlining the process for solo entrepreneurs.

Disclaimer: The content on this page is for information purposes only and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

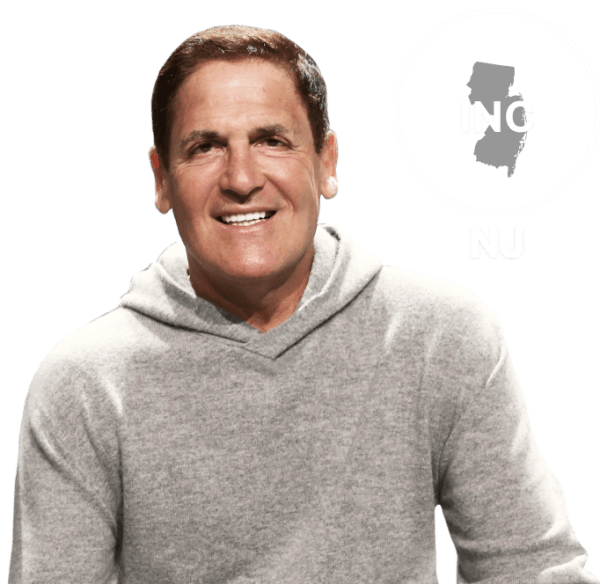

“This is your life. You want to get it right.”

– Mark Cuban on Starting a Business*

Entrepreneur and Shark Tank host lays out 3 steps to follow when starting a business

* Mr Cuban has a financial interest in ZenBusiness

Corporation Resources

New Jersey Business Resources

Form a Corporation in These States

Ready to Start Your Corporation?