Start a Florida Corporation

Starting a Florida corporation is a big step for many entrepreneurs. Incorporating in the Sunshine State offers businesses numerous advantages, such as a favorable business climate, diverse markets, and the potential for growth. This guide will walk you through the essentials of how to incorporate in Florida, providing the tools and knowledge to set your enterprise up for success.

Steps to Incorporate in Florida

Starting a business in Florida, especially a corporation, is an important legal process. Follow these steps, and you’ll be well on your way to running the newest business in the Sunshine State.

Step 1: Decide on a business name for your Florida corporation

Choose what you’ll call your Florida corporation. Choosing the right name for your Florida corporation is more than just a creative exercise — it’s a crucial first step in the incorporation process. Before settling on a business name, you’ll want to check its availability within the state to ensure no other business is using it. Florida has specific naming rules for corporations, so familiarize yourself with those to avoid any hiccups.

Additionally, it’s a good idea to check both federal registrations and state trademark databases to ensure your chosen name doesn’t infringe on any trademarks. Before you finalize an available, compliant business name, consider securing a matching domain name for your business website. This can help with branding and establishing an online presence for your corporation in Florida.

Name Your Florida Corp

Enter your desired name to get started

Step 2: Choose a Florida registered agent

Designate your registered agent. Every Florida corporation is required to have a registered agent — a designated person or entity that receives official correspondence, primarily service of process and some notices from the Department of State. To serve in this role, the agent must have a physical address in Florida and be available during normal business hours.

While it’s possible to act as your own registered agent, many corporations opt for a professional registered agent service like ours. These services help ensure the timely receipt and handling of important documents, provide an added layer of privacy for the business owner (you won’t be served with a lawsuit in front of clients, partners, or employees), and offer peace of mind knowing that you’re operating a compliant business.

Step 3: File the Florida Articles of Incorporation

File your Florida formation documents for your corporation. The Florida Articles of Incorporation is the official document that solidifies your business’s status as a corporation. This document contains essential information about your corporation, such as its name, purpose, and details about shares of stock it’s authorized to issue. To incorporate in Florida, you’ll need to complete this form and submit it to the Florida Division of Corporations (online through SunBiz is easiest).

Be aware that there are filing fees associated with this process — it typically costs a total of $70 ($35 for the Articles and $35 for your registered agent designation). While the process is relatively straightforward, it’s essential to ensure accuracy in this step. Any errors or omissions can lead to delays or potential legal issues down the road.

Step 4: Hold the first meeting and choose directors for your Florida corporation

Choose your board of directors at your first meeting. Setting up your Florida corporation’s foundation requires a pivotal first organizational meeting. This is where the initial shareholders or incorporators come together to elect the board of directors. The board of directors is instrumental in guiding the corporation, making high-level decisions, and overseeing the general direction of the business. Their role is to ensure the corporation’s goals align with the best interests of the shareholders.

Once the board is elected, the meeting doesn’t end there. The board then adopts the corporation’s bylaws, issues shares of stock, and more (more on these steps later). Maintain detailed minutes of this meeting, capturing all resolutions and decisions. This serves not only as a historical record but also helps ensure transparency and compliance in the corporation’s early stages.

Step 5: Create corporate bylaws and a shareholder agreement

Draft governing documents for your Florida corporation. Corporate bylaws act as the internal rulebook for your Florida corporation, guiding the day-to-day operations and clarifying the roles and responsibilities of directors, officers, and shareholders. They cover essential aspects like the structure of the board, voting procedures, the frequency of board or shareholder meetings, and the handling of any potential internal disputes.

Bylaws are critical as they establish a consistent framework for decision-making, reducing ambiguities and potential conflicts. Typical bylaws might outline the number of directors, their terms, the procedures for appointing and removing them, and the manner in which meetings will be called and conducted.

A shareholder agreement, meanwhile, is a contract between the shareholders. It sets out their rights and obligations and the rules governing the sale or transfer of shares. This document helps ensure that shareholders are treated fairly and establishes processes for handling situations like a shareholder’s departure or the introduction of a new shareholder. Together with the bylaws, a shareholder agreement works to maintain harmony and order within the corporation.

Step 6: Issue shares of stock for your Florida corporation

Issue stock certificates for your new corporation. Issuing shares of stock is the process by which you distribute ownership in your Florida corporation among its investors or stakeholders. This step is pivotal as it not only secures capital for the business but also defines ownership percentages, which can influence decision-making power and profit distribution. Every share represents a piece of ownership in the corporation. The more shares an individual or entity holds, the larger their stake in the company.

The process involves determining the total number of shares the corporation is authorized to issue, as stated in the Articles of Incorporation. Afterward, these shares are allocated among shareholders based on their investment or other predetermined criteria. It’s essential to maintain a detailed stock ledger, recording the issuance of shares, to help ensure transparency and adherence to legal and regulatory standards. This record aids in tracking ownership, vital for corporate governance and potential future stock transactions.

Step 7: Obtain an EIN and review Florida tax requirements

Get an EIN and prepare for Florida tax requirements. An Employer Identification Number (EIN), often referred to as a federal tax identification number, is similar to a Social Security number for a business. It’s used by the Internal Revenue Service (IRS) to identify and track businesses for tax purposes.

Whether you plan on hiring employees, opening a bank account, or simply conducting business as a corporation, obtaining an EIN is a legal requirement for all corporations. You can apply online through the IRS website or by mail using Form SS-4. Or, you can avoid this hassle by using our convenient EIN service.

Once you’ve secured your EIN, it’s essential to get acquainted with Florida-specific business income tax requirements. Unlike many states, Florida doesn’t have a personal income tax, so shareholders won’t owe taxes on their dividends at the state level. However, most Florida corporations will be subject to a corporate income tax of 5.5%. Beyond that, stay informed about any annual reports, sales taxes, or other tax obligations unique to corporations in Florida to remain in good standing.

Step 8: Open a business bank account for your Florida corporation

Get a business bank account. Having a distinct bank account for your Florida corporation isn’t just a suggestion — it’s a fundamental aspect of keeping personal and business finances separate. Blurring these lines can lead to complications in financial management and potential legal troubles.

By establishing a corporate bank account, you maintain clear records of all business transactions, making it easier to track expenses, manage funds, and monitor the company’s financial health. Moreover, when tax season rolls around, a separate business account simplifies the process of reporting income and deductions.

Additionally, consider securing a business credit card for your Florida corporation. A corporate credit card helps manage expenses, provides an additional resource for funds, and can offer perks or rewards tailored to businesses. Plus, responsible use can help your corporation build its credit history, paving the way for more substantial financial opportunities down the line.

Post-Incorporation Steps

It’s important to remember that forming a Florida corporation is only the beginning. There are several follow-up steps and ongoing requirements to remain compliant.

Maintain good standing

Keeping your Florida corporation in good standing is essential for its continued success. This involves staying updated with compliance requirements set by the state. One of the primary tasks is the submission of the annual report. This report provides the state with current information about your corporation and is vital for transparency and legal standing. Consistent compliance not only promotes trust among stakeholders but also helps avoid penalties or the risk of administrative dissolution.

Florida Business Licenses and Permits

Each business activity may have specific licenses or permits required by local, state, or federal authorities. Depending on your corporation’s operations, you may need to secure the necessary approvals before doing business. These could range from a simple business license to more specialized permits from a government agency, like those for health or environmental considerations. Regularly review these licenses and permits and renew them as needed. It’s an essential part of operating legally and responsibly within Florida.

Keeping Accurate Records

Proper record-keeping is the backbone of a successful corporation. Maintaining accurate and organized records promotes transparency, aids in decision-making, and is invaluable during financial audits or legal proceedings. You should keep detailed records of meetings, decisions, financial transactions, and any contractual obligations.

Using digital tools or software designed for business record-keeping can streamline this process. Regularly backing up and securely storing these records will ensure they’re accessible when needed and safeguarded against loss or damage.

Consideration for Foreign Entities in Florida

Businesses from other states expanding to Florida should be aware of specific steps and rules tailored for them.

Qualification to Do Business in Florida

Foreign corporations wishing to operate in Florida need a Certificate of Authority from the Florida Department of State. This certificate allows your out-of-state business to legally function in Florida. You’ll provide details about your corporation and ensure your business name is available in Florida, or offer an alternate name for operations in this state.

Florida Compliance and Regulation

Foreign businesses in Florida must meet both Florida-specific regulations and those of their home state. These include appointing registered agents, understanding local tax obligations, and filing annual reports. Staying updated on all requirements promotes seamless, compliant operations.

Pros and Cons of Incorporating in Florida

Incorporating in Florida offers several enticing advantages. One of the standout benefits is the legal protection it affords. By forming a corporation, business owners create a distinct legal entity, separating personal assets from those of the company. This distinction provides a shield against personal liability for the company’s debts or legal judgments.

Furthermore, Florida’s lack of a state personal income tax, combined with its robust business infrastructure, makes it an attractive location for entrepreneurs and investors. Beyond just the fiscal perks, a corporation’s structure in Florida can enhance credibility with customers, suppliers, and potential investors.

However, there are some drawbacks to consider when incorporating in Florida. While the corporation model offers multiple benefits, it does come with costs — both in terms of money and time. Corporations face the possibility of double taxation — once at the corporate level and again on shareholders’ dividends. This can be a significant consideration for those weighing the financial implications.

Additionally, the bureaucratic side of running a corporation — with its requisite paperwork, annual reports, and compliance checks — can be daunting for some, especially those new to the business world or without a dedicated team to handle such tasks.

We can help!

Navigating the intricacies of starting a Florida corporation might seem daunting, but you’re not alone on this journey. Our incorporation service is here to guide you every step of the way. With packages starting at $0 plus state fees, we help make the process seamless, affordable, and straightforward. From handling paperwork to promoting compliance, lean on our expertise and experience, so you can focus on what you do best — growing your business. Let us help you turn your entrepreneurial dream into a thriving reality.

Florida Corporation FAQs

-

A Florida corporation is a formal business entity registered in the state of Florida. It provides its owners, also known as shareholders, with limited liability protection, separating personal assets from business liabilities. This structure is governed by Florida’s specific corporate regulations and laws, helping ensure both credibility and a framework for business operations within the state.

-

Starting a corporation in Florida involves several steps. You’ll begin by choosing a unique business name in compliance with Florida’s naming rules. Then, appoint a registered agent based in Florida. The next step is to file the Articles of Incorporation with the Florida Department of State and pay the associated fee of $70 ($35 for the Articles and $35 for your registered agent designation). After that, you’ll conduct an organizational meeting to elect directors and establish bylaws. Lastly, obtain an EIN and set up a corporate bank account.

-

In Florida (and all other states), an LLC and an Inc. (corporation) are two distinct business entities. An LLC blends features of partnerships and corporations, offering flexible management structures and pass-through taxation. An Inc., on the other hand, is a more formal structure that provides shareholders with even stronger limited liability protection. Some limited liability companies and corporations can even choose between different tax structures, such as making an S corporation election or paying taxes as a C corporation (the default option for a corporation).

-

A Florida foreign corporation refers to a business entity that was originally incorporated in another state but seeks to conduct business in Florida. It’s termed “foreign” not in the international sense, but rather as originating from outside of Florida’s jurisdiction.

-

To register a foreign corporation in Florida, you need to secure a Certificate of Authority from the Florida Department of State. This involves providing details about your corporation and demonstrating that your business name from your home state is available in Florida, or proposing an alternate name for operations within Florida.

-

S corporations and C corporations refer to different taxation structures for corporations. A C corporation is taxed at the corporate level, and then shareholders are taxed on dividends, leading to potential double taxation. An S corporation, however, has pass-through taxation, meaning the corporation itself isn’t taxed, but income passes through to shareholders who report it on their individual tax returns. S corporations have rather stringent eligibility requirements that some corporations may not qualify for.

-

Starting a corporation in Florida involves various fees, including the $35 fee for filing the Articles of Incorporation with the state and another $35 fee for designating your registered agent. The exact cost can vary depending on whether you choose additional services or expedited filing options. It’s recommended to check with the Florida Department of State’s official website or a trusted incorporation service for the most current fee structures.

-

Starting a corporation in Florida offers numerous benefits, including limited liability protection for shareholders, enhanced credibility in the business landscape, potential tax advantages, and access to Florida’s robust business environment and lack of personal state income tax.

-

A Florida corporation’s taxation depends on its structure. C corporations face double taxation, where the corporation pays taxes on its profits, and shareholders pay taxes on dividends. S corporations enjoy pass-through taxation, where only shareholders are taxed on their individual returns. Additionally, Florida has no state personal income tax, though corporations and shareholders may be subject to federal taxes and state-specific taxes and fees.

Disclaimer: The content on this page is for information purposes only and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

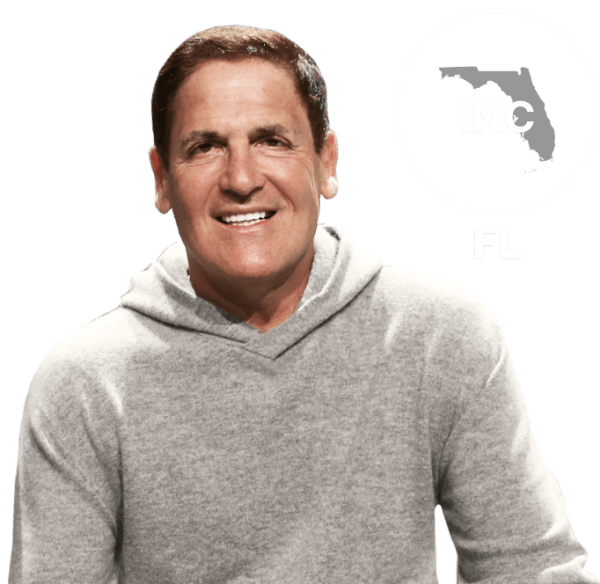

“This is your life. You want to get it right.”

– Mark Cuban on Starting a Business*

Entrepreneur and Shark Tank host lays out 3 steps to follow when starting a business

* Mr Cuban has a financial interest in ZenBusiness

Corporation Resources

Florida Business Resources

Form a Corporation in these States

Ready to Start Your Corporation?