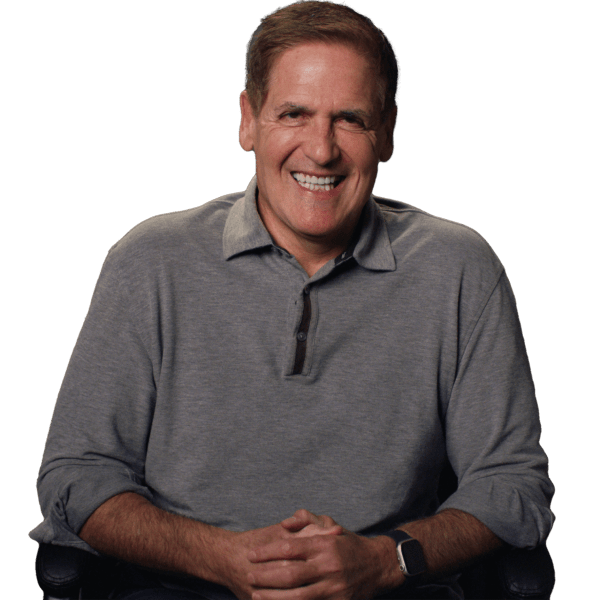

*Mr. Cuban has a financial interest in ZenBusiness and our affiliate partners may receive financial compensation for their support.

Are you starting a business, but you’re trying to save money? Then you need to know how to get an LLC for free. That’s where this guide comes in.

Get a free LLC filing through ZenBusiness. We’ll handle all of your LLC formation paperwork for you; all you have to do is provide us with your basic business information, pay your state filing fee, and you’ll be the proud owner of a new LLC.

We get it. “Free LLC” is a bit misleading if you have to pay the state filing fee. But that fee is mandatory. And no matter what LLC formation company you use, you’ll have to pay that state fee. But here at ZenBusiness, we won’t charge you anything extra.

In this guide, we’ll walk you through the basic steps to starting a free LLC with ZenBusiness.

Step 1: Name Your LLC

Every state has slightly different rules for creating a limited liability company name, but there are a few common requirements. First, you need to make sure that your name is available in your state (and beyond). Check that it’s not trademarked or claimed by another business in your state (our business search tool can help).

You’ll also need to include an entity type identifier like “LLC” or “L.L.C.” (these will vary by state). Aside from that, choose a name that’s creative, memorable, and matches all your state’s requirements. We also recommend choosing a name that has a matching available domain name so you can create your business website. Our domain name service makes this step easy.

Name your LLC

Enter your desired business name

Step 2: Get a Registered Agent

A registered agent acts as a point of contact between the state and the business; they accept official legal paperwork and government correspondence on the business’s behalf. The state calls this “service of process.” State requirements for this role vary, and so do the titles: registered office, resident agent, and statutory agent are a few examples. Every state requires an LLC to have an agent.

In general, a registered agent must be an individual or qualifying business that’s present at their listed address during all normal business hours. That’s one of the primary reasons we recommend that business owners hire a third-party registered agent service like ours. Serving as your own agent (even when it’s allowed) would tie you down to a specific location. We also make it easy to expand your business into other states later on, as we can be your agent regardless of location.

Step 3: File Your Articles of Organization

Filing your formation documents — usually called the Articles of Organization, Certificate of Organization, or Certificate of Formation — is what officially creates your LLC in your state. Typically, you’ll submit some basic information about your business, such as your name, your registered agent, your physical address, your potential business activities, and so on.

Every state charges a filing fee for this process, but the fee varies greatly. We can file your Articles for you for free (all you’ll pay is your state fees). That will free you up to handle other business tasks.

Step 4: Create an Operating Agreement

An operating agreement acts a little bit like a constitution or handbook for an LLC; the agreement dictates exactly how the business operates. Even though most states don’t legally require you to have an operating agreement, it’s highly recommended to create one. An operating agreement is an important legal document that can establish the future of your business, such as ownership percentages, how ownership can change, how profits are distributed, and more.

If you don’t have an operating agreement in place, your LLC will be governed by your state’s default statutes. Those laws don’t always fit your business’s needs, so implementing an operating agreement can set your LLC up for success. Our operating agreement template makes it easy to get started with creating your first agreement.

Step 5: Get an EIN

An EIN, or employer identification number, functions like a Social Security number for a business. It’s a nine-digit code that the IRS assigns to a business. Any multi-member LLC is automatically required to get an EIN. Single-member LLCs must get one if they have employees (or meet another IRS criteria).

Even if your business isn’t required to get an EIN, it might be helpful to get one anyway. Most banks require an EIN before they’ll issue a business bank accounting. An EIN also allows you to list a separate number on certain forms instead of your Social Security number, protecting your privacy somewhat.If you don’t want to deal with more IRS paperwork, our EIN service can get your EIN for you.

Other Steps After Getting a Free LLC

Those 5 steps are the most common steps that businesses have to complete to get started with an LLC. But depending on your LLC, there’s a good chance you’ll have to complete a few other simple steps. Here are a few examples of the additional requirements you might face.

Get business licenses and permits

It’s very common for an LLC to need one or more business licenses or permits. For example, some states require a general business license, and other states have these on the county or city level instead. It’s also extremely common for LLCs to need licenses based on their industry. Industry license requirements can come at the federal, state, and even local levels.

If you’re not sure which business permits and professional licenses you need, check out our business license report for a full rundown of what permits you’ll need to operate compliantly.

Register for state and local taxes

Getting your LLC set up with your state’s revenue department is essential. Setting up an account can register you for state personal income taxes, franchise taxes, and sales taxes. Failing to register your business for required permits can incur serious penalties, so be sure not to skip this step.

File annual reports

Most states require LLCs to file an annual report (or biennial report). One state, Pennsylvania, only requires this report every 10 years. This report keeps the state up-to-date regarding some of your basic information, such as your address and registered agent. In most states, this report has a filing fee. The fee varies greatly, from as little as a few dollars to $300 — or more if you file late. Our annual report service can make this process easy for you; we’ll do this official paperwork for you!

We can help

Starting and running an LLC can feel overwhelming, but it doesn’t have to be. Here at ZenBusiness, we’re business formation experts with one goal: to support entrepreneurs from start to finish. We handle the red tape so you don’t have to. Whether you need ongoing support through a registered agent or annual report service or anything else, we’ve got your back. We’ll also help you with the formation process so you can start your LLC for free.

IT'S FAST AND SIMPLE

Take it from real customers

Start Your LLC for Free

Enter your desired name to get started

How to Get a Free LLC FAQs

-

Technically, you can’t open an LLC absolutely free because you are legally required to pay state-required filing fees. However, we’ll file your paperwork for free even though most formation services will charge you a fee to file your LLC paperwork. All you have to do is pay your state’s fees. It’s just as affordable as doing it yourself, and it’s much easier.

-

How much an LLC costs varies depending on the state you’re forming the business in. Each state has a different filing fee for the Articles of Organization, and there isn’t a nationwide filing form or fee. We can file these forms for you at no extra charge.

-

It depends on how you file your Articles of Organization. If you file by mail, processing times can take weeks. But if you choose online filing or use a service like ours, processing is usually quicker since there aren’t mail delays.

-

A good LLC name is one that meets all state legal requirements. It should be unique, memorable, and most importantly, a name you like!

-

Starting an LLC is beneficial for many entrepreneurs because an LLC is a distinct, legal business entity that’s separate from its owner. As a result, an LLC offers limited liability protection for the members, unlike sole proprietors or partnerships.

Disclaimer: The content on this page is for informational purposes only, and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

Start an LLC in Your State

When it comes to compliance, costs, and other factors, these are popular states for forming an LLC.

Ready to Start Your Free LLC?